Jean Bovin – Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Nicholas Fawcett – Macro Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Market focus to shift: We see the market’s focus returning to higher-for-longer rates and sticky inflation after a U.S. debt ceiling deal. We prefer an up-in-quality portfolio.

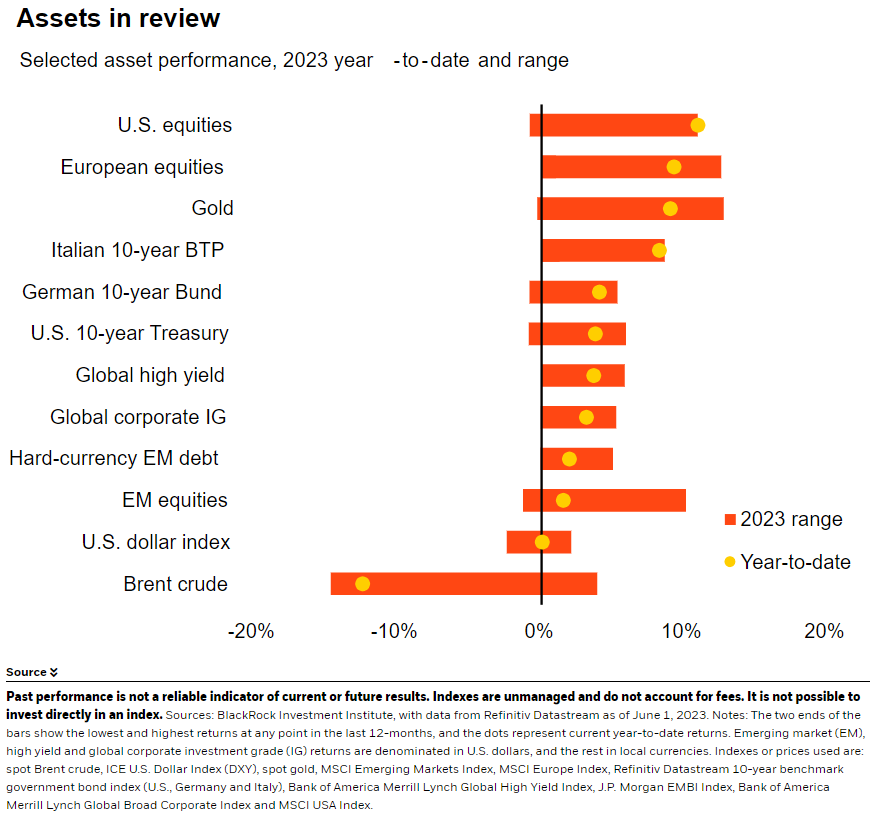

Market backdrop: U.S. stocks hit 2023 highs after the debt ceiling deal. Yields rose amid the specter of rate hikes after Friday’s payroll report showed a jump in new jobs.

Week ahead: China macro data is in focus this week. We trim our growth view slightly as the economic restart loses steam and policy reactions remain uncertain.

Last week’s U.S. debt ceiling deal removes near-term uncertainty and thrusts the market’s focus back to the macro picture: sticky inflation due to tight labor markets. We see rates staying higher for longer as a result. We keep a quality tilt in portfolios and prefer income for now. Over time, we could see the attention shifting to the large U.S. debt load – and investors demanding more compensation for holding long-term government bonds.

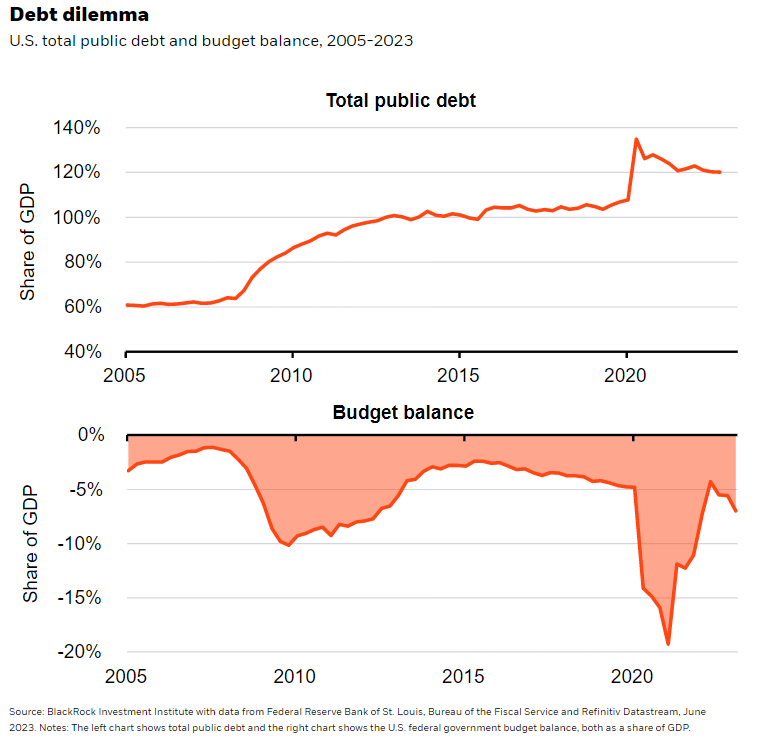

The U.S. debt ceiling deal has taken the near-term risk of default off the table. Yet the fiscal situation remains challenging, in our view. Total public debt as a share of GDP has jumped to around double the level in 2005 (left chart). The budget deficit is also already large (right chart) at a time when the economy is overheating. The debt deal doesn’t really change this picture, we think. The spending cuts are a fraction of what was cut in the last debt ceiling showdown in 2011: about 0.3% of GDP, according to the Congressional Budget Office, compared with 1% in 2011. We don’t see spending cuts dragging on growth in the same way as a result. But we do think higher-for-longer interest rates will raise debt servicing costs and could leave debt levels growing in this new macro regime. We have said the market focus would move back to the macro picture after the debt ceiling deal – now the Federal Reserve and stubborn inflation are retaking the spotlight.

The pandemic shocked U.S. labor supply, creating worker shortages. The labor market remains extremely tight, as confirmed in the latest payrolls data, with workforce participation not having improved. That is keeping core inflation sticky. This has presented the Fed with a sharp trade-off: crush growth with even higher rates or live with some inflation. We think the Fed will have to keep policy tighter. Markets have already started to mull the possibility of another rate hike even after the Fed signaled a potential pause. Markets are no longer pricing in repeated Fed rate cuts, waking up to our long-held view that rates are likely to stay higher for longer to combat persistent inflation.

High debt in the new regime

Attention could also eventually shift to the broader U.S. fiscal position with rates staying higher, in our view. The relatively smaller spending cuts in the U.S. debt ceiling deal aren’t likely to put a dent in the debt load, in our view. They stand in stark contrast with the aftermath of the 2008 financial crisis when the focus swiftly shifted to fiscal austerity. Interest rates were near zero then and debt servicing costs were at record lows. But now rates have jumped in the fastest rate hiking cycle since the 1980s.

Higher rates mean higher debt servicing costs. We think persistent inflation and high debt levels could cause investors to demand more compensation for holding U.S. assets over time, especially long-term Treasuries.

We also expect a burst of Treasury-bill issuance as the government seeks to replenish the money drawn down since the debt ceiling was hit earlier in the year. We estimate bill issuance could balloon to as much as $1 trillion in the next few months – well above normal issuance levels outside of past crises like the 2008 financial crisis and the pandemic. That could add to volatility in fixed income, in our view, especially in the very short-dated maturities. We tweak our preference for short-term Treasuries as a result, extending the preferred maturities beyond short-term paper to encompass two-year Treasury notes that have repriced in recent weeks.

Bottom line

The U.S. debt ceiling deal removes near-term uncertainty – we now expect markets to focus on the macro picture. We see higher-for-longer rates, so we keep our quality tilt in equities and bonds and prefer income for now. We like short-term Treasuries, emerging-market local currency debt and inflation-linked bonds.

Market backdrop

U.S. stocks climbed to 2023 highs after the debt ceiling deal. Yields rose as markets eyed more rate hikes after Friday’s payroll report showed a jump in new jobs. The number of jobs added in May was well above market expectations. But the unemployment rate rose with no improvement in labor force participation. We don’t think the labor shortage is easing, so wage growth remains elevated. We think that will keep core inflation sticky – and makes rate cuts this year unlikely.

China macro data is in focus this week as the restart loses steam. We now expect GDP growth to be a bit below 6% this year rather than slightly above as momentum slows and policy reactions remain uncertain. Deflationary pressures and weaker growth increase the odds of potential policy easing, but we think targeted support for sectors like real estate is more likely.

Week Ahead

June 5: China services PMI; U.S. ISM services PMI

June 7: China trade data

June 9: China CPI and PPI

June 9-16: China total social financing

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 5th June, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.