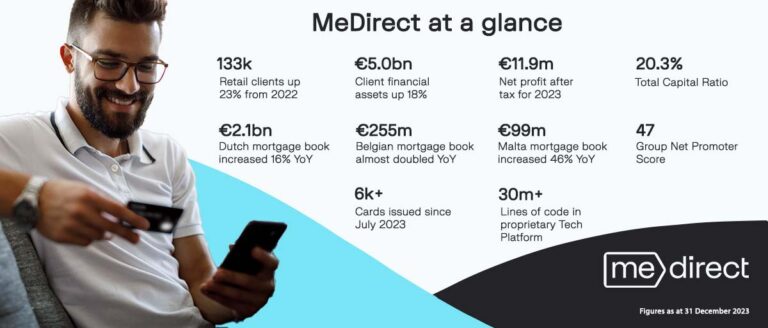

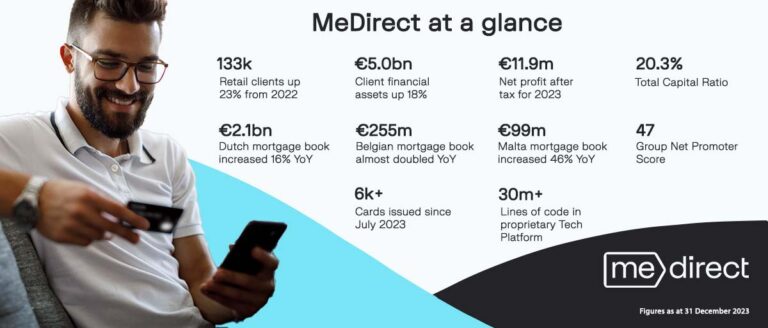

MeDirect announces more digital services and a profit after tax of €11.9 million for 2023

As a pan-European digital bank, MeDirect Group has announced a profit after tax of €11.9 million in 2023, up from €8.7 million in 2022.

As a pan-European digital bank, MeDirect Group has announced a profit after tax of €11.9 million in 2023, up from €8.7 million in 2022.

Last week’s central bank actions buoyed market sentiment, prompting BlackRock to maintain a pro-risk stance in their tactical outlook for the next six to twelve months as Q2 begins. Despite lingering concerns about persistent U.S. inflation and diminishing expectations of Federal Reserve rate cuts, they observe that stock markets are resilient.

MeDirect’s guide to creating an effective household budget can help you take control of your finances and help you save money for the future.

The upcoming Federal Reserve and Bank of Japan (BOJ) meetings, along with recent data, draw attention to the macroeconomic landscapes of the U.S. and Japan. While U.S. markets reflect optimism amid cooling inflation, BlackRock anticipates that positive risk appetite will remain largely unchallenged in the months ahead.

In this article, Stephen Yiu, discusses how in today’s volatile landscape, Blue Whale Growth Fund maintains a steadfast commitment to its high-conviction approach.

MeDirect’s insights on buying a second home are designed to help you think through the implications before making a purchase.

BlackRock is closely monitoring how the low-carbon transition is impacting investment returns, recognizing it as a significant force shaping the market landscape. They anticipate potentially market-moving developments in three key areas this year.

MeDirect employees support an initiative by FEMALE.community to collect handbags and essential items for women residing in shelters across Malta.

Establishing a successful investing strategy requires a clear risk profile. MeDirect’s MeManaged helps investors understand their risk profile and builds an actively managed portfolio accordingly.

Franklin Templeton Fixed Income economists are seeing evidence of sticky inflation across the Group of Three (G3) nations. While central banks in the United States and eurozone are gauging when to embark on monetary easing, the Bank of Japan will likely hike in April. All three will continue to monitor wages (and their impact on services inflation) and the balance of risks to economic growth.

The sooner you start managing your money, your way, using the best-in-class tools, the sooner you’ll see results. Sign up and open your account for free, within minutes.

We strive to ensure a streamlined account opening process, via a structured and clear set of requirements and personalised assistance during the initial communication stages. If you are interested in opening a corporate account with MeDirect, please complete an Account Opening Information Questionnaire and send it to corporate@medirect.com.mt.

For a comprehensive list of documentation required to open a corporate account please contact us by email at corporate@medirect.com.mt or by phone on (+356) 2557 4444.