Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Nicholas Fawcett – Macro Research and Filip Nikolic – Macro Research all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

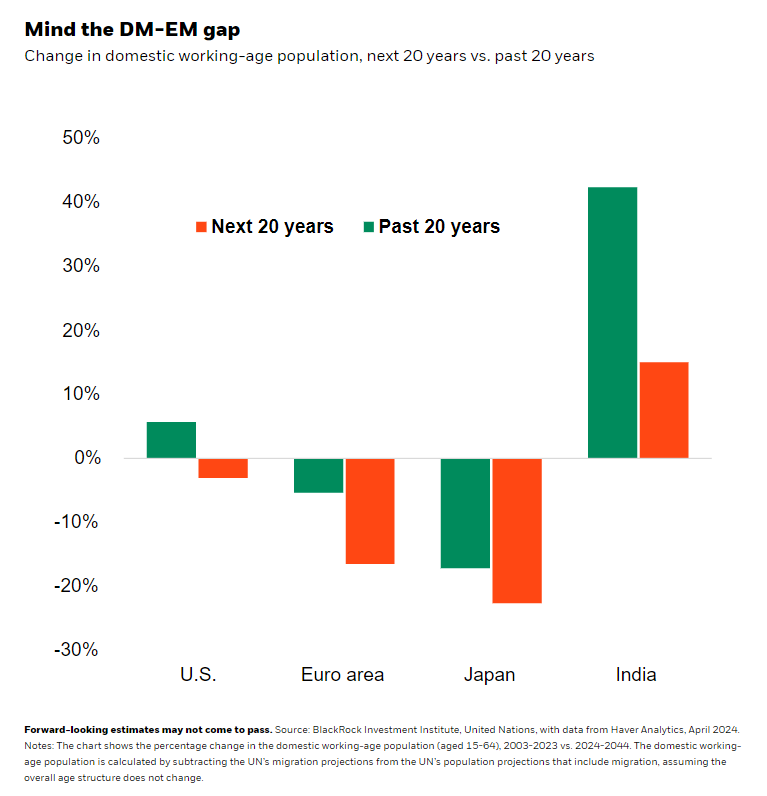

Pinpointing demographic winners: Working-age populations are declining in major economies. We favor countries that are better adapting and sectors set to benefit from spending shifts.

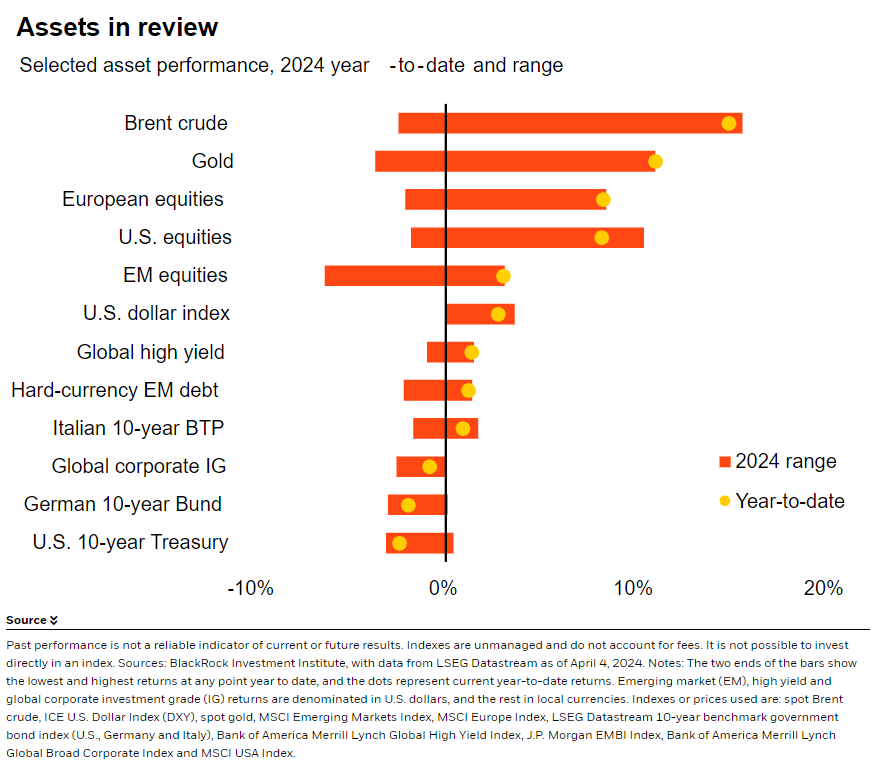

Market backdrop: U.S. yields jumped last week but U.S. stocks remain near all-time highs. The strong March U.S. jobs data supports our view of only two or three cuts this year.

Week ahead: We eye this week’s U.S. CPI. We see goods inflation pulling down overall inflation while services remain sticky. We watch for how soon the ECB will cut rates.

Working-age populations are shrinking across developed markets (DMs) but still growing in emerging markets (EMs). That hurts DM economic growth and favors EM growth – a divergence that is broadly reflected in asset prices, in our view. Yet we think the demographic mega force is also driving structural shifts in sectors – like healthcare and real estate – that are not priced in. We get selective, seeking EMs capitalizing on their younger populations and DMs better adapting to aging.

Life expectancy is rising and birth rates are falling across the globe. In many DMs, that means the working-age population is set to shrink over the next 20 years. See the chart. That has vast macro implications. Fewer workers means slower growth. It is also inflationary, in our view. Retirees stop producing economic output, but do not typically spend less, historical data show. Plus, governments are likely to spend more on healthcare and pensions. The resulting inflationary pressure is one reason why we expect central bank policy rates to stay above pre-pandemic levels. Aging-related spending also threatens to push up government debt, with global public debt having already tripled since the mid-1970s to 92% of global GDP in 2022. And that debt is likely to be subject to higher interest costs. The economic picture looks quite different in EMs, like India, where the working-age population is still growing.

We think the broad growth impact of diverging population trends is well understood by markets. Yet as we outline in our new research paper, countries can respond differently – creating an uncertain outlook. We believe this will affect asset prices as markets adjust to how countries adapt. Within EMs, we seek those more likely to capitalize on their demographic advantage by bringing more working-age people into the workforce or that look to ramp up investment in productive capital, like public infrastructure. Growing populations consume more energy, so we expect rising spending on energy infrastructure in places like India and Indonesia. We think higher returns are likely in EMs with stronger growth and greater investment demand.

Seeking winners across countries and sectors

In DMs, we look for those that could better adapt and outperform the growth outlook markets have priced. DMs can mitigate the hit to growth by finding more workers – from other countries, or among women and other groups underrepresented in the workforce. Japan has somewhat lessened the impact of aging by substantially raising female participation. The recent immigration surge in the U.S., UK and Canada is boosting their workforces, as reflected in last week’s bumper U.S. jobs report, but it would have to persist for years to fully offset working-age population declines – unlikely, in our view. We’re monitoring how much artificial intelligence (AI) can boost the productivity of a smaller workforce.

Even less understood by markets, we believe, is the sectoral impact of mega forces – or big structural shifts driving returns. Older populations spend differently than younger ones. For example, healthcare spending rises with age. Real estate demand could change since older people typically move less frequently. Yet research shows even predictable spending shifts are not priced in until they hit. That was true for healthcare in Japan, where valuations have risen broadly in lockstep with the well-signposted growth of the country’s retired population. That appears true now in the U.S. and Europe – one reason we like healthcare in both regions. We also think AI names will benefit from investment in automation to boost worker productivity.

Our bottom line

In EM, we favor countries best able to capitalize on their demographic advantage. We prefer DMs whose responses to aging could be underappreciated. We target sectors and firms poised to benefit from new spending patterns.

Market backdrop

The S&P 500 dipped 1% last week but was near a record high and 10-year Treasury yields jumped to their highs of the year near 4.40%. The March U.S. payrolls data showed job gains easily beating expectations. We think this reflects an unexpected surge in immigration helping expand the workforce. Markets are pricing in between two and three quarter-point Fed rate cuts this year. We think June is no longer a given for the Fed to start cutting rates – but see rate cuts coming as inflation falls.

U.S. inflation data is in focus this week. We expect inflation to fall toward the Federal Reserve’s 2% policy target this year as goods prices keep falling from pandemic highs. Yet we still see inflation on a rollercoaster back up in 2025, led by stubborn services inflation. We think core inflation will settle closer to 3% – higher than pre-pandemic levels. We watch for the European Central Bank (ECB) to give more clues on the timing of rate cuts at next week’s policy meeting.

Week Ahead

April 10: U.S. CPI

April 11: China CPI and PPI; European Central Bank policy decision

April 12: University of Michigan consumer sentiment survey; China trade data; UK GDP

April 10-17: China total social financing

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 8th April, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.