Jean Boivin, Head of the BlackRock Investment Institute together with Wei Li, Global Chief Investment Strategist, Alex Brazier, Deputy Head of the BlackRock Investment Institute and Vivek Paul, Senior Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points:

Cutting DM stocks: We cut developed market (DM) equities to neutral on a risk of the Fed talking itself into overtightening policy and China adding to a weaker global outlook.

Market backdrop: Stocks plumbed new 2022 lows on fears steep rate rises will trigger a growth slowdown. We see a brighter picture, but this may not become clear for months.

Week ahead: U.S. PCE inflation data this week are expected to show pressures are slowing. We think inflation will settle higher than pre-Covid levels.

The Federal Reserve signaled its focus is on taming inflation without flagging the big economic costs this will entail. As long as this is the case and markets believe it, we don’t see the basis for a sustained rebound in risk assets. We think the Fed will consider the costs to growth at some point, especially if inflation cools, and expect a dovish pivot later this year. China’s slowdown is a large shock that will be felt over time. We further trim risk and downgrade DM equities to neutral.

China slowdown to ripple across globe

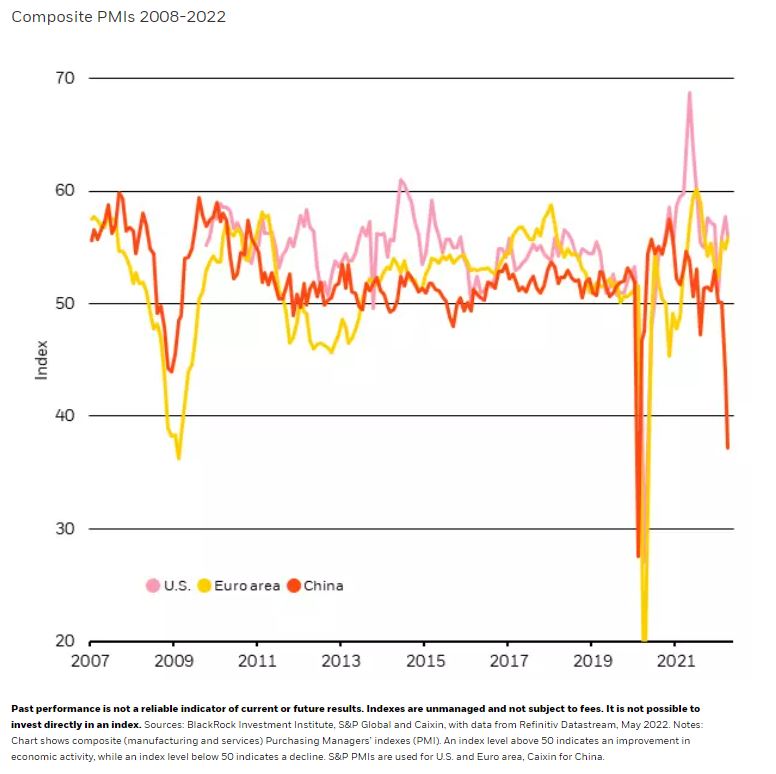

The Fed stepped up its rhetoric last week by vowing to bring inflation down at any cost. We think reality will be more complex. First, supply-driven inflation implies the sharpest policy trade-off in decades: between choking off growth via sharply higher rates or living with supply-driven inflation. Second, this trade-off is even more stark amid a weaker global macro outlook. The hit to Chinese growth is starting to rival its 2020 shock and already surpasses the one from the global financial crisis. See the chart. We think this will reduce growth in major economies and nudge up DM inflation at a very inopportune time when higher inflation is already proving more persistent. We had already seen Europe at risk of recession, which prompted us to reduce risk a few weeks ago. As a result, we further downgrade DM equities to neutral from overweight.

A hawkish pivot

The Fed’s hawkish pivot this year has been stunning, and pronouncements on reining in inflation have become regular fare. Chair Jerome Powell just last week said the Fed would keep hiking rates until inflation is “tamed” – a comment that dismisses any trade-off or the lagged effect of monetary policy on the economy. The Fed now appears to be constraining itself to the hawkish side of policy options with such language, just as talking about the jump in inflation being “transitory” last year boxed it in when inflation proved more persistent and forced a sharp pivot. We think the Fed could be forced into another sharp pivot later this year, which we expect rather than a recession. These Fed pivots are driving market volatility, in our view.

Market expectations are now calling for the Fed funds rate to zoom up to a peak of 3.1% over the next year, more than doubling since the start of the year. For the European Central Bank, market pricing reflects four hikes this year and getting to nearly 1.4% next year, well above our estimate of neutral and for an economy at real risk of stagflation this year. The equity selloff this year makes sense from this perspective – if you believe that the market’s view of the Fed and ECB rate paths are right.

The growth reality will be more complex – both from the policy trade-off it faces amid a deteriorating macro backdrop, especially China’s slowdown and Europe facing stagflation. That’s why we expect a dovish pivot later in the year. We stick to our view of the Fed raising rates to around 2.5% by the end of this year – and then stopping to evaluate the effects. We still see the U.S. economy’s momentum as strong – we expect growth of around 2.5% this year, slightly below consensus and far from recession. Equities may have short-term, technical rebounds. Yet until the Fed starts to pivot, we don’t see a catalyst for a sustained rebound in risk assets.

The upshot?

We further reduce portfolio risk after having trimmed it to a benchmark level a few weeks ago with the downgrade of European equities. We are now neutral DM equities, including U.S. stocks. But a dovish pivot by the Fed would spur us to consider leaning back into equities. Our change in view prompts us to keep an overweight to inflation-linked bonds from a whole-portfolio perspective. We prefer short-term government bonds for carry, and see scope for long-term yields to rise further as investors demand greater term premium for the risk of holding such debt in this inflationary environment. Overall we remain underweight U.S. Treasuries.

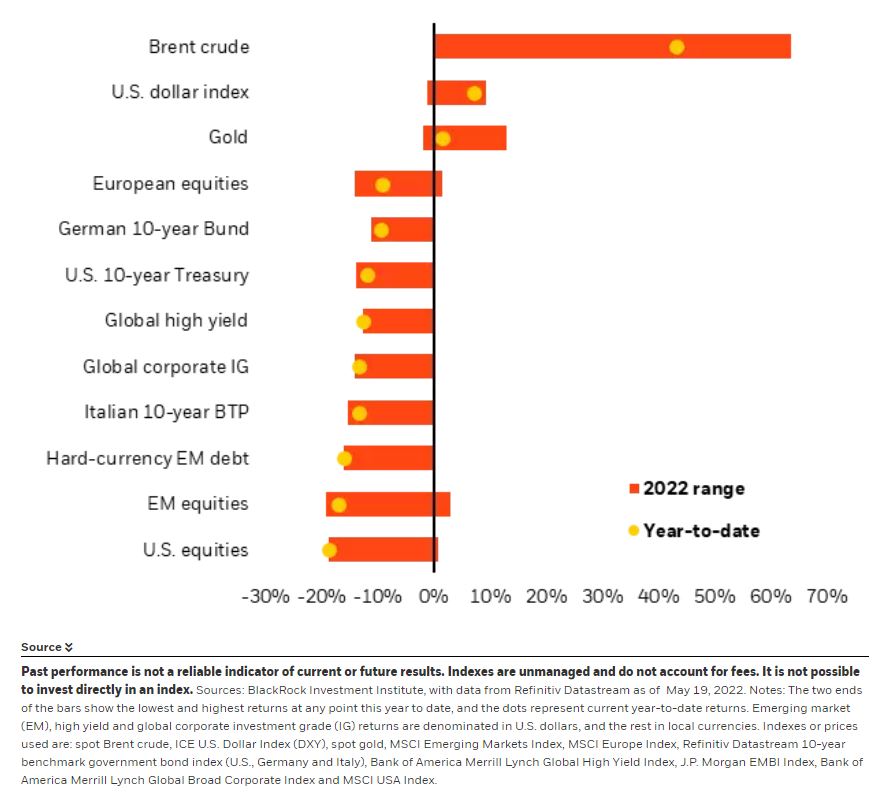

Market backdrop

Stocks plumbed new 2022 lows and bond yields edged down last week on concerns that higher rates are causing a growth slowdown. Earnings updates from large U.S. retailers underscored inflation is pinching demand – and eroding profit margins through higher costs. We see this year’s equity pullback in line with the hawkish repricing of the policy rate path. We believe the market will ultimately ease its expectations for policy tightening – but this won’t be clear for months.

This week’s U.S. PCE report is expected to show monthly U.S. inflationary pressures softening as spending shifts back to services and away from goods. Early May global PMI data could give an early read on spillovers from China’s slowdown and the knock-on impact on supply chains. We expect China’s deteriorating economic outlook to be a drag on global growth – and we think consensus forecasts for China’s 2022 GDP growth are likely to get revised down.

Week Ahead

- May24: Global May flash PMIs

- May 25: U.S. durable goods; Germany GDP

- May 27: U.S. PCE inflation and spending; Japan CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 25th, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.