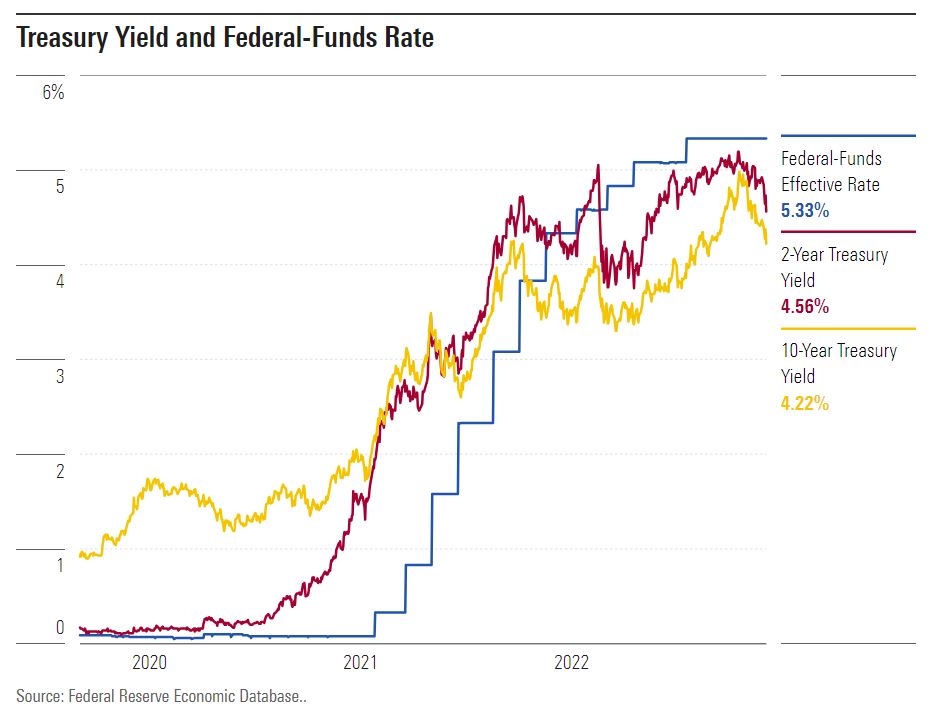

Talk about a 180. After a dismal year, the bond market is rallying as investors celebrate the likely end of the Federal Reserve’s historic interest rate tightening cycle.

After peaking at roughly 5% in mid-October, the yield on the 10-year Treasury note has fallen to 4.26%. Meanwhile, the Morningstar US Core Bond Index has returned 4.3% over the past month. As a result, the index is up 2.2% so far in 2023.

These gains mark a major reversal. Just two months ago, the Core Bond Index was flirting with an unprecedented third straight year of declines as yields surged to their highest level since 2007, thanks to an unexpectedly resilient economy. “People are surprised by the speed with which the narrative has shifted,” says Kelsey Berro, a fixed-income portfolio manager at JPMorgan Asset Management.

Why Are Bonds Rallying?

“We’ve seen in big shift in both sentiment and positioning,” Berro explains. Over a month, investors have transitioned from believing the Fed might need to hike rates even further to betting that the central bank is finished. Now, she says, “everyone is trying to time when the first rate cut is going to happen.”

Strategists credit a myriad of factors for the turnaround, including a moderating labor market, increasingly dovish discourse from the Fed, tightening lending standards, and forecasts for a much milder GDP report in the fourth quarter compared with the third quarter’s blowout reading. In other words, investors finally have a sense that the Fed’s policy tightening is catching up with the economy and cooling things off. Not to mention the inflation rate finally slowing down. “We’re quickly closing in on [the Fed’s] 2% target,” Berro says. And while we’re not quite there yet, markets are “anticipating future progress.”

It’s no wonder bond traders are optimistic. “All that seems to be coming together, and markets are quickly pricing it in,” says Jack McIntyre, a portfolio manager for Brandywine Global.

Traders Look Ahead to Rate Cuts

Bond traders now expect the Fed to cut rates at its March meeting, according to the CME FedWatch Tool. In total, bond futures markets are pricing in 1.25 percentage points of easing by the end of 2024, or five separate rate cuts of 0.25% each. That would take the federal-funds rate down to a target range of 4.00%-4.25% from its current target range of 5.25%-5.50%.

McIntyre warns that these types of market predictions can be fickle, since traders’ expectations about rate cuts and hikes ultimately depend on economic data (just like the Fed’s decisions). “It’s a little bit of a whipsaw,” he says.

Can the Bond Market Rally Continue?

Analysts at UBS are forecasting that the 10-year US Treasury yield will drop to 3.5% by the end of 2024, according to a Friday research note. They point to cooling inflation and labor market data that they believe will likely allow the Fed to start cutting rates in July. But headwinds remain. “We’ve got a whole bunch of potential landmines,” McIntyre says, pointing to upcoming jobs and inflation data and the last Fed meeting of the year.

Berro acknowledges that the bond market can be volatile: “I wouldn’t rule out the potential that [yields] could move a bit higher over the short term.” There’s also a risk that the Fed doesn’t cut rates in March like traders expect, which could push yields up. That said, she believes “risks are biased toward lower rates.”

Despite the potential for wide swings in prices, for bond investors, it’s still a better environment in which to own fixed income than before the run-up in yields.

“Bonds are back to paying income,” McIntyre says, even amid volatility and even if that income is just the bond’s coupon without any price appreciation at all. “I actually think [investors will] make money on owning bonds next year.”

Morningstar Disclaimers:

The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Morningstar, Inc. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. Any decision to invest should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.