Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Glenn Purves – Global Head of Macro and Michel Dilmanian – Portfolio Strategist, all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Binding economic rules : We’ve said economic rules could bind U.S. policy changes. Last week’s trade policy updates show how quickly these rules can bind when facing disruption.

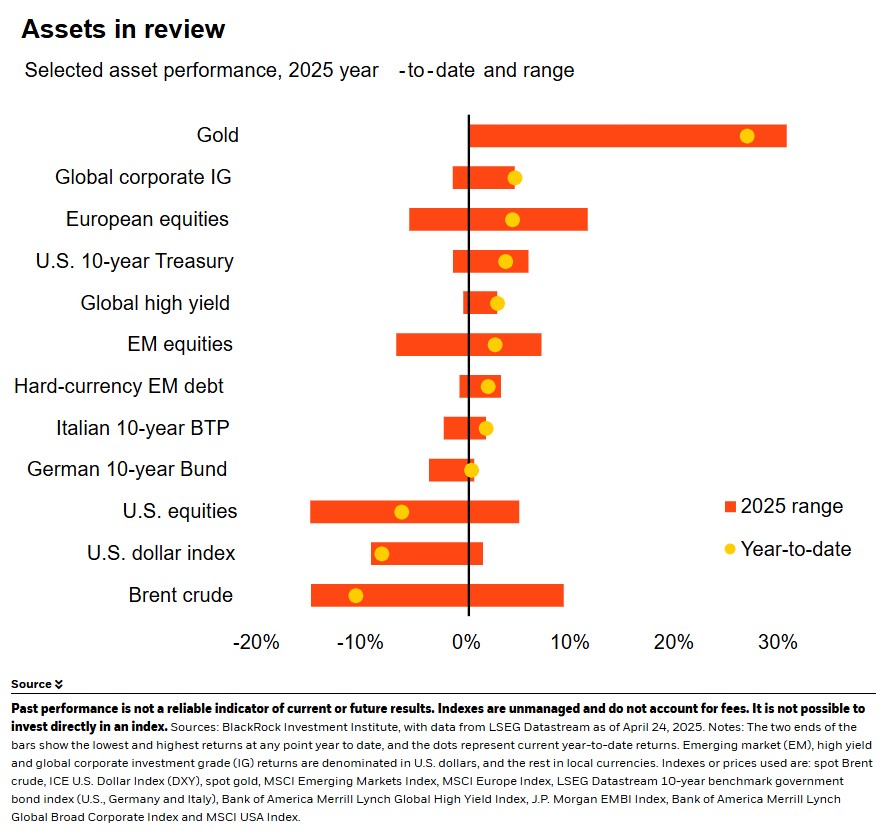

Market backdrop : U.S. stocks rebounded last week and are now down less than 3% since the April 2 tariff news. U.S. 10-year yields fell but are still up sharply from their April lows.

Week ahead : This week, we eye April U.S. jobs data for early signs of how recent U.S. tariff announcements are affecting business confidence and hiring decisions.

We laid out two economic rules binding on attempts at abrupt U.S. policy changes: financing debt and supply chains. Supply chains can’t be rewired quickly without major disruption. Signs last week of the U.S. softening its trade stance on China show the second starting to bind as negotiations take shape. That’s why we see U.S. policy settling down on our tactical six- to 12-month horizon. We stay positive on developed market (DM) stocks yet see more near-term volatility.

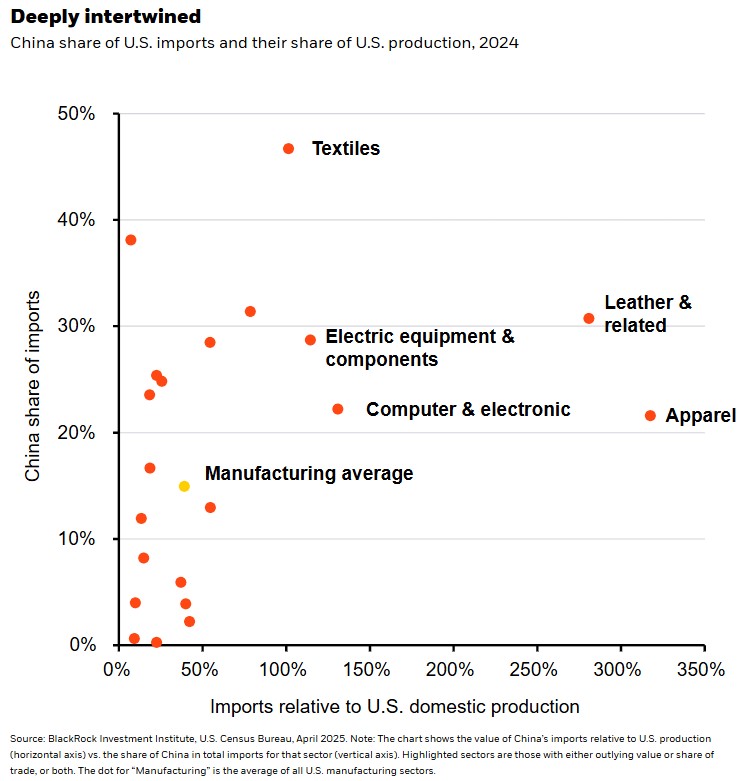

U.S. stocks rose 14% from their April lows last week as the U.S. showed signs it may soften its trade stance on China – more evidence economic rules can limit what’s possible in trade negotiations, we think. We track these rules instead of trying to predict policy shifts. Decoupling from China, bringing production to the U.S., and supply chain diversification are U.S. strategic priorities. Yet global supply chains can’t be rewired quickly without major disruption – an economic rule. China is a key supplier of critical minerals, semiconductors, industrial parts and auto parts, U.S. Census data show. How intertwined are the economies? U.S. imports of computer and electronics are bigger than total U.S. production of these items. See the chart. Tariffs could up costs, cut access to key inputs and halt production. A cooling U.S. stance would point to growing awareness of the risks tied to a supply shock.

Big questions remain about the damage tariffs could cause, even if the binding effect of economic rules means it will take time to uproot current trade relationships. We see more cause for concern on the supply side, as disruptions could lower productivity and the growth trajectory – like the pandemic shock. Long-term capital spending could also be hurt by uncertainty as happened after the 2016 Brexit vote. To gauge how long the damage could last, we’re monitoring indicators like capital spending plans, consumer confidence, high-frequency data on port traffic and early reads on trade flows.

What we’re eyeing

We look for signs of pressure on companies in earnings reports: think mentions of changes in supply chains, the ability to pass costs to consumers and consumer demand. For the “magnificent seven” of mostly big tech companies, we’re eyeing any changes in their plans for artificial intelligence (AI) capital spending given more efficient AI models and exposure to the trade war. In consumer goods, we are tracking guidance on any impacts from weakening consumer sentiment and potentially higher prices. Analysts have cut forecasts for 2025 S&P 500 earnings growth to about 9% from 14% in January, LSEG data show. Prolonged uncertainty could spur further cuts. The consumer discretionary and industrials sectors have suffered sharp declines for 2025 forecasts given their reliance on foreign revenues and global supply chains.

How to invest amid policy uncertainty? We think this calls for more dynamic portfolios. Economic rules help gauge where trade negotiations could settle, so we see uncertainty easing over six to 12 months. We stay positive on DM stocks but expect ongoing, near-term volatility. Our expectation for clarity and support from mega forces is why we favor some alterative assets on a strategic horizon of five years and longer. Policy uncertainty has caused dealmaking to slow as investors struggle to value assets near term. We see dealmaking resuming as clarity returns. Yet private markets are complex and aren’t suitable for all investors. We also like publicly listed real estate and infrastructure as they’ve diversified portfolios, outperforming U.S. large cap stocks since their February peak, Bloomberg data show. Plus, they stand to benefit from a host of mega forces.

Our bottom line

Economic rules can put bounds on the maximal stance in trade negotiations. We stay positive on DM stocks but expect ongoing, near-term volatility. We also favor publicly listed alternative assets as portfolio diversifiers.

Market backdrop

U.S. stocks jumped more than 4% last week and are now up 14% from a 14-month low hit earlier in the month, driven by tech. Yet uncertainty over tariffs has prompted more companies to withdraw or soften earnings guidance. Europe’s Stoxx 600 rose nearly 3% last week and is up roughly 10% from its April low. U.S. 10-year yields fell to near 4.25% but are still up about 40 basis points from their April low. The U.S. dollar inched up from three-year lows against major currencies.

We are closely monitoring the U.S. payrolls report out this week. The report could show early signs of changes in business confidence and hiring decisions even as the U.S. has paused tariffs announced on April 2 for most countries for 90 days. Recently strong jobs data had shown still elevated wage pressures. The pace of job gains was also not consistent with core inflation falling back near the Federal Reserve’s 2% target – even before factoring in the inflationary impact of tariffs.

Week Ahead

April 30 : U.S. PCE

May 1 : Bank of Japan policy decision

May 2 : Euro area flash inflation data; U.S. payrolls

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 29th April, 2025 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.