Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Christian Olinger – Portfolio Strategist, and Devan Nathwani – Portfolio Strategist all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

High for longer: The U.S. election result reinforces our expectation for persistent inflation pressures and high-for-longer interest rates. We evolve our strategic views.

Market backdrop: U.S. stocks slipped last week from all-time highs as the post-election surge ran out of steam. U.S. 10-year Treasury yields hit six-month highs.

Week ahead: Global flash PMIs for November will give clues on the current state of uneven global growth. Markets watch UK CPI after a second Bank of England rate cut.

We see a world shaped by supply, with structural forces set to keep inflation pressures persistent and interest rates high for longer. We favor infrastructure equity, like stakes in airports and data centers, in our strategic views as it could benefit from such forces. The impact of policy changes after the U.S. election could reinforce geopolitical fragmentation and ongoing budget deficits. We stay cautious on long-term U.S. Treasuries and expect yields to rise long term.

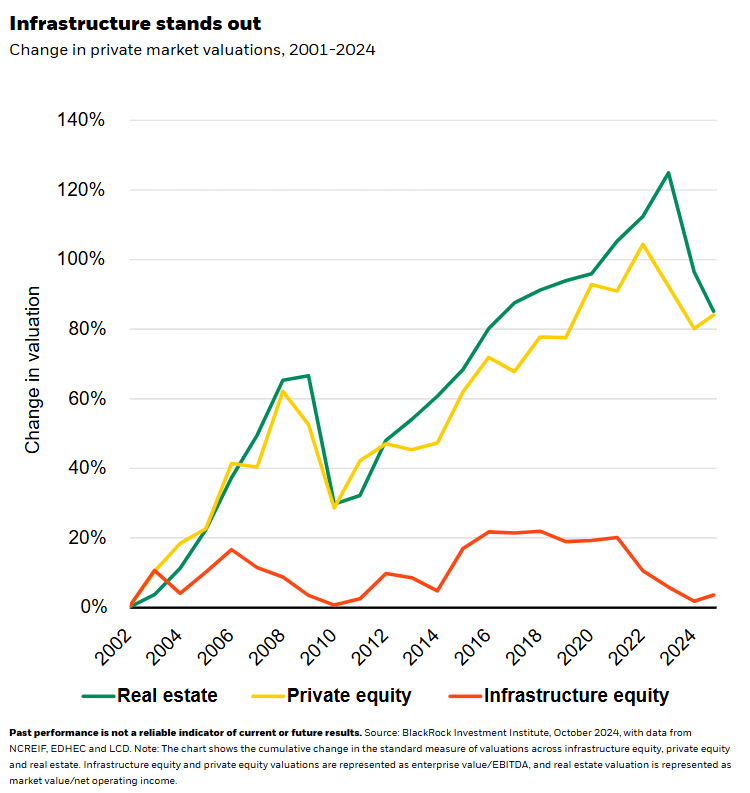

The divergence in how private markets have reacted to higher interest rates has shaped our views on a strategic horizon of five years and longer. We had been overweight income private markets, like private credit, relative to growth assets for about two years. We expected higher rates and financing costs to boost returns for investors in private debt with floating interest rates. Now we go neutral income assets as spreads tighten, yet private markets stay a sizeable part of our strategic portfolios. Within equity-like growth private markets, private equity and real estate valuations have peaked after decades of falling financing costs. See the chart. We upgrade growth assets to neutral as valuations cool from financing costs rising with rates. We still like infrastructure equity as we see fewer signs of lofty valuations (orange line) and it looks set to benefit from mega forces, or structural shifts.

Mega forces are playing a bigger role in shaping markets and economies – and driving returns now and in the future. Some of President-elect Donald Trump’s proposed policies, such as large-scale tariffs, reinforce why we see persistent inflation in the medium term and interest rates staying above pre-pandemic levels. If implemented, those policies could reinforce geopolitical fragmentation and economic competition. Plans to reduce legal immigration could impact the labor market. And we expect persistent budget deficits – one factor we see pushing up long-term U.S. Treasury yields.

Staying selective strategically

As mega forces collide, we get more dynamic – even in our strategic views. In addition to our evolving views on private markets in Q3, we stay positive on direct lending, or directly negotiated loans to small- and mid-sized firms, as the future of finance unfolds. Demand for private credit could rise as banks limit lending. But private markets are complex and not suitable for all investors. Valuations matter more over a strategic horizon. That’s why we prefer attractive valuations in emerging market (EM) stocks over developed markets (DMs). We favor EMs like India that sit at the crosscurrent of mega forces. We still like Japan within DM stocks and are neutral on DM overall given richer valuations. Our preference for short-term bonds and UK gilts keeps us overweight DM government bonds. We stay underweight long-term U.S. Treasuries on a strategic horizon as we expect yields to rise over time. We see investors demanding more term premium, or compensation for the risk of holding them, given sticky inflation, persistent fiscal deficits and greater bond market volatility.

While the long-term outlook is uncertain, we’re more pro-risk on a six- to 12-month tactical horizon. That’s supported by a more favorable macro backdrop and upbeat investor sentiment given post-election clarity and hopes for deregulation. We think the energy, financial and tech sectors can benefit. We stay overweight U.S. stocks and think the artificial intelligence theme can expand beyond the tech sector.

Our bottom line

We are in a world shaped by supply and mega forces. The U.S. election result reinforces that view. We see infrastructure equity benefiting from mega forces as we update our strategic views (for professional investors).

Market backdrop

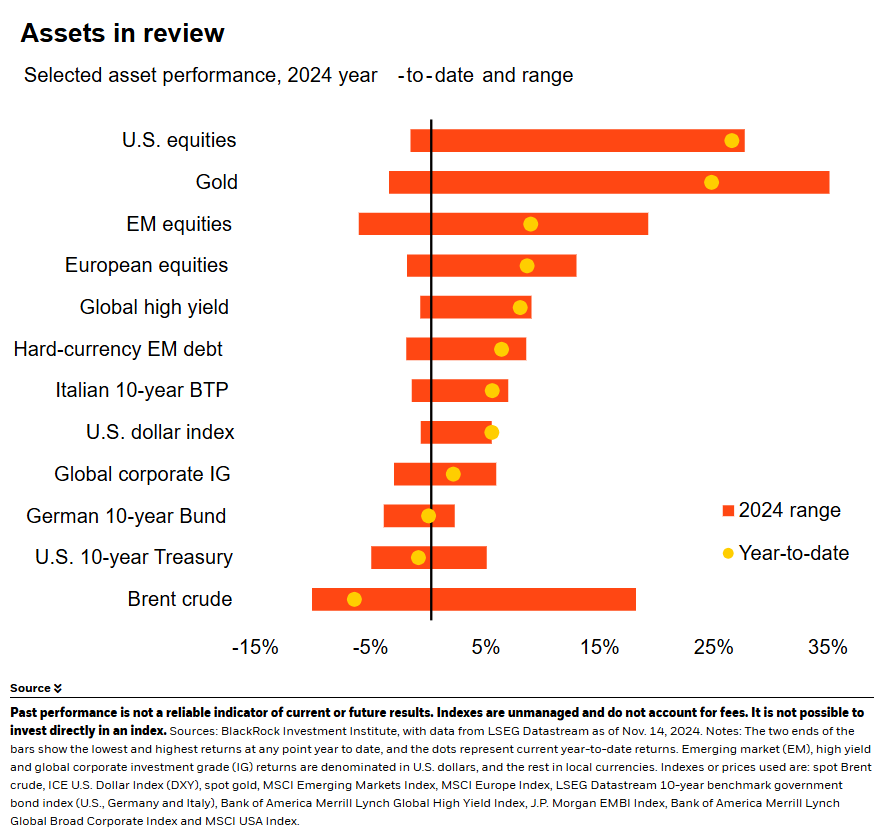

U.S. stocks slipped last week after reaching new all-time highs, with tech shares leading the retreat. The S&P 500 is still up 23% this year and 1% since Donald Trump won the U.S. presidential election. U.S. 10-year Treasury yields climbed, notching new six-month highs above 4.5%. Federal Reserve Chair Jerome Powell indicated the central bank is in no hurry to cut interest rates given the economy’s strength. Market pricing of Fed rate cuts is now more in line with our view.

Global flash PMIs for November will give clues on the current state of uneven global growth, how the robust U.S. economy is faring in Q4 and whether the euro area is showing more signs of life after stronger-than-expected Q3 GDP. Markets will also be watching UK CPI out this week. The Bank of England recently cut its policy rate for the second time this year on sharply slowing inflation and some concerns over the growth outlook.

Week Ahead

Nov. 20: UK CPI; Japan trade data

Nov. 21: U.S. Philly Fed business index;

Nov. 22: Global flash PMIs; Japan CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 18th November, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.