Wei Li, Global Chief Investment Strategist, Vivek Paul, Head of Portfolio Research, Mark Everitt, Head of Research and Strategy, and Christian Olinger, Portfolio Strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Infrastructure focus: Macro policy is ripping through markets now. We step back and look at why real assets in private markets like infrastructure could be attractive long term.

Market backdrop: Stocks fell after U.S. payroll gains slowed but not enough to deter the Fed from its singular focus on inflation, with a fourth 0.75% hike in November likely.

Week ahead: We think an upside surprise to CPI inflation data this week could strengthen the Fed’s resolve to keep hiking, but a downside surprise will not sway it to back off.

Rapid rate hikes are hitting markets now and will likely spark a recession, but we eventually see central banks stopping and living with inflation. This informs our long-term investment views. Private markets are long term by design – they’re also complex and not suitable for all investors. Public market selloffs have cut the relative appeal of many private assets, but we see value in infrastructure thanks to a huge investment wave powered by the energy crunch and digitalization.

Investment gap

Market pricing of future policy rates, 2022

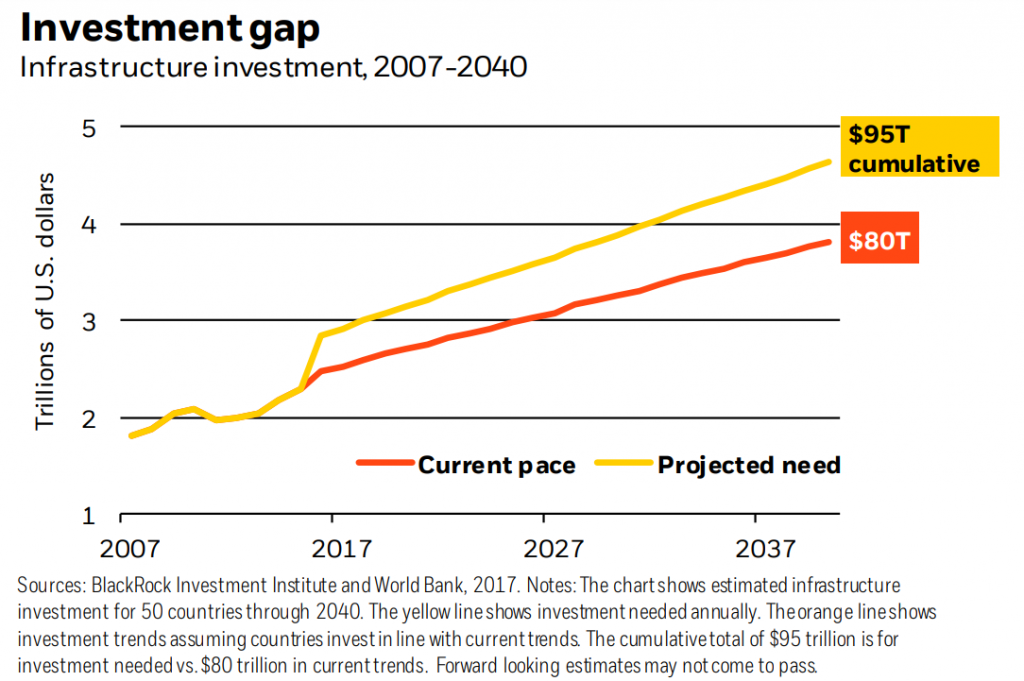

What makes infrastructure special? For one, elements of it can be seen all around. From roads to airports and energy infrastructure, these assets are essential to industry and households alike. Future needs also appear to be rising at a rapid pace. Infrastructure has the potential to benefit from increased demand for capital over the long term. An estimated $95 trillion of cumulative investment could be needed to meet global infrastructure demand over the next two decades, World Bank data show (see the yellow line in chart). That’s compared to the estimated current pace of around $80 trillion (red line), implying a total investment gap of about $15 trillion. We also find infrastructure valuations have been steadier than other private markets like real estate and private equity – they haven’t increased as much in the falling rate environment of the last few decades.

Structural trends could also support infrastructure. We find that the net-zero transition isn’t fully priced by markets across many asset classes. We think infrastructure has potential to capture the expected shift to sustainable assets. In the U.S., the Inflation Reduction Act alone earmarks nearly $400 billion of investment and incentives in sustainable infrastructure and supply chains – and the potential to pull in private investment goes well beyond the headline figures. That means there could be opportunity for private investors to get at favorable financing costs. Other trends like digitalization and decentralization signal potential for greater demaexposurend. More infrastructure would be needed to allow for the future of work. As location becomes less important, holdings would need to diversify for resilience and efficiency.

Infrastructure focus

We believe that infrastructure stands out with the potential to diversify returns and help provide stable long-term cashflows. Why? Infrastructure earnings are less tied to economic cycles than corporate assets. Long-term contracts are common. Contracts can span decades – a significant advantage in a volatile environment, in our view. Infrastructure assets also have the potential to hedge some of the effects of inflation. Most power and utility assets link their costs and prices to inflation through regulations, concession agreements or contracts. That allows them to pass higher expenses through to end users. We see risks. The new regime of increased macro and market volatility hangs over all markets, including private markets – they’re not immune to rising interest rates. Key production constraints like labor could take longer to normalize, and interest rates could remain higher than historical norms. Both would raise costs. More specifically to infrastructure, governments could also impose artificial price caps amid political pressure.

Our bottom line

What does this mean for investments? We believe private assets – while not appropriate for all investors – still have a sizeable role to play in strategic portfolios thanks to their potential diversification properties and returns. We’re underweight private markets as a whole but from a starting allocation that is much larger than what we see in institutional portfolios. As these long-term commitments reprice more, we see potential opportunity in private infrastructure given rising investment and the potential for resilient cash flow and a degree of inflation protection. Asset selection is vital, in our view, given the high dispersion of performance even within the infrastructure sector. Investment horizon is key, too. Investing takes time in private markets – funds can take up to five years to invest and over a decade to realize performance. Private markets are complex and may not be suitable for all investors.

Market backdrop

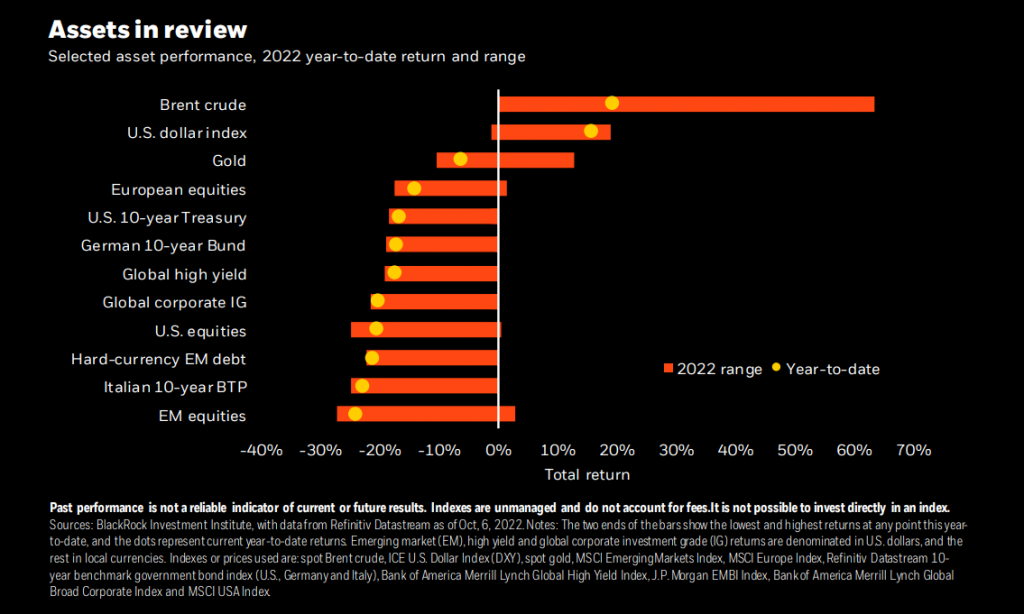

U.S. stocks slumped back near their lows of the year and short-term Treasury yields pushed near 15-year highs. September U.S. payrolls on Friday showed job gains in line with consensus with no improvement in the supply of labor. We don’t think this changes the Federal Reserve’s singular focus on inflation since it hasn’t acknowledged the policy trade-off. This underscores why we think the Fed will trigger a recession – and we don’t think hard-hit risk assets reflect the likely damage.

The U.S. CPI this week will be key for gauging the size of coming Fed rate hikes after the September jobs data reinforced expectations of more large hikes ahead. We think the Fed’s singular focus on bringing down inflation will trigger a recession – and we only see it stopping once the damage becomes clear. We should also see China’s credit data.

Week Ahead

October 10 – 17: China total social financing and lending data

October 11: UK employment

October 13: U.S. CPI inflation

October 14: China PPI; University of Michigan consumer sentiment

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 26th September, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.