Jean Bovin – Head of BlackRock investment institute, together with Wei Li – Global Chief Investment Strategist, Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Vivek Paul – Head of Portfolio Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Financial cracks: More financial cracks from rapid rate hikes are emerging. We stay underweight equities, downgrade credit and prefer short-term government bonds for income.

Market backdrop: Bank troubles on both sides of the Atlantic hit the sector’s shares last week. Short-term bond yields plunged on hopes for sharp central bank rate cuts.

Week ahead: We don’t see central banks coming to the rescue with rate cuts but using other tools to ensure financial stability. The Federal Reserve is set to hike this week.

The U.S and European bank tumult is the latest sign rapid rate hikes are causing financial cracks, reinforcing our recession view. We expect central banks to keep hiking to fight higher inflation – not come to the rescue. We stay risk-off: underweight developed market (DM) stocks and trim credit to neutral. But we are ready to seize opportunities as macro damage gets priced in. We overweight very short-term government paper for income and prefer emerging markets.

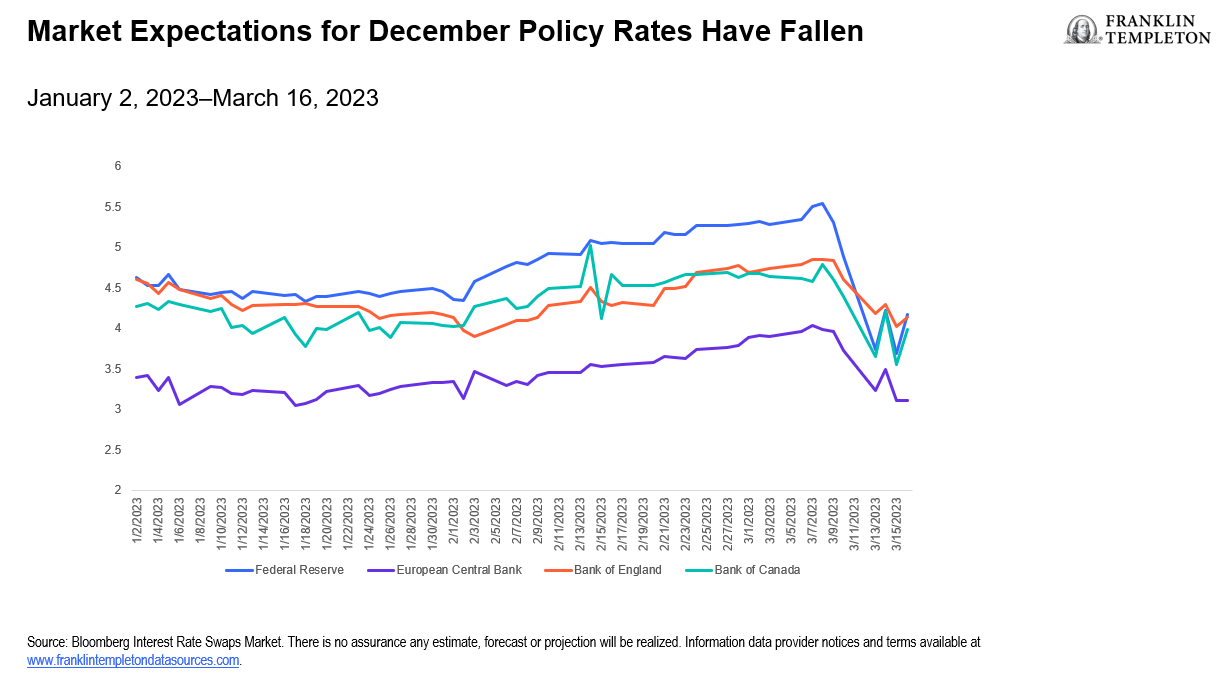

Banking troubles on both sides of the Atlantic were roiling markets last week. That’s the latest fallout from the most rapid rate hikes since the early 1980s. We have argued that bringing inflation down would be costly, creating economic damage and cracks in the financial system. This week’s events will crimp bank lending, reinforcing our recession view. As the cracks emerged, market expectations for peak rates plummeted, as the pink line in the chart shows. The reason: hopes that central banks will come to the rescue and cut rates, as they did in the past. That’s the old playbook – and it no longer works. Central banks are set to keep fighting stubbornly higher inflation, and use other tools to safeguard financial stability. Case in point: The European Central Bank raised rates by 0.5% last week. And we see the Fed raising rates this week. Our conclusion: Investors need a new investment playbook and to stay nimble in this new market regime.

The banking stresses that are roiling markets are very different – but what they have in common is that markets are now scrutinizing bank vulnerabilities through a lens of high interest rates. We don’t see a repeat of the 2008 global financial crisis. Some of the troubles that emerged recently were longstanding and well-known, and banking regulations are much stricter now. Instead, this is about a recession foretold. Why? The only way central banks could bring inflation down was to hike rates high enough to cause economic damage. The latest financial cracks are likely to tighten credit, dent confidence – and eventually hurt growth. What does this mean for investing? We see three clear takeaways:

Three takeaways

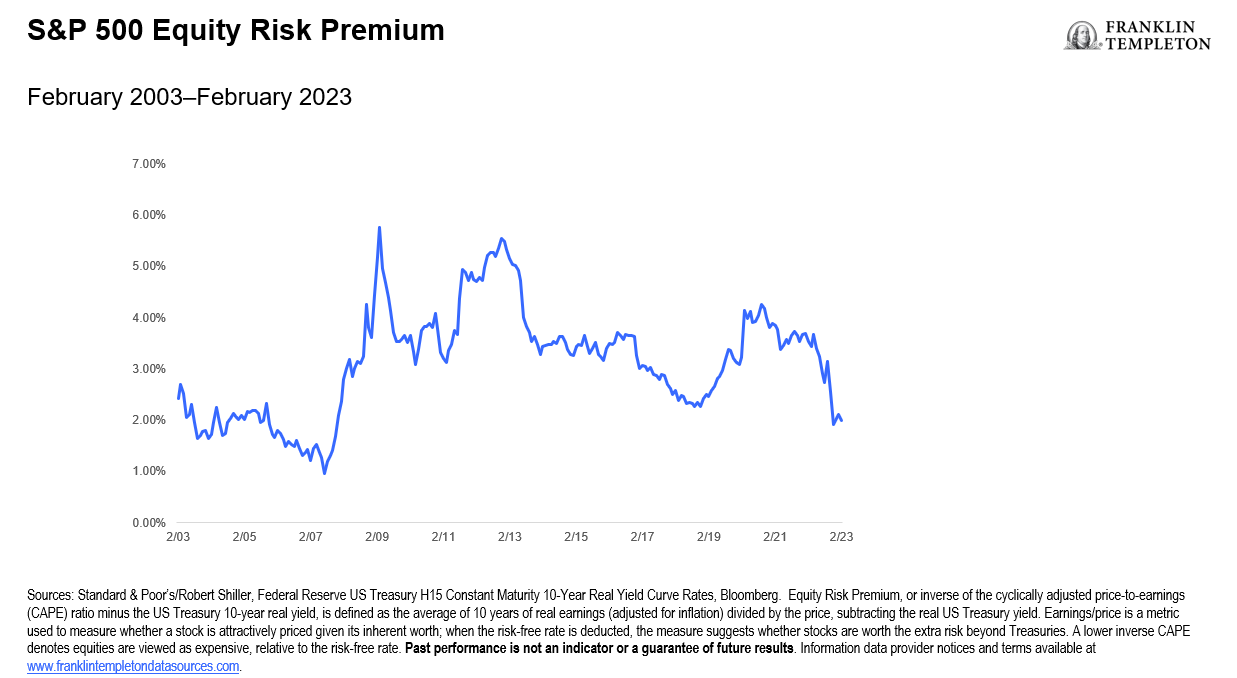

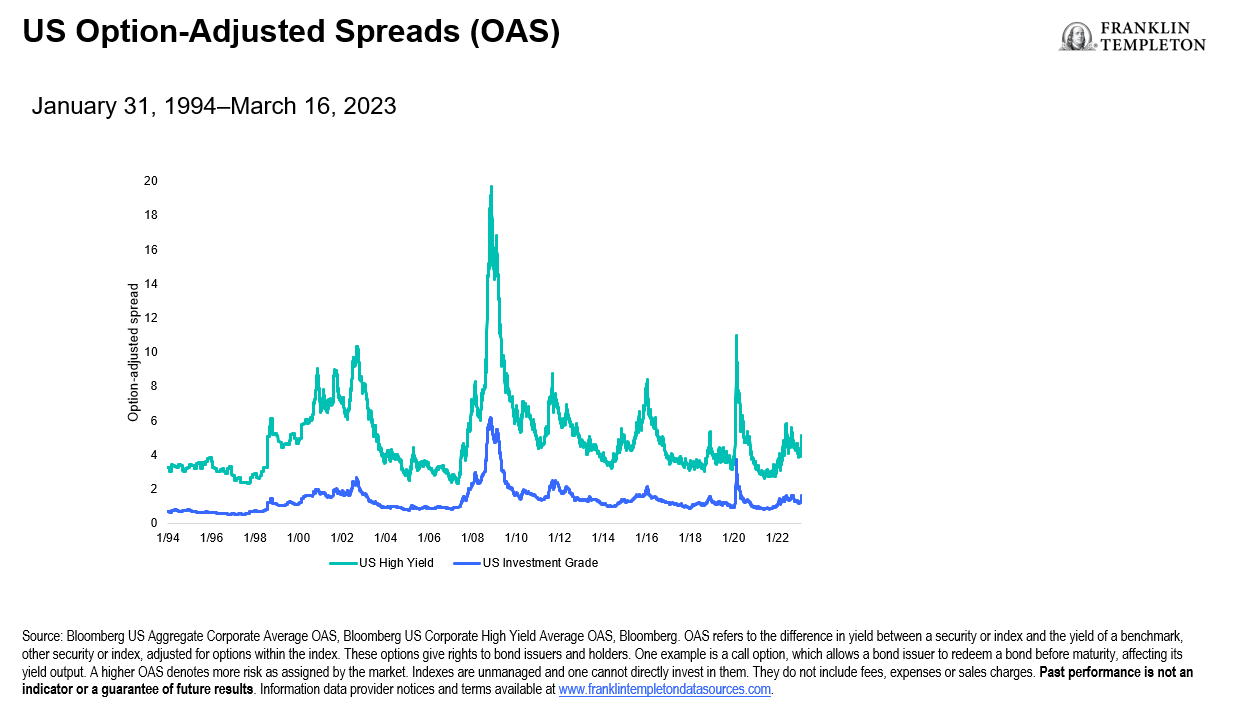

First, we stay underweight equities and downgrade credit to neutral. We believe risk assets are not pricing the coming recession. This is why we stay underweight DM equities on a tactical horizon of six- to 12-months. We expect reduced bank lending in the wake of the sector’s troubles. The recession is likely to see more credit tightening now. We downgrade our overall credit view to neutral as a result, trimming investment grade (IG) credit to neutral and high yield to underweight. We have a relative preference for European IG because of more attractive valuations versus U.S. peers.

Second, we overweight short-term government bonds. We think this recession will be different. Central banks will not try to resuscitate growth by cutting rates. The reason: persistent inflation. We think major central banks will distinguish their inflation fights from any actions taken to shore up the banking system. The ECB did so last week by hiking rates as it originally telegraphed – even as markets had started to doubt its resolve. We expect the Fed to take a similar approach when it hikes rates this week. The U.S. CPI last week confirmed core inflation is not on track to fall to the Fed’s target. That’s why we could see a reversal of the recent sharp drop in two-year and other short-term government bond yields. As a result, we now prefer even shorter maturities for income in this asset class. We stay underweight long-term government bonds and upgrade inflation-linked bonds given our view inflation is likely to stay well above current market pricing.

Third, we prefer emerging market (EM) assets. Markets have focused on the mayhem in the developed world. Under the radar has been confirmation that the economic restart in Asia from Covid restrictions is powerful. In addition, China’s monetary policy is supportive as the country has low inflation compared with DM. This should benefit EM assets, in our view. As a result, we keep our relative preference for EM stocks. We also go overweight on EM local-currency debt as EM central banks near the end of their hiking cycles and possibly cut rates.

Market backdrop

Short-term government bond yields plunged as the emergence of financial cracks spurred the market’s hopes for sharp rate cuts. Bank shares led losses in Europe and were a drag in the U.S. after the troubles at U.S. medium-sized banks and concerns over a large Swiss financial institution. We think central banks will keep hiking as they both seek to bolster banking systems but distinguish those efforts from the need to keep fighting inflation.

We expect the Fed to press ahead with another rate hike, as the ECB did last week. The Fed’s updated forecasts may prompt markets to price back in rate hikes after the February CPI data showed sticky core inflation. But the Bank of England could pause hikes next week. Global PMIs will help gauge how much rate hikes are denting economic activity.

Week Ahead

Mar 21: U.S. existing home sales

Mar 22: Fed policy decision; UK CPI

Mar 23: U.S. jobless claims; Bank of England policy decision

Mar 24: Global flash PMIs; Japan CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 20th March, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.