My Card - Modern, simple and free.

Your MeDirect Debit Card is the perfect choice for your financial needs. Mastercard’s wide acceptance across the globe allows you to withdraw cash, make online payments, and buy goods from numerous locations worldwide.

Earn Cashback with MeDirect's Mastercard!

Make contactless payments with Apple Pay

Add your MeDirect Debit Card to Apple Wallet and enable contactless and online purchases via your smartphone or smartwatch.

Make contactless payments with Google Pay™

Add your MeDirect Debit Card to Google Wallet™ and enable contactless and online purchases via your smartphone or smartwatch.

A Free Card

Ordering a MeDirect Debit Card is a quick and easy process that can be done through the MeDirect Mobile App or Online Platform, and it won’t cost you a cent.

A Free Online Account

Opening an account with MeDirect is a hassle-free process that can be completed within a few minutes. There are no minimum balance requirements, and you won’t be charged any fees for account management or maintenance.

Free Transfers

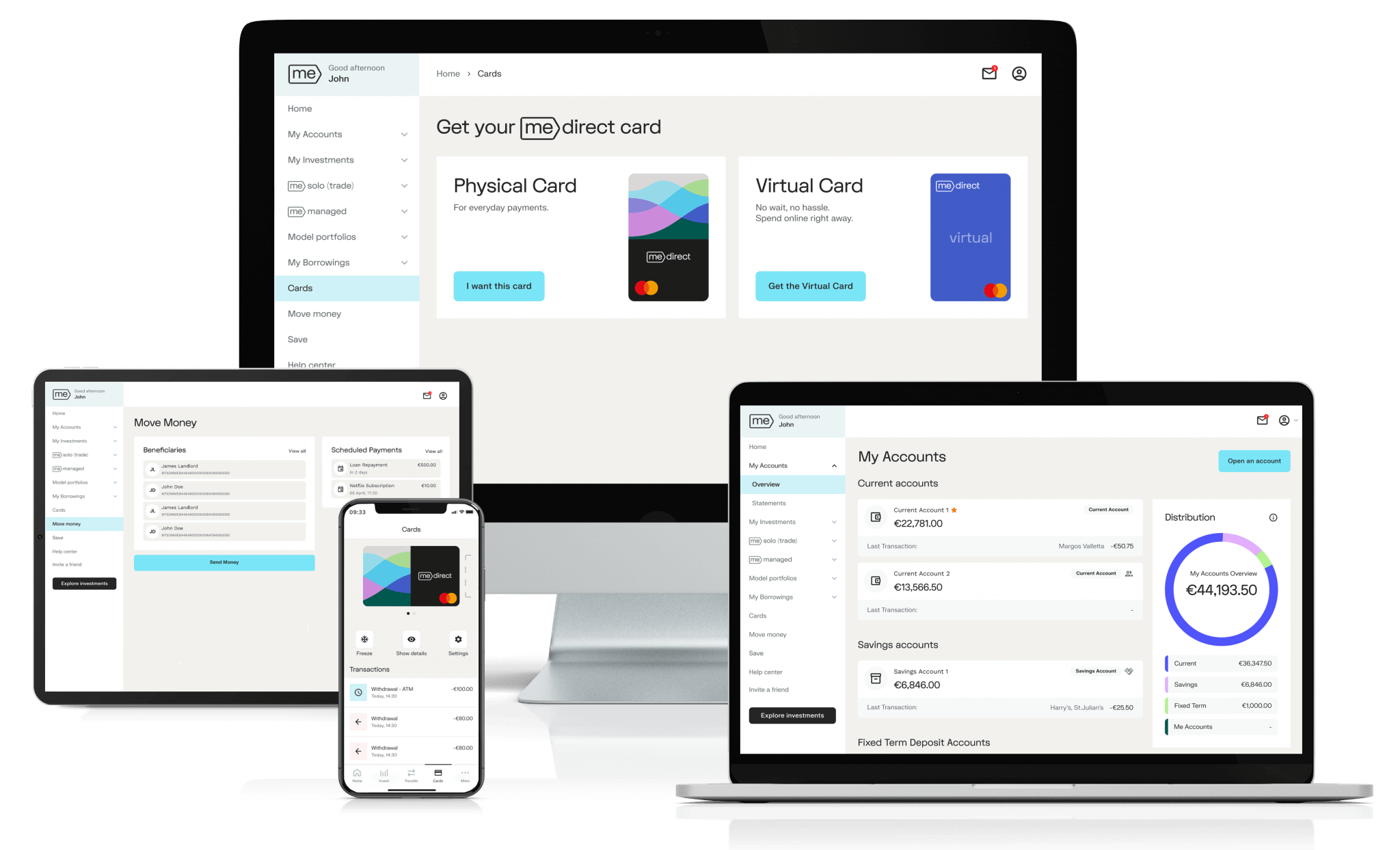

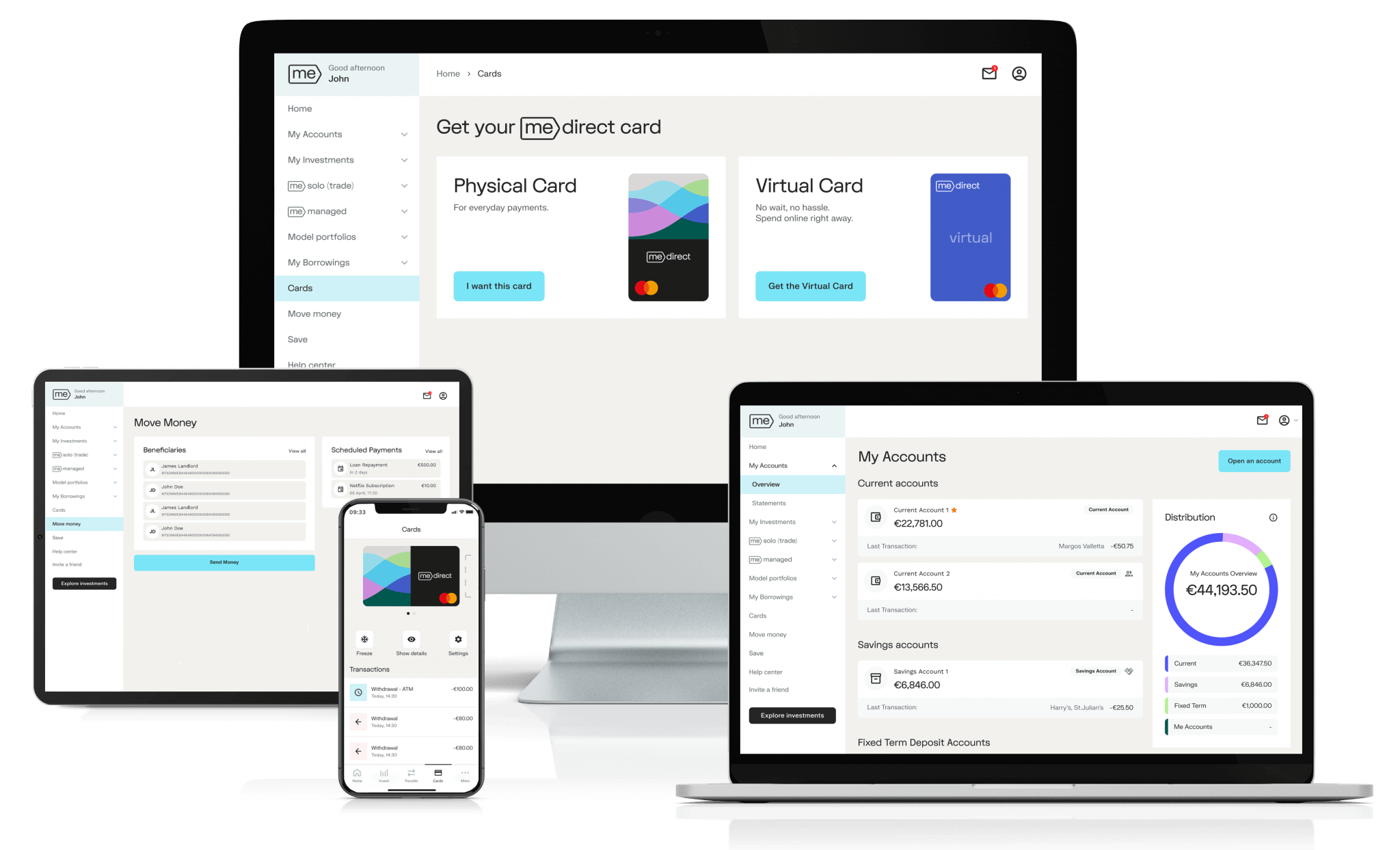

Fully Online

With MeDirect’s Mobile App and Online Platform, you can conveniently access a comprehensive overview of your financial situation. All of your bank accounts can be managed in one place, giving you complete control over your finances.

Multiple Currency Account Facility

You can open and manage accounts in EUR, GBP, USD, AUD, NOK, CAD, CHF, JPY, DKK and SEK. If you need to make a transaction in any of these currencies and you have a funded MeDirect account in that currency, you can make transactions without incurring any foreign exchange fees.

Advanced Card Controls

✔️ Geo Control

✔️ Spending Limits

|me>direct

Banking made easy

Manage your money and your card all in one place

The features and benefits of your card

24/7 access to your funds

This allows you pay for goods and services whether on the high street, over the phone or online.

Globally available

Withdraw local currency from cash machines in most countries of the world.

Free withdrawals

Withdraw cash at any cash machine free of charge up to, or equivalent to, €350 a month. A few ATMs charge a commission but you will be informed before charges are made.

Online Payments

Contactless technology

Contactless technology provides added convenience for small value transactions.

Card security

Our fraud detection system constantly monitors card transactions on your account for irregular activity. When we determine that a transaction is suspicious we will stop the transaction from going through.

|me>direct

Get a Debit Card

you can count on!

Important Information

Ordering and activating your card

You can order your MeDirect Debit Card via the MeDirect website. Once you receive a physical card you need to activate it by using the card, together with the PIN, at an ATM or by making a purchase at a point-of-sale (POS) terminal.

The contactless feature will automatically be activated after the first purchase.

Payment limits

Purchases:

ATM Withdrawals:

The total withdrawal limit from ATMs is €1,000 per day. No fees apply on the first €350 withdrawn each month. For any fees on additional withdrawals, please refer to our tariffs and charges schedule. You can adjust your withdrawal limits using our mobile app or Internet Banking.

Contactless Payments:

Switching bank services

Information on how you can switch banking services between MeDirect and other banks, click .

Fee information document

Read our fee information document .

Cross border payments

Information regarding the Cross Border Payments Regulation.

Payment Services Directive

Information related to the EU Payment Services Directive.

3D Secure

Information related to the 3D Secure.

Debit card security tips to keep you safe

- Always keep your debit card in sight when you’re paying for things.

- Never share your card details or PIN with others.

- If you spot suspicious payments on your card, report them immediately to your bank.

- Always report a lost or stolen card immediately.

- Communicate with your bank only through official, secure channels with password or identity protection.

Frequently asked questions

How do I order a card?

To be eligible to order a card you need to have a current account. Login to the MeDirect App or via Online Banking and go to the Cards tab. Here you will be given the option to choose a virtual or a physical card.

When ordering a physical card, you will be requested to confirm your delivery address as well as create your card PIN. This PIN will be used for cash withdrawals and certain card payments.

Can I use my card internationally?

Yes, you can use your card wherever Mastercard is accepted. You can also open and fund accounts in multiple currencies; this will enable you to buy the currency you need ahead of time.

Are there charges for cash withdrawals?

Withdrawing cash from an ATM using your MeDirect card is free of charge for the first €350 per month. After this limit is reached, a fee is charged as per our tariffs and charges, which can be found here.

Can I connect my MeDirect debit card to a digital wallet?

Yes, you can connect your debit card to the Google Wallet or Apple Pay in order to be able to use your smartphone or smartwatch for online and contactless in-store purchases.

The simplest way to connect your MeDirect debit card to a digital wallet is through the MeDirect mobile app. Open the app, go to the cards section, click on ‘Add to Google Pay’ or ‘Add to Apple Pay’, and follow the instructions.

You can also connect using your device. To get started with Google Pay, you first need to download the Google Wallet app from the Play Store. Once you download and open the app, at the bottom, tap ‘Add to Wallet’ followed by ‘Payment Card’. Tap ‘New credit or debit card’ and follow the instructions.

To begin using Apple Pay, open the Apple Wallet on your iPhone and tap the plus (+) sign. If you are using an Apple Watch, open the Apple Wallet and tap ‘Add Card’. If you are using and iPad or Mac, open System Preferences and select ‘Wallet & Apple Pay’. Then follow the instructions to proceed.

Can I disconnect my card from a Digital Wallet?

Yes, you can disconnect your card from a digital wallet.

Apple Pay users can go to the Wallet app on their device, tap the card you want to remove, then then tap the ‘More’ or ‘Info’ icons and then tap ‘Remove Card’. If you remove a card, you can add it again later.

Google Wallet™ users can also disconnect their cards from the Google Wallet™ app. Simply tap the card, then click ‘More’ which is located at the top right and then click ‘Remove payment method’.

What happens to my digital wallet if my card expires or is renewed?

In the case of Apple Pay, when your card is replaced, your Apple Pay will update automatically so your card will remain active throughout. On the other hand, Google Pay will become inactive whenever a card expires, or a new card is requested. This means that you will need to add your new card to Google Pay to continue using the service.

What happens if I am using a digital wallet and my device is lost or stolen?

Apple users who have activated ‘Find My iPhone’ can use this service to locate and secure their iPhone. Alternatively, you can sign in to your Apple ID account from any Mac or PC and select the lost device in the Devices section. Then, go to the Wallet & Apple Pay section and click ‘Remove Items.’ You can also access your device through another iPhone or iPad by going to ‘Settings’, inserting your name, selecting the lost iPhone and tapping ‘Remove Items’ (below Wallet & Apple Pay).

Android users should go to android.com/find and sign into their Google account from where you can remotely lock and sign out of your device as well as delete all the content.

Always remember to also contact us immediately on +356 2557 4400.

Do MeDirect cards offer Geographical access control?

Geographical access control is a security feature that allows you to restrict card transactions to specific geographic regions, helping to prevent unauthorised use. You can manage Geographical access control settings via:

- Web: Log in to your online banking account, go to 'Cards', and select 'Settings’ ‘Geographical access control' to adjust your preferences.

- Mobile App: Open the app, navigate to 'Cards', select your card, and tap on 'Settings’ ‘Geographical access control' to enable or disable the regions.

If you travel to a region which you previously restricted, transactions will be declined unless you update your 'Settings’ for ‘Geographical access control' before your trip.

Can I block/unblock Online Payments?

The block online payments feature allows you to prevent your card from being used for online transactions, adding an extra layer of security against unauthorised internet purchases. To activate or deactivate the 'Online Payments' feature follow the below instructions.

- Web: Log in to your online banking, access 'Cards', and select 'Settings’ and toggle the 'Online Payments' option.

- Mobile App: Open the app, go to 'Cards', select your card, tap on 'Settings’ and 'Online Payments' setting, activate or deactivate this option

Blocking online payments may prevent the payment of recurring subscriptions so please ensure that necessary recurring payments are authorised.

More FAQs

Experience better Banking

The sooner you start managing your money, your way, using the best-in-class tools, the sooner you’ll see results.

Sign up and open your account for free, within minutes.