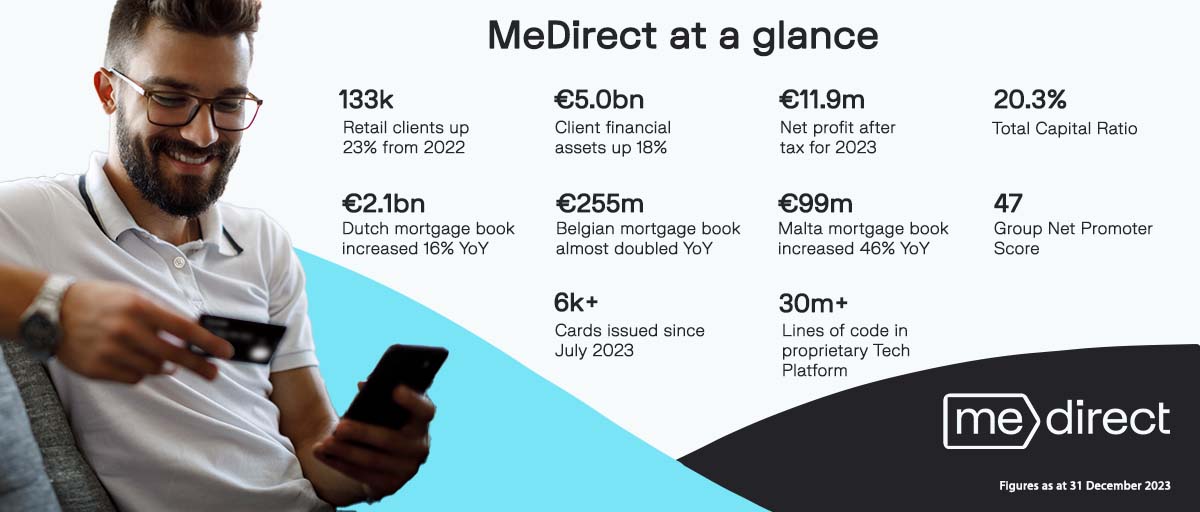

As a pan-European digital bank, MeDirect Group has announced a profit after tax of €11.9 million in 2023, up from €8.7 million in 2022. These results were achieved during a year in which the Group focused on building sustainable growth, supported by cutting-edge technology and model scalability. MeDirect’s total retail client base increased by 23% to reach 133,000. Customers’ financial assets grew by 18% to €5 billion, of which €1.7 billion were assets under custody with MeDirect. These achievements were underpinned by several significant developments.

Retail products available on MeDirect’s one-stop shop platform were expanded to offer a broader range of daily banking, deposits and wealth management solutions, with fast client onboarding and seamless user experience. In July 2023, MeDirect launched physical and virtual card services in Malta, with a range of card servicing functionalities available online. This development enhances MeDirect’s appeal as a primary bank offering seamless digital services.

MeManaged, the bank’s discretionary portfolio management service already available in Malta, was further rolled out to Belgium and the Netherlands. It is a key product aligned with MeDirect’s mission to empower people to grow their wealth with autonomy and confidence. From a geographical standpoint, MeDirect’s wealth offering launch in the Netherlands in May 2023 was promising in terms of new customers joining the platform and level of brand awareness reached in a short time frame.

These deliveries were possible thanks to MeDirect’s cutting-edge proprietary technology, allowing innovation at a rapid pace, scale with costs under control and robust risk management. The reliability of MeDirect’s platform was highlighted by an average uptime of 99.99% on all client touchpoints across multiple geographic locations. The quality of service was also reflected in a high level of client satisfaction, with amongst others a Net Promoter Score of 60 achieved in Malta. MeDirect was also recognised by clients as the second-best savings and investment platform in Belgium.

Arnaud Denis, CEO at MeDirect Group, said, “2023 was a year during which we continued to deliver at a rapid pace and to consolidate our platform. We steadily scaled our businesses both on the wealth and lending side. We now have the ambition as Malta’s first digital bank to become our customer’s primary bank. While great technology and client centricity remain at our core, our sustainable growth strategy relies on investing selectively, cost control and effective risk management to improve the bank’s profitability in what remain uncertain global macroeconomic conditions.”

During 2023, MeDirect’s total mortgage portfolio increased by 22%, from €2 billion to almost €2.5 billion: Dutch government guaranteed (NHG) mortgages passed the €2 billion mark, Belgian mortgages exceeded €250 million and Dutch professional buy-to-let mortgages reached €85 million. In Malta, our mortgage book reached almost €100 million and the offering was broadened to add property investment loans, as well as an 18-month interest only feature. For all categories of lending, the Bank leverages on technology and on designing seamless processes to reduce the time required to issue sanction letters and complete home loan contracts. Across the board, MeDirect applies a robust risk selection process which has resulted in high-quality portfolios with low arrears and defaults.

On the corporate side, MeDirect continued to support the local Maltese economy by dynamically developing its franchise. The domestic corporate lending book grew to €140 million as at December 2023, with a conservative average loan-to-value ratio of 54%. MeDirect also provides high quality corporate services (account opening, payments, treasury, liquidity management, foreign exchange) to approximately 400 clients across various sectors. The bank further enhanced its e-banking platform to offer best-in-class digital services to its corporate clients.

Lastly, MeDirect continued its de-risking programme, with the International Corporate Lending (“ICL”) portfolio reduced from €512 million in 2022 to €329 million as at 31 December 2023. ICL assets now comprise less than 7% of the Group’s total assets and 12% of its lending book at Group level.

As a systemic bank in Malta, MeDirect is regulated by the European Central Bank as part of the Single Supervisory Mechanism. Being part of the Single Supervisory Mechanism ensures that MeDirect is regulated at the standard of the largest banks in Europe. At year end, MeDirect’s total capital ratio stood at 20.3%, and its Liquidity Coverage Ratio stood at 209%. Such ratios exceed all regulatory requirements, recommendations and management buffers.

More information, including the full Annual Report and Financial Statements is available at https://www.medirect.com.mt/about-us/investor-relations/

MeDirect Bank (Malta) plc, company registration number C34125, is licensed to undertake the business of banking in terms of the Banking Act (Cap. 371) and investment services under the Investment Services Act (Cap. 370). MeDirect Bank (Malta) plc is regulated by the Malta Financial Services Authority as a Credit Institution under the Banking Act 1994.

MeDirect iniedi aktar servizzi diġitali u jħabbar profitt wara t-taxxa ta’ €11.9 miljun għall-2023

Bħala bank diġitali pan-Ewropew, MeDirect Group ħabbar profitt wara t-taxxa ta’ €11.9 miljun fl-2023, żieda minn €8.7 miljun fl-2022. Dawn ir-riżultati nkisbu matul sena li fiha l-Grupp iffoka fuq tkabbir sostenibbli, sostnut minn teknoloġija avvanzata u mudell ta’ negozju li huwa skalabbli. In-numru ta’ klijenti ta’ MeDirect żdied bi 23% biex laħaq 133,000 ruħ. L-assi finanzjarji tal-klijenti kibru bi 18% għal €5 biljun, li minnhom €1.7 biljun kienu assi taħt kustodja mal-MeDirect. Dawn il-kisbiet kienu sostnuti minn diversi żviluppi sinifikanti.

Il-prodotti disponibbli fuq il-pjattaforma ta’ MeDirect għall-konsumatur ġew estiżi biex joffru għażla akbar ta’ servizzi bankarji ta’ kuljum, depożiti u wealth management. Wieħed jista’ jsir klijent ta’ MeDirect b’mod effiċjenti u malajr u jgawdi minn esperjenza bla xkiel għal min jużaha. F’Lulju 2023, MeDirect nieda servizz ta’ kards fiżiċi u virtwali f’Malta, b’firxa ta’ funzjonalitajiet li huma kollha disponibbli online. Dan l-iżvilupp isaħħaħ l-għajta ta’ MeDirect bħala bank primarju li joffri servizzi diġitali bla xkiel.

MeManaged, is-servizz ta’ Discretionary Portfolio Management tal-bank li diġà kien disponibbli f’Malta, tnieda wkoll fil-Belġju u l-Olanda. Huwa prodott ewlieni allinjat mal-missjoni ta’ MeDirect li jagħti s-setgħa lin-nies biex ikabbru l-ġid tagħhom b’awtonomija u kunfidenza. Mil-lat ġeografiku, it-tnedija tal-offerta ta’ wealth management minn MeDirect fl-Olanda f’Mejju tal-2023 kienet promettenti f’termini tan-numru ta’ klijenti ġodda li ngħaqdu mal-bank u l-livell għoli ta’ għarfien ma’ MeDirect, fi żmien qasir.

Dawn l-iżviluppi kienu possibbli grazzi għat-teknoloġija proprjetarja inhouse avvanzata ta’ MeDirect li tippermetti l-innovazzjoni b’pass mgħaġġel, li jiskala u jkabbar waqt li jżomm l-ispejjeż taħt kontroll u li jopera b’ġestjoni robusta tar-riskju. L-affidabbiltà tal-pjattaforma ta’ MeDirect ġiet enfasizzata mill-ħin tal-operat jew uptime medju ta’ 99.99% fuq il-punti ta’ kuntatt kollha tal-klijenti f’diversi postijiet ġeografiċi madwar id-dinja. Il-kwalità tas-servizz kienet riflessa wkoll f’livell għoli ta’ sodisfazzjon tal-klijenti, b’fost oħrajn in-Net Promoter Score ta’ 60 miksub f’Malta. MeDirect ġie rikonoxxut ukoll mill-klijenti bħala t-tieni l-aħjar pjattaforma ta’ tfaddil u investiment fil-Belġju.

Arnaud Denis, CEO ta’ MeDirect Group, qal, “L-2023 kienet sena li matulha komplejna niksbu progress b’pass mgħaġġel u nikkonsolidaw il-pjattaforma tagħna. B’mod kostanti kabbarna n-negozji tagħna kemm min-naħa tal-wealth kif ukoll tas-self. Issa għandna l-ambizzjoni bħala l-ewwel bank diġitali f’ Malta li nsiru l-bank primarju tal-klijenti tagħna. Filwaqt li t-teknoloġija u l-klijenti tagħna jibqgħu fil-qalba tal-għanijiet tagħna, l-istrateġija ta’ tkabbir sostenibbli tiddependi fuq investiment selettiv, kontroll tal-ispejjeż u ġestjoni effettiva tar-riskju biex ittejjeb il-profittabbiltà tal-bank minkejja li għadna ninsabu f’kundizzjonijiet makroekonomiċi globali inċerti.”

Matul l-2023, il-portafoll totali ta’ self fuq id-djar jew home loans ta’ MeDirect żdied bi 22 %, minn €2 biljun għal kważi €2.5 biljun: home loans garantiti mill-gvern Olandiż (NHG) qabżu s-somma ta’ €2 biljun, home loans Belġjani qabżu €250 miljun filwaqt li self għal buy-to-let professjonali fl-Olanda laħaq il-€85 miljun. F’Malta, il-portafoll ta’ home loans laħaq kważi €100 miljun u l-offerta twessgħet biex tinkludi self għall-investiment fil-proprjetà, kif ukoll il-possibbiltà li l-klijenti jħallsu biss l-imgħax fuq is-self għal perjodu ta’ 18-il xahar. Għall-kategoriji kollha ta’ self, il-Bank juża t-teknoloġija u tfassil ta’ proċessi bla xkiel biex jitnaqqas iż-żmien meħtieġ biex tinħareġ l-approvazzjoni tas-self (magħrufa bħala sanction letters) u jitlestew il-kuntratti għax-xiri tad-djar. F’kull okkażjoni, MeDirect japplika proċess robust ta’ għażla tar-riskju li rriżulta f’portafolli ta’ kwalità għolja b’numru baxx ta’ arretrati u nuqqasijiet.

Fuq in-naħa korporattiva, MeDirect kompla jappoġġja l-ekonomija lokali Maltija billi żviluppa b’mod dinamiku l-franchise tiegħu. Is-self korporattiv domestiku kiber għal €140 miljun f’Diċembru 2023, b’loan-to-value ratio konservattiv li kien fuq medja ta’ 54%. MeDirect jipprovdi wkoll servizzi korporattivi ta’ kwalità għolja (bħal ftuħ ta’ kontijiet bankarji, servizzi ta’ ħlas u teżor, ġestjoni tal-likwidità, kambju ta’ muniti barranin eċċ) lil madwar 400 klijent f’diversi setturi. Il-bank kompla jsaħħaħ il-pjattaforma tal-e-banking tiegħu biex joffri l-aqwa servizzi diġitali lill-klijenti korporattivi tiegħu, wkoll.

Fl-aħħar nett, MeDirect kompla il-programm ta’ tnaqqis tar-riskju, bil-portafoll ta’ International Corporate Lending (“ICL”) li minn €512 miljun fl-2022 niżel għal €329 miljun sal-31 ta’ Diċembru 2023. L-assi tal-ICL issa jammontaw għal inqas minn 7% tal-assi totali tal-Grupp u 12% tas-self tiegħu.

Bħala bank sistemiku f’Malta, MeDirect huwa regolat mill-Bank Ċentrali Ewropew bħala parti mill-Mekkaniżmu Superviżorju Uniku. Li tkun parti mill-Mekkaniżmu Superviżorju Uniku jiżgura li MeDirect huwa regolat bl-istess standards bħall-akbar banek fl-Ewropa. Fl-aħħar tas-sena, il-proporzjon tal-kapital (capital ratio) totali ta’ MeDirect kien ta’ 20.3%, u l-proporzjon tal-kopertura tal-likwidità (Liquidity Coverage Ratio) kien ta’ 209%. Tali ċifri jaqbżu r-rekwiżiti regolatorji, ir-rakkomandazzjonijiet u l-buffers tal-ġestjoni kollha.

Tista’ ssib aktar informazzjoni, inkluż ir-Rapport Annwali sħiħ u d-Dikjarazzjonijiet Finanzjarji, fuq https://www.medirect.com.mt/about-us/investor-relations/.

MeDirect Bank (Malta) plc, bin-numru ta’ reġistrazzjoni C34125, huwa liċenzjat biex joffri servizzi bankarji skont it-termini tal-Att dwar il-Kummerċ Bankarju (Kap. 371) u servizzi ta’ investiment skont it-termini tal-Att dwar is-Servizzi ta’ Investiment (Kap. 370). MeDirect Bank (Malta) plc huwa regolat mill-Awtorità Maltija għas-Servizzi Finanzjarji bħala Istituzzjoni ta’ Kreditu taħt l-Att Bankarju tal-1994.