Wei Li, Global Chief Investment Strategist of the BlackRock Investment Institute together with Vivek Paul, Head of Portfolio Research, Paul Henderson, Portfolio Strategist and Christian Olinger, Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Long-term asset views: Strategic views are evolving in the new regime. We lean into investment-grade credit and away from high yield. We stay overweight inflation-linked bonds and stocks.

Market backdrop: Stocks were flat and the yield curve further inverted last week. The Federal Reserve seems set on rate hikes, even as the damage is starting to be clear.

Week ahead: Global manufacturing and services data should signal how economic activity is responding to central banks’ policy tightening. We see recessions ahead.

Our strategic views of five years and longer are positioned for the new regime of greater macro and market volatility. We go more overweight investment grade (IG) credit on attractive yields and healthy corporate balance sheets that can withstand the mild recession we expect. We stay modestly overweight developed market (DM) equities. We expect the overall return of stocks over the coming decade to be greater than fixed-income assets even if equities take a near-term hit.

Leaning into investment grade credit

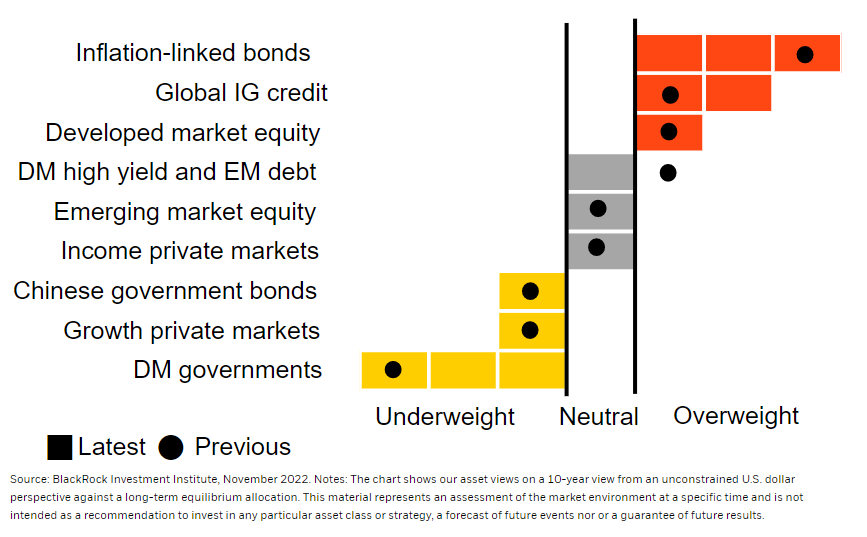

Strategic (long term) asset views, November 2022

Since our last strategic view update, we increased our overweight on global IG credit and cut high yield to neutral from overweight (see chart). We like the income we can pick up in IG at higher spreads. And we see looming recessions having more ripple effects on high yield than IG. Other views hold true as the new regime plays out. Our expectation of sticky inflation favors inflation-linked bonds not yet pricing in that view. Nominal long-term bonds are challenged for multiple reasons that we see driving a higher term premium, or the compensation for holding them. We prefer short-term government bonds because they don’t face the same risks from investors demanding more term premia as in long-term bonds. Our modest overweight in DM stocks is because we think central banks will live with inflation, keeping recessions mild, and long-term valuations are fair.

Unpacking our views

The new regime warrants getting more granular than broad asset class views can convey – both between and within asset classes. For example, old correlations have broken down between equities and bonds that underpinned the bond role as portfolio ballast. We’re underweight government bonds because we think investors will demand higher term premium amid higher inflation and elevated debt burdens. Within government bonds, we like short maturities to collect attractive coupons. We prefer to take fixed-income risk in credit – and prefer public credit to private. We like the income potential and strong balance sheets in IG where credit spreads are near the widest in two years. We’re cautious on high yield and move to neutral – even mild recessions lead to greater defaults and downgrades in lower quality credit.

We stay overweight in inflation-linked bonds because we see persistent inflation – and we still like long-term inflation-linked bonds. Why? We think the new regime of production constraints is set to persist, reinforced by three big transitions. First, aging populations mean shrinking workforces – one reason why labor supply is struggling to keep up with output. Second, we think geopolitical fragmentation is rewiring supply chains. Efforts to re-shore operations could also add to the upward pressure on wages and inflation. Third, we see the transition to net-zero carbon emissions reshaping energy demand and supply over time. Yet market pricing shows expectations for inflation to slow back near pre-pandemic levels.

Over the next year, stocks don’t yet fully reflect our recession expectation and the resulting drag on corporate earnings. That’s why we’re underweight tactically. But strategically we expect the overall return of stocks to be greater than fixed-income assets over the coming decade. That’s partly because we see the politics of recession taking over from the politics of inflation – and central banks will eventually live with some inflation. Staying invested in stocks is one way to get more granular with structural trends impacting sectors. We think lower-carbon sectors like tech and healthcare will benefit more on average than traditional energy stocks in the transition to net-zero carbon emissions, even as traditional energy firms with credible transition plans can do well. In private markets, valuations have not caught up with the public market selloff, reducing their relative appeal. But we think private markets should be a larger allocation than what we see most qualified investors hold.

Our bottom line

Our strategic views are positioned for the new regime of greater macro and market volatility. We think portfolios need to be more dynamic and change more frequently by constantly assessing the economic damage in market pricing. Watch for our updated views and more on navigating the new regime in our 2023 Outlook on Nov. 30.

Market backdrop

Stocks flatlined this week while the U.S. Treasury yield curve neared its most inverted levels since the early 1980s. Federal Reserve officials made clear that what matters is not the pace of rate hikes, but the end-point for policy rates. The Fed is set to overtighten policy, causing a mild recession, just as signs of damage become evident – such as a further drop in U.S. housing starts. We think the Fed will ultimately stop when the economic pain is clearer and live with some inflation.

This week’s global PMIs take center stage as we gauge activity relative to the looming recession we expect in major economies. We don’t see a soft landing outcome from central bank overtightening but think they will stop short of causing deep downturns as the damage from sharply higher rates becomes clearer.

Week Ahead

Nov. 22: Euro area flash consumer confidence

Nov. 23: Global flash PMIs; U.S. durable goods

Nov. 24: Germany IFO business survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 21st November, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.