Alex Brazier, Deputy Head of the BlackRock Institute together with Wei Li , Global Chief Investment Strategist, Elga Bartsch, Head of Macro Research and Nicholas Fawcett, Member of the Economic and Markets Research Team all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points:

Macro impact – We see the Ukraine war reducing global growth, increasing inflation and putting central banks in a bind. We prefer developed stocks in the inflationary backdrop.

Market backdrop – Stocks led by European equities bounced from 2022 lows last week, as oil prices came off highs. The European Central Bank accelerated policy normalization.

Week ahead – The Fed is set to raise its policy rate by 0.25% this week – the first hike since the pandemic started. We still see a historically muted response to inflation.

The war in Ukraine has already caused a terrible human toll. We see it extracting a heavy economic price as well, mostly via higher energy costs. This is a major supply shock layered onto an existing one, and we see it resulting in higher inflation and lower growth, especially in the euro area. This puts central banks in a bind: Trying to contain inflation will be more costly, and they can’t cushion the growth shock. We prefer developed equities in this inflationary environment.

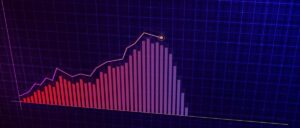

The Ukraine war has caused a spike in energy prices, putting a damper on growth and exacerbating supply-driven inflation. Europe is most exposed. Natural gas prices have surged beyond 2021 peaks, as the red line in the chart shows, before reversing a bit last week. The big difference with 2021: High energy prices are now the cause of a downdraft in growth, whereas they were the outcome of strong growth then. The culprit is Europe’s reliance on Russian gas in an already tight market. The powerful economic restart from the Covid-19 shock in 2021 had already exposed mismatches in the region’s energy supply and demand. This was aggravated by a mix of geopolitical factors and weather-related supply disruptions just as European inventories were low. The recent surge in European energy prices has pushed the region’s energy burden as a percentage of GDP to above levels reached in the early 1970s, we calculate, whereas the U.S. is still well below it. This is why we think the impact of the current energy shock for Europe could be on par with previous severe episodes such as the 1973 oil embargo.

Higher energy prices are a material, global shock. Europe is facing a large, stagflationary shock, in our view. Analysts are ratcheting down their growth forecasts and upping their inflation projections. This is not over, and we believe the European Central Bank (ECB) growth forecasts understate the shock’s impact on growth. The U.S. is in a better spot, in our view. The shock is less than previous energy crises. The U.S. also has a larger growth cushion thanks to the strong restart’s momentum – even if some of European weakness is bound to spill over.

How will policymakers respond to the poisonous combination of slowing growth and rising inflation? Central banks have to normalize policy as the economy no longer needs stimulus, we believe, so policy rates are headed higher. The ECB last week said it would phase out asset purchases and left the door open for a rate increase this year – the first in more than a decade. The U.S. Federal Reserve this week is expected to announce its first rate hike since the Covid shock, while the Bank of England and a slew of emerging market central banks are set to hold rates or raise them. We still see a historically muted cumulative response to inflation; more aggressive tightening would come at too high a cost to growth and employment. Central banks will be forced to live with inflation. But it’s tough to see central banks coming to the rescue to halt a growth slowdown in this inflationary environment. Our conclusion: central banks are less likely to shape macro outcomes going forward. That leaves fiscal support. The war has raised the prospect of fiscal stimulus to achieve energy security and up defense outlays, but we see this taking time.

The imminent hit to growth has reduced the risk that central banks slam the brakes and aggressively raise rates to contain inflation. So what are the risks? In the short run, escalation of the war and more energy supply shocks are key catalysts for more risk-off market moves. We see a risk of inflation expectations becoming unanchored in the medium term, causing central banks to raise rates sharply. Energy prices are now driving growth, rather than being the result of it. This raises the specter of stagflation–something that was not in play before due to the economy’s strong growth momentum.

What does this mean for investments? We prefer to take risk in DM equities against the inflationary backdrop of negative real bond yields. We expect the global energy shock to hurt corporate earnings, especially in Europe. Recent market declines reflected this, we believe, and the region’s stocks are highly geared toward global growth. We stay underweight government bonds. They are losing their diversification benefits, and we see investors demanding greater compensation for holding them amid higher inflation and larger debt loads. Within the asset class, we prefer short-dated and inflation-linked bonds.

Market backdrop

Crude oil prices shot up to 14-year highs on supply concerns but then suffered their biggest one-day decline in almost two years. Equities followed suit, rebounding from plumbing new 2022 lows earlier in the week. The ECB said it would phase out asset purchases in the third quarter and left the door open for a rate increase this year. Peripheral bond spreads widened.

Week ahead

March 15 – China industrial output and retail sales; UK unemployment data

March 16 – Fed monetary policy meeting; Brazil rate decision

March 17 – UK, Indonesia and Turkey rate decisions

March 18 – Russia rate decision

The U.S. Federal Reserve is expected to raise its policy rate for the first time since the Covid shock. The Bank of England (BoE) is set to announce its third hike, and a slew of emerging market central banks are set to hold rates or raise them. Both the Fed and BoE are keen to normalize policy rates back to pre-Covid settings. We don’t expect them to go beyond that to try to squash high inflation as the costs to growth and employment would be too high. We see central banks living with inflation.

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of February 28th, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.