Throughout the COVID-19 pandemic, MeDirect delivered dynamic franchise growth and further invested in its WealthTech platform, in line with its strategic intent of scaling up as a retail-focused pan-European digital challenger bank. 2020 profitability was adversely affected by significant COVID-related impairments in the Group’s legacy international corporate lending portfolio. The Group has remained resilient and operates with strong capital and liquidity ratios, well in excess of regulatory requirements.

In terms of business performance, the Group is on track with the delivery of its strategic transformation. Arnaud Denis, Chief Executive Officer of MeDirect Group said: “Despite the significant and unprecedented challenges posed by COVID-19 on its clients, employees and communities in which it operates, we accelerated the implementation of our business strategy of diversifying the balance sheet and delivering long-term profitable growth as a pan-European retail digital challenger bank. Our goal is to make digital investing simple and convenient for everyone, offer best-in-class user experience and an innovative wealth value proposition, with a specific focus on addressing needs of the underserved mass affluent and affluent customer segments.”

As a systemically important bank supervised by the European Central Bank, MeDirect Group continued to demonstrate resilience in the current challenging environment and remains well capitalised, with a strong funding and liquidity base, with ratios well in excess of regulatory requirements as of 31 December 2020.

“Against this extraordinary backdrop, the Group is proud of the way it responded to the COVID-19 pandemic, prioritising supporting its clients, protecting its people, preserving capital and ensuring the ongoing future value of the business by continuing to invest in the Bank’s platform with a clear strategic intent. The Group demonstrated that MeDirect is a strong, resilient and agile organisation, able to protect the interests of all its stakeholders in such a challenging operating environment,” said Mr Denis.

The Group’s WealthTech platform operates with an open architecture model for mutual funds and brokerage. MeDirect continued to implement new digital solutions to provide customers with straightforward services and seamless investing and banking experiences. During 2020, it delivered on a number of fronts such as the launch of its mobile app, a revamped online e-banking platform and a fast and convenient digital onboarding process.

These innovations were very well received by clients. In particular in Belgium, which is a core market for the Group, MeDirect was assessed in independent surveys as being amongst the top five Belgian banks for the quality of its savings and investment products, mobile application and e-banking platform.

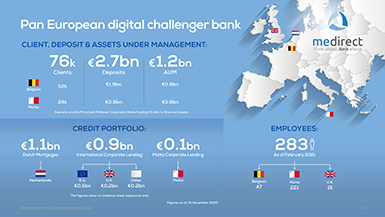

The Group is also further diversifying its lending portfolio with strong risk management. Following a series of transformational initiatives to diversify the Group’s asset base from its historic core focus on international corporate lending, this portfolio value was halved from its peak of Eur1.8 billion as of 31 March 2019 to Eur0.9 billion as of 31 December 2020.

2020 was a year of steady growth in the Group’s Dutch government-supported (NHG) mortgage business, as the Group’s Belgian banking subsidiary built a portfolio of Eur1.1 billion as of 31 December 2020. Following the dynamic ramp-up of its NHG mortgage business line, MeDirect Belgium is looking to expand its Dutch residential mortgage business and is exploring new opportunities in the attractive Belgian residential mortgage market.

In Q2 2020, during the height of the COVID-19 pandemic lockdowns, the Group successfully obtained third-party financing in the Dutch Residential Mortgage-Backed Security (RMBS) market. As a result of the transaction, MeDirect Belgium raised Eur350 million of long-term lower cost funding and diversified its funding sources. The Group’s success in obtaining low-cost financing from third party investors in such a difficult market environment demonstrated investor confidence in MeDirect’s business model and growth strategy. A second RMBS transaction, which raised Eur350 million at even more attractive funding cost levels, closed in early 2021. The second transaction confirmed the Group’s ability to access wholesale funding even in highly challenging market environments.

MeDirect Group successfully attracted international Tier 2 investors through the issuance in February 2021 of Eur11 million subordinated notes. Such access to institutional investors in the capital markets allowed the Group to continue the diversification of the capital base. The purpose of this issuance was to reinforce and optimise the Group’s regulatory capital and to support the execution of its business growth strategy.

The Group continued to build its franchise by offering attractive savings products and wealth solutions. These products have continued to drive growth in client financial assets (deposits and assets under management), which reached Eur3.9 billion as of 31 December 2020, an increase of 15% from Eur3.4 billion as of 31 December 2019. MeDirect Belgium delivered even more dynamic growth in client financial assets, with an 18% growth over the same period.

MeDirect Group continued to grow its client base at a steady pace throughout 2020, with an increase of 13%, from 67,000 to 76,000. MeDirect Belgium grew its client base by 20% – from 43,000 to 52,000.

In Malta, MeDirect continued to support the Maltese real economy through lending to Maltese corporates and small and medium-sized enterprises. MeDirect Malta provides fully collateralised lending facilities and transactional banking services to established businesses, with controlled risk management discipline. Corporate lending portfolio remained stable and stood at Eur88.2 million as of 31 December 2020. In response to the COVID-19 pandemic and its effect on the Maltese businesses, MeDirect Malta launched its MeAssist lending product, an assistance package issued in collaboration with the Malta Development Bank, which aims at supporting and enhancing access to bank financing for corporate customers.

In early 2021, MeDirect has also launched its new home loans product in the Maltese market, thus widening its retail service offering. MeDirect’s goal is to provide a new type of mortgage product in the Maltese market, using a more digitalised approach, faster turnaround of mortgage applications and a competitive pricing strategy.

Human resources are a key component of the Group’s success. Throughout 2020, the Group strengthened its management team at Group and MeDirect Belgium levels and, despite COVID-19, continued to be very successful in attracting high calibre talent and digital experts to support its strategic objectives. In aggregate, 70 new positions were created across the Group in 2020. Almost two thirds of the new recruitment was in Technology, Digital Channels, CRM, Product and Marketing and Compliance areas, in order to accelerate the delivery of the WealthTech roadmap.

One of the Group’s competitive advantages is the efficient and high-quality service centre it operates in Malta, including Technology, Digital Channels, CRM, Operations and other support functions. This service centre acts as the backbone of the Group, supporting the roll-out of its business strategy and in particular the development of its WealthTech platform across different retail markets: Belgium, the Netherlands and Malta, as well as potentially other jurisdictions in Europe. Dedicated marketing and product teams, as well as control functions, are located in each country. This international set-up enables MeDirect to scale up efficiently while remaining flexible and close to local market requirements, in particular from a customer and regulatory standpoint.

Historically, the Group has invested significantly in its Technology platform with approximately Eur40 million of CapEx invested since 2015, in particular to develop digital capabilities and the WealthTech platform.

MeDirect Group was one of the first banks to implement full remote working capabilities in March 2020 to address the operational challenges posed by COVID-19. Throughout the pandemic, MeDirect proactively and rapidly deployed measures to ensure that its premises remain as safe as possible while supporting the wellbeing of all employees and customers.

In 2020 there was further investment in WealthTech and diversification of the balance sheet, while regulatory ratios remained strong despite significant COVID-related losses.

The balance sheet increased by 29% in 2020, from Eur3.1 billion to Eur4.0 billion. This was principally driven by the increase in the NHG portfolio. The NHG portfolio as of 31 December 2020 amounted to Eur1.1 billion, compared to Eur0.1 billion as of 31 December 2019. Total customer deposits grew by 12.7% to Eur2.7 billion as of 31 December 2020 from Eur2.4 billion as of 31 December 2019.

As a result of prudent COVID-related impairments, MeDirect Group reported a loss before tax of Eur75.2 million in the financial year ended 31 December 2020, compared to a profit before tax of Eur7.1 million in previous period. The primary driver for the loss were the impairments of Eur65.2 million, of which Eur55.7 million were recognised during the first half of the year during the height of the economic fallout from the pandemic. Additionally, the Group took the prudent decision of reversing net deferred tax assets which decreased by Eur7.8 million as compared with 31 December 2019. Unutilised tax benefits do not expire, and the reversal does not affect future cash flows or the Group’s ability to use such tax benefits in the future.

The Group’s financial performance also reflected the effects of execution of its transformation plan; including lower revenues from its lending book (with a gradual replacement of international corporate lending with mortgage lending) and continued significant investments in its WealthTech platform.

Even after having absorbed COVID-related impairments, the Group’s capital ratios remained strong, with the Tier 1 capital ratio at 14.8% and the total capital ratio at 17.3%, well above its regulatory capital requirements.

The Group is comfortable that the robustness of its prudent, forward-looking provisioning process ensures that it has taken appropriate impairments reflecting the adverse credit effects of the pandemic. The Group believes that it has provisioned strongly as soon as the pandemic manifested itself, as is evidenced also in the reduced impairment losses experienced in the second half of the financial year.

The Group’s liquidity reserves remained strong, with a liquidity buffer of Eur685 million as of 31 December 2020. The Group’s Liquidity Coverage Ratio was more than five times the regulatory requirement (LCR at 563% compared with a regulatory requirement of 100%).

The Group’s leverage ratio stood at 5.7% as of 31 December 2020, also well above the 3% regulatory requirement.

Against the backdrop of COVID-19, the Group provided exceptional levels of support to the clients, colleagues and the communities it serves whilst making strong progress toward the achievement of its strategic priorities. The Group is grateful to all its employees for the energy and dedication they have displayed in remarkably challenging times.

Mr Denis said: “Our Group enters 2021 with renewed confidence that its transformation plan, high-calibre staff and cutting-edge innovation will enable it to continue to build a digital challenger bank with a promising future.”

Waqt li kienet għaddejja l-pandemija tal-COVID-19, il-bank MeDirect xorta waħda kompla għaddej bi tkabbir dinamiku fil-franchise u kompla jinvesti aktar fil-pjattaforma WealthTech tiegħu, f’konformità mal-istrateġija tal-bank stess li jespandi l-operat tiegħu bħala bank innovattiv u diġitali madwar l-Ewropa. Il-profittabilità tal-2020 tal-bank kienet milquta ħażin minn impairments sinifikanti minħabba l-COVID, li sofra fil-portafoll ta’ self lill-kumpaniji internazzjonali, li l-Grupp għandu. Minkejja dan il-Grupp baqa’ reżiljenti u jopera b’ ammont ta’ kapital u likwidità b’saħħithom, li huwa ferm ogħla mir-rekwiżiti regolatorji.

F’termini ta’ prestazzjoni kummerċjali, il-Grupp qiegħed fit-triq it-tajba fl-implimentazzjoni tat-trasformazzjoni strateġika tiegħu. Skont Arnaud Denis, l-Uffiċjal Kap Eżekuttiv tal-Grupp MeDirect: “Minkejja l-isfidi sinifikanti u bla preċedent maħluqa mill-pandemija tal-COVID-19 fuq il-klijenti, fuq l-impjegati tagħna kif ukoll fuq il-komunitajiet li fihom jopera l-Bank, ħaffifna l-implimentazzjoni tal-istrateġija kummerċjali tagħna biex niddiversifikaw parti mill-operat tagħna biex nilħqu tkabbir profittabbli u sostenibbli fit-tul bħala challenger bank diġitali Ewropew għall-konsumatur. L-għan tagħna huwa li noffru mod kif tinvesti b’mod diġitali, sempliċi u konvenjenti għal kulħadd. Irridu noffru esperjenza tal-ogħla livell lill-klijenti, b’mod innovattiv u ta’ valur, b’enfasi speċifika fuq nies affluwenti (mass affluent and affluent) li attwalment mhumiex servuti biżżejjed.”

Bħala bank sistematikament importanti sorveljat mill-Bank Ċentrali Ewropew, il-Grupp MeDirect kompla juri reżiljenza fl-ambjent diffiċli, li għandna fil-preżent, u għadu kapitalizzat sew, b’bażi ta’ finanzjament u ta’ likwidità b’saħħitha, bi proporzjonijiet ferm ogħla mir-rekwiżiti regolatorji, kif kienu fil-31 ta’ Diċembru 2020.

“F’dan l-isfond straordinarju, il-Grupp huwa kburi bil-mod kif wieġeb għall-pandemija tal-COVID-19, fejn il-prijorità tiegħu kienet li jkompli jaqdi lill-klijenti tiegħu, jagħti l-protezzjoni meħtieġa lill-impjegati tiegħu, jikkonserva l-kapital u li jiżgura l-valur futur kontinwu tan-negozju billi jkompli jinvesti fil-pjattaforma tal-Bank b’intenzjoni strateġika ċara. Il-Grupp wera li MeDirect huwa organizzazzjoni b’saħħitha, reżiljenti u b’aġilità, li kapaċi tipproteġi l-interessi tal-partijiet interessati kollha tagħha f’ambjent operattiv ta’ sfida bħal m’għandna bħalissa,” qal is-Sur Denis.

Il-pjattaforma WealthTech tal-Grupp topera b’mudell ta’ arkitettura miftuħa għal mutual funds u stockbroking. MeDirect kompla jimplimenta soluzzjonijiet diġitali ġodda biex jipprovdi lill-klijenti servizzi sempliċi u esperjenza ta’ investiment u ta’ banking mingħajr ebda xkiel. Matul l-2020, il-bank introduċa diversi inizzjattivi bħat-tnedija tal-mobile app, it-tiġdid tal-pjattaforma online għall-e-banking kif ukoll proċess ta’ on-boarding diġitali veloċi u konvenjenti.

Dawn l-innovazzjonijiet intlaqgħu tajjeb ħafna mill-klijenti. Fil-każ tal-Belġju, li huwa suq ewlieni għall-Grupp, MeDirect ġie vvalutat fi stħarriġ indipendenti bħala wieħed fost l-aqwa ħames banek Belġjani għall-kwalità tal-prodotti ta’ tfaddil u l-investiment, għall-mobile app u għall-pjattaforma tal-e-banking.

Barra minn hekk il-Grupp qed ikompli jiddiversifika l-portafoll ta’ self tiegħu bi mmaniġġjar strett tar-riskju. Wara sensiela ta’ inizjattivi biex jiddiversifika l-bażi tal-assi tal-Grupp lil hinn mill-enfasi ewlenija storika tiegħu fuq is-self korporattiv internazzjonali, il-valur ta’ dan il-portafoll naqas bin-nofs mill-quċċata tiegħu ta’ EUR 1.8 biljun fil-31 ta’ Marzu 2019 għal Eur 0.9 biljun fil-31 ta’ Diċembru 2020.

L-2020 kienet sena ta’ tkabbir kostanti fin-negozju tas-self għad-djar fl-Olanda (NHG), assigurat mill-gvern Olandiż stess (NHG), fejn sal-31 ta’ Diċembru 2020 is-sussidjarja bankarja Belġjana tal-Grupp kienet akkumulat portafoll ta’ EUR 1.1 biljun. Wara dan is-suċċess, MeDirect Belgium qed ifittex li jespandi n-negozju tas-self għad-djar residenzjali fl-Olanda, kif ukoll qed jesplora opportunitajiet ġodda fis-suq tas-self għad-djar fuq propjetà residenzjali fil-Belġju stess.

Fit-tieni kwart tal-2020, fl-eqqel tal-lockdowns minħabba l-pandemija tal-COVID-19, il-Grupp kiseb b’suċċess finanzjament minn partijiet terzi fis-suq Olandiż tar-Residential Mortgage-Backed Security Market (RMBS). Bħala riżultat tat-tranżazzjoni, MeDirect Belgium irċieva EUR350 miljun bħala finanzjament bi prezz baxx u fit-tul, waqt li kien ukoll qed jiddiversifika s-sorsi ta’ finanzjament tiegħu. Is-suċċess tal-Grupp fil-kisba ta’ finanzjament bi prezz baxx minn investituri terzi f’ambjent ta’ suq daqshekk diffiċli wera l-fiduċja tal-investituri f’MeDirect, fil-mod kif qed jopera kif ukoll fl-istrateġija ta’ tkabbir tiegħu. It-tieni tranżazzjoni ma’ RMBS, li ġġenerat EUR350 miljun oħra b’termini ta’ finanzjament saħansitra aktar attraenti mill-ewwel darba, għalqet kmieni fl-2021. It-tieni tranżazzjoni kkonfermat il-kapaċità tal-Grupp li jaċċessa finanzjament mill-operaturi anke f’ambjent ta’ suq daqshekk ta’ sfida.

Il-Grupp MeDirect attira b’suċċess investituri internazzjonali tal-Grad 2 permezz tal-ħruġ ta’ dejn subordinat ta’ EUR 11-il miljun fi Frar 2021. Dan il-finanzjament minn investituri istituzzjonali fis-swieq kapitali ppermetta lill-Grupp ikompli jiddiversifika l-bażi kapitali tiegħu. L-iskop ta’ dan il-finanzjament kien li jsaħħaħ u jottimizza l-kapital regolatorju tal-Grupp kif ukoll biex isostni l-eżekuzzjoni tal-istrateġija tat-tkabbir tan-negozju tiegħu.

Il-Grupp kompla jibni l-franchise tiegħu billi joffri prodotti ta’ tfaddil attraenti u soluzzjonijiet relatati mal-investiment (wealth products). Dawn il-prodotti komplew jgħinu fit-tkabbir fl-assi finanzjarji li l-klijenti għandhom mal-Bank (f’sens ta’ depożiti u assi mmaniġġjati jew aħjar assets under management), li sal-31 ta’ Diċembru 2020 kienu jlaħħqu għal EUR3.9 biljun, żieda ta’ 15% minn Eur3.4 biljun fil-31 ta’ Diċembru 2019. Partikolarment, MeDirect Belgium kellu tkabbir sostanzjali fl-assi finanzjarji tal-klijenti, bi tkabbir ta’ 18% fuq l-istess perjodu.

Matul l-2020 il-Grupp MeDirect kompla jkabbar il-numru tal-klijenti tiegħu b’rata konsistenti, b’żieda ta’13%, minn madwar 67,000 għal 76,000. MeDirect Belgium kabbar il-bażi tal-klijenti tiegħu b’20% – minn 43,000 għal 52,000.

F’Malta, MeDirect kompla jappoġġja l-ekonomija reali Maltija permezz ta’ self lill-kumpaniji Maltin u lil intrapriżi żgħar u ta’ daqs medju. MeDirect Malta jipprovdi faċilitajiet ta’ self kompletament kollateralizzati u servizzi bankarji tranżazzjonali għal negozji stabbiliti, b’kontroll u mmaniġjar strett tar-riskju. Il-portafoll tas-self korporattiv baqa’ stabbli fejn fil-31 ta’ Diċembru 2020 dan kien ta’ EUR 88.2 miljun. Bi tweġiba għall-pandemija tal-COVID-19 u l-effett tagħha fuq in-negozji Maltin, MeDirect Malta nieda prodott ta’ self bl-isem ta’ MeAssist, li jikkonsisti minn pakkett ta’ assistenza maħruġ b’kollaborazzjoni mal-Bank Malti tal-Iżvilupp, bil-għan li jappoġġja u jtejjeb l-aċċess għall-finanzjament bankarju għall-klijenti korporattivi.

Fil-bidu tal-2021, MeDirect nieda wkoll il-prodott il-ġdid tiegħu tas-self għad-djar (jew kif inhu magħruf iktar il-homeloans) fis-suq Malti, biex b’hekk kabbar il-firxa ta’ servizzi li joffri għall-konsumaturi personali. L-għan ta’ MeDirect huwa li jipprovdi tip ta’ prodott ta’ self għad-djar ġdid fis-suq Malti, b’ mod aktar diġitalizzat, proċess aktar mgħaġġel biex tingħata risposta għall-applikazzjonijiet u strateġija ta’ prezzijiet kompetittivi.

Ir-riżorsi umani huma komponent ewlieni tas-suċċess tal-Grupp. Matul l-2020, il-Grupp saħħaħ it-tim maniġerjali tiegħu fil-livell tal-Grupp u ta’ MeDirect Belgium u, minkejja l-COVID-19, kompla bis-suċċess kbir tiegħu li jattira talent ta’ kalibru għoli u esperti diġitali biex jappoġġjaw l-objettivi strateġiċi tal-istess Grupp. B’kollox, inħatru 70 persuna ġdida fl-2020. Kważi żewġ terzi tar-reklutaġġ il-ġdid kien fil-qasam tat-Teknoloġija, tal-Mezzi Diġitali, tas-CRM, tal-Prodotti u tal-Marketing u tal-Compliance, sabiex titħaffef l-implimentazzjoni tal-pjan direzzjonali tal-WealthTech.

Wieħed mill-vantaġġi kompetittivi tal-Grupp huwa ċ-ċentru ta’ servizz effiċjenti u ta’ kwalità għolja li jopera f’Malta, li jinkludi t-Teknoloġija, il-Mezzi Diġitali, is-CRM, l-Operat u support functions. Dan iċ-ċentru ta’ servizz huwa s-sinsla tal-Grupp, u jappoġġja t-tnedija tal-istrateġija kummerċjali tiegħu u b’mod partikolari l-iżvilupp tal-pjattaforma WealthTech fi swieq differenti għall-konsumaturi bħal m’huma: Il-Belġju, l-Olanda u Malta, kif ukoll potenzjalment ġurisdizzjonijiet oħra fl-Ewropa. F’kull pajjiż hemm timijiet dedikati għall-marketing u għall-prodotti, kif ukoll funzjonijiet ta’ kontroll. Din is-sistema internazzjonali tippermetti lill-MeDirect jespandi b’mod effiċjenti filwaqt li jibqa’ flessibbli u viċin il-ħtiġijiet tas-suq lokali, b’mod partikolari mil-lat tal-klijent u dak regolatorju.

Storikament, il-Grupp minn dejjem investa b’mod sinifikanti fil-pjattaforma tat-Teknoloġija tiegħu bi spiża ta’ madwar Eur40 miljun mill-2015 ‘il hawn, b’mod partikolari biex jiżviluppa l-kapaċitajiet diġitali u l-pjattaforma WealthTech.

Il-Grupp MeDirect kien wieħed mill-ewwel banek li implimenta kapaċitajiet li jippermettu li x-xogħol kollu jsir b’mod remot f’Marzu 2020 biex jindirizza l-isfidi operattivi ppreżentati mill-COVID-19. Matul il-pandemija, MeDirect implimenta b’mod proattiv u rapidu miżuri biex jiżgura li l-bini tiegħu jibqa’ kemm jista’ jkun sigur filwaqt li appoġġja l-benesseri tal-impjegati u tal-klijenti kollha.

Fl-2020 kien hemm iktar investiment f’WealthTech u d-diversifikazzjoni tal-operat, filwaqt li l-proporzjonijiet (ratios) regolatorji baqgħu b’saħħithom minkejja telf sinifikanti relatat mal-COVID.

Il-balance sheet żdiedet b’29% fl-2020, minn Eur3.1 biljun għal Eur4.0 biljun. Dan kien prinċipalment ikkawżat miż-żieda fil-portafoll tal-NHG (in-negozju tas-self għax-xiri ta’ djar fl-Olanda). Fil-31 ta’ Diċembru 2020 il-portafoll tal-NHG kien jammonta għal Eur1.1 biljun, meta mqabbel ma’ Eur0.1 biljun fil-31 ta’ Diċembru 2019. Sal-31 ta’ Diċembru 2020 id-depożiti totali tal-klijenti kibru bi 12.7% għal EUR 2.7 biljun minn EUR 2.4 biljun fil-31 ta’ Diċembru 2019.

Bħala riżultat ta’ impairments li ttieħdu bi prudenza b’konnessjoni mal-COVID, il-Grupp MeDirect irrapporta telf, qabel it-taxxa, ta’ EUR 75.2 miljun fis-sena finanzjarja li għalqet fil-31 ta’ Diċembru 2020, meta mqabbel ma’ profitt, qabel it-taxxa, ta’ Eur 7.1 miljun fis-sena preċedenti. Il-kawża ewlenija għat-telf kienu l-impairments ta’ EUR65.2 miljun, li EUR55.7 miljun minnhom ġew diġa identifikati fl-ewwel nofs tas-sena fl-eqqel tal-konsegwenzi ekonomiċi mill-pandemija. Barra minn hekk, il-Grupp ħa d-deċiżjoni ta’ prudenza li jreġġa’ lura l-assi netti ta’ taxxa differita (reversal of net deferred tax assets) li naqsu b’Eur7.8 miljun meta mqabbla mal-31 ta’ Diċembru 2019. Il-benefiċċji tat-taxxa mhux utilizzati ma jiskadux, u t-treġġigħ lura ma jaffettwax il-flussi tal-flus futuri (future cash flows) jew il-possibiltà tal-Grupp li juża benefiċċji tat-taxxa (tax benefits) bħal dawn fil-futur.

Il-prestazzjoni finanzjarja tal-Grupp irriflettiet ukoll l-effetti tal-eżekuzzjoni tal-pjan ta’ trasformazzjoni tiegħu; inkluż dħul aktar baxx mis-self li jagħti (b’sostituzzjoni gradwali ta’ self korporattiv internazzjonali għal self għax-xiri tad-djar) u l-investiment sinifikanti li kompla jsir fil-pjattaforma WealthTech tiegħu.

Anke wara li assorba l-impairments relatati mal-COVID, il-proporzjonijiet kapitali (capital ratios) tal-Grupp baqgħu b’saħħithom, bil-proporzjon kapitali tal-Grad 1 ikun ta’ 14.8% u l-proporzjon kapitali totali jkun ta’ 17.3%, ferm iktar għoli mir-rekwiżiti tal-kapital regolatorju.

Il-Grupp jinsab ċert li l-mod kif sar il-proċess ta’ proviżjonament kien wieħed serju, b’saħħtu u prudenti. Jemmen ukoll li l-impairments li saru kienu meħtieġa u xierqa, li jirriflettu l-effetti tal-pandemija fuq is-self korporattiv internazzjonali tiegħu. Il-Grupp jemmen li malli faqqgħet il-pandemija għamel il-provvedimenti meħtieġa, u dan jidher ukoll fit-tnaqqis ta’ telf mill-impairments li kien hemm bżonn isiru fit-tieni nofs tas-sena finanzjarja.

Ir-riżervi ta’ likwidità tal-Grupp baqgħu b’saħħithom, b’liquidity buffer ta’ EUR685 miljun fil-31 ta’ Diċembru 2020. Il-Liquidity Coverage Ratio tal-Grupp kien aktar minn ħames darbiet ir-rekwiżiti regolatorji minimi (LCR ta’ 563% meta mqabbel ma’ minimu regolatorju ta’ 100%).

Fil-31 ta’ Diċembru 2020 il-Leverage Ratio tal-Grupp kien ta’ 5.7%, li anke dan huwa ferm ogħla mir-rekwiżit minimu ta’ 3%.

Fl-isfond tal-COVID-19, il-Grupp ipprovda livelli eċċezzjonali ta’ appoġġ lill-klijenti, lill-kollegi u lill-komunitajiet li jaqdi filwaqt li għamel progress qawwi lejn il-kisba tal-prijoritajiet strateġiċi tiegħu. Il-Grupp huwa rikonoxxenti lejn l-impjegati kollha tiegħu għall-enerġija u għad-dedikazzjoni li wrew fi żminijiet tant diffiċli.

Is-Sur Denis qal: “Il-Grupp tagħna qed jiffaċċja l-2021 b’fiduċja qawwija li l-pjan ta’ trasformazzjoni tiegħu, l-istaff ta’ kalibru għoli u l-innovazzjoni mill-aktar avvanzata se jippermettulu jkompli jibni challenger bank diġitali b’futur promettenti ferm.”

MeDirect Bank (Malta) plc, is licensed to undertake the business of banking in terms of the Banking Act (Cap. 371) and investment services under the Investment Services Act (Cap. 370).