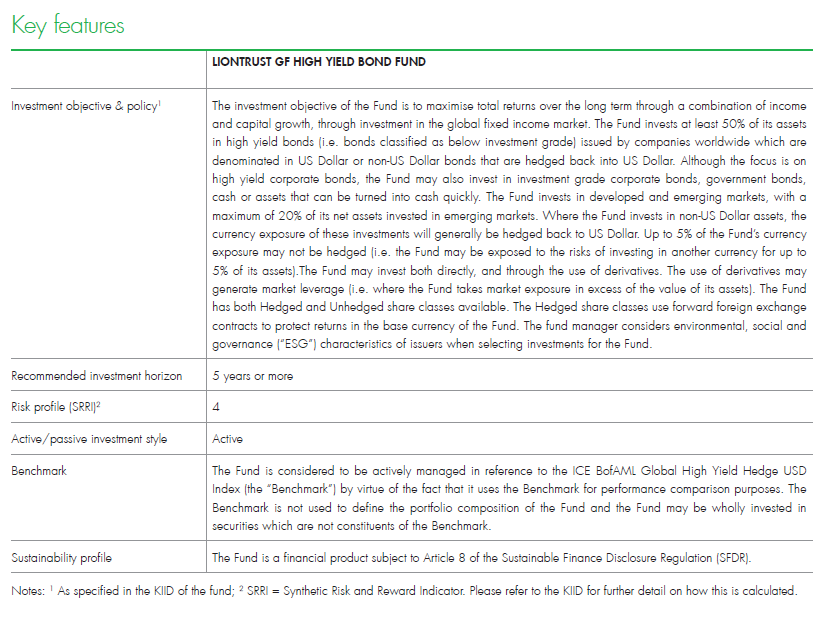

Liontrust GF High Yield Bond Fund is manufactured by Liontrust Fund Partners LLP and represented in Malta by MeDirect Bank (Malta) plc.

Market review

The global high yield (HY) market returned a positive quarter of +0.9% (USD) in Q1 2024, taking the full year 2023 return to +12.9%, a complete turnaround from last year’s negative return (-11.4%). The US HY market produced a return of 0.3% (USD) in Q1 2024; in Europe the market returned 1.4% during the period.

Both markets performed well primarily on the back of expectations that rate cuts are on the horizon amid easing inflation concerns, while the Federal Reserve embraced a ‘lower, sooner’ narrative at its December meeting. These developments led the market to price rate cuts in the early part of 2024, with the ‘peak rates’ narrative this resulted in boosting performance in risk assets.

The US and European HY markets in Q1 both saw CCC bonds outperform BB and B bonds, in particular in Europe. A lot of the better-quality credits in the asset class are trading with a tight spread; investors are looking for pockets of value across bonds, some further down the capital structure, further down the ratings spectrum or across sectors that have previously been unloved.

Demand for new issues is resilient, bonds are tightening well inside IPT (Initial Price Talk) and often leave minimal premium to the secondary market, but access to the market has predominantly been from better quality issuers. We are likely to see the uptick in primary over the next quarter.

We have not seen issuance from lower-quality companies, mainly because of the high coupon that would be required to get a deal done at the expense to issuers who may not have the best free cash flow profile to deal with an increase in interest costs. These companies are having to seek alternative financing. However, we have seen a few headlines this quarter from companies that have a good business but also have 2025 maturities to address. In these cases, where accessing the bond market doesn’t look feasible they are having to seek advice from debt advisors about restructuring their debt.

Fund review

Relative to index, the best performing sectors in the Fund during Q1 2024 were real estate, insurance and basic industry. Real estate in particular has seen a strong turnaround year-to-date, supported by market expectations of rate cuts on the horizon and also by being one of the few sectors looking attractive from a valuation standpoint. This sector was previously a drag to performance, but we expect the positive turnaround to persevere. Among the strong stock picking contributors was CPI Properties (office, retail and hotels in central & eastern Europe). The bonds benefited from positive headlines around asset disposals and also from news that the company is in talks with private equity Apollo about a €450 million investment.

This quarter, the healthcare and capital goods sectors were a drag on performance, but mainly for idiosyncratic reasons. Grifols (a Spanish plasma therapeutics company) has upcoming 2025 maturities to address which it intends to do so from a mixture of asset sale proceeds (due to complete H1 2024) and cash. The bonds experienced some volatility relating to a short-seller note from Gotham City questioning the company’s financial accounting, which the company and Spanish regulators later addressed. Rating downgrades mainly cite the risks around the success of the asset stake sale and proceeds coming through, which in turn would be a risk for the company of not being in a position to address upcoming maturities. We believe we have right-sized our exposure considering the risks, and expect the asset sale to successfully go through. Management have formally said how they wish to use the proceeds for debt reduction explicitly, the rating agencies are now waiting to conclude their review on the back of the anticipated debt reduction.

Ardagh, an Irish glass and metal packaging company, is well known within the HY market. Operationally, it has been impacted by volume declines due to customer de-stocking and isolated issues related to one of its key customers. It too, like Grifols, has 2025 maturities to address and had plenty of liquidity to get through 2025 needs, but a headline regarding the company’s intention to seek debt restructuring advice saw the bonds react negatively. We sold out of our modest position on the back of the headline. A company like Ardagh has a good business but too much debt on its balance sheet to navigate the current environment, where access to the markets requires issuers to pay a substantial coupon.

Trade activity

During Q1 2024, we participated in five new issues. We participated in Pinewood (BB+/BBB-), a leading independent provider of infrastructure required to produce film and TV content. We liked the fact the credit is supported by rents that are mostly long-term and RPI linked. The company has recently expanded out its sites and have pre-let most of the expansion before completion, indicating the level of demand for space, alongside the positive demand for online streaming provides a good tailwind for the credit. Interest costs will increase on the back of this refinancing but it will be manageable and the expected increase in EBITDA should offset this. The company offered a six year, £500 million note with a 6% coupon. Although it came at the tighter end of guidance, for a highly rated company with a solid credit profile, we thought it justified a tighter spread.

FirstCash is a company we already had exposure to via the unsecured 4.625% $ 2028 notes, a company that owns and operates pawn stores in North and Central America. It came to market with a 2032 bond with a 6.875% coupon, for a Ba2/BB rated credit. We thought the pricing was attractive and participated in the deal.

Q-park is one of the leading off-street parking infrastructure owners and operators in Western Europe, and came to the market to refinance upcoming maturities. We liked the strong business model, ability to pass on inflationary linked costs to customers and strong operating track record, mainly supported by the company’s ability to increase tariffs. The new euro issue is rated B1/BB- and came with a 5.125% coupon.

We participated in Ardonagh, an insurance broker, carrying out both property and casualty insurance distribution and specialty insurance broking. We like the structural growth in the end markets, low cyclicality of the industry, capital-light business model, and high customer retention rates. As Ardonagh expands, the company is moving up the value chain to start to look more like a European version of Marsh or Aon. Net leverage is high at 5.5 times, and that’s using pro forma EBITDA figures as opposed to reported ones, but the company has the ability to deleverage using cash flow by about 0.5 times per annum. The secured euro denominated bonds purchased are rated B-/B with a coupon of 6.875%, giving a credit spread of about 475 basis points.

Finally, we also purchased debt issued by Kier, a construction company with a large proportion of revenue from public sector contracts. While the construction sector itself is highly cyclical, the long-term contracts that Kier has create great revenue visibility which is an attribute that we value highly in a bond issuer. Kier had a chequered past – it undertook a rescue rights issue five years ago and the new management has turned the company around and de-risked the contracts. The balance sheet has also improved and is forecast to continue to do so, resulting in a broad credit rating of BB (BB- at S&P, BB+ at Fitch). We are attracted to the revenue visibility and continued credit improvement story, and with a yield of 9% for 5-year sterling bonds we think this is an attractive opportunity.

Outlook

The market looks to be embracing the prospect of interest rate cuts in 2024. As the rate cuts arrive, we still anticipate a mild recession. We expect credit spreads to remain tight until there is further evidence of fundamental deterioration amongst credits.

We anticipate lower-quality companies to suffer from refinancing difficulties, especially with the 2025/26 debt maturity walls that investors are anxious about. The higher coupon needed to get a deal done in this market will be a burden on free cash flow generation for those companies that are able to access the market, and liquidity buffers will be impacted as well as leverage increasing. These factors should lead us to see higher default rates (from a low base) in the asset class over 2024 and a wider dispersion of credit spreads from higher quality credits to lower quality ones.

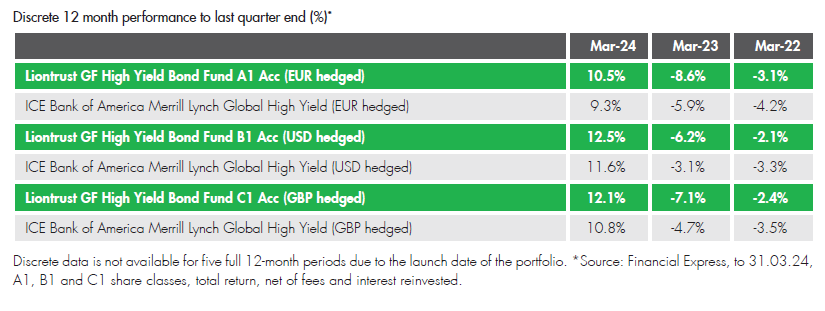

Our strategy has survived and succeeded from what we believe was close to a perfect storm in 2022, when duration fears took over. The Fund continues to invest in bonds based on strong corporate fundamentals and has a bias towards high quality defensive credits, with minimal exposure to cyclical credits. It is notable that the spread compensation between BB and CCC credit is now below average, so the natural opportunity cost that comes with our strategy is reduced.

CCCs outperformed in 2023, yet the Fund performed well. We believe our defensive approach stands us in good shape to perform well if and when default risk is the major driver of the market, rather than interest rates. The Fund is currently offering a yield of around 9.2% for sterling investors (~7.6% for euro investors). Given the credit risk we ask our clients to take when investing in this Fund, we view this as attractive for long-term investors.

Liontrust Key risks & Disclaimers:

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF High Yield Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative’s underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

Issued by Liontrust Fund Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518165) to undertake regulated investment business.

This document should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Liontrust Fund Partners LLP. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.