Jean Boivin, Head of the BlackRock Investment Institute together with Wei Li, Global Chief Investment Strategist, Alex Brazier, Deputy Head of the BlackRock Investment Institute and Scott Thiel, Chief Fixed Income Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points:

Reducing Risk: We slightly reduce risk on a worsening macro outlook. We upgrade European government bonds and investment grade credit, and downgrade Chinese assets.

Market backdrop: The Fed raised rates by 0.5% last week – the largest increase since 2000 – and signaled similar rises ahead. Long-term yields shot up and stocks gyrated.

Week ahead: Data this week may show increasing U.S. core inflation on likely higher services and housing costs. We see inflation settling at a higher level than pre-Covid.

Inflation and hawkish central bank talk have spooked investors and led to bond losses not seen since the U.S. wages are growing at the fastest clip since the 1980s. Is this the start of a “wage-price spiral” – a We nudge down risk on a worsening macro outlook: the commodities price shock and a growth slowdown in China. We also see little chance of a perfect economic scenario of low inflation and growth humming along. Last week’s market rout shows investors are adjusting to this reality. We upgrade investment grade (IG) credit and European government bonds to neutral as we see opportunities there. We downgrade Chinese assets and Asia fixed income as we consider them riskier now.

Yield on offer

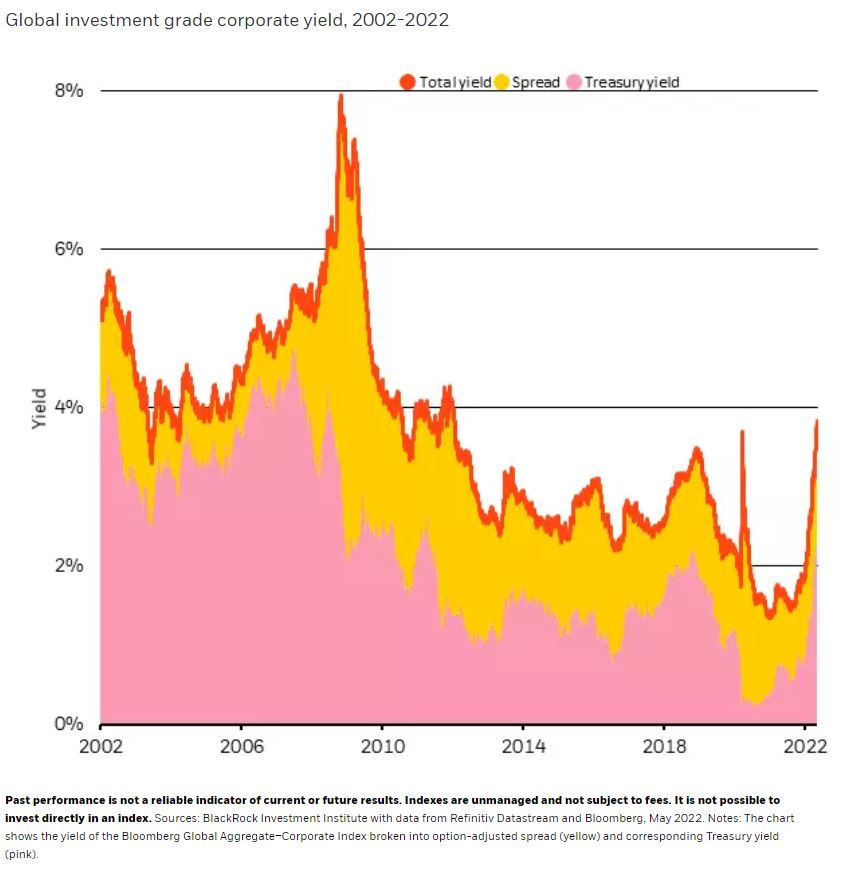

U.S. labor costs, 2019-2021

Bonds are generally not attractive in inflationary times, and we remain overall underweight the asset class. Yet this year’s dramatic sell-off has restored some value in pockets of the market, in our view. First, we have warmed up to European government bonds because we believe market expectations of rate hikes by the European Central Bank (ECB) are too hawkish. We see the energy shock hitting Europe hard – and causing the ECB to move very slowly in normalizing policy. We also see the asset class as a buffer against the growth shock, after downgrading European equities in March. Second, we are seeing some value in IG credit as annual coupon income is nearing 4%. That’s the highest in a decade, as the red line in the chart shows, driven by a rise in Treasury yields (the pink area in the chart) and a widening of spreads (yellow). Crucially, we remain underweight U.S. Treasuries. We see the yield curve steepening on further rises in long-term yields as investors want more compensation for holding long-term bonds amid inflation.

The big picture

The Ukraine war, a global energy shock and the risk the Fed tries to fight the supply-driven inflation have sparked a reassessment of macro scenarios among market participants. The root cause is inflation in a world shaped by supply. It started with the supply shock from the restart of economic activity. Russia’s invasion of Ukraine added a broad commodities price shock on top of that. The Fed and other central banks are facing a tough choice now: suppressing supply-driven inflation means raising rates so high that they destroy growth and jobs. We believe the Fed ultimately won’t raise rates beyond neutral – a level that neither stimulates nor decreases economic activity – to avoid such a scenario. This means it will have to live with inflation that we see settling at a higher level than pre-Covid. We believe the eventual sum total of rate hikes will be historically low, given the level of inflation. This means we still favor equities over fixed income.

At the same time, we recognize risks have risen. The commodities price shock is set to hit growth, especially in Europe and emerging markets that are commodities importers. The Fed rightly is fast normalizing policy but could slam the brakes on the economy if it chooses to fight inflation. It’s tough to see a perfect outcome. Getting inflation down to pre-Covid levels likely means recession, as the Bank of England warned last week. And the growth outlook for China, the world’s second-largest economy, is quickly deteriorating amid widespread lockdowns in an attempt to halt the spread of Covid.

We are downgrading Chinese stocks and bonds to neutral on the deteriorating macro outlook. We see a growing geopolitical concern over Beijing’s ties to Russia. This means foreign investors could face more pressure to avoid Chinese assets for regulatory or other reasons. We previously kept our modest overweight on Chinese assets because we saw improved valuations making up for the risks. The rapidly worsening outlook for China’s growth on widespread lockdowns to curtail a COVID spike has changed this. Lockdowns are set to curtail economic activity. China’s policymakers have heralded easing to prevent a growth slowdown – but have yet to fully act. And yields on Chinese government bonds have fallen below those on U.S. Treasuries amid policy divergence, eroding their previous appeal as a source of potential coupon income.

Bottom line

We are nudging down risk amid the commodities price shock, deteriorating growth in China and tough trade-offs for central banks. We upgrade European government bonds and IG credit to neutral as we see tactical opportunities there. We downgrade Chinese assets to neutral due to geopolitical concerns and a worsening macro outlook. Overall, we remain overweight equities, with a preference for U.S. and Japanese stocks, and underweight U.S. Treasuries.

Market backdrop

The Fed raised its policy rate by 0.5% last week and said it would start winding down its balance sheet by not re-investing the proceeds from maturing bonds. Chair Jerome Powell signaled 0.5% hikes at the next two meetings in an effort to rein in inflation, and dismissed larger increments for now. We believe the sum total of hikes will be historically low, but see long-term yields rising further as investors demand higher compensation for holding long-term bonds amid persistent inflation.

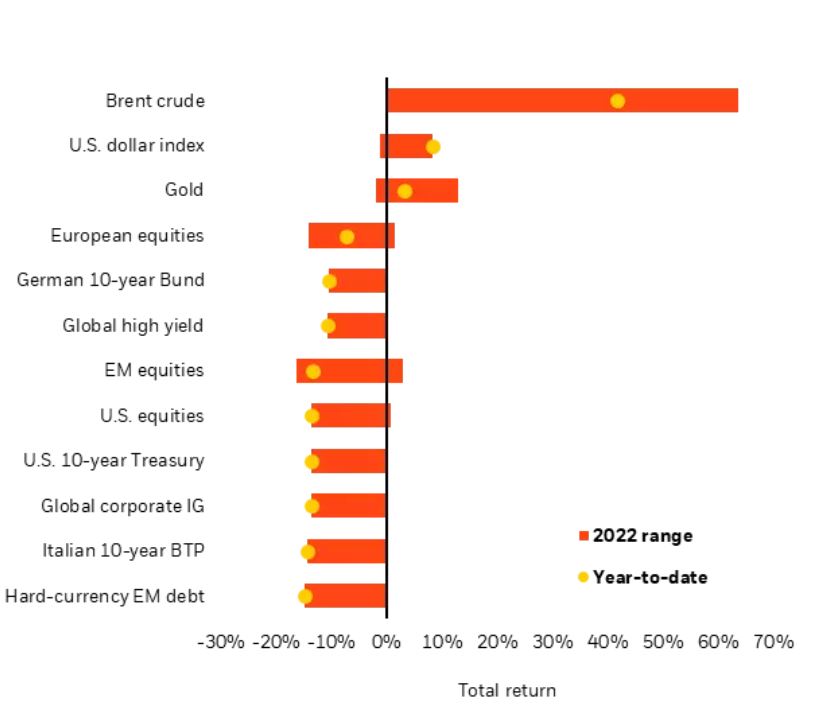

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and do not account for fees. It is not possible to invest directly in an index. Sources: BlackRock Investment Institute, with data from Refinitiv Datastream as of May 5, 2022. Notes: The two ends of the bars show the lowest and highest returns at any point this year to date, and the dots represent current year-to-date returns. Emerging market (EM), high yield and global corporate investment grade (IG) returns are denominated in U.S. dollars, and the rest in local currencies. Indexes or prices used are: spot Brent crude, ICE U.S. Dollar Index (DXY), spot gold, MSCI Emerging Markets Index, MSCI Europe Index, Refinitiv Datastream 10-year benchmark government bond index (U.S., Germany and Italy), Bank of America Merrill Lynch Global High Yield Index, J.P. Morgan EMBI Index, Bank of America Merrill Lynch Global Broad Corporate Index and MSCI USA Index.

Week Ahead

- May 9: China trade data

- May10: Germany ZEW survey; China credit and money data

- May 11: U.S. consumer prices; China consumer and producer prices

- May 12: UK GDP release

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 25th, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.