Liontrust GF High Yield Bond Fund is manufactured by Liontrust Fund Partners LLP and represented in Malta by MeDirect Bank (Malta) plc.

Market review

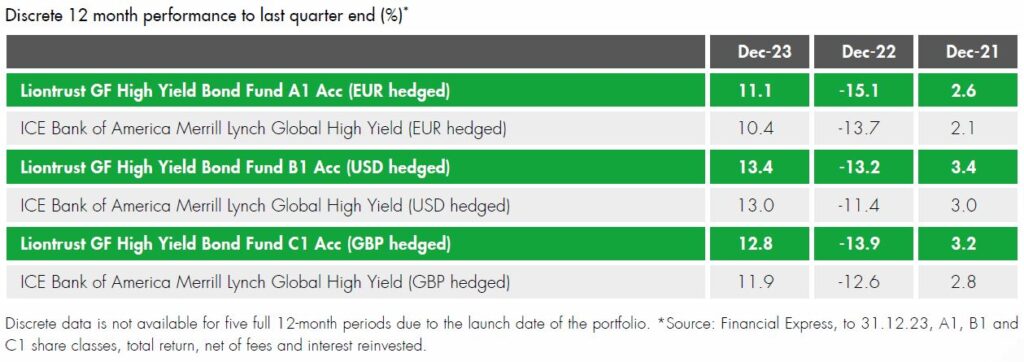

The global high yield market returned a positive quarter of +6.7% (USD) in Q4 2023, taking the full year 2023 return to +12.9%, a complete turnaround from last year’s negative return (-11.39%). The US HY market produced a return of 7.1% (USD) in Q4 2023; in Europe the market returned 6.1% during the period.

Both markets performed well primarily on the back of expectations that rate cuts are on the horizon amid easing inflation concerns, while the Fed embraced a ‘lower, sooner’ narrative at its December meeting. These developments led the market to price rate cuts in the early part of 2024, with the ‘peak rates’ narrative boosting performance in risk assets.

In Q4, both the US and European high yield markets saw BB and B bonds outperform CCCs, in particular in Europe. Performance was also supported by corporates demonstrating how resilient their balance sheets are to the headwinds they have been facing, along with limited primary supply, providing a strong technical rally. The volume of issuance this year has increased 90% from last year, demonstrating improving capital market access, but is still trailing below the average over the past four years or so. Issuance has been dominated by refinancings, representing nearly 80% of total volume and very little issuance from debut issuers or for M&A reasons. The deals that have come to market have predominantly been issued with an attractive coupon and deals have been oversubscribed, demonstrating the demand for new deals.

Fund review

Not that much reminding is required, but 2022 was an extremely tricky year for our strategy, with more defensive sectors taking the brunt of the interest-rate driven sentiment and exposures in the real estate sector being a particular lightning rod for fears around higher interest rates. After such a tricky period, we are pleased with the rebound in Fund performance seen in 2023, in absolute terms and versus index and peers. It’s worth mentioning that the negative sentiment towards real estate bonds continued in 2023, however we had right-sized our holdings such that their weakness was insufficient to de-rail the strong rebound across the portfolio. We stuck to our process and we feel investors in the Fund benefitted in 2023.

Relative to the index, the best performing sectors in the Fund in Q4 2023 were financial services/banking, healthcare and telecommunications. Among the strong contributors were Payment Sense, a UK payments business for SMEs, where the company announced a refinancing of their bonds which were due to mature in 2025, paying us an 8% coupon since we invested in the credit back in 2020. The bonds were called at 102 (5 points above where they were trading immediately before the call announcement). Many of the other strong contributors were mainly from higher-rated quality credits with strong balance sheets that had reported a solid set of results. In conjunction with our concentrated approach to investments, these holdings benefitted most from the market rally.

As previously mentioned, real estate has been a persistent drag. This has largely been sentiment-based as these companies have been operating well. In Q4, issues around CPI Property (office, retail and hotels in central & eastern Europe) were more idiosyncratic following what we view as an unfair short-seller note by the infamous Muddy Waters (MW). The company put out a detailed and robust response to the note, which has significantly improved the bond price, though MW has threatened to release more accusations (yet to be seen more than a month later). CPI Property has continued to dispose of assets, typically at or above book value and has significantly improved its liquidity position. This is a risky holding, trading at 30 cents on the euro, and is a 0.5% position size. The upside could be significant in this bond from here, but is position-sized to reflect its risky nature. It’s worth noting that, in the early days of the year, real estate bonds in general have been the standout performer. Perhaps 2024 will be a very different environment for real estate bond returns.

Trade activity

During Q4 2023, the Fund participated in three new issues, one of which was IQVIA (healthcare research services). The Fund already holds the unsecured notes (rated Ba2/BB). The new issue was a secured bullet maturity deal which has an investment grade rating (Baa3/BBB-) and came with an attractive, 6.25% coupon. The investment helped us maintain our exposure to a solid credit, improved our position by investing further up the capital structure, meanwhile offering the prospect of an attractive total return.

We also participated in Paprec, a French waste and recycling company. We like the defensive nature of the business, although we do have governance concerns about the chairman being investigated for bribery. Fortunately, the balance sheet of this BB rated company is strong enough to withstand any realistic worst case scenario fine, so for a five year Euro denominated bond offering a 7.25% coupon, the bonds are an attractive risk/return proposition.

Lastly, we participated in a new additional tier one (AT1) issue in US dollars by Banco Santander which came with a 9.625% coupon. Despite weak sentiment at the very end of 2022 and the banking crisis in March, most AT1 closed the year between +2 and +8pt higher. The structure of the product should still be attractive, supported by the current macro theme.

During the second half of the year, we built up some liquidity in the Fund, leaving ‘dry powder’ to take advantage of any stock opportunities during a market wobble. This was parked in very short-dated US treasuries, which offered much higher yields than cash. However, in order to avoid the drag of being out of the HY market, we took a long CDS index overlay position(selling default protection on the CDX HY index). This, along with adjusting interest rate hedges at advantageous points throughout the year, boosted fund returns, while managing risk prudently.

Outlook

The market looks to be embracing the prospect of interest rate cuts in 2024. As the rate cuts arrive, we still anticipate a mild recession. We expect credit spreads to remain tight until there is further evidence of fundamental deterioration amongst credits.

We anticipate lower-quality companies to suffer from refinancing difficulties, especially with the 2025/26 debt maturity walls that investors are anxious about. The higher coupon needed to get a deal done in this market will be a burden on free cash flow generation for those companies that are able to access the market, and liquidity buffers will be impacted as well as leverage increasing. These factors should lead us to see higher default rates (from a low base) in the asset class over 2024 and a wider dispersion of credit spreads from higher quality credits to lower quality ones.

Our strategy has survived and succeeded from what we believe was close to a perfect storm in 2022, when duration fears took over. The Fund continues to invest in bonds based on strong corporate fundamentals and has a bias towards high quality defensive credits, with minimal exposure to cyclical credits. It is notable that the spread compensation between BB and CCC credit is now below average, so the natural opportunity cost that comes with our strategy is reduced.

CCCs outperformed in 2023, yet the Fund performed well. We believe our defensive approach stands us in good shape to perform well if and when default risk is the major driver of the market, rather than interest rates. The Fund is currently offering a yield of around 9.2% for sterling investors (~7.6% for euro investors). Given the credit risk we ask our clients to take when investing in this Fund, we view this as attractive for long-term investors.

Liontrust Key risks & Disclaimers:

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF High Yield Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative’s underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

Issued by Liontrust Fund Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518165) to undertake regulated investment business.

This document should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Liontrust Fund Partners LLP. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.