Liontrust GF High Yield Bond Fund is manufactured by Liontrust Fund Partners LLP and represented in Malta by MeDirect Bank (Malta) plc.

Market review

This has probably been the most challenging quarter of my fund management career for both the strategy and the market. While government bond markets had the worst first half to a year since the 1850’s and major equity aggregates the worst since 1970, liquidity and market moves point to stress that has arguably not been seen in credit markets since the global financial crisis.

Fundamentally, we view the market as temporarily broken, but do not think the same is true of the business models of the companies we lend to. We believe patience will be rewarded with strong returns from this point and Phil and I remain heavily invested in the Fund alongside you.

In the second quarter, close to 60% of the index-relative underperformance has come from bonds in the real estate sector. We believe this sector is suffering particularly because of troubled debt capital markets, not broken business models. That is certainly our view of the companies that we lend to on your behalf.

Frustratingly, given the marked underperformance, there has been zero bad news in relation to the Fund’s holdings during the period. Other unrelated real estate companies, Adler and SBB, have had very aggressive notes written by the fearsome short-selling fund, Viceroy, with accusations of financial shenanigans the key issue. Add to this some sentiment spill-over from everything happening in Chinese real estate (which is mainly a property development issue) add bid side liquidity in real estate bonds has gone very dry.

Fund review

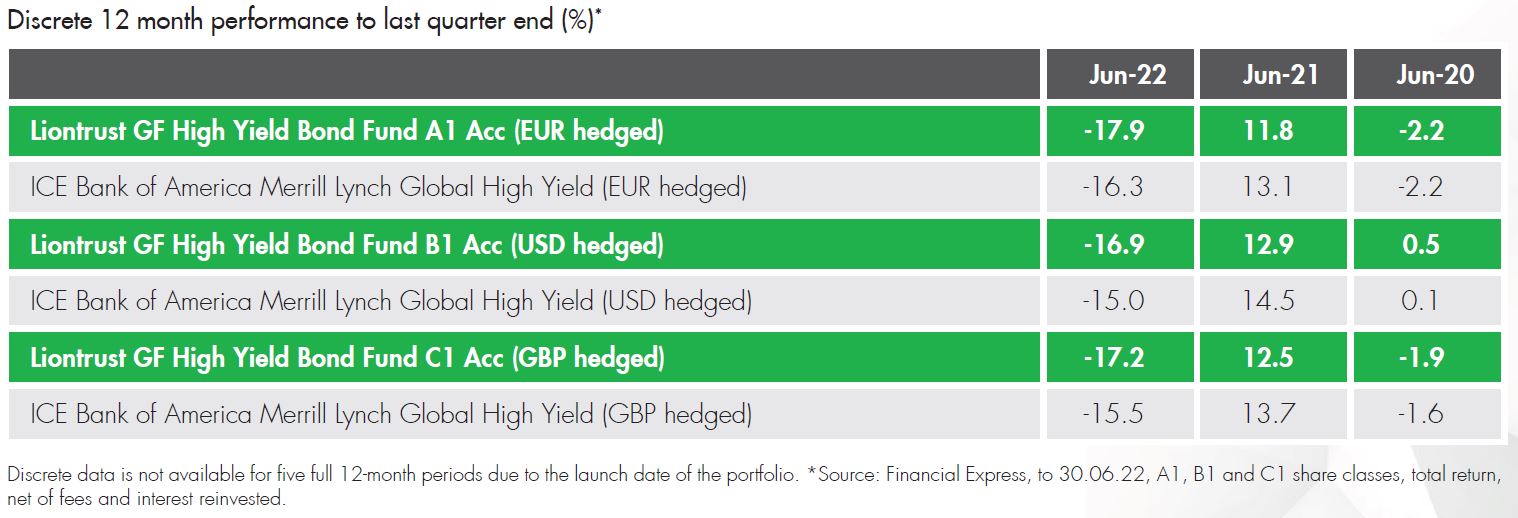

Over the quarter, the Liontrust GF High Yield Bond Fund (A1, accumulation class, total return in euros) produced a return of -8.9% versus the ICE BAML Global High Yield index’s (euro hedged) -7.0%*.

Anecdotally, there has been forced selling due to industry-wide outflows and hedge funds have taken the opportunity to attack the whole sector in Europe. The drop in prices has been dramatic. To put it into context, our holding in bonds issued by Swedish office company, Castellum has dropped in value by around 45% since the end of March, while the high yield market has returned about -10% during the period. Our holding in Heimstaden, a residential real estate company, has fallen -36%. Our holding in CPI Property, a CEE/German primarily office company, has fallen -35%. Even in the last week of the quarter, the Castellum bond fell by 12pts into month end, but then as I type on 1st July, has bounced ~10pts and is bid by various counterparts. This is evidence of market technical at play, not fundamentals.

Note the diversity we have between residential and office, which have much different elasticities of demand, and also by geography across Nordics and Germany/Central Eastern Europe (N.B., not Russia and Ukraine). In addition, please note that in each case, the parent company of the bond issuer is an investment grade-rated company and the minimum rating amongst the three bonds is BB-. The Nordic economies have low debt-to-GDP ratios in an international context and very healthy banks. These companies are mainly landlords, not property developers.

Moreover, the loan-to-value of each company is below 50% and the companies generate profit which far outweighs interest cost. Indeed, each company has tenant agreement based on index pricing, so rents will continue to increase in this inflationary environment. We continue to believe each of these companies are resilient and sustainable.

However, we have to concede that the deterioration in sentiment towards European real estate companies has taken us by surprise. We have felt low LTVs and high interest coverage ratios would provide resilience, which we believe will still prove to be true, but the market, at least the European debt capital market, is testing this view.

Indeed, the market is treating these bonds like its 2008/9. The fundamentals in the property sector, although coming off a top, do not match that level of bearishness, in our view. The bonds in question do have flexibility over when they redeem, which impacts the present value, but we believe each company will remain a going concern.

This appears also to be the view of the equity market for the two listed companies. For example, Castellum’s market cap is SEK46bn, versus around SEK150bn of property assets and ~SEK77bn of debt. Heimstaden and CPI Property have told us they are considering buying their own bonds at stressed prices and also that they fully intend to call bonds (at par) at first call dates. Using the Castellum bond, should they choose not to call at any date (not our base case), the current spread into perpetuity is in excess of 8%.

In recent conversations with Castellum’s Head of Treasury, he confirmed that the Swedish banks continue to support his company and the spreads at which they lend to them are the same today as last year, five years, ten years ago.

Heimstaden recently confirmed to us SEK40bn of liquidity, which can cover debt maturities to 2025, assuming debt capital markets remain closed.

CPI Property has continued to issue debt in Germany and US during this difficult quarter. It has a bank loan that was issued to bridge finance of its recent acquisition of a competitor, which falls due in 2024. Excluding this bridge finance, which the company has used the recent debt issuance to partially repay, the weighted average life of its debt is 5.3 years and it has no debt to refinance in European debt capital markets until 2026. The company also has €2.4bn of liquidity, which is approximate to the amount of debt that matures in the next two years. Meanwhile, all of these companies are cash flow generative.

Away from real estate, bonds issued by pharmaceutical company Bausch Health cost the fund ~35bps relative to index. Bausch Health is spinning off a relatively stable part of the business (Bausch & Lomb eyecare) and leaving the remaining pharmaceutical business with a lot of debt to deal with. Meanwhile, a competitor is challenging the patent on one of its key drugs, a major driver of revenue. This was all known before March, but the drop in sentiment has seen the market really punish companies with some uncertainty. We believe Bausch has enough time (no major debt to deal with before 2025) and cash flow potential (could generate $4.5bn cash in next 2-3 years) to get through this tricky period. We have reduced the position size at an average price of 77 (current price 55), but remain with a ~1% position.

Another detractor, automated transaction machine manufacturer Diebold, had a profit warning largely based on supply chain bottlenecks. It has a lot of debt to deal with 2023-2025 and the issues it is having in 2022 make refinancing trickier. It plans to issue asset-backed financing to refinance the bank debt which falls due next year. It is allowed to issue this ahead of the secured bonds (which we owned) and ahead of the bank debt it will replace. We are left uncomfortable that secured bonds will be junior to the new debt and this is before we consider the prospect of recession in 2022/23. We sold the bonds at 76.5, which was a relative hit to funds in the region of 27bps.

More positively, during the quarter it was announced that the large European recruitment agency House of HR is being acquired by private equity, and it will seek to refinance the bonds in the bank market at some point in Q3. This held the House of HR bonds close to par in a falling market.

Outlook

There is plenty in the world to worry about, but we don’t believe there is a material risk of a systemic rise in default rates. Of course, in a world of both higher interest rates and energy prices, profits and cash flow will be squeezed, but we believe there is enough quality and resilience in the high yield market to continue to make good risk-adjusted returns in this type of environment. This applies to BB-rated and B-rated bonds although, spoiler alert, we don’t think this is the case in CCC-rated bonds!

US high yield spreads are still below the long-term average, but with the number of interest rate hikes priced into US government bonds, the overall yield is in line with the long-term average. Given the likely resilience the US economy has to continued conflict in Europe, we think US high yield is decent value.

However, with European spreads above the long-term average, we also like valuations in Europe. The Fund is split fairly evenly between US and Europe (including the UK), which in an index context represents a large European overweight. The Fund has light exposure to cyclicals and companies with high energy costs of production. We have zero airlines, which are so exposed to fuel costs. The quality bias we have within our process means we are light in CCC-rated risk, which is only 5% of Fund. Moreover, our quality bias means we seek companies with pricing power and resilience, two operational qualities that are the best defence in more difficult economic periods.

Liontrust Key risks & Disclaimers:

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF High Yield Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility.

Issued by Liontrust Fund Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518165) to undertake regulated investment business.

This document should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Liontrust Fund Partners LLP. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.