Jean Bovin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Ben Powell – Chief Investment Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Stock selectivity: Developed market (DM) central banks have signaled high-for-longer policy rates. We stay selective in DM equities and prefer international stocks.

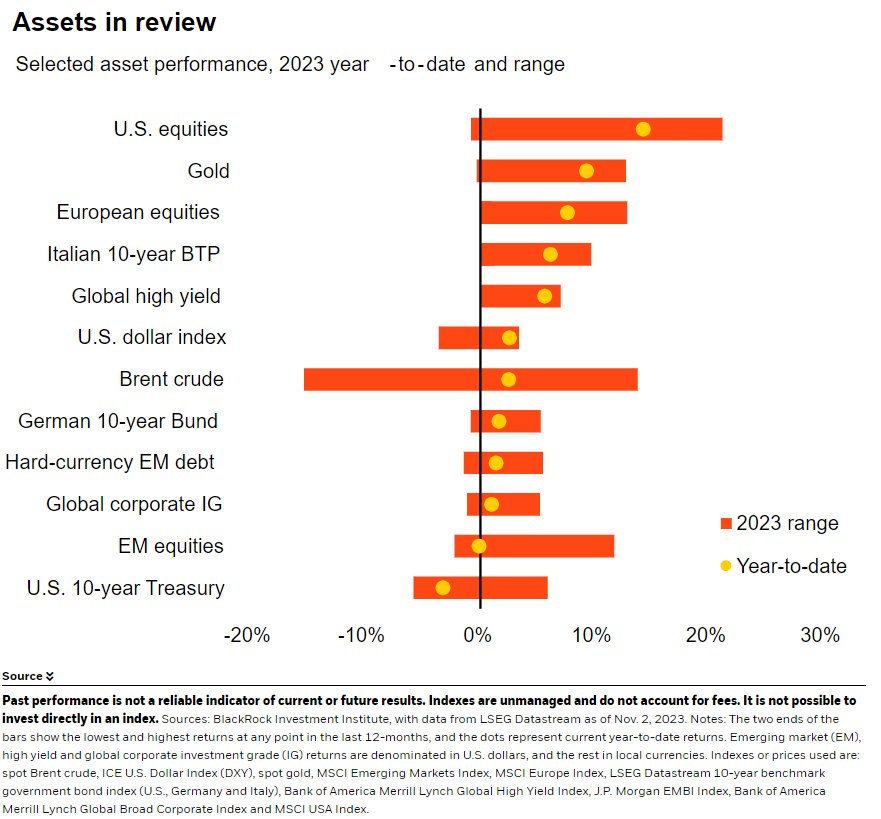

Market backdrop: U.S. stocks bounced 6% last week as 10-year Treasury yields plummeted on the Fed’s pause and slowing wage growth, underscoring the new regime’s volatility.

Week ahead: This week’s slew of macro data will likely show muted economic activity in China on weak consumer spending and exports. We’re neutral emerging stocks.

Markets rallied last week from multi-month lows after central banks kept rates steady and signs emerged of slowing U.S. wage growth, highlighting the volatility of the new macro regime. What got lost in the shuffle: Central banks have signaled policy rates are staying high for longer. As markets adjust, we find that granular opportunities abound. We stay selective in DM stocks and bonds, tapping markets like Japanese stocks on the back of corporate earnings and reforms.

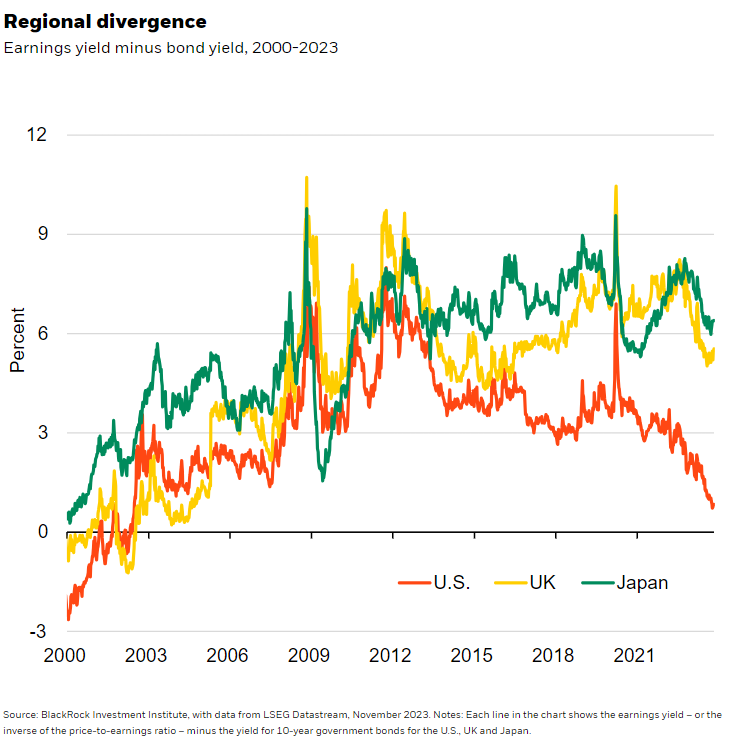

We see regional stock markets facing diverse policy, inflation and growth prospects – affecting corporate earnings. That variety is reflected in the wide dispersion in excess compensation investors receive for the risk of holding stocks over bonds – or earnings yield minus bond yield – in different DMs. That divergence creates opportunities to be selective, in our view. The excess yield is compressed in the U.S. (dark orange line). We remain underweight U.S. stocks – still our largest portfolio allocation – on a six-to-12-month, tactical horizon. We get exposure to the tech sector, which has outperformed the broader U.S. stock market, through an overweight to the artificial intelligence (AI) theme in DM stocks. The compensation is higher for the UK (green line) but we see diminished growth prospects there. We’re neutral UK stocks. The excess yield is slightly higher for Japan (yellow line) where we are overweight.

Ten-year Treasury yields saw their largest weekly drop in a year last week. We went neutral long-term Treasuries last month because we saw equal odds of Treasury yields swinging in either direction after their surge to 16-year highs. That two-way volatility is playing out now in large daily moves – and yields are still sharply higher since the start of the year. U.S equities have bounced up after a stretch of losses – even when stripping out the impact of the largest public companies. Higher valuations have pinched the earnings yield gap over higher bond yields. Yet U.S. corporate earnings growth has sputtered in the past year as economic activity has broadly slowed. We stay cautious on DM stocks. U.S. Q3 corporate earnings have slightly beat muted expectations on modest revenue growth, pointing to an expansion of profit margins. But we think higher interest rates and financing costs will crunch earnings and profit margins.

Other DMs

We assess what’s in the price for both stocks and bonds in other DM markets. We recently went overweight euro area government bonds and UK gilts to lock in higher yields as markets price in rates staying higher than even we expect. We stay underweight euro area stocks: Even with attractive valuations versus U.S. stocks, expectations for high single digit earnings growth over the next year look too rosy to us. Euro area corporate margins face pressure from higher rates and slower global growth. We upgraded UK stocks to neutral in July and stay there as attractive valuations better reflect the weak growth outlook and hit from rate hikes. Yet we don’t see a catalyst for turning more positive.

We’re underweight Japanese government bonds. We see their yields rising further: The Bank of Japan took a step away from its ultra-loose monetary policy last week when it loosened the cap on 10-year yields even while reserving the option to intervene if yields rise too fast by making 1.0% the “reference rate.” We still see a supportive backdrop for Japanese corporate earnings and stocks thanks to stronger growth and reduced policy uncertainty. We stay overweight after upgrading them from neutral in July. Corporate reforms such as bigger share buybacks and dividends are also shareholder friendly.

Bottom line

Markets are starting to price in the volatile new regime of higher rates and lower long-term growth. We see greater dispersion – and opportunities – as a result. DM stocks are the major building block of portfolios. We get selective across regions based on valuations, earnings prospects and what’s in the price. We’re overweight short-term Treasuries and recently upgraded long-term bonds to neutral. We are also overweight euro area government bonds and UK gilts.

Market backdrop

U.S. stocks jumped 6% this week on the drop in long-term yields. Ten-year U.S. Treasury yields fell around 0.3 percentage points this week – the largest weekly drop in a year – and are nearly 0.5 percentage points below the 16-year high hit last month. We think these sharp yield swings reflect the more two-way risk for bonds as the Fed nears the peak in policy rates. While data revealing slowing wage growth is a step in the right direction, we don’t see in rate cuts until later next year.

China takes center stage this week. A slew of macro data will help gauge how subdued activity remains. Two key challenges weigh on China’s economy: sluggish consumer spending and weak demand for its exports. Crucially, spending lags its pre-pandemic pace. We revised our 2023 growth expectations down to around 5% as a result.

Week Ahead

Nov. 7: U.S. trade data; China trade data

Nov. 9: China CPI, PPI; U.S. initial jobless claims

Nov. 10: University of Michigan consumer survey; UK GDP

Nov. 10-17: China total social financing

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 6th November, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.