Jean Boivin – Head of BlackRock investment institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Vivek Paul – Head of Portfolio Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Lessons learned: A historic 2022 taught us to widen the lens of possible scenarios, factor in geopolitical risk and use a new playbook for more frequent portfolio changes.

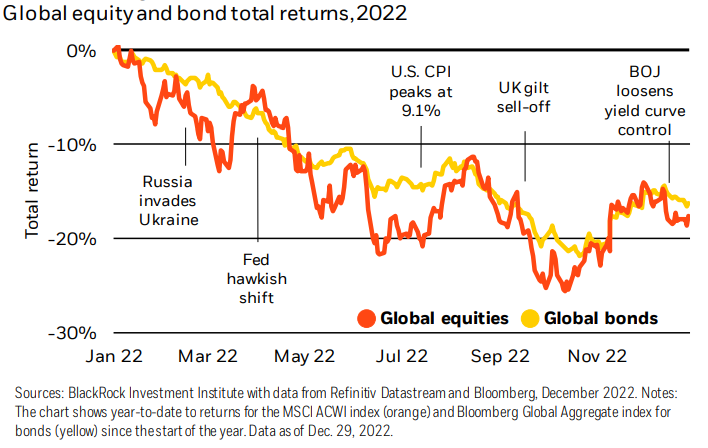

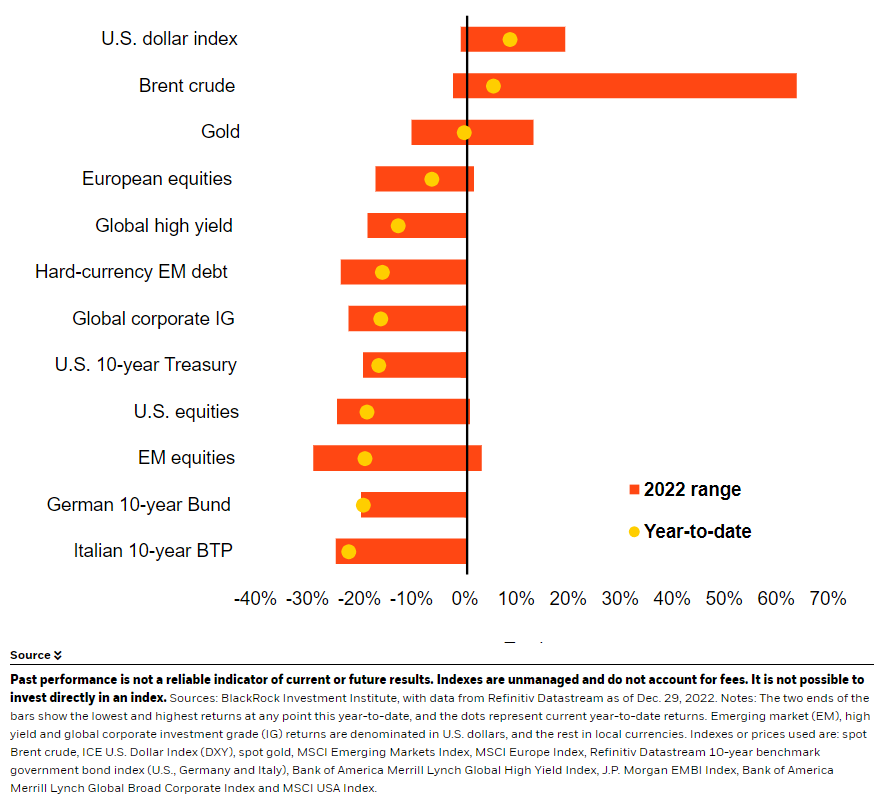

Market backdrop: Global stocks ended the year down 18%, while bonds fell 16%. This marked the biggest market storm in decades amid inflation and hawkish central banks.

Week ahead: U.S. jobs data this week are set to jolt market expectations of the Fed’s rate path. PMI data is likely to show further slowing in manufacturing activity.

The historic shocks of 2022 – war, soaring inflation and a perfect market storm – shape our three investment lessons for the new year. First, widen the lens of possible scenarios and beware of inertia and other behavioral biases. Second, factor in compensation for geopolitical risk. Third: We need a new investment playbook – the key theme of our 2023 Global Outlook. That means more frequent portfolio changes in the new regime of greater macro and market volatility.

A historic year

Last year’s shocks were extreme, causing sharp stock and bond sell-offs. See the chart. Russia amassing troops on Ukraine’s border quickly erupted in the fullblown war that is still raging. That sent energy prices soaring, stoking already hot inflation from pandemic-induced production constraints. Headline inflation

surged to 40-year highs, spurring the Federal Reserve to embark on the steepest rate hike path since the early 1980s. A year ago, markets expected policy rates to rise to 1% by year-end. They are four times as much now, and we see more to come. Other shocks like the UK gilt crisis showed a return of the so-called bond vigilantes: market forces punishing fiscal splurges with higher yields and diving currencies. The Bank of Japan also surprised markets by loosening its yield control policy just days before year-end.

The lesson

We must widen the lens of possible scenarios because the new regime of higher macro and market volatility entails a wider range of outcomes. And it requires quick reactions. We must fight behavioral biases like inertia that make it hard to embrace change or carry out too little to make a difference. Sometimes you know something is happening but just don’t want to believe it – either because recency bias or out of sheer disbelief.

Our second lesson

Geopolitical risk now warrants persistent risk premia across asset classes, rather than being something markets only react to when it materializes. We see a fragmented world of competing blocs replacing an era of globalization and geopolitical cooperation. Geopolitics are driving economics now, instead of economics driving geopolitics, in our view. We think the war in Ukraine and strategic competition between the U.S. and China are long-term geopolitical risks, not just market drivers of short-lived sell-offs. Fragmentation could also create more supply and demand mismatches as resources are reallocated. We see this keeping inflation pressure higher than before the pandemic and contributing to market volatility.

Our final lesson

We need a new investment playbook in the new regime. This means not being lulled into thinking what worked in the past will work now, like automatically buying the dip. We see stock rallies built on hopes for rapid rate cuts fizzling. Why? Central banks are unlikely to come to the rescue in recessions they themselves caused to bring inflation down to policy targets. Earnings expectations are also still not fully reflecting recession, in our view. But markets are now pricing in more of the damage we see – and as this continues, it would pave the way for us to turn more positive on risk assets. We don’t

count on long-term government bonds as diversifiers. We expect central banks to pause hikes when the economic damage becomes clearer – but keep rates at high levels. We also see long-term yields rising as investors demand more compensation for the risk of holding them amid persistently high inflation and record debt levels. We see services inflation as sticky due to worker shortages fueling wage growth. And we see long-term drivers keeping inflation pressures higher than before the pandemic: aging populations, geopolitical fragmentation and the net-zero transition. All these expectations feed into our new investing playbook of granular views and frequent portfolio changes.

Our bottom line

We’re widening our lens of scenarios, factoring in geopolitical risk and using a new playbook for 2023. We’re tactically underweight developed market equities and long-term government bonds. Investment grade credit, U.S. mortgage backed securities and short-term Treasuries offer attractive income. And we prefer inflation-linked bonds over nominal peers.

Market backdrop

Global stocks fell 18% and bonds dropped 16% in 2022 – a rare joint selloff that only happened in two other years (2015, 2018) since the Bloomberg global aggregate bond index series started in 1990. And those losses were only single digits. Soaring inflation and aggressive rate hikes in response roiled markets as the pressure from production constraints tied to the pandemic converged with an energy crisis brought by the war in Ukraine.

Week Ahead

Jan. 4: U.S. ISM manufacturing PMI; job openings

Jan. 5: China services PMI

Jan. 6: U.S. payrolls; U.S. ISM services PMI; euro area flash inflation

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 3rd January, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.