Careers

We are always looking for determined and hard-working colleagues who want to take a step forward in their career.

At MeDirect we strive to provide an exceptional employment experience.

Join the fast-growing journey of an international digital bank!

“MeDirect is all about working in a dynamic and exciting environment for continuous growth and learning. The fast-paced nature of the bank, combined with evolving financial technologies, provides ample opportunities to develop new skills and advance in your career. ”

Gabriel Agius

Senior Manager – Business Finance

“Working at MeDirect is an incredible journey of personal and professional growth and a celebration of success. We invest in our customers but also in our teams too. We are given the space to challenge ourselves and to grow.”

Jessica Mangion

Senior Manager – Wealth Support

Work with us

At MeDirect we strive to provide employees with an exceptional employment experience, as the international banking dynamic is quite unique for Malta. The environment is challenging yet fulfilling, as it stretches people’s capabilities beyond their comfort zone. Opportunities for professional development are ongoing and our people are rewarded with highly competitive benefits.

Internship

Programme

Are you a student?

We’ve got some great opportunities for you to experience what it’s like to work at Malta’s first digital bank.

Graduate

Programme

Have you graduated?

Start your career with an opportunity to spend up to a year working in different roles across the bank.

What we offer

Grow with us

- Ongoing internal training

- External training opportunities, both locally and abroad

- Study leave

- Sponsorship schemes for further studies

- Opportunities for career growth

Earn and save

- Free life and premier health insurance

- Discretionary performance bonus

- Staff savings account at a highly preferential rate

- Home loan subsidy

- Relocation programme

- Employee referral incentive

- Free parking

Invest in yourself

- 18 weeks of fully-paid maternity leave

- Hybrid working model

- Extended unpaid parental leave

- Possibility to work from home

- Fitness refund

- Additional bank holidays

- Staff discounts

Interested in joining us?

We’re always looking for determined and hard-working people who want to take a step forward in their career. Submit an open application.

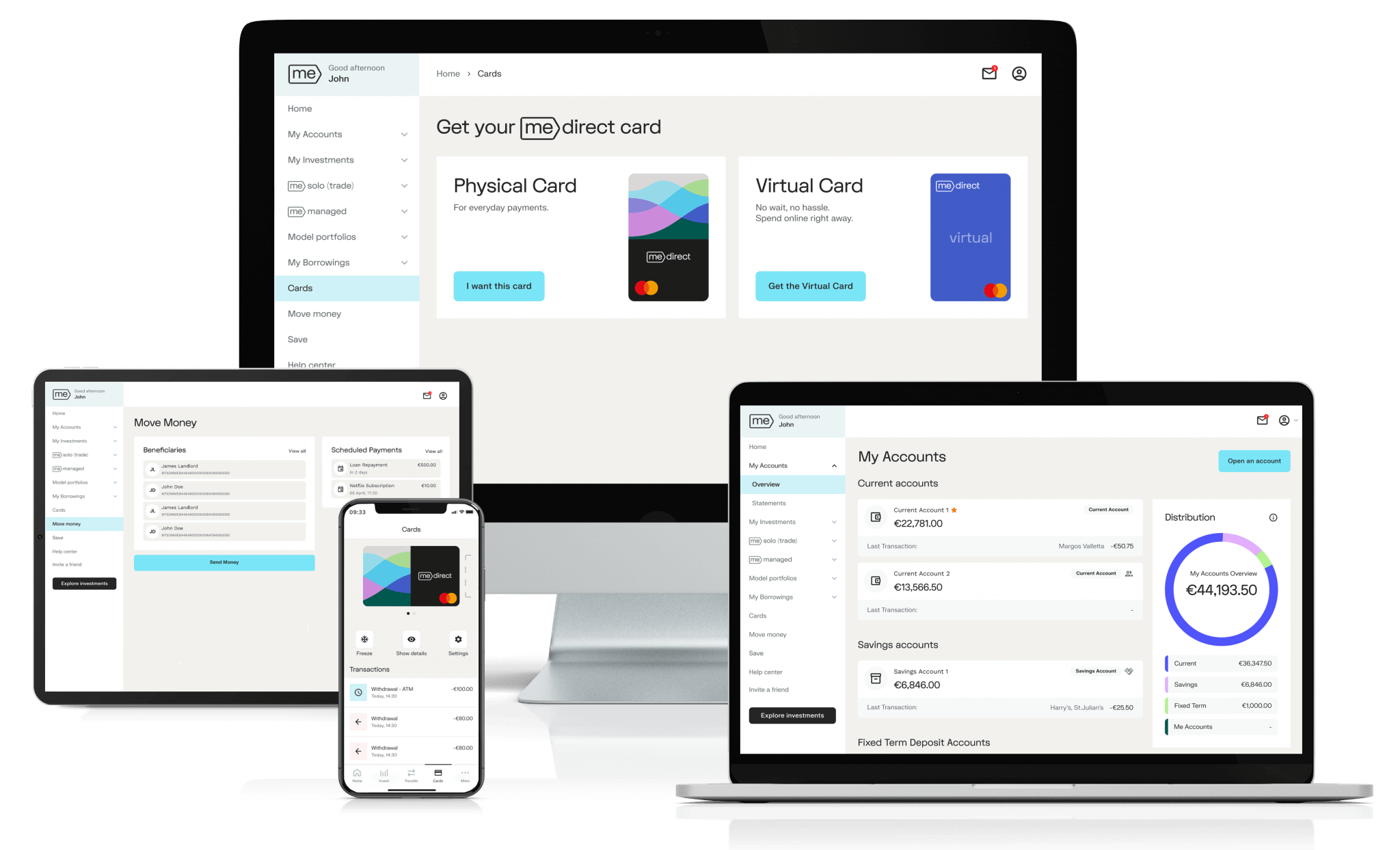

Experience better Banking

The sooner you start managing your money, your way, using the best-in-class tools, the sooner you’ll see results.

Sign up and open your account for free, within minutes.