Jean Bovin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Carolina Martinez Arevalo – Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Earnings outlook: U.S. corporate earnings have stagnated for a year, but Q2 beat a low bar. Expectations of improving margins look rosy. We stay selective in equities.

Market backdrop: U.S. stocks moved sideways and 10-year Treasury yields surged in volatile trading last week after CPI data. We see inflation on a rollercoaster ahead.

Week ahead: We’re watching inflation in Japan this week after the central bank loosened its yield cap last month. We see that pulling local and global bond yields higher.

U.S. corporate earnings have stagnated over the past year even as Q2 earnings improved a bit on better profit margins. We still see a margin squeeze ahead as worker shortages push wages back up, even if that takes longer to play out – our first takeaway. So the consensus for margins to expand into next year looks rosy, to us. Second, we see clear sector winners and stay selective with and within sectors that delivered earnings growth. Third, we see key regional divergences.

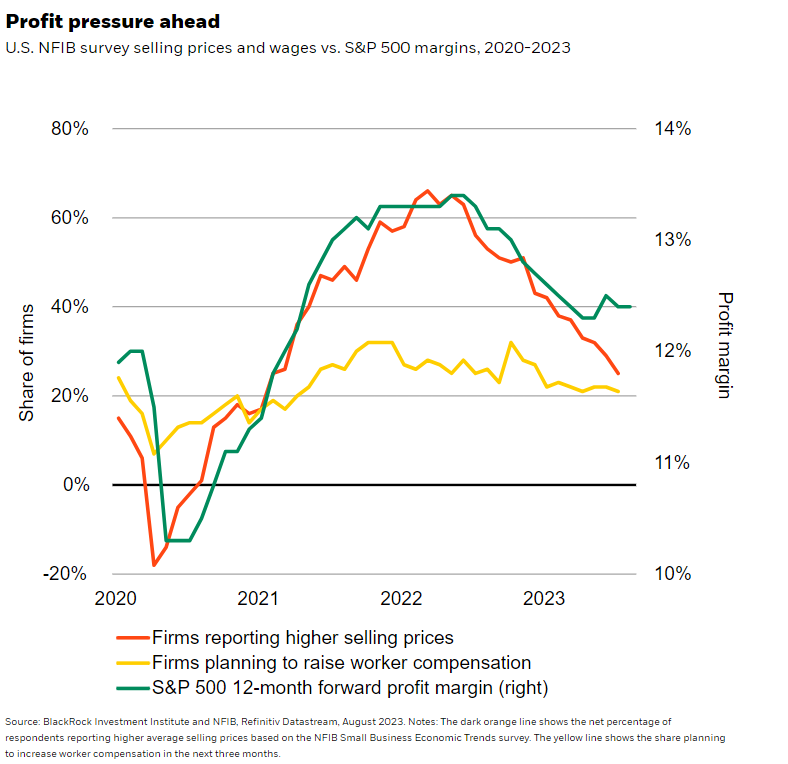

U.S. earnings have stagnated over the past year as pandemic-driven spending shifts normalized, squeezing profit margins. Margins ticked up in Q2, so earnings topped low expectations, partly from companies benefitting from lower input costs. We don’t think this will last. The consensus for profit margins looks too rosy – our first takeaway from Q2 earnings (green line in chart). Firms may struggle to pass on persistent labor costs to consumers: The share of businesses reporting higher prices for their products is the lowest since January 2021 (dark orange line), NFIB data show. We see companies facing higher labor costs from lifting wages to attract fewer available workers: The workforce is 4 million smaller than it would have been if it had kept growing at its pre-Covid pace, we find. The recovery of jobs lost in the pandemic has masked what has proved tepid job growth. Competition for workers should boost employee wages – at the expense of profit margins and shareholders.

We believe this structural labor shock is poised to take over as the driver of inflation as the pandemic-driven spending mismatch unwinds. That historic shift in consumer spending during the pandemic to goods from services created mismatches in production and consumption, and within the labor market as a result. It drove up prices and led to fatter profit margins, especially in the goods sector. Recent data showing a further sharp drop in goods prices in the July U.S. CPI and cooling Q2 wage data confirmed spending is normalizing. And that means profit margins are starting to normalize as well, even with the slight improvement in Q2.

Varied results

As worker shortages due to an aging population become more binding, we see firms needing to devote revenue to hiring or retaining workers – to the detriment of margins. We see inflation on a rollercoaster as the labor shock takes over from the spending mismatch. If companies try to protect margins from these wage pressures in a stagnant economy, that could add to inflation pressures and result in even higher central bank policy rates. We have evolved our macro framework to account for these forces.

Our second takeaway from Q2 earnings season: Tech met a high bar and selectivity is coming through in earnings. Other sectors that perform well as economic activity picks up fared better than expected, like industrials, communication services and consumer discretionary. As U.S. growth stagnates, it would be logical to question consumer sector resilience – especially as pandemic savings dwindle. But that’s the old playbook: The sector impact may be different. We think workers gaining income share from firms and unemployment staying low could reinforce consumer spending power for some time. We use our new playbook instead to get granular with and within equity sectors. Tech aligns with our preference for sectors delivering earnings growth. But we stay selective in tech with our overweight to the developed market (DM) artificial intelligence mega force theme, tapping into this structural shift within DM stocks, even when the macro is unfriendly to broad equity exposures.

Our last takeaway is regional differences. Q2 earnings of European firms contracted twice as much as U.S. peers, contributing to European stocks underperforming DM peers in recent months. Within DM, we prefer equities in Japan, where policy is still relatively easy, real rates are negative and shareholder-friendly reforms are taking root.

Bottom line

U.S. earnings are stagnating. Market expectations for a pickup in margins over the next year look rosy as worker shortages keep pressure on wages. We’re keeping a close eye on the labor market as a result and stay granular in DM stocks.

Market backdrop

U.S. stocks moved sideways below the 16-month high hit in July, with tech stocks underperforming after their sharp gains this year. Ten-year Treasury yields surged back near 15-year highs after volatile trading, partly due to a weak bond auction. The July CPI showed inflation cooling more. We see inflation on a rollercoaster ride ahead (see above). Market pricing of long-term inflation has diverged from shorter-term pricing, suggesting that markets see inflation pressures persisting longer term.

We’re watching GDP and inflation data across DMs this week. Inflation has returned in Japan but not as much as other major economies. The Bank of Japan (BOJ) is still unsure if higher wages are sustainable and can keep inflation around its target. Yet the BOJ loosened its yield cap again in July. We see that pulling local and global bond yields higher.

Week Ahead

Aug. 15: Japan GDP; China retail sales

Aug. 16: Euro area flash GDP; UK inflation

Aug. 18: Japan inflation

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 14th August, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.