Jean Boivin Head of the BlackRock Investment Institute together with, Wei Li, Global Chief Investment Strategist, Alex Brazier, Deputy Head and Kurt Reiman, Senior Strategist for North America all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Hope rally: Surging stocks show markets believe hopes of a soft landing by the Fed to be true. We disagree and stay underweight developed market (DM) stocks.

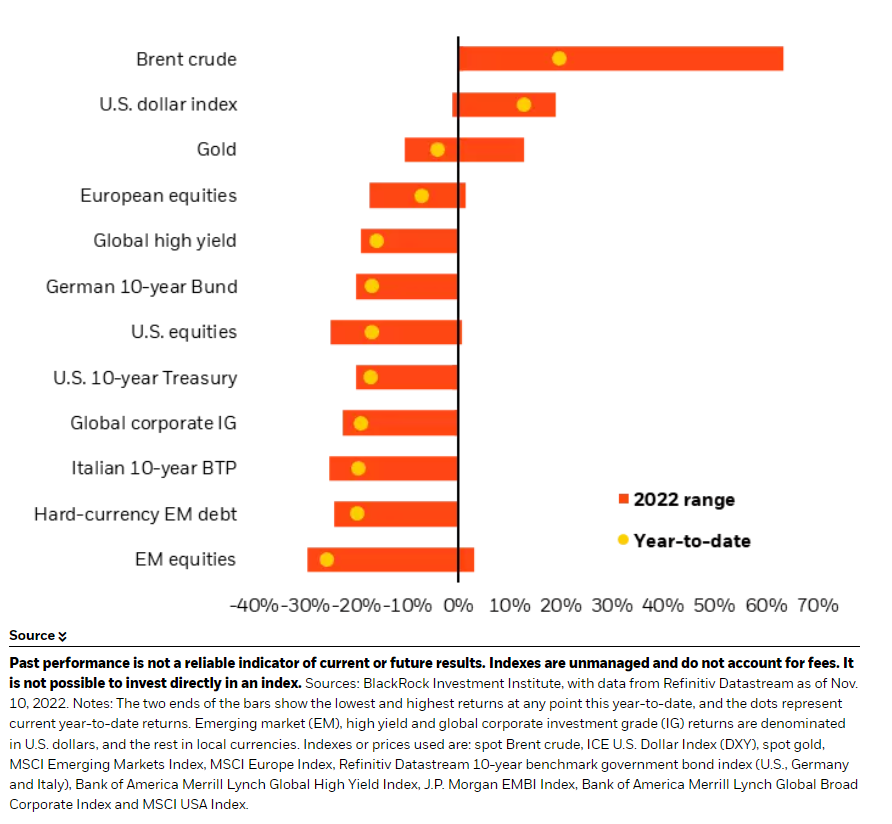

Market backdrop: U.S. stocks jumped and bond yields plunged after October CPI rose less than the market expected. But sticky core inflation keeps the Fed on track to overtighten.

Week ahead: We’re watching UK unemployment, CPI and the fiscal update. The data may show more signs the UK is falling into a recession with inflation staying high.

One economic release overshadowed the U.S. midterms for markets. Stocks surged last week after the October core CPI rose less than expected, stoking market hopes a Federal Reserve pause on rate hikes is nearer. That’s optimistic, we think. Goods inflation is easing as it needed to, but the labor constraints driving wage growth and core inflation persist. So the Fed is still on a path to create a recession via policy overtightening. Stocks aren’t pricing that in, so we stay underweight.

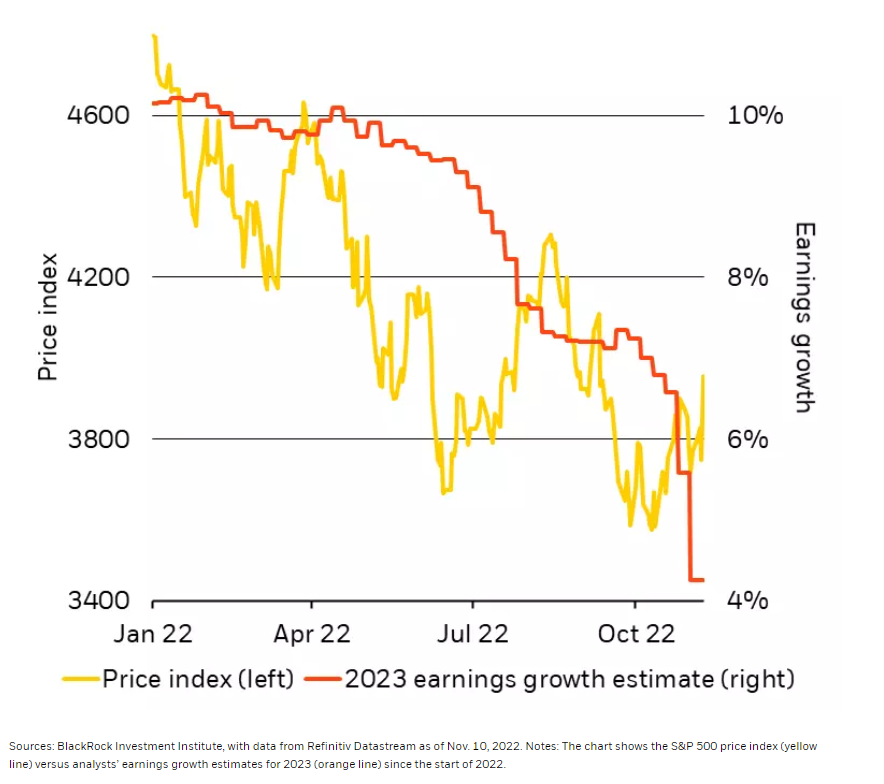

Stocks and earnings expectations part ways

S&P 500 price and 2023 earnings growth estimates

Equities have repeatedly jumped this year on hopes the Fed may be getting closer to stopping the fastest hiking cycle since the 1980s, letting the economy enjoy a soft landing that avoids recession. We think those hopes will be dashed again as the Fed pushes ahead with policy overtightening. With the S&P 500 jumping 13% from its October low, stocks are even further from pricing in the recession – and earnings downgrades – we see ahead. See the yellow line in the chart. Earnings estimates are set to be downgraded further. The consensus expects earnings growth of just over 4% in 2023, down from about 10% at the start of 2022 (orange line). We expect zero growth. Third quarter annual earnings growth would already be negative without the energy sector, Refinitiv data show. We need to see stocks fall more or more good news of easing inflation to turn positive on stocks.

Good news and bad news

The slower rise in core CPI inflation, which excludes volatile food and energy prices, due to falling core goods inflation is good news. We’d expected this to happen at some point as spending patterns normalize after the pandemic, when a sharp shift in consumer spending toward goods and away from services drove the initial spurt of goods inflation. Spending is starting to return to services, easing supply constraints on goods. We expect declining goods inflation to continue. But high core inflation also reflects constraints on labor supply that are driving up wages, seen in services inflation. We don’t expect this to improve much because many workers retired during the pandemic. We also see the U.S. labor pool shrinking as people over 65 account for a larger share of the population in coming decades.

The Fed can only try to push wage and overall core inflation quickly down to its 2% target by crushing demand with a deep recession, in our view. We expect the Fed to pause its sharp hikes only after having caused a recession and when confronted with the economic pain. We don’t think a soft landing is in the cards. Yet it took just one downside surprise in CPI – one data release, not a trend – to revive hopes that the Fed would stop hiking soon and a soft landing could still be achieved. That helped to quickly wipe the U.S. midterm election – the original subject of this week’s commentary – from the market’s mind. This is a good reminder that in this new regime of higher macro and market volatility, we should not be surprised by surprising data. We think the Fed’s “whatever it takes” approach to bringing down inflation means that no single data release or catalyst is about to change the Fed’s path to overtighten policy.

Our bottom line

We’re tactically underweight DM stocks, including the U.S., because they’re even further away from pricing in recession after last week’s surge. But we think some sectors like energy, financials and healthcare allow us to take advantage of thematic, near-term and structural trends. Landmark U.S. legislation over the past year, like the Inflation Reduction Act, has brightened the outlook for renewable energy and the industrial sector. Earnings for traditional energy are still strong given ongoing supply shortages. Healthcare is a favorite of investors looking for shelter as recession looms given its stable cashflows in economic downturns and attractive valuations. The sector will also benefit as an aging world population ramps up medical spending. Lastly, deposit rates not rising as much as policy rates has boosted bank earnings, making their income from lending greater than the amount paid on deposits. We believe the new regime warrants a granular approach as themes like production constraints, dollar strength and geopolitical fragmentation are better implemented through sectors.

Market backdrop

U.S. stocks surged and Treasury yields fell sharply after the core October CPI rose a lower-than-expected 0.3%. We think this is finally an encouraging development on inflation but doesn’t yet change the overall picture. Core goods prices declined. But core services inflation remains sticky. We don’t think one data release will change the Federal Reserve’s path to overtightening policy – and think it would need to see more sustained signs of core inflation slowing.

The UK takes center stage this week with unemployment and CPI inflation data, as well as the announcement of the much-anticipated fiscal statement from the new government. The UK fiscal update will factor into the Bank of England policy tightening plans depending on the size and timing of any austerity unveiled as the UK heads for a deep recession.

Week Ahead

Nov. 15: UK unemployment; euro area GDP; U.S manufacturing PPI

Nov. 16: UK CPI; U.S. industrial production

Nov. 17: UK fiscal statement; U.S. Philly Fed Business Index; Japan CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 14th November, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.