Wei Li – Global Chief Investment Strategist of BlackRock Investment Institute together with Ben Powell – Chief Investment Strategist for APAC, Axel Christensen – Chief Investment Strategist for Latin America, and Catherine Kress – Head of Geopolitical Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

EM resiliency: We see emerging markets better withstanding volatility and benefiting as supply chains rewire. We switch our EM debt preference to hard currency from local.

Market backdrop: Developed market stocks slid last week and long-term bond yields jumped as markets focused on U.S. fiscal challenges. We see long-term yields rising more.

Week ahead: All eyes are on U.S. inflation this week after softer-than-expected data in the last CPI print. We see persistent wage pressure keeping core inflation sticky

Last week’s bond yield jump and stock tumble underscore we’re in a new regime of greater volatility. A renewed focus on U.S. fiscal challenges and surprise policy tightening in Japan have stirred up volatility in developed markets (DM). We think emerging market (EM) assets have an edge as their central banks cut rates and some benefit from rewiring supply chains. What’s in the price is key. We rotate our EM bond preference to favor hard currency and stay granular in EM stocks.

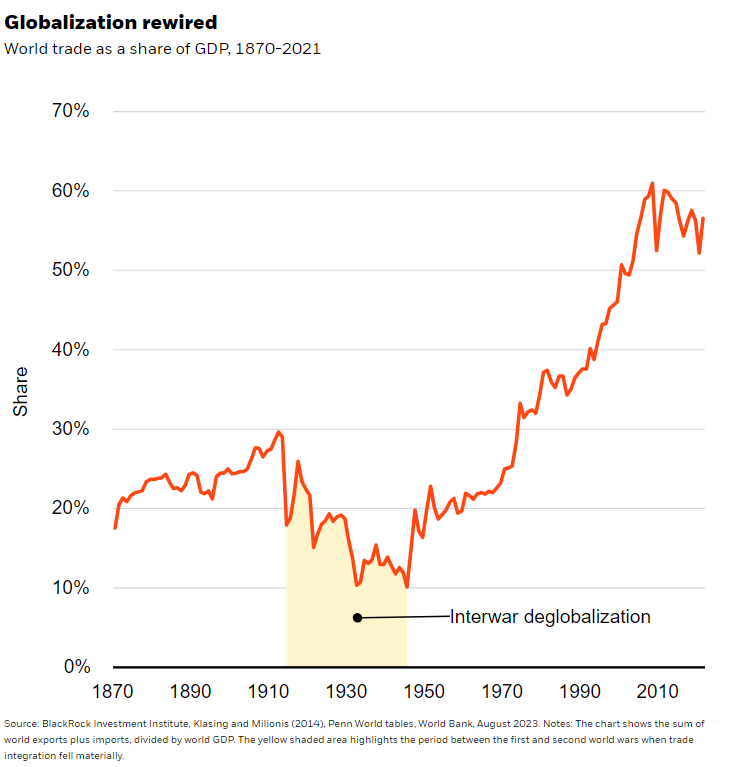

Trade activity between nations dipped between World War One and World War Two (yellow shaded area in chart) before surging in the decades after World War Two as globalization took shape. Yet trade as a share of global GDP has plateaued (orange line) since the 2008 global financial crisis – one sign that globalization is under pressure. We see a world of fragmentation ahead: Competing defense and economic blocs are emerging. Multi-aligned nations are set to grow in power and influence, and we expect many major EMs to fall into this camp. As global fragmentation plays out, countries and companies are increasingly prioritizing security and resiliency – through industrial subsidies, export controls and other tools – over maximum efficiency. We see this shift in priorities accelerating the rewiring of supply chains as nations aim to bring production closer to home. All this favors selected EMs, in our view.

Against that structural backdrop, we also favor broad EM exposures over DMs in the short term. DMs are experiencing bouts of volatility and we see risk of more. The Fitch Ratings downgrade of the U.S. credit rating last week and the U.S. Treasury’s sizable borrowing needs put a spotlight on the challenging U.S. fiscal outlook. We think EMs are relatively better positioned to withstand some of this volatility. That’s partly due to EM central banks nearing the end of their rate hiking cycles. Some have started to cut policy rates, like in Chile and Brazil. Yet they’re not immune from a sharp hit to risks assets, in our view.

EM angle

We put our new playbook in action again by gauging what’s in the price. We flip our overweight to EM local currency debt to neutral and turn overweight EM hard currency debt on a six- to 12-month tactical horizon. We had been overweight EM local currency debt since March on attractive yields from EM central banks nearing the end of their hiking cycles and a broadly weaker U.S. dollar. We began to reassess our view on local currency in July: Yields have fallen closer to U.S. Treasury yields. Rate cuts seem largely priced in and could put downward pressure on EM currencies, dragging on local currency returns.

EM hard currency debt – issued in U.S. dollars and thus cushioning returns from any local currency weakness – looks more attractive. Hard currency debt is more diversified than local currency, based on J.P. Morgan indexes, and it could benefit from the rewiring of globalization. We also think lower credit ratings in EM hard currency debt are priced in given that yields are at a near 14-year high versus local currency bond yields, Refinitiv data show.

We prefer EM bonds and stocks as we see a rewiring of supply chains benefiting select countries that offer valuable commodities and supply chain inputs. That includes oil from the Gulf states; India’s chemicals and industrial manufacturing; South Korea’s battery and memory supply chain businesses; Indonesia’s nickel and cobalt; and Chile’s lithium. Some, like Mexico, could benefit from U.S. and other DM efforts to reshore production closer to home. That push includes the making of semiconductors – the technology powering artificial intelligence (AI) and a key part of major EM tech sectors. Yet as an investment opportunity, the AI mega force may be bigger within DM, supporting revenues and margins across sectors.

Bottom line

We are in a new regime of greater volatility – and we see EMs better positioned to withstand it, for now. We harness mega forces to find opportunities based on what’s in the price. We stay overweight EM debt overall but switch our preference to hard currency on its high yields. We like EMs that may benefit from rewiring globalization.

We’re watching July U.S. CPI inflation this week after softer-than-expected data in June. We expected the normalization in consumer spending to lead to a decline in goods prices. The key for us: persistent service price pressures from wage growth in a tight labor market. Payrolls data last Friday confirmed that tightness, with unemployment still near historical lows.

Week Ahead

Aug. 8: China trade data

Aug. 9: China CPI, PPI

Aug. 10 – 17: China total social financing; U.S. July CPI (Aug. 10)

Aug. 11: UK GDP; U.S. PPI, Michigan consumer sentiment survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 7th August, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.