Jean Bovin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Nicholas Fawcett – Macro Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Yield surge: Bond yields are surging as the volatile macro regime brings uncertainty over central bank policy and risks ahead. We get granular in bonds and equities.

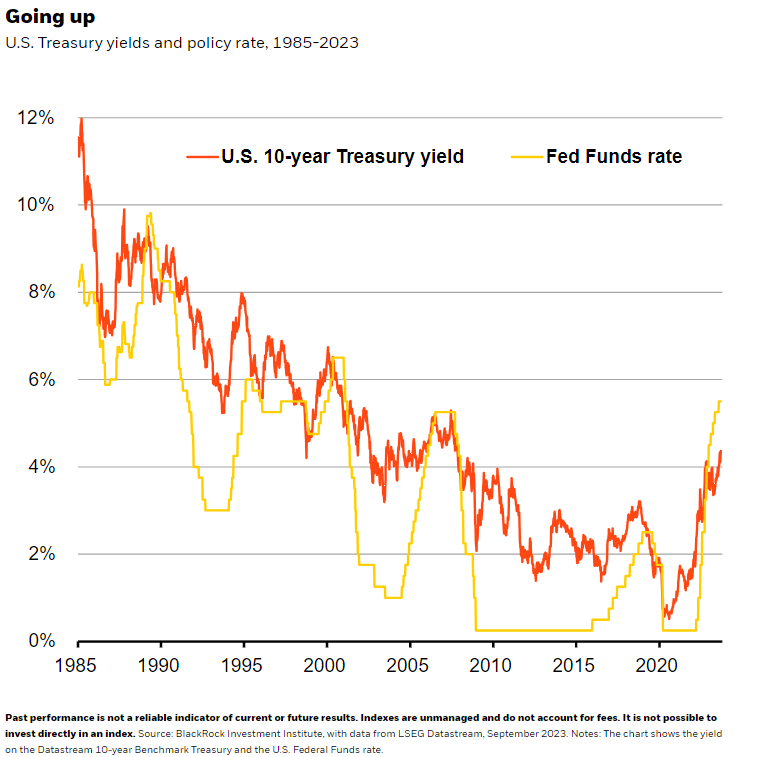

Market backdrop: The 10-year U.S. Treasury yield jumped to 16-year highs and stocks slumped over 2% last week. We think yields can go higher but see regional opportunities.

Week ahead: U.S. and euro area inflation is in focus this week. Inflation has cooled as pandemic mismatches resolve, but we see demographics starting to bite.

Yields on benchmark 10-year U.S. Treasuries last week briefly rose to 16-year highs above 4.50% as major central banks paused rate hikes but left the door open for more. Markets are coming around to our view that rates will stay high – and now even exceed our expectations in Europe. Rising long-term bond yields show markets are adjusting to risks in the new regime of greater macro and market volatility. We get granular in bonds and equities.

All eyes initially were on monetary policy last week amid a blitz of central bank decisions. Then the main story quickly became surging 10-year bond yields to 16-year highs (dark orange line in chart) – even as the Fed and other central banks left policy rates unchanged (yellow line). We think the market is adjusting to the new regime and its implications – especially higher macro volatility. This is bringing to light just how uncertain the outlook is as well as the risks to longer-term bonds. As markets adjust to the new regime, we see opportunities. We’ve turned positive on long-term UK gilts and European government bonds, where that adjustment is more advanced. But we’re not yet ready to jump back into long-term U.S. Treasuries. We think term premium – the compensation investors seek to hold long-term bonds – can return and push yields higher still, as can quantitative tightening and the step-up in Treasury issuance.

Rate hikes are weighing on economies. Major central banks are administering the medicine of tighter monetary policy and economies have slowed. The medicine is still working its way through the system – and effects have varied across regions. PMI data across Europe has shown stagnation. GDP data suggest activity has held up in the U.S. But we think activity has actually stagnated there as well. That seems to have gone under the radar: a stealth stagnation. The average of GDP and another official measure of activity, gross domestic income, shows the U.S. economy has flatlined since the end of 2021.

Central bank blitz

The market narrative hasn’t been one of U.S. stagnation though. One reason: We’ve avoided the short and sharp drop of recession for now. Instead, it’s felt like a rolling effect of hikes rippling through the economy – that may be why the market feels different, too. The weakness we’re seeing isn’t a normal business cycle slowdown, in our view. Unemployment is still low. That suggests something structural is at play, so we don’t think a purely cyclical lens applies. We’ve long said we’re in a world shaped by supply – and this is playing out. We see constraints on supply building over time – especially from a shrinking workforce in the U.S. as the population ages. Central banks need to keep a lid on growth to avoid resurgent inflation once pandemic-era mismatches unwind. That’s why we see them holding tight, not cutting rates like they did in past slowdowns.

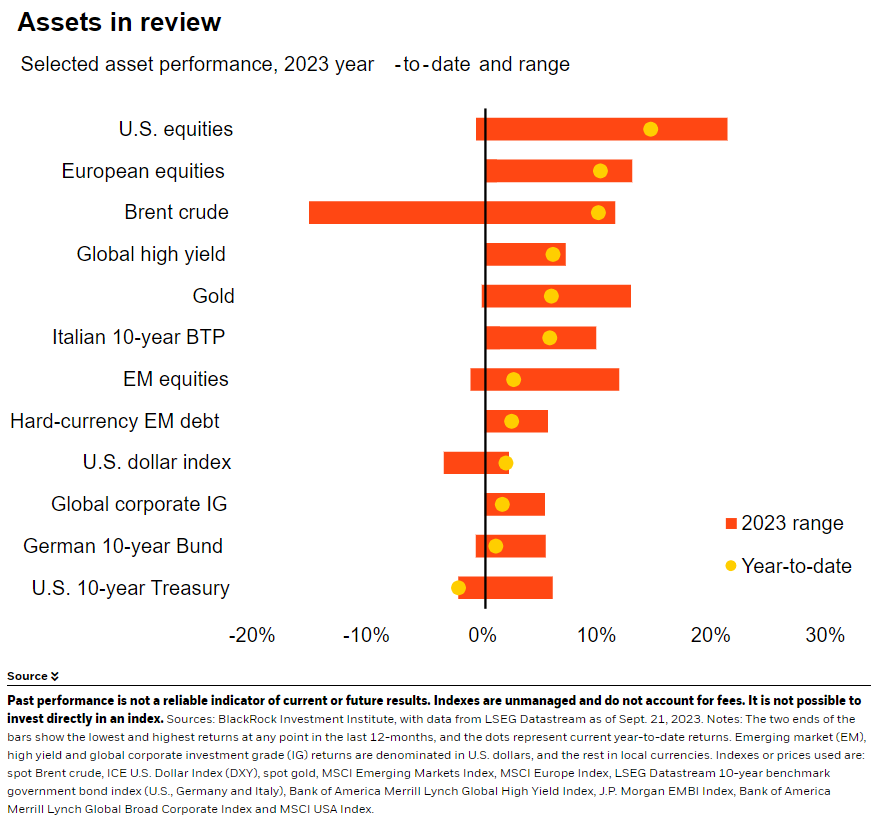

Our long-held underweight to long-term U.S. Treasuries has served us well as yields climb. Markets have come around to our view on policy rates. Yet there is still little term premium. We prefer short-term Treasuries given comparable income to high-quality credit without the same credit or interest-rate risk. We also like long-term bonds in Europe and the UK. Ten-year yields there are around three percentage points higher than the pre-pandemic average, versus about two in the U.S.

Japan stands apart. First, the Bank of Japan is seeking to ensure it has got inflation up sustainably to 2%. Keeping policy unchanged last week suggests it would rather hike too late than risk being too early. Japanese bond yields have been relatively stable, but we expect a jump as suggested in market pricing with the BOJ loosening its yield cap over time. Second, Japan is not suffering the same structural downshift in growth – and corporate reforms are taking shape. We think strong growth can boost earnings and shareholder-friendly actions may keep attracting foreign investors to Japanese equities.

Bottom line

Bond yields are surging as the market adjusts to the implications of the new macro regime. We tactically prefer short-term bonds in the U.S. for income, long-term bonds in Europe and the UK – and Japanese stocks.

Market backdrop

The 10-year U.S. Treasury yield jumped to 16-year highs and U.S. stocks slumped over 2% last week – with the S&P 500 steadying some on Friday after its worst day since the March banking tumult. The Fed, the Bank of England and BOJ all kept rates unchanged. We think surging bond yields show markets reassessing the greater uncertainty and volatility in the new macro regime. We expect persistent inflationary pressures to play into this as demographic changes start to bite.

U.S. and euro area inflation is in focus this week, including the Fed’s preferred PCE gauge. Inflation has cooled as the spending shift back to services helps resolve some the pandemic-era mismatches in supply. But we expect core inflation to stay on a rollercoaster as aging populations keep the labor market tight and keep up inflationary pressures.

Week Ahead

Sept. 26: U.S. consumer confidence

Sept. 29: Flash euro area inflation; U.S. PCE

Sept. 30: China manufacturing PMI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 25th September, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.