| An article written by: Pawel Malukiewicz, Group Head – Channels and Customer Experience and Chief Product Officer at MeDirect Bank. |

Successful investing needs knowledge, experience and, occasionally, a little luck. It also needs time, and lots of it. Understanding markets and managing an investment portfolio is highly complex and not something that can be sustainably undertaken based on the latest memes. It needs countless hours of study and self-discipline. And how many of us have the time for that? While the potential of growing your wealth has its obvious appeal, the answer is very few.

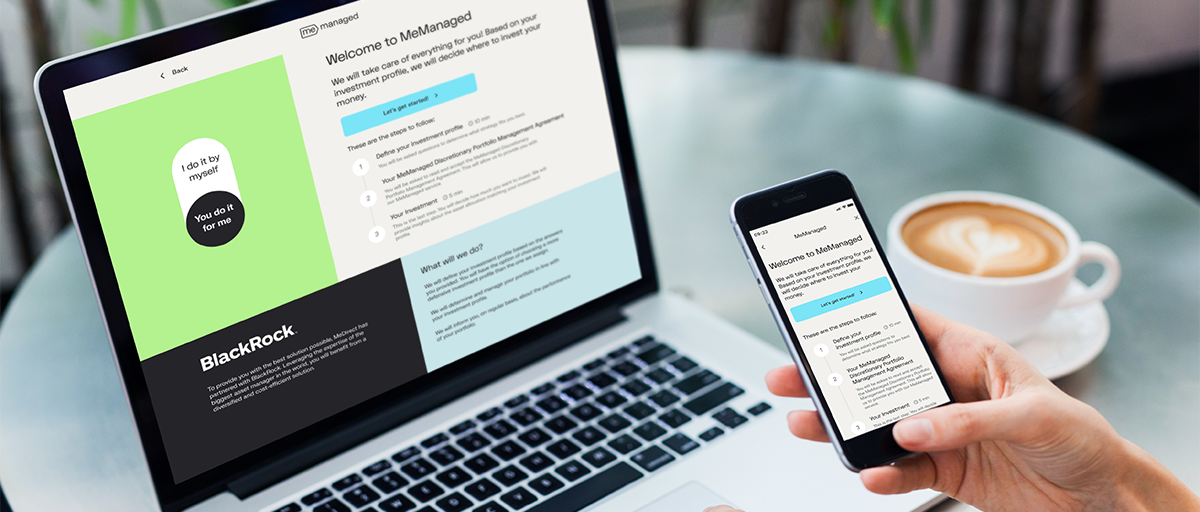

At MeDirect we have just launched MeManaged, Malta’s first Discretionary Portfolio Management service that is accessible to all investors. Our objective in launching this product is precisely to give customers the opportunity to have an actively managed investment portfolio while leaving the day-to-day decisions on what to invest in, to an expert. A Discretionary Portfolio Management Service, in fact, means that you, as the investor, provide a clear understanding of your financial goals and risk appetite to a portfolio manager who is then authorised to carry out transactions on your behalf, without asking for permission.

Discretionary Portfolio Management is, of course, not a new idea. Until now, however, this service has only been accessible in Malta to high-net-worth individuals with significant funds available to invest. MeManaged has changed this. By setting the minimum investment at €2,000, MeDirect has made this service accessible to all retail investors. Additionally, should investors wish to top up their MeManaged account on a regular basis, the minimum investment required is €100 per month. Whilst dramatically reducing the barriers to entry is a significant innovation, it is not the only one. An additional factor which makes MeManaged unique in Malta is that the entire process of opening and managing the account happens through the MeDirect website and mobile app. As Malta’s first digital bank, we continue to focus on simplifying things for customers and taking up as little of their time as possible.

The benefits of a Discretionary Portfolio Management service are clear. It enables investors to enjoy the potential benefits of an active investment portfolio while also leaving the investor free to focus on what he or she does best. But, for this to work, it’s vital that the investor trusts the portfolio manager. This is where the next important factor in MeManaged comes in. While the customer relationship is directly between the investor and MeDirect, the bank has partnered with BlackRock, the world’s largest fund manager to deliver this product. This means that with an investment of just €2,000, MeDirect customers can now benefit from the global expertise, insight and cutting-edge investment technology which BlackRock possesses.

In bringing this innovation to Malta, MeDirect is also being very transparent about any ongoing charges of fees associated with MeManaged. The fact is that, apart from the ongoing fee relating to the costs of running the fund, the only charge to be applied is an annual management fee of 1.2 per cent of the market value of the portfolio (inclusive of VAT). This is something which is not always the case, especially in those investment products where charges are applied based on the number of transactions rather than on performance. Customers also need to keep in mind the efficiencies organisations like BlackRock can achieve through advanced market trading technology.

Two final benefits of MeManaged that I would like to mention are the fact that customers can withdraw funds or redeem their MeManaged account any time without facing any additional fees or charges and that we will be offering top-ups of between €50 up to €200 on all Managed accounts opened by 28 February 2023.

The world of financial services continues to be disrupted by innovation. Technology continues to make services which were previously available only to the few, accessible to all. MeDirect continues to lead the way in delivering this change, and these new opportunities, in Malta.

MeDirect Bank Malta is the Island’s first Digital Bank and offers its clients access to market-leading financial products. One can become a client of MeDirect and open a MeManaged account by clicking here. For further information clients may contact MeDirect Bank on 25574400 or visit www.mediret.com.mt

MeDirect Bank (Malta) plc, company registration number C34125, is licensed to undertake the business of banking in terms of the Banking Act (Cap. 371) and investment services under the Investment Services Act (Cap. 370).