Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Glenn Purves – Global Head of Macro and Vivek Paul – Global Head of Portfolio Research, all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Eyes on opportunities : At our internal Midyear Forum, our portfolio managers were laser focused on how and where to capture opportunities, even as uncertainty abounds.

Market backdrop : U.S. stocks rose last week on news of fresh U.S.-China trade talks and a solid U.S. jobs report – but it’s too soon to tell if tariffs are hurting the labor market.

Week ahead : We’re looking at U.S. CPI to see if tariffs are starting to push inflation up and see persistent inflation pressure limiting how far the Fed can cut rates this year.

BlackRock’s senior portfolio managers came together at our Midyear Forum last week. What was striking was the sharp focus on opportunities even as uncertainty abounds and as policymaking disrupts, rather than stabilizes, markets. They saw a plethora and shared techniques for spotting them. Their takeaways: look through near-term noise; be deliberate about the kinds of risk you’re taking; leverage AI; and watch for biases. More to come in our Midyear Outlook, out on July 1!

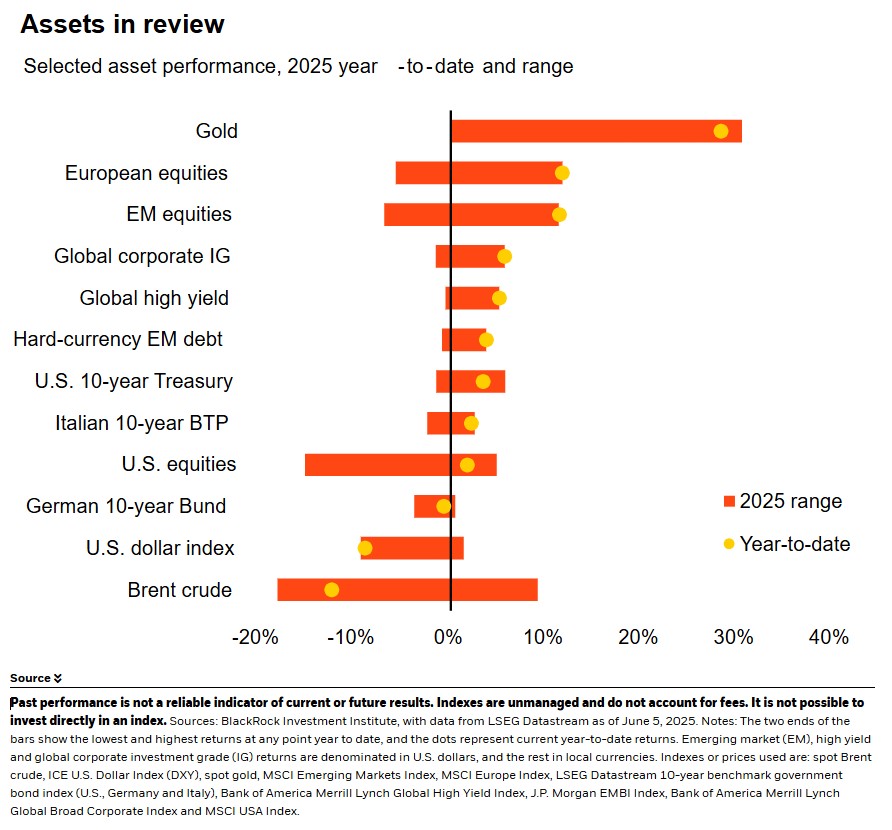

A key takeaway from our end-2024 Forum was that policymaking would become a source of disruption rather than stability. That has played out this year. In the U.S., inflation is stickier and public debt and fiscal deficits have swelled since the pandemic. With rates structurally higher now, governments and central banks face sharper trade-offs between aiding growth and curbing inflation. This reduced room to maneuver – and the global economic impact of mega forces like geopolitical fragmentation and AI – makes the macro outlook less predictable. As a result, long-term assets like 10-year U.S. Treasuries are more sensitive to incoming data, a stark departure from the pre-pandemic era. See the chart. Today, policy interventions are more likely to amplify than dampen market volatility. Yet at our Midyear Forum, our managers focused on the many opportunities, not the uncertainty.

One way our portfolio managers are finding opportunities in this environment? Looking through the near-term noise and focusing on the big picture. For all the ups and downs in markets since the start of the year, they agreed that the drivers of the best-performing companies’ equity gains have not actually changed much. They exchanged views on specific opportunities they see weathering or benefiting from the volatility. That included a shared conviction in the AI mega force driving further returns, pointing to Nvidia’s recent earnings beat despite tariff-related drags on earnings – but noted medium-term regulatory risk and the potential for slower deployment. They also like energy, again pointing to the AI mega force as one key driver of rising global energy demand that calls for more production of all kinds of energy. They noted how governments’ prioritization of homegrown, reliable power has opened up opportunities in select regions and industries.

Taking risk differently

Another key to finding opportunities? Taking risk differently. Our portfolio managers are refining their frameworks for taking risk, identifying multiple distinct types like macro, mega forces and relative value. One example: they are increasingly looking for pockets of relative value – such as that created by the dispersion we’re seeing in the government bond market. They are finding it across different bond maturities, especially as long-term bond yields are marching steadily upwards across developed markets. They are also finding it across countries as central banks take different approaches to managing the tougher trade-off between growth and inflation. Euro area bonds, for instance, are increasingly less correlated to swings in U.S. Treasuries and stand to benefit from recent rate cuts to support growth in the region.

Our portfolio managers discussed several other techniques for spotting opportunities. They are leveraging AI to discern the signal from the noise, as well as tracking patterns and sentiment shifts in their own discussions. They also discussed the importance of being aware of and managing behavioral biases, recognizing that people are less likely to take risk when uncertainty is higher. Look out for our Midyear Outlook – coming on July 1 – which will discuss these themes in more depth.

Our bottom line

Our portfolio managers are laser focused on opportunities even as policymaking adds to volatility. They’re finding opportunities by looking through near-term noise and taking risk differently. Watch for more in our Midyear Outlook.

Market backdrop

The S&P 500 rose 1.5% last week after news emerged about fresh U.S.-China trade talks and the U.S. May jobs report showed solid job growth. Policy uncertainty is likely slowing company decision-making, so any tariff impact on the labor market may only come later. A mid-week dip in 10-year U.S. Treasury yields was short-lived: they ended the week up slightly at 4.5% and 60 basis points above April lows. Europe’s Stoxx 600 rose 1%.

We’re monitoring the U.S. CPI report for signs that tariffs are starting to feed through into consumer prices. Inflation has cooled in recent data, but we don’t see this as a good guide to the future: we see tariff pressures building in coming months and expect a tight labor market to push up on services inflation. That will likely limit how far the Fed cuts policy rates.

Week Ahead

June 9 : China CPI

June 11 : U.S. CPI

June 13 : University of Michigan May sentiment survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 9th June, 2025 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.