Jean Bovin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Vivek Paul – Head of Portfolio Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Mega forces in focus: We see markets adjusting to the new regime. This is not a typical business cycle – structural mega forces are shaping the outlook now, in our view.

Market backdrop: The 10-year U.S. Treasury yield jumped to 16-year highs as markets eyed higher-for-longer interest rates. Stocks ended a volatile week little changed.

Week ahead: The Middle East conflict is in focus. U.S. CPI data this week will help gauge how quickly supply mismatches are unwinding.

Markets are adjusting to the new regime of greater macro and market volatility, in our view. This is not a typical business cycle. What matters are the mega forces – or structural shifts – playing out now. Most point to higher interest rates and lower long-term growth: Aging constrains the workforce, and geopolitical fragmentation rewires supply chains. But digital disruption has potential for productivity gains. We see mega forces creating opportunities and risks across sectors and regions.

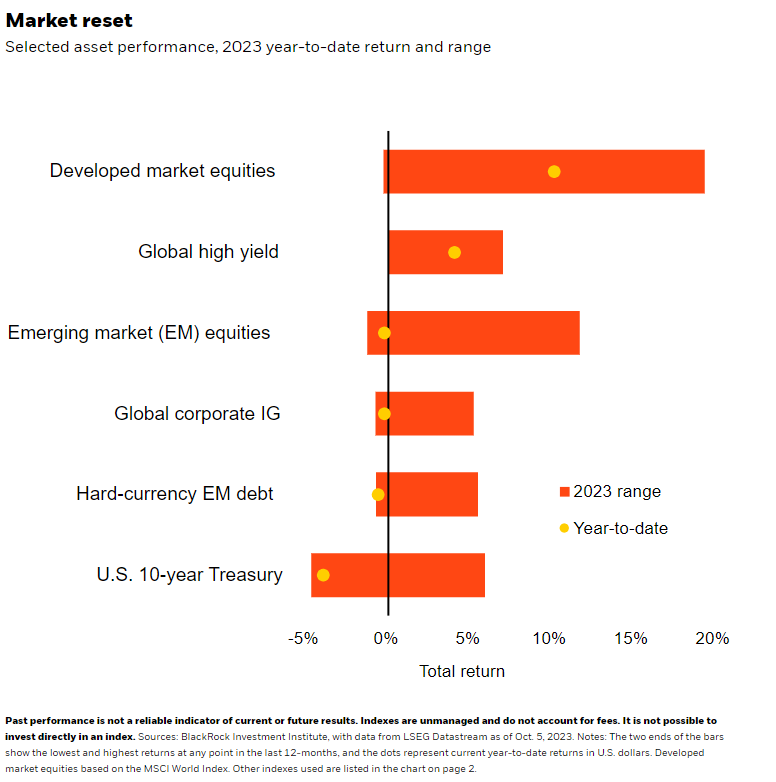

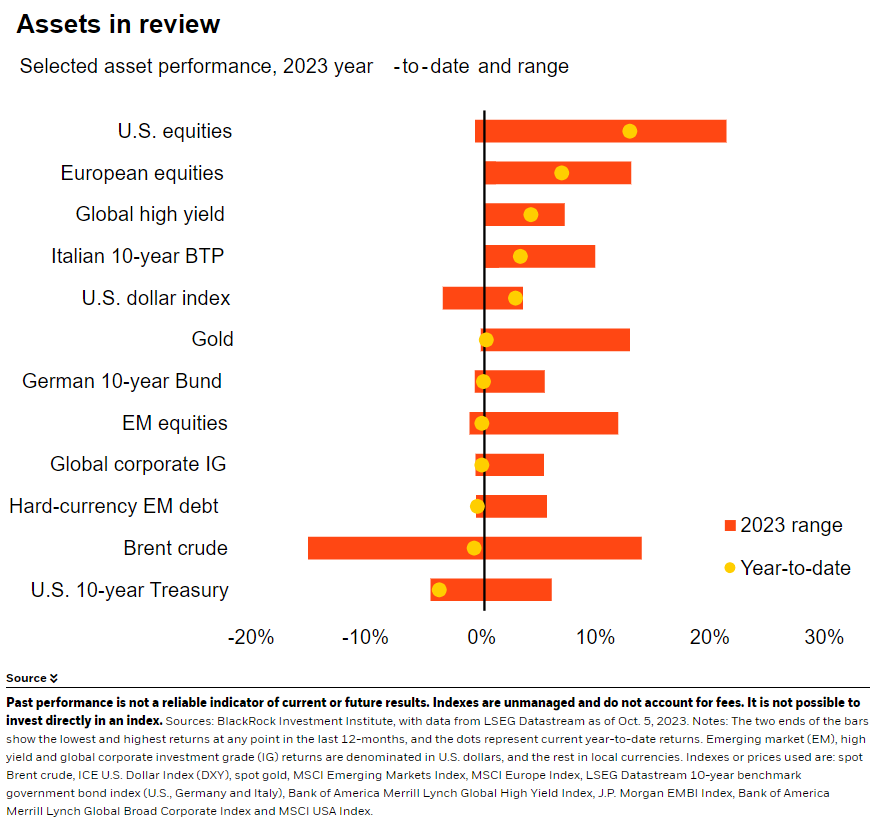

Developed market (DM) stocks have erased about half of this year’s gains – though tech has held up partly due to momentum behind the artificial intelligence (AI) mega force. See the chart. The 10-year U.S. Treasury total return is nearing a loss of about 4% this year with capital losses wiping out the income it provides. And the risk it bears has been thrown into the spotlight this year: a full percentage point climb in 2023 and double-digit basis point swings each day becoming routine. Surging long-term Treasury yields show markets are adjusting to a higher level tied to mega forces: looser U.S. fiscal policy, the big reallocation of resources in the low-carbon transition and geopolitical fragmentation rewiring supply chains. We see many DM economies on a structurally weaker growth trend due to mega forces such as aging populations. Long-term yields are more in line with our views, but we think equities still don’t fully reflect higher-for-longer policy rates.

Activity in the U.S. has stagnated for 18 months as the economy moves onto a lower growth path. Seemingly strong payroll gains last week might seem like good news. But companies were slow to rehire in the restart of activity following the pandemic – and they’re still catching up. We estimate that, without this catchup effect, job gains would be slowing. We think focusing on monthly job creation also masks a broader trend since 2020: Overall employment growth has been modest, yet unemployment is lower. That shows labor supply has slowed as the population aged. We think the tight labor market reflects this supply constraint, not a strong economy.

Harnessing mega forces

That’s why it’s key to harness the sector and company impacts of these mega forces in this tricky macro environment. The key for us: Identify the catalysts that can supercharge them, see how they interact with each other and uncover the likely beneficiaries not yet priced in by markets. We saw such a catalyst in AI earlier this year when we went overweight on our tactical six- to 12-month horizon. Our work finds the value of AI patents from public companies has surged, and it could suggest they’re submitting higher quality patents. This is not just about public markets: we find private markets make up a growing portion of firms filing for AI patents and may have more companies focused exclusively on AI.

We see other mega forces intersecting and creating big shifts in profitability across economies and sectors. We see potential across the energy system in the shift to a low-carbon economy, depending on the interplay of policy, tech, and consumer and investor preferences. Healthcare, real estate, leisure and companies with products and services for seniors may stand to benefit in DMs as people age, while emerging markets (EM) like India and Mexico benefit from younger populations. EM is also leading the way in digital payments in the future of finance. Some EMs could strike deals across divides in a fragmenting world and benefit from companies bringing production closer to home, while broader economic competition could spur global investment across tech, clean energy, infrastructure and defense. We also think a fast-changing U.S. financial landscape is poised to create opportunities in private credit as banks curb lending. U.S. regional banks have come under renewed pressure from surging yields just as Q3 earnings reporting season kicks off this week.

Bottom line

Mega forces are shaping the new regime with geopolitical fragmentation now in focus. Treasuries has served us well as yields rise. We stay underweight DM equities but lean into AI to harness mega forces while the macro backdrop remains unfriendly for broad asset class exposures.

Market backdrop

The 10-year U.S. Treasury yield jumped to new 16-year highs last week, while U.S. stocks ended a volatile week little changed. We are seeing the new, volatile regime in action, with sharp intraday and weekly market moves. U.S. payrolls data showed a surprisingly strong number of jobs created in September. We think the economy can only sustain a fraction of recent job growth as the population ages – or it risks stoking further inflationary pressures.

We’re eyeing U.S. inflation and spending data this week to gauge if the drop in goods prices will keep leading inflation lower as consumer spending shifts back to services. We estimate about two thirds of the spending shift has now unwound. Yet population aging will likely keep the labor market tight, driving inflationary pressures and a rollercoaster ride in the data.

Week Ahead

Oct. 12: U.S. CPI; UK GDP

Oct. 13: China CPI, PPI, trade data; U.S. trade data; University of Michigan consumer survey

Oct. 10-17: China total social financing

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 9th October, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.