Wei Li, Global Chief Investment Strategist with the BlackRock Investment Institute, together with Alex Brazier, Deputy Head, Scott Thiel, Chief Fixed Income Strategist and Beata Harasim, Senior investment strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Reaffirming tactical views: The new regime of macro volatility is playing out with weaker growth, persistent inflation and volatile markets. We stick with our dialed-down risk stance.

Market backdrop: U.S. stocks slumped and yields surged on a renewed rise in core inflation. We’ve argued inflation will be persistent and see the Fed hiking through year-end.

Week ahead: Central banks are the main attraction this week. The Fed and the Bank of England are set to hike rates again. We see the Fed hiking 0.75% a third time.

The new regime of macro volatility is playing out. Business activity is slumping and higher inflation persists. Central banks are responding with aggressive rate hikes without fully acknowledging the growth damage required. Expected policy rates have jumped further since we downgraded developed market (DM) stocks in July – and recession risks still aren’t factored in. We reaffirm our reduced risk taking stance in our tactical views and favor credit over stocks.

Weak growth, higher rates: a tough combo

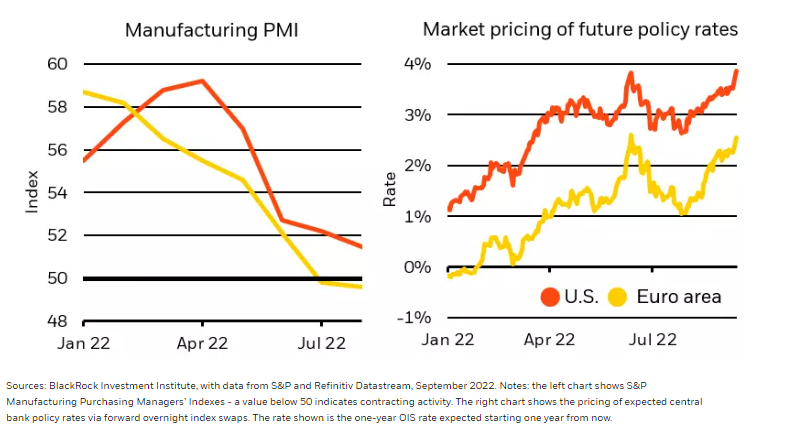

Manufacturing PMIs and policy rate pricing, 2022

Business activity is already stalling in the U.S. and Europe, as business surveys show (left chart). Yet the Federal Reserve and the European Central Bank (ECB) are expected to hike rates aggressively with a singular focus on fighting inflation (right chart). Last week’s U.S. CPI report confirmed why we don’t see a soft landing for the economy: inflation is proving sticky as we expected, and central banks are following a whatever-it-takes approach to inflation. This suggests they will overreact to upside inflation surprises but not necessarily respond to downside surprises. The upshot? We expect a policy overtightening that causes recessions. Our whole portfolio approach prompts us to reaffirm our tactical views taking reduced risk. We favor credit given our view that a major default cycle is unlikely and are underweight DM equities given the recession hit we see ahead.

Our investment views had already been based on a mild recession in the U.S. and a deeper one in Europe given the energy crunch – but we don’t think risk assets have come to terms with the combination of deteriorating activity and central banks pushing up rates more quickly. These developments prompt us to stick with our tactical positioning.

Reaffirming tactical views

Our relative preference for high quality credit over equities still holds because of one big aspect: valuation. Higher spreads and government bond yields push up expected returns. And strong balance sheets imply investment grade credit could weather a recession better than stocks. We like investment grade credit, especially with short maturities, over high yield. This reflects our preference to be up in quality amid a worsening macro backdrop.

We’re underweight most DM equities for now. We haven’t bought the dips all year. The combination of an imminent recession and higher rates is still not fully reflected in equity valuations, in our view. If and when both of these are factored in – we would tilt back to neutral on stocks and start to consider signposts to turn more positive.

We are underweight U.S. Treasuries. Overall, we see long-term yields moving higher as investors demand greater term premium – the extra return that investors demand to compensate them for the risk of holding long-term bonds amid persistent inflation and high debt loads. That’s partly why we favor inflation-linked bonds – we expect inflation to persist and this isn’t reflected in current pricing. We’ve also started to prefer short-term over long-term government bonds. We’re neutral European government bonds, but we think the market pricing of the ECB is unrealistically hawkish given the deteriorating growth outlook on the back of the energy crisis.

Our bottom line

The new regime of macro volatility is taking root with weaker growth, persistent inflation and volatile markets. Our whole portfolio approach prompts us to stick with our tactical views especially with the macro deterioration since our last update. We like credit over equities on valuations. High quality credit can also weather a recession better than stocks, we think. Persistent inflation keeps us away from longer-term nominal government bonds and makes inflation-linked bonds more attractive. Shorter-term government bonds are looking better because market pricing of policy rates looks too hawkish to us and recession risks are underappreciated. We think economic damage from rate hikes, and the energy crunch in Europe, will eventually lead central banks to stop hiking, but not anytime soon given persistently high core inflation.

Market backdrop

U.S. equities slumped and Treasury yields pushed near this year’s highs after data showing a renewed rise in U.S. core inflation in August, suggesting core higher inflation will persist. That prompted the market to price in a third-straight 0.75% rate hike by the Fed next week and more big hikes for the rest of this year. We see the Fed hiking rates through year-end. Yet we doubt the Fed will acknowledge the recession needed to bring inflation back to its 2% target in its projections next week.

The Fed seems determined to get inflation down to 2% without recognizing the extent of the contraction needed to do so, in our view. The upside surprise in the August U.S. CPI confirms why we expect the Fed to hike rates by 0.75% for a third straight time. The BoE has recognized the inflation-growth trade-off it faces and still seems determined to trigger a recession to fight inflation – especially after the UK fiscal response to the energy shock.

Week ahead

Sept, 21: Fed policy decision

Sept, 22: Bank of England and Bank of Japan policy decisions

Sept, 23: Global flash PMIs

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 8th August, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.