Wei Li, Global Chief Investment Strategist with the BlackRock Investment Institute, together with Alex Brazier, Deputy Head, Scott Thiel, Chief Fixed Income Strategist and Beata Harasim, Senior investment strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Credit over stocks: We prefer investment grade credit over equities right now. Our reasoning: valuations, strong balance sheets, low supply and moderate refinancing risks.

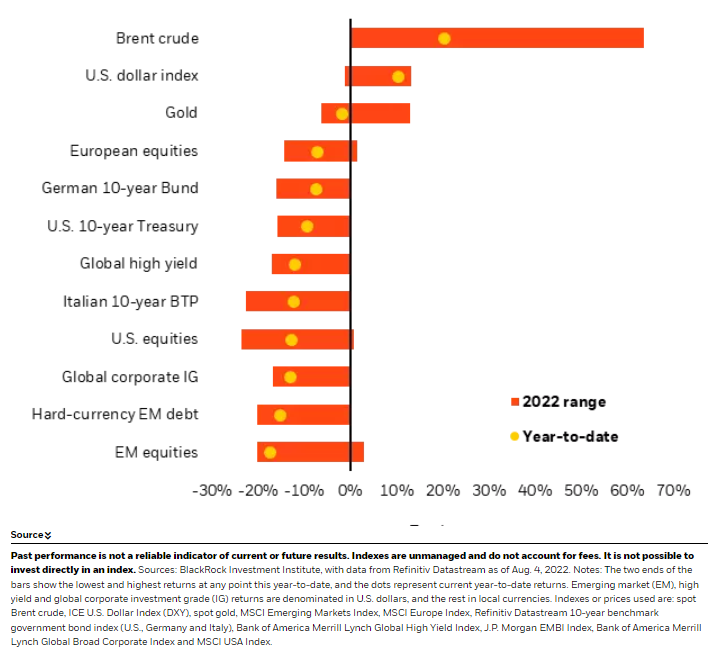

Market backdrop: U.S. data last week showed strong job creation but still low labor participation. Stocks lost steam and bond yields spiked as markets priced in more Fed hikes.

Week ahead: We expect U.S. CPI and PPI data this week to show that high inflation is persisting. China’s social financing and CPI inflation data are also in focus.

We prefer investment grade (IG) credit over equities on a tactical horizon as we see a new market regime with higher volatility taking shape. First, yields on IG credit have risen, making for improved valuations and a larger cushion against defaults. Second, balance sheets are strong, we think. Third, supply is low, and we see only moderate refinancing risks. Our conclusion: We believe IG credit can weather a significant growth slowdown whereas equities don’t look priced for this risk.

Attractive yields

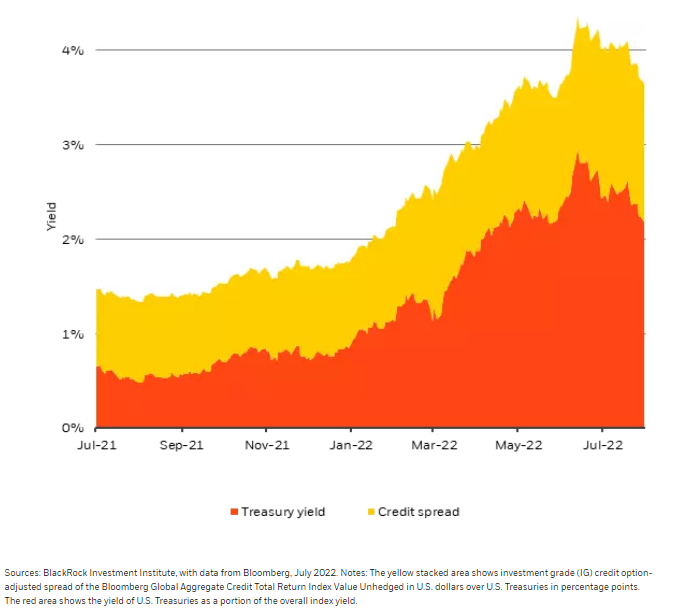

U.S. Treasury yield and IG credit spread, July 2021–July 2022

Yields look more attractive than at the start of the year, in our view. That’s because of a surge in government bond yields (red area in chart) and a widening of spreads (yellow area), the risk premium investors pay to hold IG bonds over government peers. Since June, markets have been captivated by the prospect of lower rates in the face of a growth slowdown. This has resulted in a drop in yields, boosting IG performance and triggering a 10%-plus equities rally. We still like IG credit at these levels. Spreads have only marginally narrowed as investors lean back into equities. Plus, we think higher coupon income provides a cushion against another yield spike as markets price in the persistent inflation we expect. Equity valuations, meanwhile, don’t reflect the chance of a significant slowdown yet, so earnings estimates are still optimistic, in our view.

IG companies are in good shape, in our view. First, debt servicing remains low by historical standards and leverage has been coming down. U.S. non-financial IG companies lowered leverage, as measured by debt-to-equity, for the seventh straight quarter at the end of last year, according to ratings agency S&P Global. Second, the number of defaults in 2022 is the lowest since 2014, S&P data show. Lastly, we think credit quality is still solid. S&P’s tally shows that rising stars in credit, or those that gain into investment grade status from high yield, have outpaced those going the other way, so-called fallen angels. We are neutral high yield as we prefer up-in-quality credit amid a worsening macro backdrop. We think parts of high yield offer attractive income, but concern over widening spreads in any slowdown steers us toward IG.

Trends in the corporate bond market also support our overweight on credit, in our view. First, supply is relatively low. Corporate bond issuance is down almost 20% this year versus 2021, according to S&P. Many issuers could be waiting to see if financing conditions improve before issuing more debt. Second, refinancing needs don’t look pressing after a surge in issuance last year. For example, typical U.S. IG bond issuance of around $1 trillion a year easily exceeds upcoming maturities of less than $600 billion a year through 2029, S&P data show.

Our take on inflation

How do inflation and the Fed’s next moves play into our credit view? Markets currently appear to expect that a mild contraction will result in falling rates and lower inflation. We don’t think such a “soft landing” is likely in a volatile macro regime shaped by production constraints. Central banks will have to plunge the economy into a deep recession if they really want to squash today’s inflation – or live with more inflation. We think they’ll ultimately do the latter – but they are not ready to pivot yet. As a result, we see lower growth and elevated inflation ahead. We see bond yields going up and equities at risk of swooning again. IG credit, in our view, benefits from relatively high all-in yields that reflect moderate default probabilities.

Our bottom line

We overweight IG credit versus equities on a tactical horizon. This is a move up in quality in a whole portfolio approach after we reduced risk throughout this year in response to higher macro volatility. IG valuations still look attractive, balance sheets appear strong, refinancing risks seem moderate. As a result, we see IG credit weathering a slowdown better than stocks. We see activity stalling, underpinning our underweight to most developed market equities. Rising input costs also pose a risk to elevated corporate profit margins. When would we turn positive on equities again? Our signpost is a dovish pivot by central banks when faced with a big growth slowdown, a definite sign they will live with inflation.

Market backdrop

The U.S. economy added some 528,000 new jobs in July, double the average of analyst expectations. The labor market has not yet normalized, with labor force participation ticking down, while wages ticked up. This caused the rally in U.S. stocks to lose steam and bond yields to spike as markets priced in higher odds of a 0.75%-hike by the Federal Reserve in September. This aligns with our view that markets had prematurely priced in a dovish pivot by central banks amid signs of a slowdown.

All eyes will be on this week’s U.S. CPI and PPI data to gauge whether high inflation is persisting. We see inflation staying above the Fed’s 2% target through next year. We think the Fed will keep responding to calls to tame inflation until it acknowledges how that would stall growth. We’re also watching China’s social financing and CPI inflation data releases.

Week ahead

Aug. 10: U.S. and China CPI inflation data

Aug. 11: U.S. PPI data

Aug. 12: UK GDP; U.S. University of Michigan sentiment survey

Aug. 10-17: China total social financing

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 8th August, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.