Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, Ann-Katrin Petersen – Senior Investment Strategist, and Nicholas Fawcett – Macro Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Eyeing Europe: We think improving euro area activity signals more rate hikes to come. We like short-term government bonds, high-quality credit and selected equity sectors.

Market backdrop: Data last week showed still-high euro area inflation and strong U.S. manufacturing activity. So we see central banks keeping rates higher for longer.

Week ahead: This week’s U.S. jobs data will help gauge how tight the labor market remains, a key factor keeping core services inflation stubbornly high.

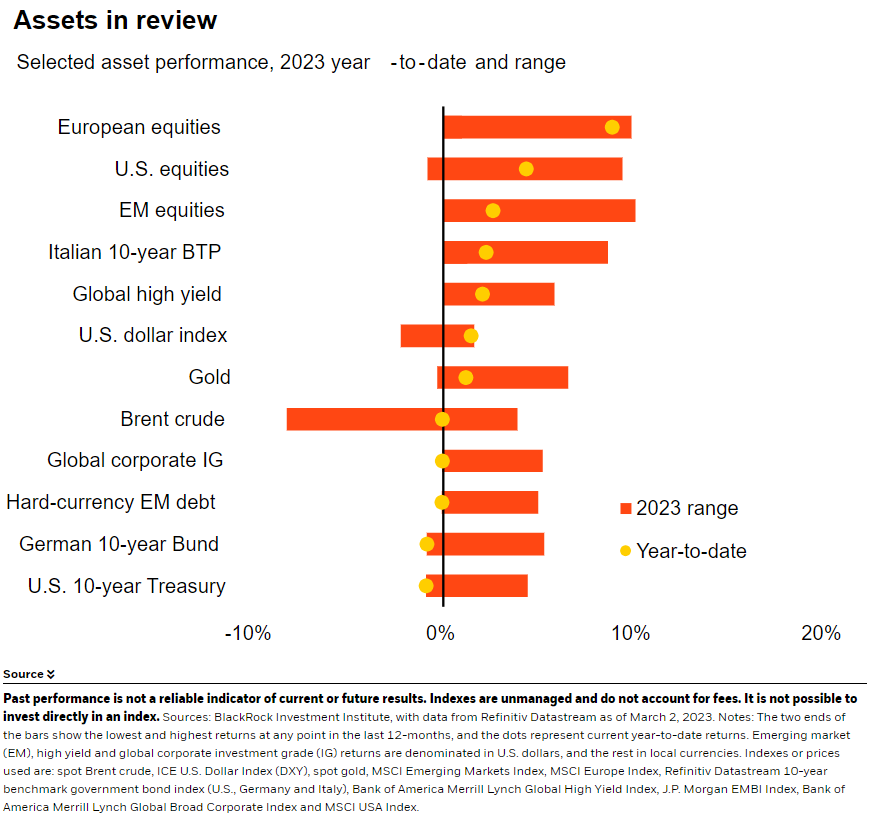

European stocks have outperformed this year as China’s economy restarts and the energy shock proved less severe than expected. We don’t see the outperformance lasting: The market’s focus is shifting to sticky inflation due to firms upping wages to hire and retain staff. Good news on the economy means the European Central Bank (ECB) needs to hike rates more to cool inflation. We still expect a recession as higher rates kick in. We prefer short-term bonds for income.

Shifting expectations

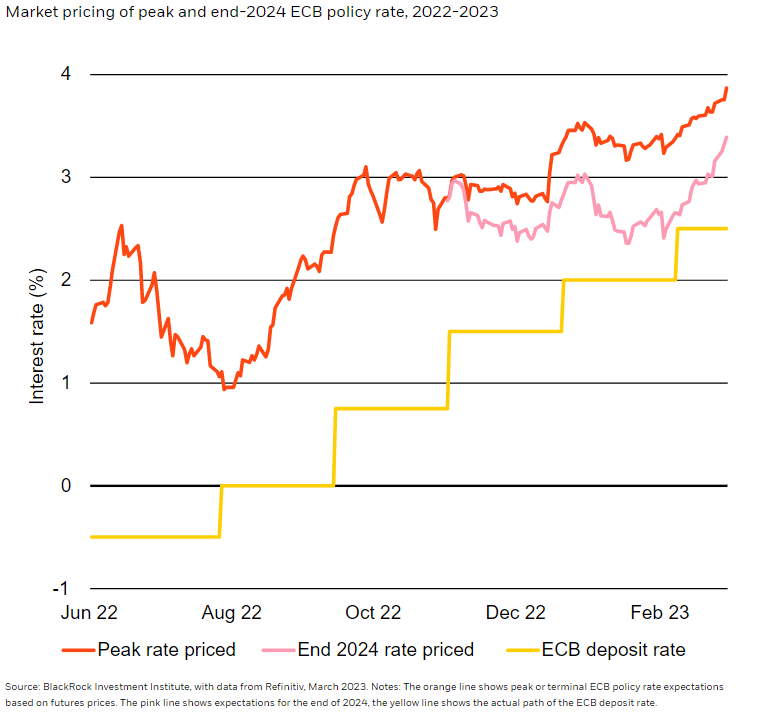

Euro area stocks have outperformed U.S. peers by about 14% in local currency terms since the end of September, MSCI index data shows. That’s partly because the economy has withstood the energy crunch even as the war in Ukraine drags on. Plus, export-centered sectors also look set to benefit from China’s restart. Yet good news on growth now means the ECB has more work to do to cool inflation later, as we said for the U.S. We think that’s bad news for Europe’s risk assets. We see policy rates already on track to tip the economy into recession this year after growth stagnated at the end of 2022. Data last week showing core inflation rising and services activity improving may push the ECB to hike more. Market pricing now expects rates to peak around 3.9% (orange line in chart) versus about 3.2% in February, with fewer rate cuts seen in 2024 (pink line).

Europe’s cooling goods inflation and lower gas prices have driven a drop in overall inflation. We think elevated services inflation will prevent inflation from falling to the ECB’s 2% target on its own – similar to the U.S. That’s because wage inflation is bleeding into the services sector. The reason: European firms are raising pay to recruit new hires given a surge in workers jumping to the public sector. That labor marker tightness looks set to persist. Data last week confirmed euro area unemployment is near a record low. The ECB faces a stark trade-off between pushing up unemployment or living with persistent inflation. ECB officials seem determined to do “whatever it takes” to get inflation down to target, in our view, as that is their only objective. We expect the ECB to raise rates through midyear and not cut them until the second half of 2024.

Income opportunities

We think this backdrop of higher rates and persistent inflation boosts the appeal of high-quality European credit and short-term government bonds. Yields have jumped from their ultra-low levels reached during a decade of negative interest rates. Strong corporate balance sheets limit the risk of credit defaults when recession hits, in our view. We’re overweight both on a tactical horizon of six- to 12-months. We also turn to credit for income from a strategic horizon of five years and beyond.

Equity view

We don’t think European stocks are pricing in the economic pain we see ahead even as valuations look inexpensive relative to the past and regional peers. Stocks could also lose support if foreign investors’ attention shifts, as it historically has. We’re tactically underweight developed market (DM) stocks, including Europe. Within Europe, we favor the financial sector as rates rise. We also like the energy sector given the energy shortage, stronger balance sheets and better return on equity than in the past. We favor healthcare on its relatively steady cash flows in economic downturns and strong growth potential from long-term trends like aging populations. Plus, we like the consumer discretionary sector as European brands benefit from ramped up demand for luxury goods from China’s restart. Our preferences underpin why we’re neutral on Swiss stocks compared with our overall underweight in Europe. The financial, healthcare and consumer staple sectors dominate the index. We are strategically overweight DM stocks and expect earnings to recover once recessions end. We also see returns surpassing bond returns as yields rise due to investors demanding more compensation for risk amid high inflation and heavy debt loads.

Bottom line

European risk assets have outperformed so far this year. But we think that trend will end as recent data pushes the ECB to raise rates and keep them higher for longer. We prefer income from credit and short-term government bonds. We’re underweight European stocks but like the financial, energy, healthcare and consumer discretionary sectors.

Week Ahead

Mar 7: China trade

Mar 8: China inflation

Mar 9: Bank of Japan policy decision; U.S. payrolls

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 6th March, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.