Many market pundits have advocated a strategy of “buying the dip” after significant selloffs, but does it always make sense to do so? Franklin Templeton Investment Solutions’ Gene Podkaminer and Miles Sampson explore market reactions to geopolitical events and caution against celebrating the success of this strategy too soon.

Equity markets year-to-date have been marked by volatility. At first, markets fell as inflation forced major central banks to acknowledge the need to raise rates quicker than anticipated. Along with intense human suffering, the Russian invasion of Ukraine also brought heightened uncertainty, major sanctions and policy shifts, as well as commodity supply shortages. In the past few weeks, markets have partially rebounded, and investors are wondering what comes next.

Key Points

- There is no “one size fits all” geopolitical playbook for asset allocation. While “buy-the-dip” is a popular mantra, we have found equity and commodity performance to be inconsistent following geopolitical events.

- Our framework for thinking through geopolitical events is to consider the potential duration and regional impact. Global and long-lasting events have a higher probability of being disruptive for assets.

- In our view, the Russia/Ukraine war qualifies as a global geopolitical event with long-term implications.

- The macro backdrop is also an important consideration. Today, we see a macro environment that is becoming more precarious for risky assets.

- Our analysis of asset performance following geopolitical events, alongside a deteriorating macro context, lead us to prefer a nimble and cautious approach to risk assets.

What Is the Geopolitical Playbook for Asset Allocators?

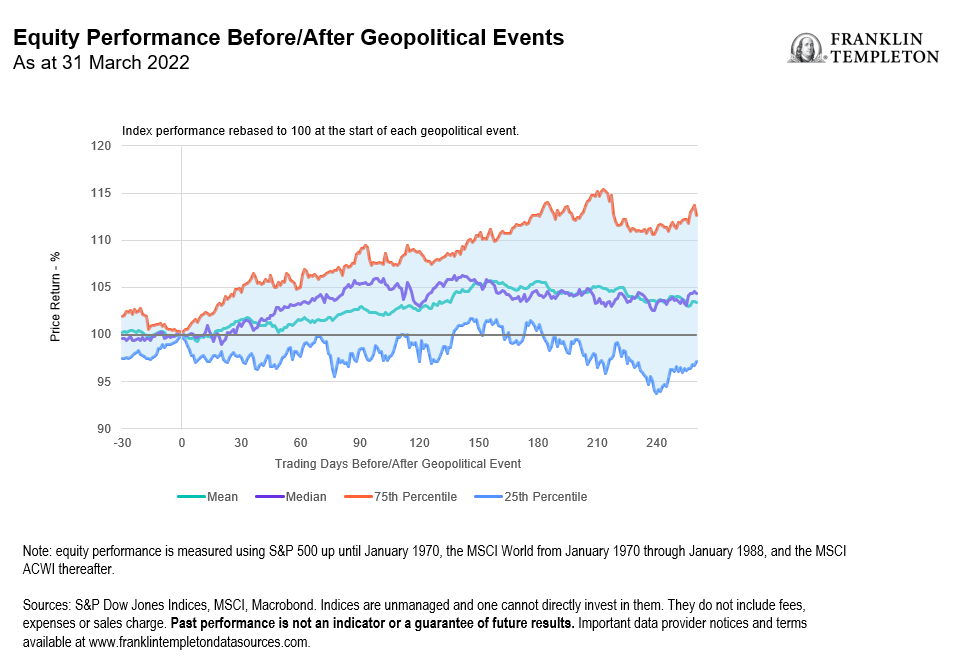

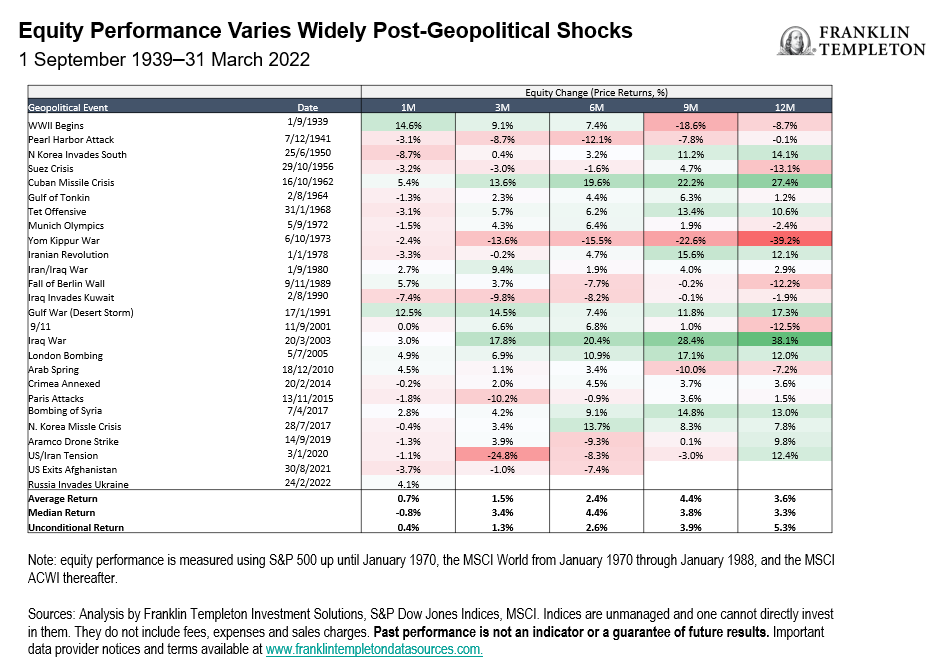

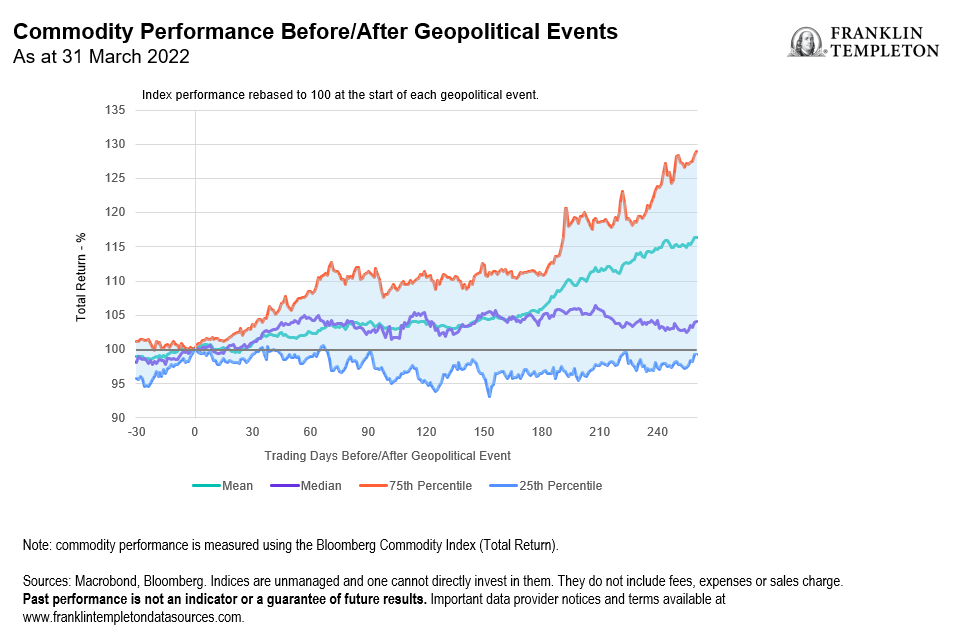

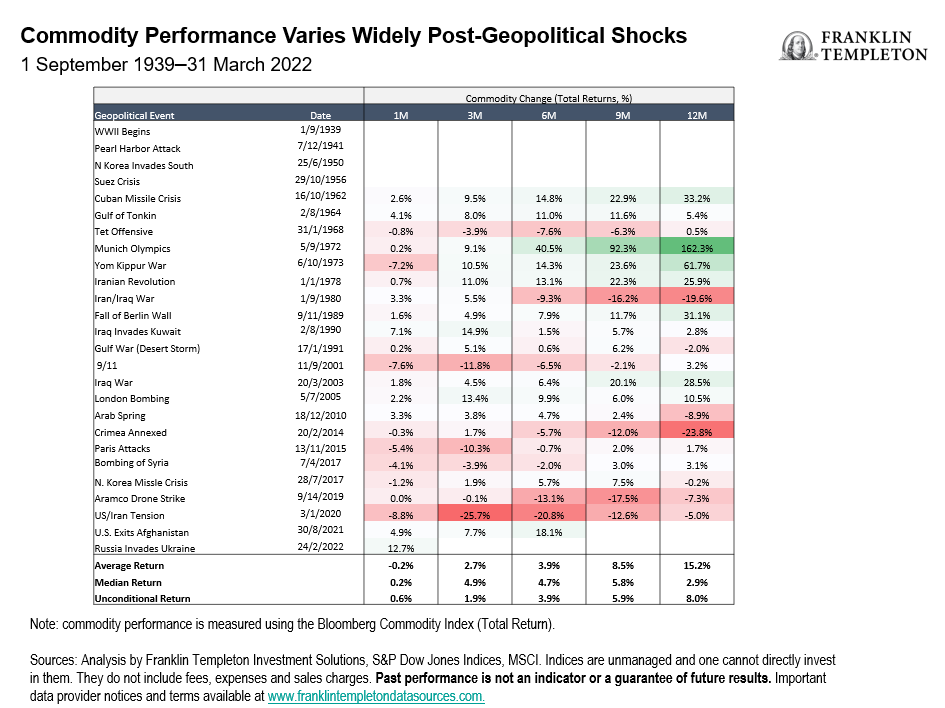

As global developed equity markets have rallied approximately 6% from their lows in early March, the popular investment mantra, “buy the dip”, has gained traction, particularly as it relates to investment strategy around geopolitical events. We would caution against celebrating the success of this strategy too soon. When analysing a broad array of geopolitical events, it’s clear that asset performance can vary significantly in the year following a geopolitical event.

There are several reasons why performance may vary following a geopolitical event. First, many types of events are classified as geopolitical, from unpredictable terrorist attacks, to political regime changes, local land disputes, and global wars. Most of these crises have included a horrifying human element but are otherwise distinct, and took place amidst disparate political and macroeconomic contexts.

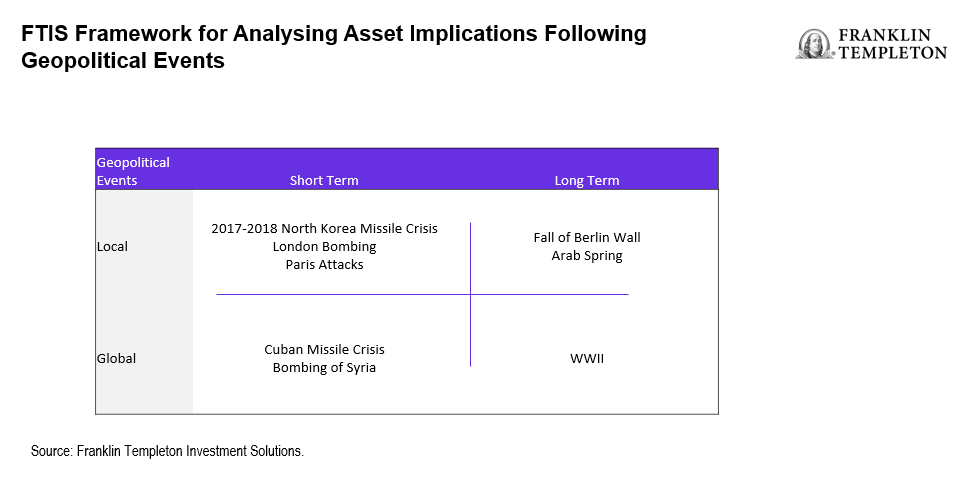

Our asset-allocation framework for thinking through heterogenous geopolitical events is to consider the potential duration and regional impact. Global and long-lasting events have a higher probability of disrupting economic supply and demand, and thus, asset performance. Our analysis suggests that many geopolitical events are local and short-term in nature. Some events have a global or long-term influence, and only a few are both global and long-term in nature. The table below provides a visual example of this framework.

Where does the Ukraine war fit? While the fighting is currently confined to territory between Russia and Ukraine, the reach of the war is global. Coordinated sanctions from Western economies, including the United States and Europe, have broadened the repercussions of this war. The rise in commodity prices, affecting many different sectors, also has a global reach.

While the duration of the war is uncertain, it has already lasted longer than many observers expected. And we believe there are many long-term implications which will continue to play out well after the violence subsides. This war has exposed Europe’s energy dependence on Russia and has accelerated its shift away from Russian energy. Investments into alternative forms of energy, especially green energy, are being accelerated as a result. Geopolitically, the war has further unified NATO countries and increased the divide between Russia and its allies. Secularly, the reorientation of globalisation is likely to accelerate. For instance, the steady mantra of just-in-time inventories may be recast as just-in-case.

The Macro Backdrop

Another reason for performance dispersion is that the macro backdrop varies substantially across historic geopolitical events. Our analysis suggests that the macro starting point matters (a lot)— geopolitics can often accelerate macro trends that were already underway.

This is an important consideration today, where we are expecting growth to slow to trend levels amidst a challenging inflationary environment. The Ukraine war has intensified both trends. Inflation pressures are not only increasing from higher energy prices, but Russia and Ukraine also play an important role in global supply chains that will impact production of food, semiconductors, autos, and more. Higher inflation is stunting consumer confidence across the world and lowering real purchasing power. Ultimately, this should amplify the slowdown in growth.

Alongside the challenging growth and inflation mix, we believe the monetary policy outlook is becoming more precarious. Outside of China and Japan, nearly every major central bank is expected to tighten policy rates by year-end—in many places significantly. The recent Federal Reserve communications continue to support a more hawkish future stance.

Implications for Multi-Asset Portfolios

Our analysis of asset returns following geopolitical events, along with the deteriorating macro backdrop, has led our team to reduce our bullishness over the past month. We continue to disfavour European equities relative to their North American counterparts, where energy exposure is more positive and trade less disrupted by the war. Emerging market equities remain vulnerable, in our opinion, as they bear the brunt of many supply chain shocks alongside weak growth dynamics in China.

In fixed income, we prefer less duration exposure in developed government bonds. Similarly in credit, we prefer asset classes with less duration, such as high yield and bank loans. We find some value in hard-currency emerging market debt and still favor exposure to Chinese government bonds, where policy easing remains out of sync with other major regions. Moving forward, the uncertainty surrounding the Ukraine war and its aftershocks, coupled with a challenging inflationary background, leaves us carefully assessing where we take risks in our portfolios.

Franklin Templeton Key risks & Disclaimers:

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What are the risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Franklin Templeton Investment Management Limited (FTIML). No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.