Jean Boivin, Head of the BlackRock Investment Institute together with Wei Li, Global Chief Investment Strategist, Alex Brazier, Deputy Head of the BlackRock Investment Institute and Nicholas Fawcett, Macro Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points:

Shocks to supply – Supply shocks have created scarcity inflation, making higher inflation more persistent and increasing the risk of a growth slowdown.

Market backdrop – Ten-year U.S. Treasury yields hit three-year highs after it became clear the Fed will start to reduce its balance sheet quickly. We see further yield rises ahead.

Week ahead – We could see European Central Bank officials trying to guide down market expectations for multiple rate hikes this year and next.

Scarcity inflation is here. Supply shocks have created shortages of goods, energy and food that are driving up prices. We see this making inflation more persistent. It’s also spurring central banks to normalize policies faster. This is needed, in our view, as the economy no longer requires stimulus. The problem: Scarcity inflation has raised the risk of a global growth slowdown, either via the direct impact of the supply shocks or through central banks slamming the brakes on the economy.

Scarcity shock and inflation

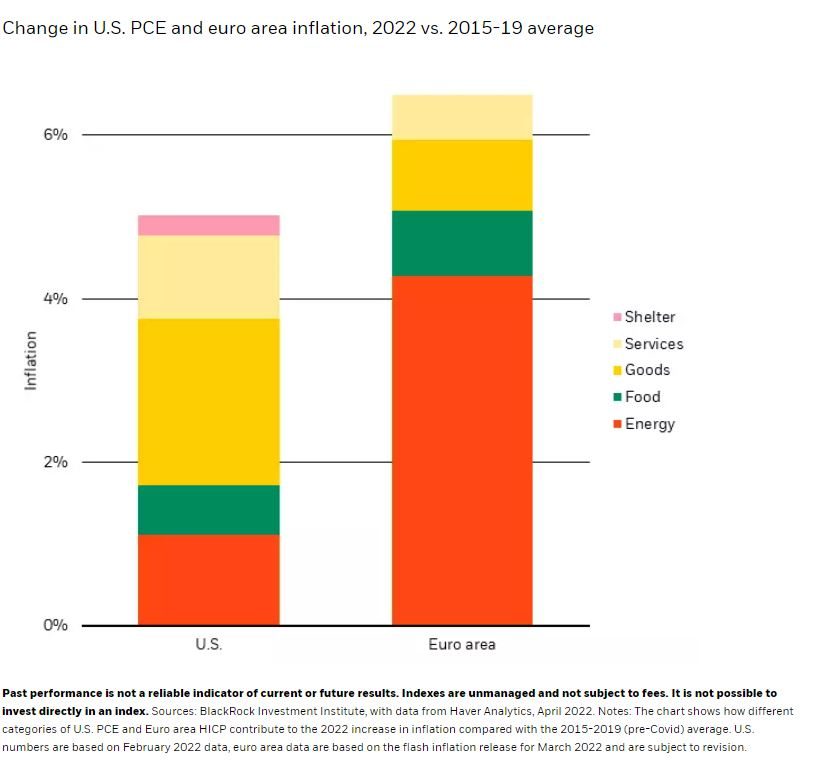

Higher inflation is still driven by the sudden restart of economic activity from the pandemic’s lockdowns. Supply has struggled to keep up with shifting bursts in demand across sectors. Russia’s horrific invasion of Ukraine added a classic supply shock that is driving inflation higher and hurting economic activity. First, the West’s drive to wean itself off Russian energy added to an existing energy crunch. The result: Rising energy prices today are contributing 4 percentage points more to euro area inflation than in the five years before COVID, as the chart shows. Second, reduced food and fertilizer exports from Russia and Ukraine have created food insecurity around the world. These new supply disruptions add to existing pressures: Farmers already faced sharply higher fertilizer and diesel costs. Food inflation (green bars in the chart) could become a larger driver of inflation in developed markets as a result. World food prices jumped 13% in March to a new high, Food and Agriculture Organization data show.

Compounding and varying impacts

What is the impact of the two supply shocks and resulting scarcity inflation? It differs greatly by region. For Europe, the second shock could result in outright stagflation as the region’s energy costs have surged to near-record levels, as we detail in A new supply shock. In the U.S., a net exporter of energy these days, the momentum of the economic restart is strong. The risks to growth there stem from the Federal Reserve’s response to headline inflation running at 40-year highs, in our view.

Indeed, scarcity inflation is compounding the dilemma for central banks around the world: Inflation is high, but economies are not overheating. The usual playbook of jacking up rates to cool the economy doesn’t really apply in a world shaped by supply. Central banks are normalizing policy rates back to neutral levels that neither stimulate nor restrain the economy. Minutes of the Fed’s March meeting released last week reinforced our view that the central bank is determined to normalize very quickly, with a large projected rate increase this year and a quick reduction of its balance sheet.

The key issue: Will central banks go beyond neutral and slam the brakes on the economy with higher rates that crush activity – and risk assets? We believe central banks will ultimately choose to live with higher inflation, rather than destroy growth and employment. As a result, we expect the sum total of rate hikes to be historically low given the level of inflation. Once the Fed gets closer to neutral levels of rates later this year, inflation will likely have peaked. Growth and spending on goods should be normalizing. We see two risks. First, central banks could slam the brakes anyway because they think they can lift rates higher without causing damage. Second, the sticker shock from higher day-to-day prices causes inflation expectations to become de-anchored from central bank targets.

What are the investment implications?

We prefer equities over credit because the inflationary environment favors stocks, in our view. Many developed market companies so far have been able to pass on rising costs and kept margins high. First-quarter results starting this week will provide a reality check. We are underweight government bonds. We see long-term bond yield rising further and yield curves steepening as investors demand extra compensation for the risk of holding long-term government bonds amid high inflation and debt loads. Short-term bonds could outperform as we believe market expectations for rate increases have become overly hawkish. Such a backdrop could still be positive for equities because it represents a relative investor preference for stocks over bonds. We favor U.S. and Japanese equities over European peers within developed markets because we see the impact of the energy and food shocks as greatest there.

Market backdrop

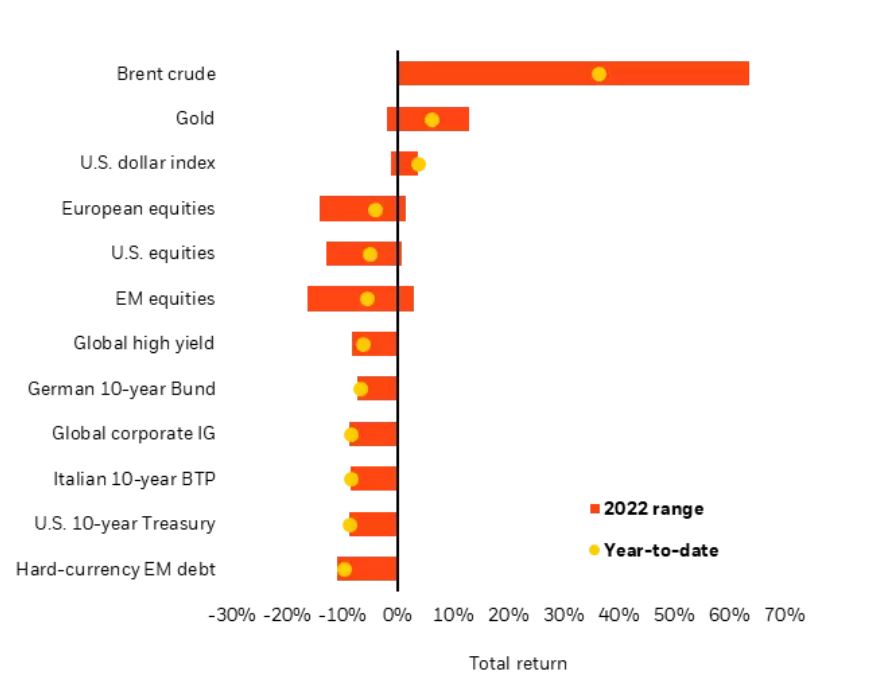

U.S. 10-year Treasury yields jumped to three-year highs of around 2.7% even as short-term yields steadied, causing the yield curve to steepen sharply. The Fed’s plans to shrink its balance sheet – so-called quantitative tightening – was close to expectations but helped spark the back up in yields. We expect a further steepening of the yield curve as investors demand more term premium, or extra compensation for the risk of holding long-term bonds.

The European Central Bank’s rate decision is our focus this week, against a backdrop of hawkish market pricing that points to a lift-off in policy rates later this year. We think the ECB will be more cautious about lifting policy rates back near zero than markets currently expect. Our reasoning: The energy shock’s hit to growth will do some of the work for the ECB.

Assets in Review

Week ahead

- April 11-18: China total social financing

- April 12: Germany ZEW economic sentiment

- April 14: ECB policy meeting; University of Michigan sentiment

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of February 28th, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.