Jean Boivin, Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head and Vivek Paul – Global Head of Portfolio Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

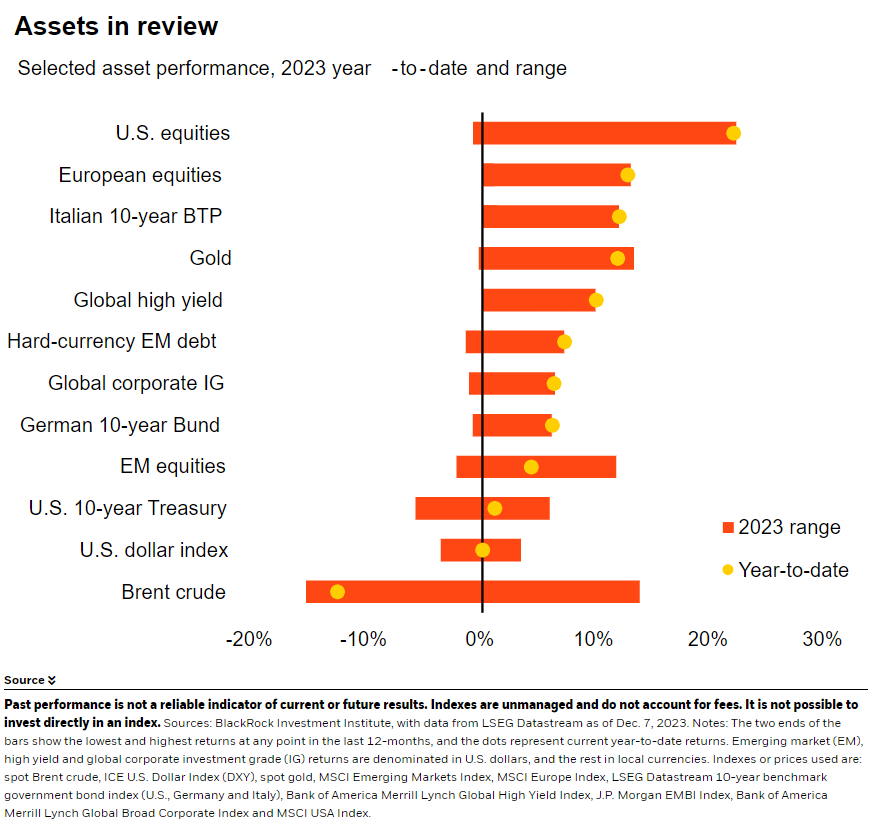

Transition themes: The new regime has led to greater dispersion of returns. We think this backdrop calls for managing macro risk, being selective and seeking out mispricings.

Market backdrop: U.S. stocks hit a new 2023 high and U.S. Treasury yields inched up on Friday after U.S. payrolls data. Market pricing of rate cuts in 2024 still looks overdone.

Week ahead: We see central banks pushing back against market hopes for rate cuts at this week’s meetings. We expect structurally higher interest rates in the new regime.

We think the new regime of greater macro and market volatility makes this the time to grab the wheel and take an active portfolio approach. Our 2024 Global Outlook outlines how we do that. First, we are deliberate in managing macro risks. Second, we aim to capitalize on greater dispersion of returns by getting selective within asset classes, geographies and sectors. Third, we tap mega forces, the structural shifts we see driving returns and transcending the macro backdrop.

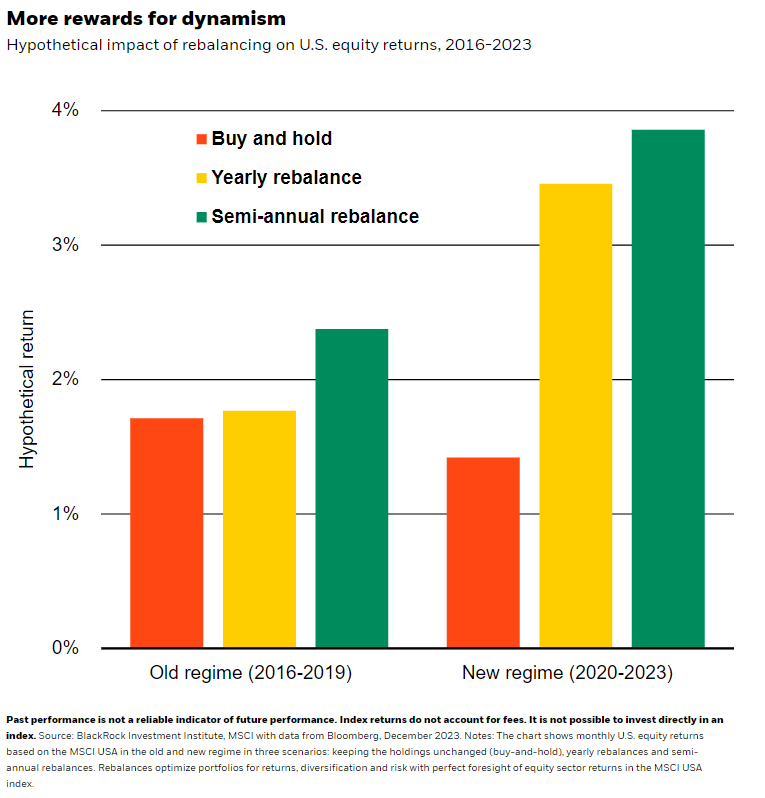

The new regime’s higher interest rates and greater volatility are a sea change from the Great Moderation, the four-decade period of stable growth and inflation that was capped by ultra-low rates in the wake of the financial crisis. That helped suppress macro and market volatility, stoking bull markets in both stocks and bonds – but also limiting the reward of having investment insight. We find that reward is back. The test: Imagine you could perfectly predict future U.S. equity sector returns and adjust your portfolio to capture them. That would have had little upside in the four years before the pandemic. “Buy-and-hold” strategies (the orange bar on the left chart) would have generated similar returns to portfolios allocating to outperforming sectors more frequently (the left yellow and green bars). The reward has been much greater since the pandemic, with rebalancing delivering more than double the hypothetical returns of a buy-and-hold strategy. See the gap between the orange bar and the others on the right chart.

How do we try to capitalize on this new regime? First, we focus on managing macro risk – the first of three investment themes that help us identify opportunities to generate alpha, or above-benchmark returns. Markets have been swinging between hopes for inflation to fall as growth holds up and recession fears. Yet we think the context is that the economy has just climbed out of a pandemic-shaped hole. Plus, structural drivers such as shrinking workforces are poised to push up inflation. One macro risk we’re watching is the uneven market adjustment to structurally higher rates. The income cushion bonds provide has increased, leading us to upgrade long-term Treasuries recently to neutral on a tactical horizon. We went overweight European and UK government bonds at the same time, but have since trimmed again given the fall in yields. This more dynamic approach contrasts sharply with our previously long-held underweight in developed market long-term bonds.

Steering portfolio outcomes

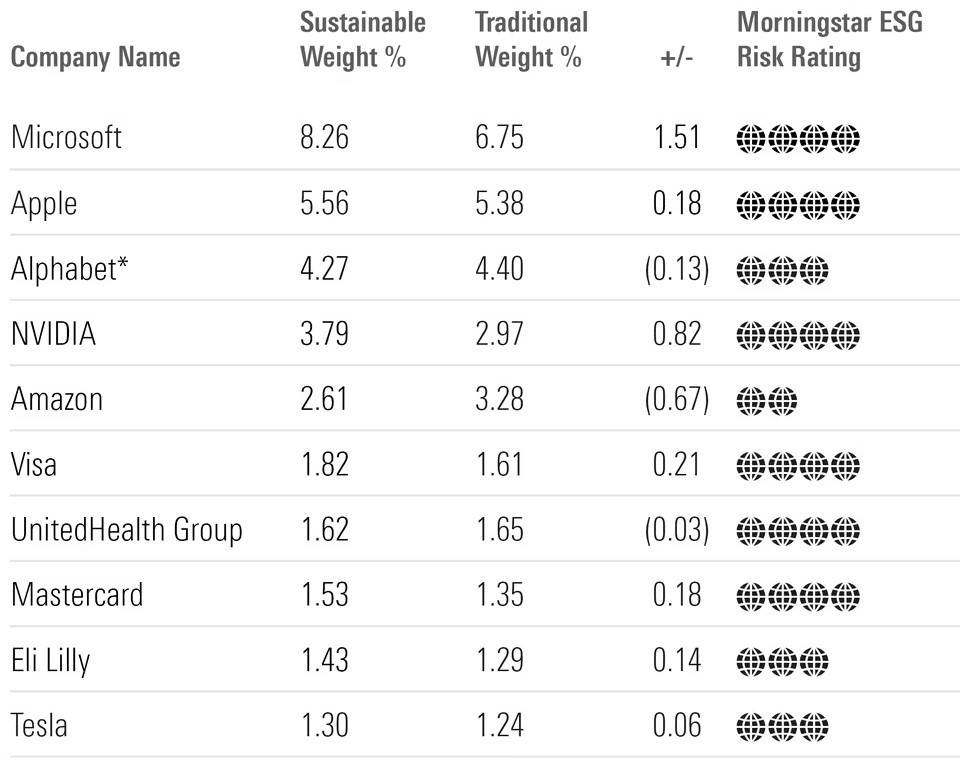

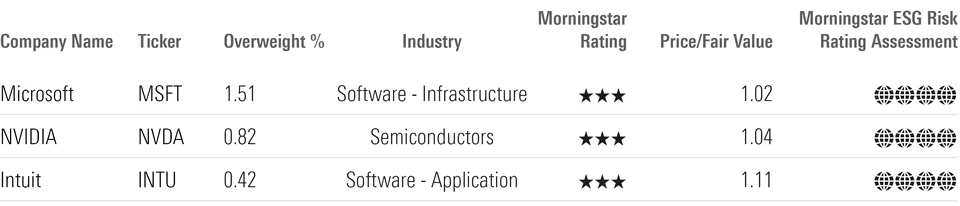

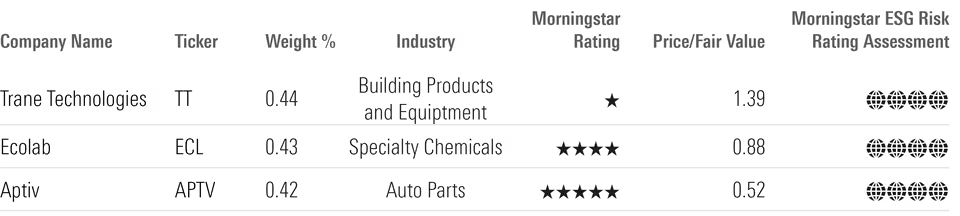

Greater dispersion of returns creates space for investment expertise to shine and means security selection is likely to be more impactful – as detailed in our second theme, steering portfolio outcomes. This involves being dynamic with both indexing and alpha-seeking strategies, while staying selective and seeking out mispricings. For example, we upgraded Japanese equities twice without hedging against currency swings this year due to high compensation for the risk of holding them, strong earnings growth and shareholder-friendly corporate reforms. On sectors, we like European banks for their low valuations and positive outlook for net interest margins, as well as developed market technology.

Harnessing mega forces

Our preference for tech is supported by our third theme, harnessing mega forces, which offer opportunities uncorrelated to economic cycles. Case in point: Investor enthusiasm for digital disruption and artificial intelligence (AI) – one of five mega forces we track – has buoyed U.S. tech stocks and offset the drag of higher bond yields. Our expectation for high-for-longer rates would keep us underweight broad U.S. equities on a tactical, six-to-12-month horizon. Yet adding the AI theme has taken us closer to neutral. Other mega forces present opportunities, too. Within the low-carbon transition, climate resilience – society’s ability to adapt to and withstand climate hazards – is emerging as an investment theme. And we see geopolitical fragmentation dialing up investment in strategic sectors like tech, energy and defense.

Our bottom line

The three investment themes of our outlook guide us on how to take a more active approach to investing. Mega forces help us get granular in DM stocks. And higher rates have increased the income in fixed income, boosting its appeal.

Market backdrop

The S&P 500 hit a new 2023 high, beating the record it set on Dec. 1. The U.S. jobs report for November stemmed the fall in 10-year U.S. Treasury yields – down about 75 basis points from 16-year highs – from markets pricing in multiple Fed rate cuts next year. The data showed a gradually cooling labor market, but falling unemployment and still-high wage growth aren’t consistent with inflation returning to the Fed’s 2% target. So we don’t think the Fed will cut rates as swiftly as markets expect.

The Fed and ECB policy decisions will be the center of market attention this week. We think both central banks will push back against market expectations on how many rate cuts they’ll deliver in 2024 and how soon they will come. For the Fed, in particular, persistent inflationary pressures and loose fiscal policy will prevent it from cutting rates as swiftly as markets expect, in our view.

Week Ahead

Dec. 12: U.S. CPI

Dec. 13: Federal Reserve policy decision

Dec. 14: European Central Bank (ECB), Bank of England policy decisions

Dec. 15: U.S., UK flash PMIs

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 11th December, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.