Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Andrew Huzzey – Portfolio Manager, Systematic Active Equity and Beata Harasim – Senior Investment Strategist all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Earnings in view: U.S. stocks have slid from their highs as inflation proves sticky and geopolitical tensions rise. We eye whether corporate earnings can keep buoying sentiment.

Market backdrop: The S&P 500 slid 3% last week on jitters before key tech earnings results and rising bond yields. Geopolitical flare-ups are keeping oil prices elevated.

Week ahead: We look to this week’s U.S. PCE release for any signs of acceleration or stubborn services inflation. We see inflation and interest rates staying higher for longer.

We saw 2024 as a year of two stories. First, cooling inflation and solid corporate earnings would support upbeat risk appetite. And later, resurgent inflation would come into view and disrupt sentiment. We stay overweight U.S. stocks yet are ready to pivot. The second leg may be playing out now, reinforcing our expectations for persistently high inflation. That raises the stakes for Q1 corporate earnings to buoy sentiment, in our view, just as higher bond yields add pressure to equity valuations.

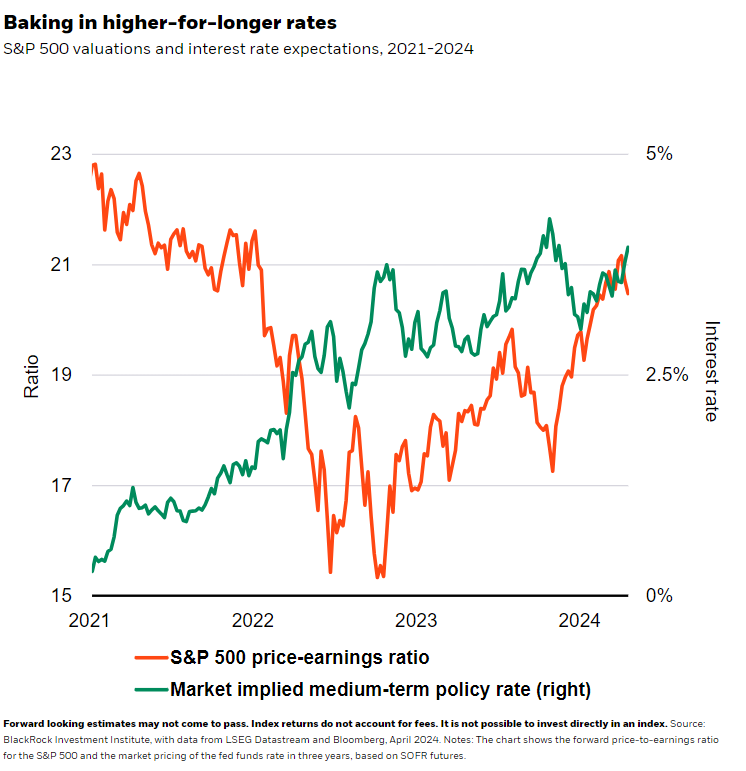

We’ve expected inflation would be on a rollercoaster as the drag from falling goods prices faded and firm wage growth made services inflation stubborn. Yet the March pick-up in core services inflation shows that inflation is proving sticky. Further escalation of Middle East tensions could see oil prices staying elevated, reinforcing higher inflation and higher-for-longer interest rates. Sticky inflation has prompted markets to slash their expectations for Federal Reserve rate cuts to less than two this year (green line in chart) in line with our view. The Fed has gone from blessing market hopes for inflation to fall to 2% without a growth hit to implying policy may have to stay tight. The S&P 500 price-to-earnings ratio – a popular valuation metric – shows stocks feeling the heat from higher rates (orange line). We think that’s why it’s more crucial that companies keep meeting or beating high earnings forecasts.

We question whether the slide in stocks is a blip or a bigger shift toward pricing in inflation – and interest rates – settling higher than pre-pandemic. We stay overweight U.S. stocks on a six- to 12-month tactical horizon but are ready to pivot given that uncertainty. We have broadened out our stock view to include segments of the market with an improving earnings growth outlook. And we have leaned against small cap stocks whose earnings are at greater risk from higher rates. Earnings face a critical test this week, with some mega cap tech companies reporting. With stocks under pressure and rate cut hopes fading, we think the bar is higher for tech firms to deliver on earnings expectations – and for other sectors to show an earnings recovery. Confirmation of inflation settling higher and earnings misses could trigger a change to our view.

Moving up the tech stack

We still prefer artificial intelligence (AI) beneficiaries to tap into the AI and digital disruption mega force – a structural shift driving returns now and in the future. We went overweight early AI winners and enablers like chip and hardware makers in 2023. That view paid off as some valuations soared above historical averages. We are eyeing potential winners further up the technology stack – the layers of technology needed to develop AI applications – and beyond as AI adoption spreads. That’s the case in healthcare, financials and communication services, sectors we like because they have more scope for productivity gains. Outside of tech, those sectors have had some of the most mentions of AI-related keywords in earnings calls and company filings, BlackRock’s Systematic Equity team finds. AI mentions in non-tech sectors have soared 250% since 2022.

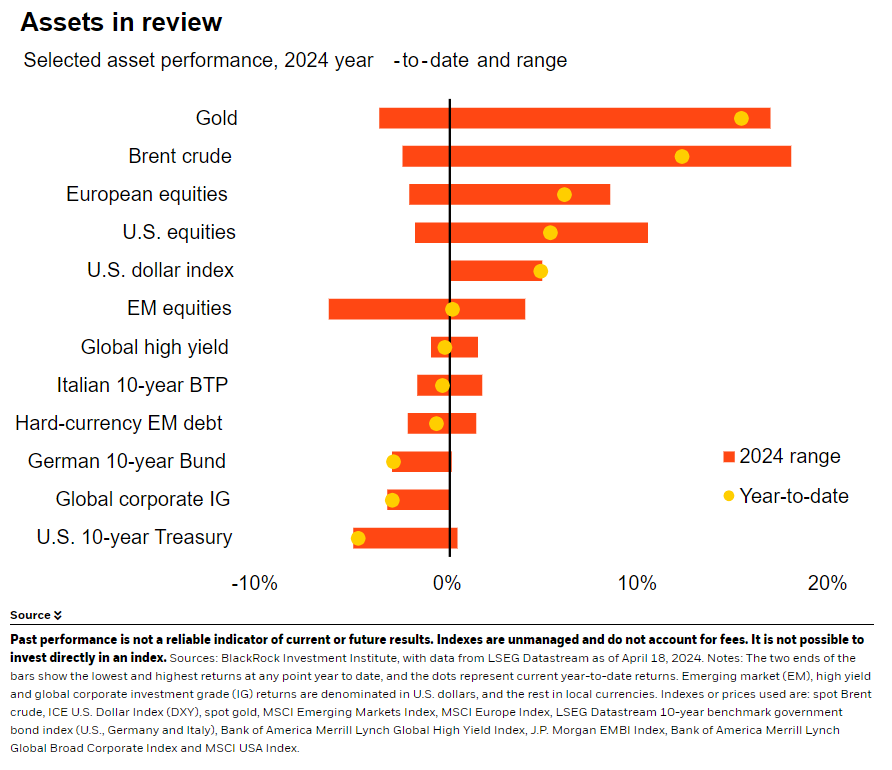

In fixed income, we stay neutral long-term U.S. bonds even as 10-year yields have risen this year. We think yields can swing in either direction as policy rate expectations shift in the near term. Long-term yields are moving toward our view that investors will demand more term premium, or compensation for the risk of holding long-term bonds in the long run. Term premium is muted for now. We prefer short-term bonds, euro area high yield credit and emerging market hard currency debt for income.

Our bottom line

U.S. earnings updates this week will be key to see if they can keep topping expectations and buoying risk appetite in a higher-for-longer interest rate environment. We’re overweight U.S. stocks and see the AI theme broadening.

Market backdrop

The S&P 500 slid 3%, led by tech, on jitters before key earnings results this week and rising bond yields. The first direct strikes between Iran and Israel also helped stoke market unease. U.S. 10-year Treasury yields hit a new 2024 high of 4.70% before settling back slightly. Oil prices eased 4% last week after having been pushed higher due to geopolitical unrest in recent months. We think we’re in a world of structurally higher geopolitical risk – and a lower threshold for conflict escalation.

We’re watching this week’s release of March U.S. PCE data, the Federal Reserve’s preferred measure of inflation, for any signs of acceleration or stubborn services inflation. U.S. CPI data showed that core services inflation, excluding housing, ramped up in March – signaling that inflation may not fall as much as markets expected. Elsewhere, we don’t expect the Bank of Japan to hike rates. Markets will likely focus on its updated economic projections and CPI data.

Week Ahead

April 23: Global flash PMIs

April 24: U.S. durable goods; Japan services PPI

April 25: U.S. GDP data

April 26: U.S. PCE; Bank of Japan policy meeting; Japan CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 22nd April, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.