During the first six months of 2022, MeDirect continued its transformation towards becoming a pan-European WealthTech leader and a specialised mortgage lender. By taking advantage of the flexibility offered by its technology and ability to innovate, during the past three years MeDirect Group has successfully executed its strategy, which is based on four pillars: building a world-class WealthTech platform, growing its retail franchise focused on affluent customers, de-risking and diversifying its balance sheet with a focus on mortgages, and improving the efficiency of its operating model.

When announcing its interim financial results for 2022, MeDirect stated that it is on track to complete the delivery of its disruptive Wealth SuperApp featuring a single, user-friendly suite of products combining innovative wealth solutions with daily banking functionalities, which will make MeDirect a one-stop-shop for its customers.

“In the coming months, MeDirect will continue to strengthen its platform with the launch of online advisory and discretionary portfolio management services, as well as, virtual and physical cards to enhance its everyday banking offering. This unique combination of daily banking and wealth services available via both the mobile app and online banking platform is expected to be highly differentiating in the market,” said Arnaud Denis, Chief Executive Officer of MeDirect Group.

In mid-2022, MeDirect revamped its brand in anticipation of the release of its new suite of products. The new branding emphasises that MeDirect offers its clients the tools necessary to empower them to navigate the complexity of the financial world and makes them feel confident and in control of their finances. MeDirect is shifting its customers’ perception of banking from “we” to “me” – my money, my choices.

Another important development has been the building of a scalable specialised mortgage lending platform in Malta, Belgium and the Netherlands. In Malta, MeDirect introduced three new products during the first half of 2022 –green home loans, 10-year fixed-rate mortgages and a home equity product. These products were all well-received and have been gaining momentum in the Maltese market. MeDirect’s home loan offering, which features personalised service ensures a faster and market-leading turnaround for customers financing their homes.

MeDirect’s Dutch government-guaranteed (NHG) mortgage portfolio now represents approximately 40% of the Group’s balance sheet. In December 2021, MeDirect launched its meHomeLoan product in the Belgian market in partnership with Allianz. In addition, MeDirect continues the steady development of its well-established Maltese corporate lending business to support the local economy.

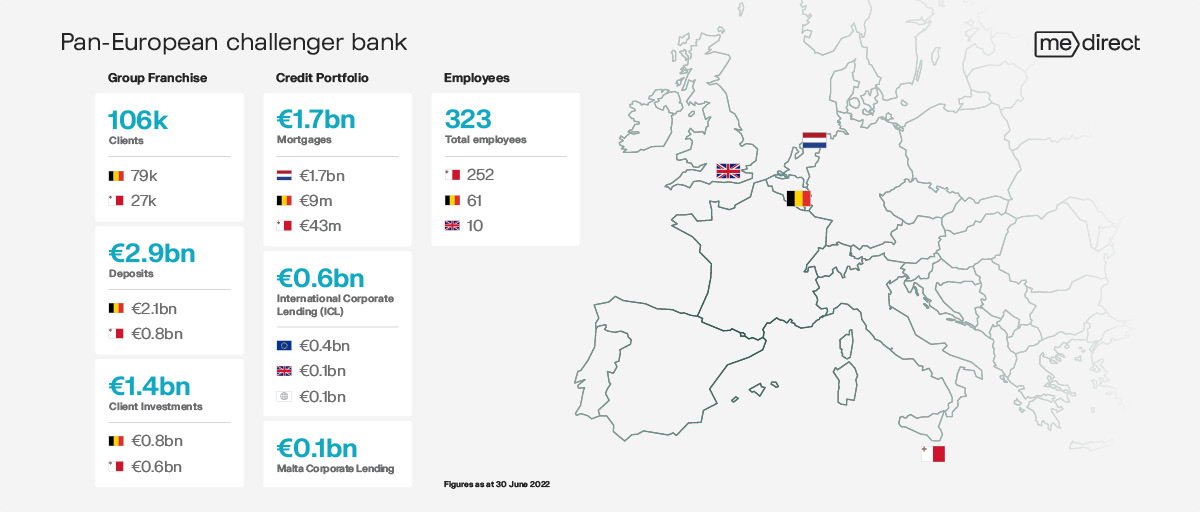

MeDirect’s retail franchise, focused on affluent customers, grew by almost 30% over the past twelve months to more than 106,000 clients. Total client financial assets increased by almost 4% year over year, notwithstanding very challenging market and macroeconomic conditions, reaching €4.3 billion. Strong trust in the MeDirect brand and its award-winning onboarding process enabled MeDirect to increase its wealth client base by 19% over the past twelve months. This growth was supported by high customer satisfaction and retention levels. Success in retaining clients is demonstrated by the fact that over 90% of clients who opened accounts with MeDirect five years ago remain with the bank.

Profit before tax for the period ended 30 June 2022 amounted to €2.7 million, compared to €3.2 million for the period ended 30 June 2021. Operating income grew by 7% year over year whilst improved market conditions led to a €3.5 million net release of loan impairment charges. Net interest income increased by 11% compared with the same period last year, from €25.8 million in 2021 to €28.7 million, while net fee and commission income increased by 8% from €2.8 million in 2021 to €3.1 million.

The Group’s non-performing loan ratio was reduced to 4.6% as at 30 June 2022, from 6.7% in 31 December 2021. The capital and liquidity positions remained strong, supporting the continuation of MeDirect’s business transformation and growth strategy. MeDirect’s Tier 1 capital ratio stood at 13.6%, with a total capital ratio of 17.3% – both well above regulatory requirements. The Group’s liquidity reserves remained strong at €740 million as at 30 June 2022, and the Group’s Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) stood at 247% and 129%, respectively, both well above the minimum requirements.

MeDirect’s mortgage portfolio increased by 9% over the past twelve months. As part of the Group’s de-risking plan, the international corporate lending portfolio was reduced by 12% to €624 million as at 30 June 2022, representing less than 15% of the Group’s balance sheet.

Environmental, Social and Governance (ESG) is an important area of focus, and the Group has integrated ESG principles into its daily business. During the first half of 2022, MeDirect implemented a range of ESG initiatives including, amongst others, incorporating sustainability principles in its credit and investment businesses, launching green home loans, including a feature in its brokerage platform enabling investors to identify and filter funds and ETFs which focus on sustainability and providing ESG training to MeDirect’s Board and employees. These efforts were validated by MeDirect’s improved rating by EcoVadis, one of the top international providers of sustainability ratings. MeDirect’s overall score was in the top 15% of all companies rated by EcoVadis.

When commenting on the outlook for the coming months, Mr Denis said: “MeDirect aims to continue delivering an attractive value proposition to its customers, whilst at the same time diversifying and de-risking its balance sheet despite a challenging geopolitical and macroeconomic environment.”

Il-Bank MeDirect ikompli jinvesti biex isir wieħed mill-banek ewlenin tal-WealthTech fl-Ewropa

Fl-ewwel sitt xhur tal-2022, MeDirect kompla t-trasformazzjoni tiegħu biex isir wieħed mill-banek ewlenin tal-WealthTech fl-Ewropa u jispeċjalizza aktar fis-self fuq id-djar. Il-Grupp MeDirect uża l-vantaġġ tat-teknoloġija u l-innovazzjoni li bena fl-aħħar tliet snin biex ikompli jimplimenta l-istrateġija tiegħu bbażata fuq erba’ pilastri: il-ħolqien ta’ pjattaforma ta’ klassi dinjija għall-WealthTech, it-tkabbir tar-retail franchise tiegħu ffukata fuq klijenti affluwenti, it-tnaqqis tar-riskju u d-diversifikazzjoni fil-balance sheet b’enfasi fuq is-self għal propjetà, u t-tisħiħ ta’ l-effiċjenza fil-mudell tal-operat tiegħu.

Meta ħabbar ir-riżultati finanzjarji għall-ewwel nofs tas-sena 2022, MeDirect spjega li l-iżvilupp tal-Wealth SuperApp miexi bir-ritmu mixtieq u li l-bank ħa jkun jista joffri għażla wiesgħa ta’ prodotti li jinkludu kemm soluzzjonijiet innovattivi, kif ukoll funzjonalitajiet bankarji li wieħed juża ta’ kuljum – dan kollu minn app waħda għal klijenti ta’ MeDirect.

Arnaud Denis, il-Kap Eżekuttiv tal-Grupp MeDirect, qal: “Fix-xhur li ġejjin MeDirect se jkompli jsaħħaħ il-pjattaforma tiegħu bit-tnedija ta’ servizzi ġodda ta’ konsulenza elettronika u servizz ta’ discretionary management, kif ukoll, iniedi l-prodott ta’ kards virtwali u fiżiċi. Permezz ta’ din il-pjattaforma attrajenti, li hi faċli biex tintuża, MeDirect ħa jkun qed joffri lill-klijenti tiegħu għażla ta’ kif jistgħu jinvestu u jkabbru flushom, filwaqt li tagħtihom il-possibbiltà li jużaw l-app għas-servizzi bankarji li jkollhom bżonn ta’ kuljum – dan hu maħsub biex jgħamel lil MeDirect bank uniku għal kollox fis-suq.”

F’nofs l-2022, MeDirect bidel id-dehra korporattiva tiegħu bil-lest għat-tnedija tal-firxa l-ġdida tal-prodotti tiegħu. Id-dehra viżiva l-ġdida tenfasizza li MeDirect joffri lill-klijenti l-għodda meħtieġa biex ikunu jistgħu jesploraw il-kumplessità tad-dinja finanzjarja waħedhom u jħossuhom kunfidenti biex jikkontrollaw il-finanzi tagħhom. MeDirect qed jibdel il-perċezzjoni tal-klijenti dwar il-bank minn “aħna” għal “jien” – my money, my choices.

Żvilupp importanti ieħor kien il-bini ta’ pjattaforma flessibbli u speċjalizzata għas-self fuq id-djar f’Malta, fil-Belġju u fl-Olanda. F’Malta, MeDirect introduċa tliet prodotti ġodda fl-ewwel nofs tal-2022 – is-self għal djar li huma effiċjenti fl-użu ta’ l-energija, rata fissa ta’ self għal 10 snin, u prodott fuq l-ekwità tad-djar. Dawn il-prodotti ntlaqgħu tajjeb ħafna u qed ikomplu jsiru popolari fis-suq Malti.

Il-portafol tas-self fuq id-djar li MeDirect għandu fl-Olanda, huwa self b’garanzija mgħotija mill-gvern Olandiż (NHG), li jirrappreżenta 40% mil-balance sheet tal-Grupp. F’Diċembru 2021, MeDirect nieda l-prodott meHomeLoan fis-suq Belġjan bi sħab ma’ Allianz. Barra minn hekk, MeDirect baqa’ għaddej bin-negozju tiegħu tas-self lill-kumpaniji, servizz li hu stabbilit sew f’Malta u li bih qed jappoġġja l-ekonomija lokali.

Ir-retail franchise ta’ MeDirect, li hija iffukata fuq klijenti affluwenti, kiber bi kważi 30% fl-aħħar tnax-il xahar u issa jinkludi aktar minn 106,000 klijent. L-assi finanzjarji totali ta’ dawn il-klijenti żdiedu b’madwar 4% fuq is-sena l-oħra u, minkejja l-isfidi ġeopolitiċi u makroekonomiċi tas-swieq bħalissa, jlaħħqu l-€4.3 biljuni. Il-fiduċja li MeDirect għandu fis-swieq li jopera fihom, flimkien mas-suċċess tal-infrastruttura tal-onboarding li għandu l-bank biex wieħed ikun jista jsir klijent fi ftit minuti, wassal biex tiżdied il-bażi tal-klijenti b’19% fl-aħħar tnax-il xahar. Aktar important hi t-turija ta’ sodisfazzjon tal-klijenti eżistenti tal-bank li baqgħu jinvestu. Dan jidher ċar mill-fatt li aktar minn 90% tal-klijenti li ħames snin ilu fetħu xi kont ma’ MeDirect, illum għadhom jużaw is-servizzi tal-bank.

Il-profitt qabel it-taxxa għall-perjodu li ntemm fit-30 ta’ Ġunju 2022 jammonta għal €2.7 miljuni, kkumparat ma €3.2 miljuni matul il-perjodu li ntemm fit-30 ta’ Ġunju 2021. Id-dħul mill-operat żdied b’7% meta mqabbel mas-sena l-oħra, filwaqt li t-titjib fil-kundizzjonijiet tas-suq wassal għal rilaxx nett ta’ €3.5 miljuni fuq loan impairment charges. Id-dħul nett mill-imgħax żdied bi 11% meta mqabbel mal-istess perjodu tas-sena li għaddiet, minn €25.8 miljuni fl-2021 għal €28.7 miljuni, filwaqt li d-dħul nett mit-tariffi u l-kummissjoni żdied bi 8% minn €2.8 miljuni fl-2021 għal €3.1 miljuni.

Il-proporzjon tan-non-performing loans tal-Bank tnaqqas għal 4.6% sat-30 ta’ Ġunju 2022, minn 6.7% fil-31 ta’ Diċembru 2021. Il-kapital u l-likwidità baqgħu sodi, u qed ikomplu jsostnu l-istrateġija tat-trasformazzjoni u tat-tkabbir ta’ MeDirect. Il-proporzjon tal-kapital Tier 1 ta’ MeDirect baqa’ għoli (13.6%), bi proporzjon tal-kapital totali ta’ 17.3% – it-tnejn ferm ogħla mir-rekwiżiti regolatorji. Ir-riservi tal-likwidità tal-Grupp baqgħu b’saħħithom ukoll b’€740 miljuni sat-30 ta’ Ġunju 2022, u l-proporzjon ta’ kopertura tal-likwidità (LCR) tal-Grupp u l-proporzjon ta’ finanzjament stabbli nett (NSFR) kienu 247% u 129% rispettivament, it-tnejn ferm ogħla mir-rekwiżiti minimi.

Il-portafoll tas-self fuq id-djar ta’ MeDirect żdied b’9% fl’aħħar tnax-il xahar. Bħala parti mill-pjan ta’ tnaqqis tar-riskju tal-Grupp, l-ammont ta’ self lill-korporazzjonijiet internazzjonali tnaqqas bi 12% għal €624 miljuni sat-30 ta’ Ġunju 2022, li jammonta għal inqas minn 15% tal-balance sheet tal-Grupp.

L-aspett ambjentali, soċjali u ta’ governanza (ESG) huwa qasam importanti għal MeDirect. Fil-fatt, il-Grupp integra l-prinċipji ESG fl-attivitajiet ewlenin tiegħu. Fl-ewwel nofs tal-2022, MeDirect implimenta firxa ta’ inizjattivi ESG li, fost l-oħrajn, jinkludu prinċipji u kundizzjonijiet ta’ sostenibbiltà fin-negozji tal-kreditu u tal-investiment, it-tnedija ta’ self għal propjetajiet li huma effiċjenti fl-użu tal-enerġija, iż-żieda ta’ karatteristika fil-pjattaforma li biha l-investituri jistgħu jidentifikaw u jiffiltraw il-mutual funds u l-ETFs li jiffukaw fuq is-sostenibbiltà, kif ukoll taħriġ fuq il-prinċipji tal-ESG li ngħata lill-Bord u lill-impjegati ta’ MeDirect. Dawn l-isforzi ħallew il-frott mixtieq, għax MeDirect, tejjeb il-pożizzjoni mogħtija lilu minn EcoVadis, waħda mil-fornituri internazzjonali ewlenin għall-klassifikazzjoni tas-sostenibbiltà. MeDirect tqiegħed fl-ewwel 15% tal-kumpaniji kollha kklassifikati minn EcoVadis.

Fil-kumment tiegħu fuq il-ħidma li se tkompli għaddejja fix-xhur li ġejjin, is-Sur Denis qal: “L-għan ta’ MeDirect hu li jkompli jwassal servizzi attrajenti u ta’ valur lill-klijenti u, filwaqt li, ikompli jiddiversifika u jwettaq il-programm ta’ assessjar strateġiku biex inaqqas ir-riskji mill-balance sheet tal-Bank minkejja l-isfidi ġeopolitiċi u makroekonomiċi.”

MeDirect Bank (Malta) plc, is licensed to undertake the business of banking in terms of the Banking Act (Cap. 371) and investment services under the Investment Services Act (Cap. 370).