Morningstar are cautiously optimistic for both stocks and bonds as we enter 2024, even accounting for heightened risk.

In equities, we see opportunities in size, style, sector, and country exposures. Targeted exposure is well placed to beat broad market-weight exposure, according to our analysis. For bonds, we see broad appeal across different maturity profiles. Government bonds are our preferred exposure. Corporate bonds are priced for a slowdown, but not a recession, so they could carry heightened risk. The U.S. dollar looks expensive versus other major currencies, so international currency positioning (and possibly hedging) may be a worthwhile addition to your portfolio toolkit.

Equity Opportunities

- Among the basket of undervalued and unloved assets, smaller-capitalization value stocks stand out.

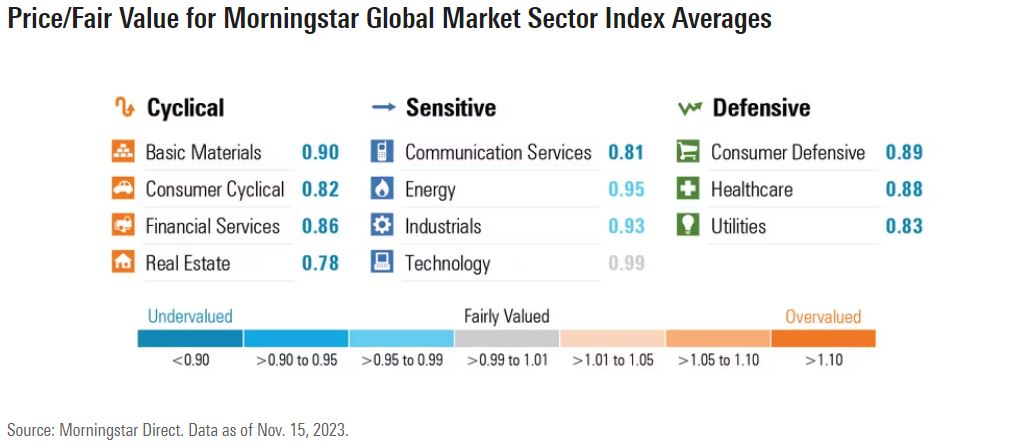

- Cyclical sectors like financials (namely banks), leap out as attractive. Among economically sensitive sectors, communication services remain appealing. Among defensive sectors, healthcare and utilities could offer a ballast with upside potential.

- Global contrarian plays include the United Kingdom, emerging markets equities, and, specifically, Chinese technology. The volatility could be worth it, but sizing is important.

- Second-derivative artificial intelligence plays, primarily in the U.S. market, could offer an earnings tailwind.

The Broad Equity Landscape Entering 2024

Equities look fairly well positioned as we start 2024, despite facing a wall of worry. Stocks are reasonably valued overall, with all major countries better placed than a few years ago from a valuation standpoint.

Overall, we see U.S. equities as playing a role for investors, although the concentrated rise in the so-called “Magnificent Seven″ has created opportunities to add selected value—which looks especially interesting in smaller, value-oriented companies. In other developed markets, we see attractive valuations with higher-than-usual return prospects on our analysis, especially in pockets of Europe (for example, U.K. and European energy stocks). While emerging markets are undoubtedly risky, we can see strong return prospects in most scenarios, although position sizing remains important.

Naturally, reward for risk is the key distinction to make, with some developing risks that must be accounted for in equity allocations. One longer-term risk is the lack of earnings growth. This is a challenge because investors have been driving prices higher relative to earnings—a dynamic known as multiple expansion. One potential reason for the expansion of multiples this year was a belief that central banks would quickly and aggressively pivot to cut rates. This is no longer the consensus base case.

Here are some of the key risks we’re watching:

Moderate Valuations

- Valuation expansion has largely been in AI stocks. Second-derivative AI stocks have not had the same rally.

- The U.S. market contains some expensive sectors and concentration risks.

- Select opportunities exist in global equities.

Softening Economy

- High rates can weaken consumer demand, particularly if they persist.

- A weaker consumer can impact corporate revenue and ultimately the labor market.

- Weaker European countries may trough sooner than the U.S. market.

Weakening Fundamentals

- In the United States, overall corporate leverage is manageable, but debt costs are increasing.

- Corporate profitability is high, but vulnerable on the margin.

- Capital-intensive sectors remain more exposed to a protracted move higher in debt costs.

External Shocks

- Geopolitical risk is high (Ukraine, Israel, and China).

- An oil market shock could hurt the global economy.

- Commercial real estate remains a risk but appears to be a localized problem.

- Suddenly higher long-term yields could have unintended effects.

While stocks have certainly not tumbled off a cliff, investors continue to feel nervy, with consumer sentiment scores still well below normal levels. At a deeper level, valuation spreads—the disparity in valuation levels between sectors—is where we see opportunity.

Equity Opportunity 1: Select Sectors—Including Financials, Utilities, and Healthcare

With U.S. index returns having been driven predominantly by large-cap growth companies that dominate index weightings—aka the “Magnificent Seven″—we’re finding valuation opportunities elsewhere.

Financial services, squarely a cyclical value-leaning sector, leaps out as inexpensive with low expectations. Rising rates and the 2023 U.S. banking crisis led the sector to underperform. We believe much of the risk here has been discounted and that U.S. banks, in particular, are worth a look.

Looking for undervalued assets that can help with portfolio robustness, we see defensive sectors—including healthcare and utilities—as areas of interest. They are not necessarily the cheapest sectors but can play a strong role in portfolio risk management. Among the more economically sensitive sectors, our preference remains for communication services, despite strong returns for the year to date, as it still represents solid value and reasonable risk/reward, in our view.

Equity Opportunity 2: Small-Cap Value Stocks

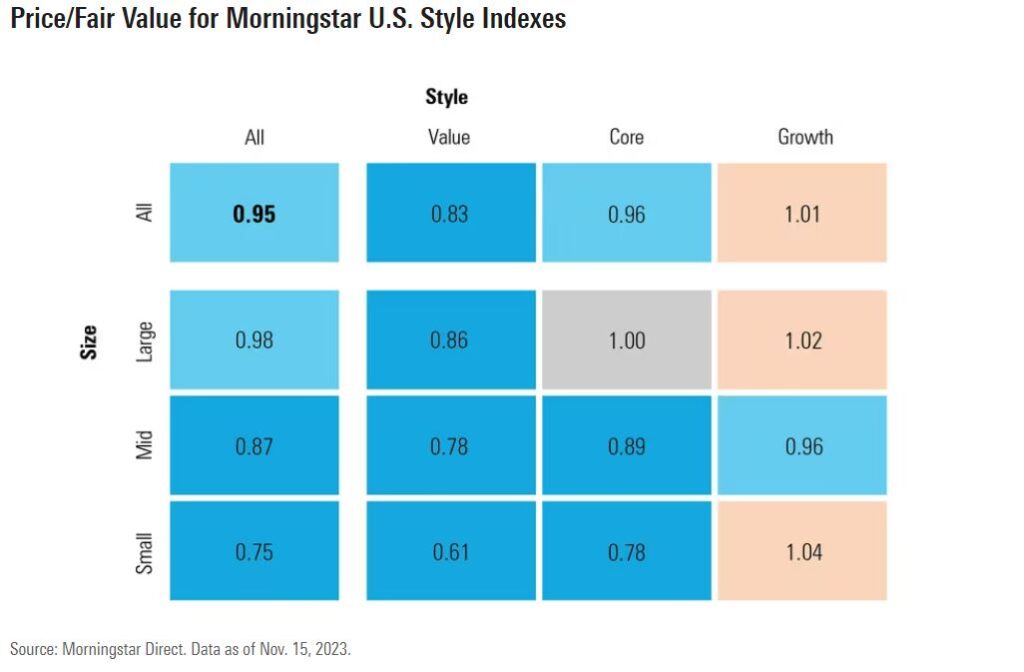

Looking at the Morningstar Style Box across the U.S. and Europe, we can see that the biggest valuation opportunity exists in the bottom left corner—small-value stocks.

In our latest U.S. Stock Market Outlook, this represents a large discount to fair value, which is considerably better than the large-growth counterparts that have dominated 2023 leaderboards. You can see a similar discount in our European Equity Market Outlook.

We note that small-cap stocks are hard to place in a single bucket, in large part because so many disparate industry groups—from biotech to banks—are part of this asset class. Plus, small companies generally display greater sensitivity to the broad economic environment, given the preponderance of money-losing and highly leveraged companies in the small-cap indexes.

Therefore, while small-cap stocks seem substantially cheaper than their large-cap counterparts, careful asset selection is needed, and we think it’s important to focus on quality.

Equity Opportunity 3: International Exposures—Including the U.K., European Energy, Emerging Markets, and China Tech

While U.S. equity returns have been dominant over recent years, we think there is a significant opportunity for investors looking outside the U.S. Our work suggests that the U.K., with a significant amount of the index consisting of a well-diversified group of global companies, including both cyclical and defensive components, represents good value. Plus, cyclical industries such as European energy companies, which are displaying significantly improved capital allocation amid robust energy markets, look comparatively cheap. The broad opportunity in emerging markets has grown more significant during 2023, as those stocks have lagged their developed-markets peers.

Much of the performance drag can be attributed to Chinese stocks as investors weighed looming geopolitical and secular growth concerns. The aggregate sentiment toward emerging markets remains bearish in absolute (compared with its own history) and relative terms (compared with developed markets).

Despite the risks—or maybe because of them—China itself has become a very interesting opportunity. Chinese equities carry particularly low expectations. However, over the long term, consumer-facing Chinese technology equities trade at a substantial discount to normalized earnings and are anticipated to generate excess returns against broad emerging markets.

Equity Opportunity 4: Second-Derivative AI Plays

AI-focused stocks have topped the leaderboard in 2023, with significant valuation risks embedded, in our analysis. However, second-derivative plays, including those that can improve margins by using AI capabilities in their products, offer much better valuations with earnings upside.

This could offer a way to access the emerging AI theme, with generative AI allowing companies to generate marketing content, write code, and improve efficiency, among other things. No doubt this will create winners that can harness the benefits of AI with the ability to massively scale businesses and losers that cannot.

Fixed-Income Opportunities

- Areas with positive real yields. Broad opportunities exist, especially in developed markets. However, niche opportunities also appeal, including inflation-linked bonds, U.S. agency mortgage-backed securities, and emerging-markets debt.

- Government bonds over corporate bonds. In particular, U.S. Treasuries look well positioned, with the balance of probable outcomes for yields leaning toward falls.

- Short-duration bonds are attractive for cautious portfolios, adding healthy income with appropriately lower duration risk.

The Broad Fixed-Income Landscape Entering 2024

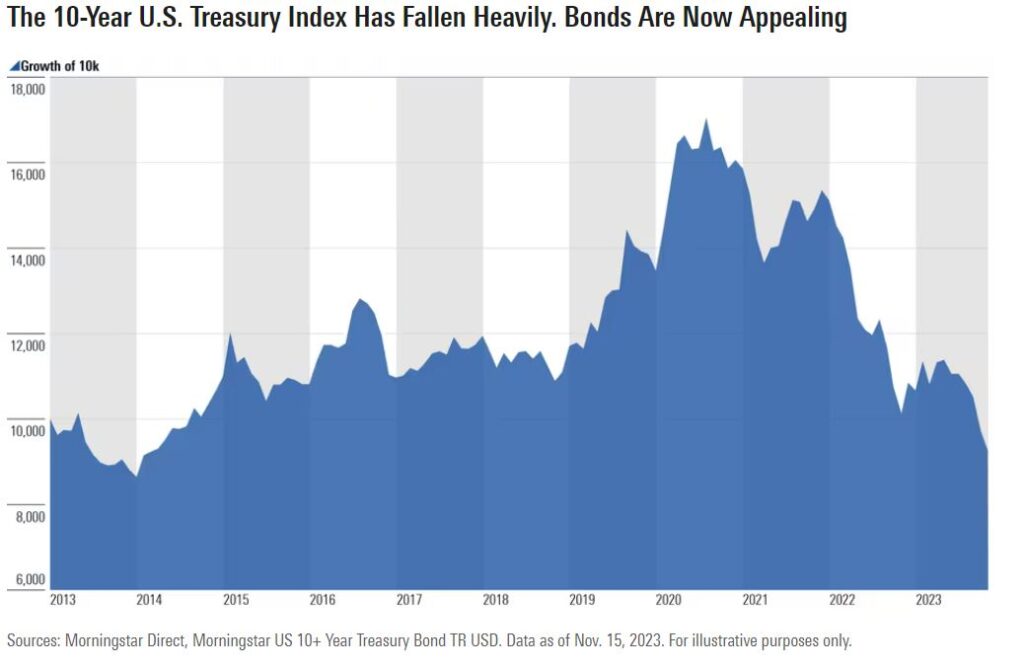

The bond market has not provided the defensive features over the past two years that investors grew to love it for in the four decades before July 2021. It has been one of the worst periods on record for developed-markets bonds in 2022 and into 2023.

This is especially true for long-dated bonds.

The potential long-term regime for inflation and rates has affected these bonds with equitylike drawdowns. We now see this as a positive in a forward-looking context. The material increase in bond yields has improved their attractiveness versus other assets and for portfolio risk management more generally.

This applies to the U.S., U.K., and Australia, where yields now cover inflation in many instances, offering positive “real” yields. European yields are also rising strongly but—from a very low base—exhibit less attractive absolute yields to date.

Going slightly deeper, the ability to add income to portfolios while mitigating default risk looks attractive to us currently. Duration risk again looks attractive in many scenarios, but it requires prudent management. We are cognizant of the potentially sizable drawdown risk from longer-duration assets. Adding materially to duration might make sense at some point, but any changes should be measured and deliberate, given the fast-changing response from central banks and the threat of stickier inflation. One key consideration in a portfolio context is reinvestment risk, with short-dated bonds offering strong yields but which could be left behind if rates get cut.

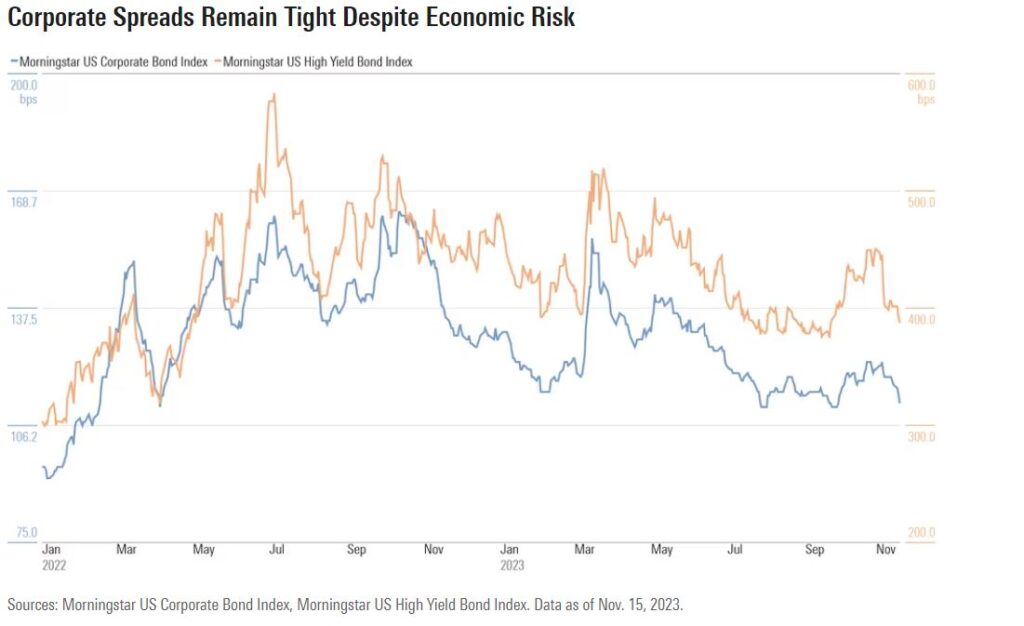

Corporate bonds, whether investment grade or high yield, offer higher yields than government bonds (given greater credit risk), although the “spread” between the two remains tighter than we might prefer, given the environment. They have a place as a middle ground—providing some extra yield versus government bonds and a duration profile that can help in portfolio construction.

Other bonds, including emerging-markets debt, retain appeal. However, we’ve softened our conviction in this space as developed peers now offer more appealing prospects. Our view remains that many emerging-markets sovereigns, though with notable exceptions, have improved their fundamental strength compared with history. This includes improved current account balances, enhanced reserves, movement to orthodox monetary policy, and a buildout of a local investor base allowing for a shift to local-currency funding.

In all cases, the key risk for fixed income is that interest rates fail to sufficiently slow economic growth and inflation. For this reason, inflation-linked bonds have appeal as a reasonably cheap form of insurance.

Bonds Opportunity 1: Focus on Positive Real Yields

A slew of opportunities now exist with positive real yields. This is a fantastic pond to fish in, with several opportunities apparent:

- Developed-markets bonds, excluding Japan.Wehave seen significant moves across the yield curve. Higher yields make these bonds more attractive, especially shorter-dated bonds where an inverted yield curve exists. The defensive attributes are appealing. On the contrary, Japan is an area to be avoided, in our view, with negative real yields persisting.

- U.S. agency mortgage-backed securities.We note solid fundamentals. Given the sharp rally in mortgage rates and significant duration extension, the attractiveness of this asset class looks appealing to us. The idea of slowing economic activity could support higher-rated assets, such as agency MBS, with little default risk. That said, further spread-widening may take place before moving in investors’ favor should the economic environment turn weaker.

- Emerging-markets debt still offers attractive yields and prospective currency returns, even accounting for risk. This applies across local- and hard-currency offerings, although sizing is important.

- Inflation-linked bonds continue to warrant some attention as they have repriced more attractively. Low inflation expectations make this a cheap form of insurance, with positive real yields now available.

Bonds Opportunity 2: Short-Dated Bonds for Cautious Portfolios

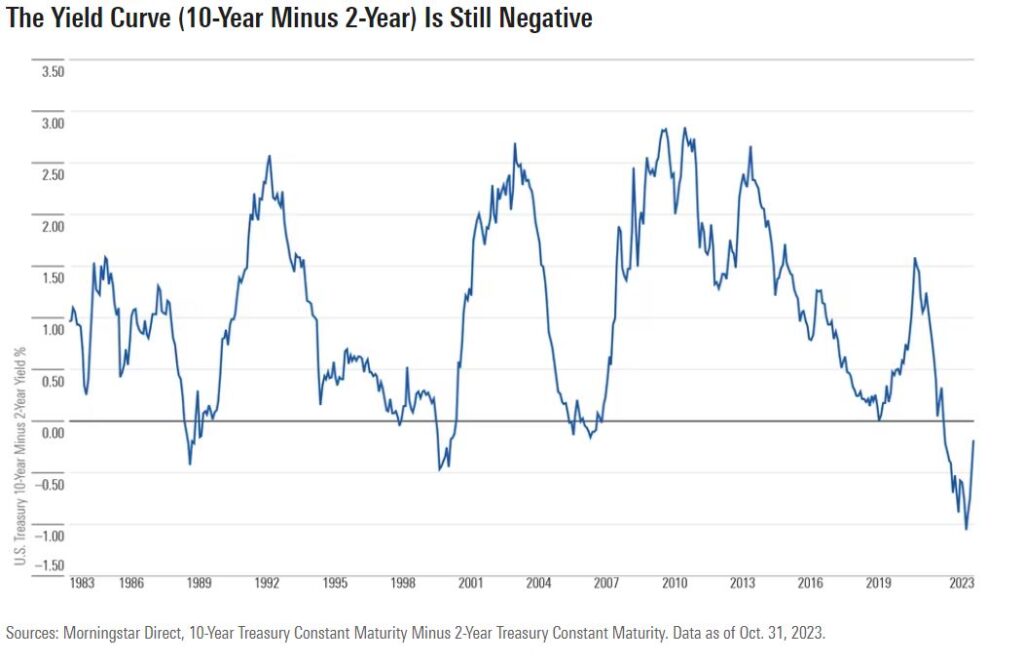

The yield on short-dated bonds still exceeds long-dated bonds. This is coming from an unusual base in a historical context, creating the so-called “inverted yield curve” we still have today.

To take advantage, it can be tempting to favor short-dated bonds. This is certainly sensible in an absolute sense, although the time frame matters. For investors who are cautious and/or have a short time horizon, short-dated bonds certainly appeal. We do note this brings reinvestment risk, which is notable if interest rates go down as expected. It may not be possible to lock in today’s long-term rates forever.

In practice, we think short-dated bonds are attractive given the inverted yield curve, so we have a great starting point—with a big gap between the current yield and our fair value yield at the short end of the curve. But for investors with longer horizons, we see merit in exposure across the maturity profile.

Bonds Opportunity 3: Overweight Government Bonds Versus Corporate Bonds

In this environment, we don’t need to stretch for yield. Government bonds in the developed world currently look as attractive to us as we’ve seen in at least a decade. This view holds across all durations.

At the same time, corporate bonds also look attractive, but the “spread” between them is on the tight side.

This is best expressed by watching credit spreads, which would usually increase if economic vulnerabilities rise. Yet, we haven’t seen spreads budge, so corporate bonds (both investment grade and high yield) lose relative appeal given the risk of economic deterioration.

For this reason, our analysis leads us to favor government bonds—particularly U.S. Treasuries—on a risk-adjusted basis. Withstanding another serious inflation run, the skew of upside to downside looks favorable to us. Of note, we do see appeal in short-term corporate bonds, where we can achieve positive real yields.

Another Idea for Your Toolkit: Currency Management

While stocks and bonds look broadly attractive to us, we do seek opportunities from across the entire investment universe. As such, we offer yet another idea for your toolkit, before summarizing the collection of our favored investment ideas: currency management.

The U.S. dollar looks expensive, although it still acts as a flight to safety in turbulence, so prudent international currency positioning (and possibly hedging) is an attractive dimension of portfolio management.

While currencies are notoriously volatile, we tend to think of currency positioning via the lens of portfolio robustness (focusing on those currencies with defensive characteristics where sensible), but also as a potential source of upside at extremes. Looking ahead, we continue to see merit in currencies outside the U.S. dollar. The yen has the potential to provide diversification qualities and potentially help preserve capital in times of extreme economic and market stress, as well as provide potential upside.

A Positive Take on 2024: Summary of Portfolio Opportunities

Taken together, the list below culminates our best ideas. By balancing these convictions into a broader diversified portfolio, we foresee a positive outlook for 2024 and beyond.

- International-equity opportunities

- The healthcare, financial-services (namely banks), and utilities sectors

- Small-cap and value stocks

- Second-derivative AI stocks

- Positive real yields in fixed income

- Treasuries over corporates

- Diversified currency outside U.S. dollar

Morningstar Disclaimers:

The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Morningstar, Inc. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. Any decision to invest should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.