Liontrust GF High Yield Bond Fund is manufactured by Liontrust Fund Partners LLP and represented in Malta by MeDirect Bank (Malta) plc.

Market review

The Global HY market returned a positive quarter of 1.6% (USD) in Q2 2023. The US HY market produced a return of 1.6% (USD) in Q2 2023; in Europe the market returned 2.1% during the period.

Unlike a year ago, high yield in general was fairly sheltered from rising government bond yields. That said, in a hark back to 2022, the US market saw lower quality bonds outperform higher quality bonds across the last three months, with its biggest rally in June. Meanwhile, the European HY market saw the opposite where better quality credits outperformed lower quality ones, and CCC-rated bonds recorded a negative return for the quarter. Overall, credits spreads have been supported by the positive technical of limited primary issuance, we’d expect a pick-up in issuance if spreads continue to remain tight judging by the appetite for the few deals that have come to market this quarter.

Fund review

Relative to index, the best performing sectors in the Fund in Q2 2023 were financial services, services and capital goods. Strong contributors to stock picking include Paymentsense (a UK-based fintech payment processing company), Burford Capital (a leading global litigation finance company), Loxam (an equipment rental business) and Klockner Pentaplast (a packaging company). The Klockner Pentaplast bonds had popped up +11 points on the back of news of an equity injection by shareholders, indicating support for the credit.

Areas where our relative underweight position was a drag to performance included more cyclical sectors, such as leisure, retail and energy. This shouldn’t come as a surprise as the fund has a bias towards less cyclical defensive credits. The long-rumoured takeover of the Fund’s only energy holding – Neptune Energy – is finally happening, expected to complete Q1 2024 with bonds to be called sometime between July and then. One holding that was a drag to performance was Catalent, previously in talks for a takeover by an investment grade rated company, Danaher, but which later fell through. This was followed by a profit warning which caused us to reassess the fundamentals of the company –we sold out of our position during the quarter.

Corporate earnings have been mixed, with some talking about customer destocking impacting performance where customers have prudently increased inventory levels on the back of a period of experiencing supply chain issues. Some were talking about successfully navigating through the inflationary environment with cost pass through features in customer contracts. But on the whole, corporate balance sheets are in good shape, liquidity is good and default rates are increasing but remain relatively low.

The Fund has been gradually reducing risk ahead of any market wobbles and, to stand in good shape ahead of entering a recessionary environment, we participated in a few primary deals that offered good value and rightsized some exposure across rating buckets. In the banking sector, tier 2 capital bonds, a more defensive exposure than topical AT1 bonds (see last quarterly commentary), were purchased in GBP in both Swedbank and BBVA – spreads of over 300bps for these quality issuers look very attractive compared to some BB high yield issuers. Given banking can be a very homogenous (or thematic) sector, we have kept this Fund’s overall weighting low at 6.5% in line with our investment philosophy of diversifying credit risks.

During Q2 2023, the Fund participated in six new issues, one of which was 3i, which is a UK-based mid-market private equity and infrastructure company. 3i is an extremely solid credit investment, with a very healthy balance sheet, tried and tested investment process and good access to capital. The six-year bonds, rated Baa1, issued in June 2023, were an absolute steal at B+280bps, making the bonds not only cheap to IG, but many BB rated bonds too.

We participated in IPD, which is a leading European B2B information provider focusing on industry-specific information platforms. It is a well-established company which has the support of its private equity sponsors, TowerBrook, to grow the business. The company is growing through M&A activity as well as organically. IPD benefits from a ~60% subscription-based model which gives it good visibility and ~80% recurring sales. Financial performance has been good and fared well during softer economic environments. Over the Covid period it had a 13% drop in sales but managed to maintain EBITDA margin at a relatively high ~27% (28% the previous year). Liquidity is healthy and improved with a new bank liquidity facility. The deal was denominated in EUR, rated B2/B/B+, secured notes with an 8% coupon.

Iron Mountain is a well-known, listed, global leader for storage and information management services company. The business has been growing organically in recurring and non-cyclical storage rental revenues, it has long standing relationships with its customers with a high retention rate. It benefits from addition upside potential from the data centre and asset lifecycle management businesses. The deal was a USD denominated bond, rated Ba3/BB- with a 7% coupon, we viewed it as an attractive investment for a stable business.

Loxam is an equipment rental company that we are already invested in in the Fund. We are invested in the B-rated, unsecured bonds, which we switched a little out of and into the new secured bond, BB- rated, issued in EUR with a 6.375% coupon.

CABB is primarily a contract development and manufacturing organisation (CDMO), supplying chemical ingredients, often customised, to customers in the crop science, life science and performance materials markets. There are various elements to CABB’s business model that make it an attractive credit. The key points are customer stickiness, structural growth in crop science and an ability to make money from waste products. The bonds were issued in EUR, rated B3/B, secured, the notes came with a 8.75% coupon.

Cheplapharm is a specialist pharmaceuticals business that we were already invested in, they issued a 7-year secured EUR denominated debt with a 7.5% coupon; in this case the Fund switched some of its existing 5-year exposure into a bond which was two years longer for a decent yield pick-up.

Looking at some of the new issues we participated in, quite a few of the issuers were paying up to access the bond market, some issuing secured debt over unsecured debt. Issuance was relatively light during the quarter, which meant that deals that did come to the market were oversubscribed, they priced tighter than the IPT (Initial Price Talk) range. It is clear that higher quality credits are gaining better access to the bond market vs. lower quality ones, a reflection of risk appetite and also the ability/willingness of issuers to take on a higher interest cost burden. In general, use of proceeds has been more for refinancing, with the US market more active than Europe.

Outlook

We have built up a bit of liquidity in the Fund, so we are able to take advantage of any stock opportunities should market volatility occur over the summer. However, we have measures in place to reduce the drag that comes from holding cash, particularly in a higher yield environment. For example, rather than just leave that liquidity in cash, we have bought a 7-month maturity US Treasury yielding 5.4% (a hangover from the debt ceiling and overhang from the T Bill deluge) and put in place a long risk CDS index overlay for the same weighting (selling default protection on the CDX HY index) at a spread of about 4.7%. Overall 5.4%+4.7%=10.1% yield (in USD or GBP terms) is pretty good carry.

A natural market implication of increased yields is a gradual re-couponing of debt as issuers refinance their liabilities. As old low-coupon debt gradually matures over the coming months and years companies will have to pay a much higher coupon, commensurate with today’s market yield levels, to attract capital. The downside to this is a deterioration in interest coverage ratios and free cash flow for the companies, which is another reason why we avoid those issuers with the most fragile balance sheets. The upside is that bond investors receive a significant boost to the running yield from the higher coupons and that lifts future expected returns from the asset class. We believe our bias towards better quality, less cyclical credits should benefit well in this market environment and going forward into a potential mild recessionary period towards the latter part of the year. The fund is currently offering ~10.4% yield for GBP investors (~8.1% for EUR investors),

Liontrust Key risks & Disclaimers:

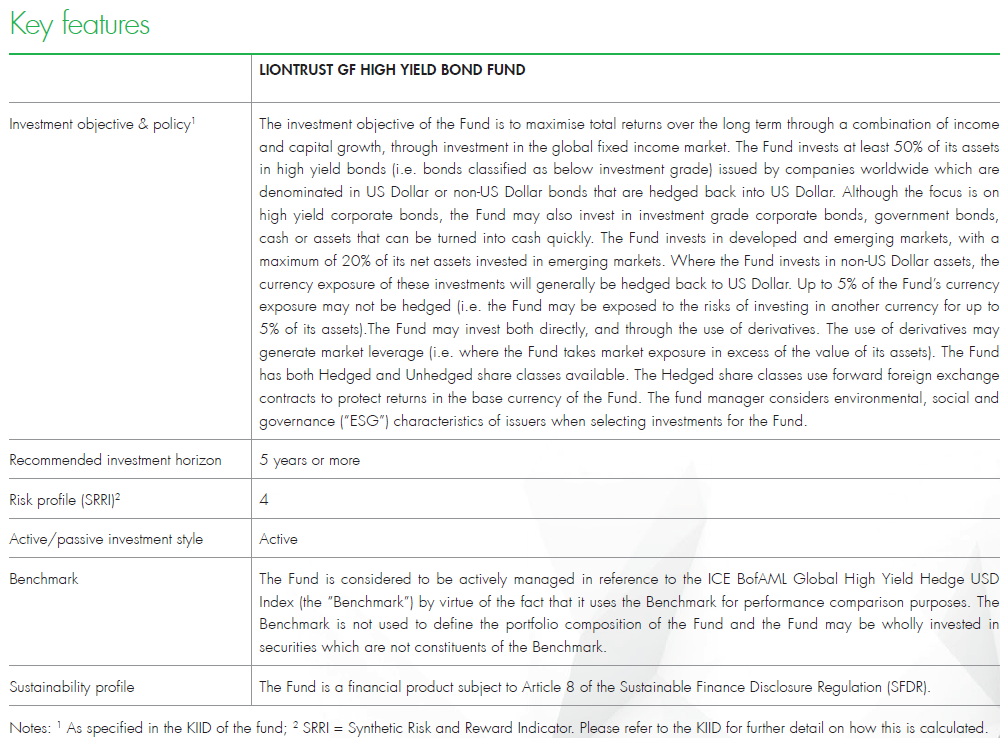

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF High Yield Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative’s underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

Issued by Liontrust Fund Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518165) to undertake regulated investment business.

This document should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Liontrust Fund Partners LLP. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.