Jean Bovin – Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Vivek Paul – Head of Portfolio Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Forum takeaways: BlackRock investment leaders at our Outlook Forum agreed the new regime is playing out. They eye assets that price that in and benefit from structural trends.

Market backdrop: Developed market (DM) stocks ticked up last week, led by U.S. tech. Bond yields rose as markets priced out Federal Reserve rate cuts ahead of its June meeting.

Week ahead: We see the Fed and the European Central Bank (ECB) keeping rates higher for longer to fight inflation. We think that overshadows rate decisions this week.

BlackRock investment leaders at our June 6-7 Outlook Forum agreed the new regime of macro and market volatility is playing out. The consensus: Granular investment opportunities abound even against that backdrop. Counting on broad market moves won’t do now, in our view. That shift comes as U.S. and European economies have entered recession. But we don’t see central banks coming to the rescue with rate cuts. We see opportunities in relative pricing and structural trends.

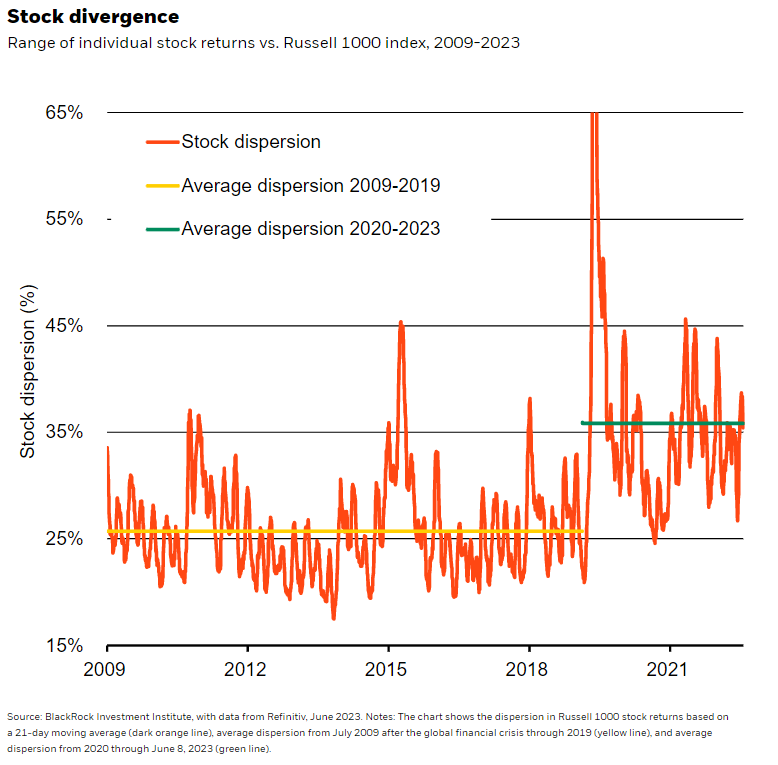

The average range of individual stock returns versus broad index returns, or dispersion, since 2020 (green line in chart) has jumped about 10 percentage points above the average from 2009 to 2019 (yellow line). We think that reflects the new macro regime and structural changes shaping returns. Forum attendees agreed the new regime of heightened volatility is playing out. We see supply constraints driving higher inflation in the new regime. Persistent inflation makes it unlikely developed market (DM) central banks will cut interest rates this year. The new regime presents central banks with a sharp trade-off between living with some inflation and crushing activity, as we’ve argued. That shift is in sharp contrast with the four-decade period of steady activity before 2020 known as the Great Moderation. Today’s environment offers new opportunities, in our view, thanks to market divergences and structural changes playing a bigger role.

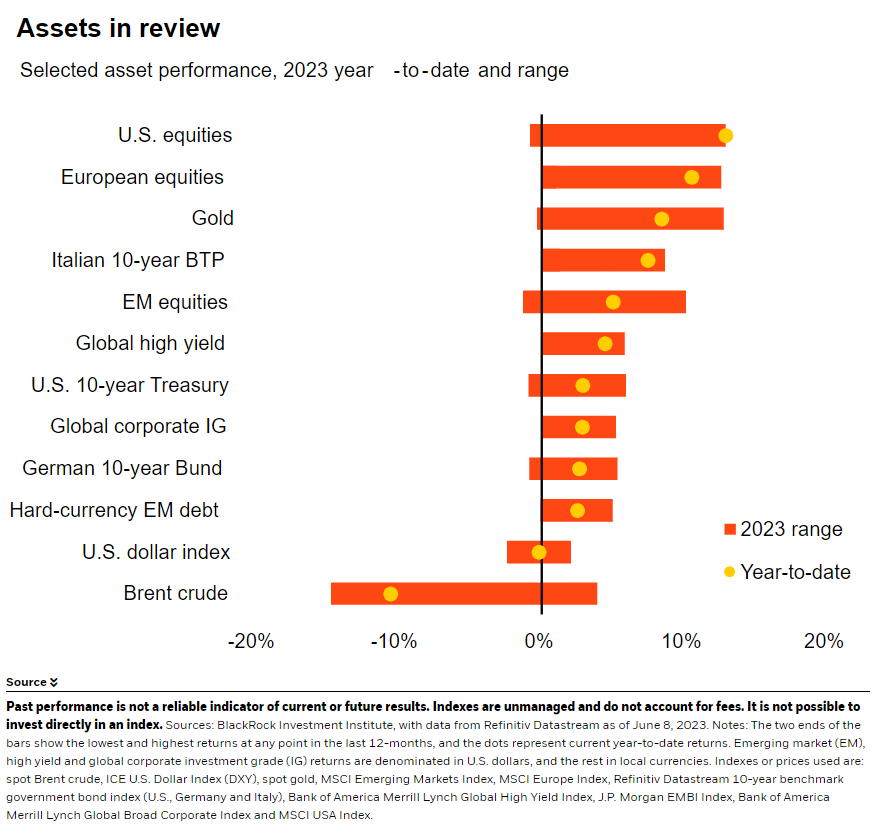

Roughly 100 of BlackRock’s portfolio managers, executives and experts gathered in London for our semiannual forum to debate the macro and market outlook. They agreed the new regime calls for getting more selective and dynamic in making investment decisions. That approach starts by first assessing to what extent assets are pricing in the economic damage from rate hikes. They’re also eyeing relative pricing divergences across sectors and regions. A case in point: We think emerging market (EM) stocks better price in the damage we expect than developed market (DM) peers. EM stocks and local currency debt also benefit from China’s economic restart, EM hiking cycles nearing an end and a broadly weaker U.S. dollar.

Megaforces

Megaforces, or structural changes shaping returns now and longer term, were also top of mind. Investment decisions need to reflect them, in our view – even within a cautious macro outlook. We see some megaforces already playing out: There is a widening disconnect between bond and stock pricing of the macro environment. The market’s hopes artificial intelligence (AI) will gain widespread adoption may help explain that gap. Just a few technology firms valued over $200 billion are carrying the U.S. equities rally so far this year, and upbeat tech earnings expectations are reinforcing the gains. Other megaforces include aging populations, geopolitical fragmentation causing a rewiring of supply chains and the transition to a lower carbon economy. These forces are likely to be largely inflationary over time, though AI could eventually help lessen inflationary pressure as it delivers productivity gains.

A tough macro picture

We focus on other methods of generating additional returns as the macro outlook itself calls for keeping risk low. Core inflation has fallen from its highs but remains above the Fed and ECB’s 2% policy targets. We think tight labor markets are driving wage gains and making core inflation sticky – even as the U.S. and European economies have arguably slipped into recession. In particular, the U.S. lacks enough workers to fill job openings, while in Europe, workers have left the private sector for the public sector. Tight labor markets could squeeze corporate profit margins or force companies to trim workforces to maintain profits. These dynamics mean broad asset class exposure may not generate the same level of returns as in the past.

Bottom line

Forum participants agreed that the new regime keeps playing out as central banks’ rate hikes start to kick in, but they debated the extent of the economic damage. We think the new macro regime still offers abundant, if different, investment opportunities relative to the past with the right approach. Read more in our 2023 midyear outlook on June 28.

Market backdrop

DM equities posted slight gains last week, with U.S. tech stocks pushing to 14-month highs. Short-term yields led an overall rise in government bond yields as markets further priced out Fed rate cuts later in the year heading into next week’s meeting. The U.S. economy is in recession based on some income-based measures, while euro area Q1 GDP data confirmed it slipped into a mild recession. Last week’s U.S. services activity data also showed the sector barely grew in May.

Major central banks take center stage this week. We see rates staying higher for longer because of stubbornly high inflation, driven by wage pressures in tight labor markets. Central banks face a sharp trade-off: crush growth or tolerate some above-target inflation. We see the Fed eventually living with some inflation but see the ECB resolved to bring it down to target.

Week Ahead

June 13: U.S. CPI

June 14: Fed policy decision

June 15: ECB policy decision; U.S. industrial production

June 16: Bank of Japan policy decision; University of Michigan sentiment survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 12th June, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.