News & Updates

In our News & Updates section, we’ll keep you informed about what is happening at MeDirect Group. Through this section we also publish weekly market updates provided by well-established fund houses and other interesting financial reads. Make sure to visit often to keep yourself up to date.

BlackRock Commentary: Fiscal boost is not a market risk – yet

The prospect of another large U.S. fiscal package has fed debates about potential economic overheating. BlackRock believe central banks for now have strong incentives to lean against any rapid rise in nominal yields even as inflation rises, supporting their

tactically pro-risk stance.

medirectalk discussing Sustainable Investments: Investing for a Better Future

On Thursday 25th February 2021, MeDirect will be holding its fifth edition of medirectalk – a series of seminars featuring several financial experts and asset managers on market and investment Updates.

Notes from the Trading Desk – Franklin Templeton

The United Kingdom remains far ahead of its European counterparts in terms of vaccination progress, which helped sentiment. It is also encouraging to see new COVID-19 cases fall sharply in the United States, and the vaccination programme continues to make good progress with over 1 million people there being vaccinated per day.

BlackRock Commentary: Why we favor tech and healthcare

The pandemic has turbocharged transformations that were already under way – from sustainability to inequality. Yet markets have not fully priced in the durability of these trends, BlackRock believe, even with the glimpse into the future offered by the pandemic. They favor technology and healthcare on a tactical horizon, as they offer both quality characteristics and are likely beneficiaries of structural growth trends.

Notes from the Trading Desk – Franklin Templeton

Global equities were stronger across the board last week. Improving sentiment around vaccination programmes, together with the positive developments in Italian politics, were the focus in Europe, while in the United States, stimulus hopes boosted markets.

BlackRock Commentary: Valuation – not a worry for now

Equity valuations have been top of mind after major stock indexes have scaled new highs. Last week’s volatile market moves as a result of technical deleveraging added fuel to these concerns. BlackRock do not see risk asset valuations as obviously stretched overall, and expect low interest rates – and a vaccine-led restart – to support risk assets over the next six to 12 months.

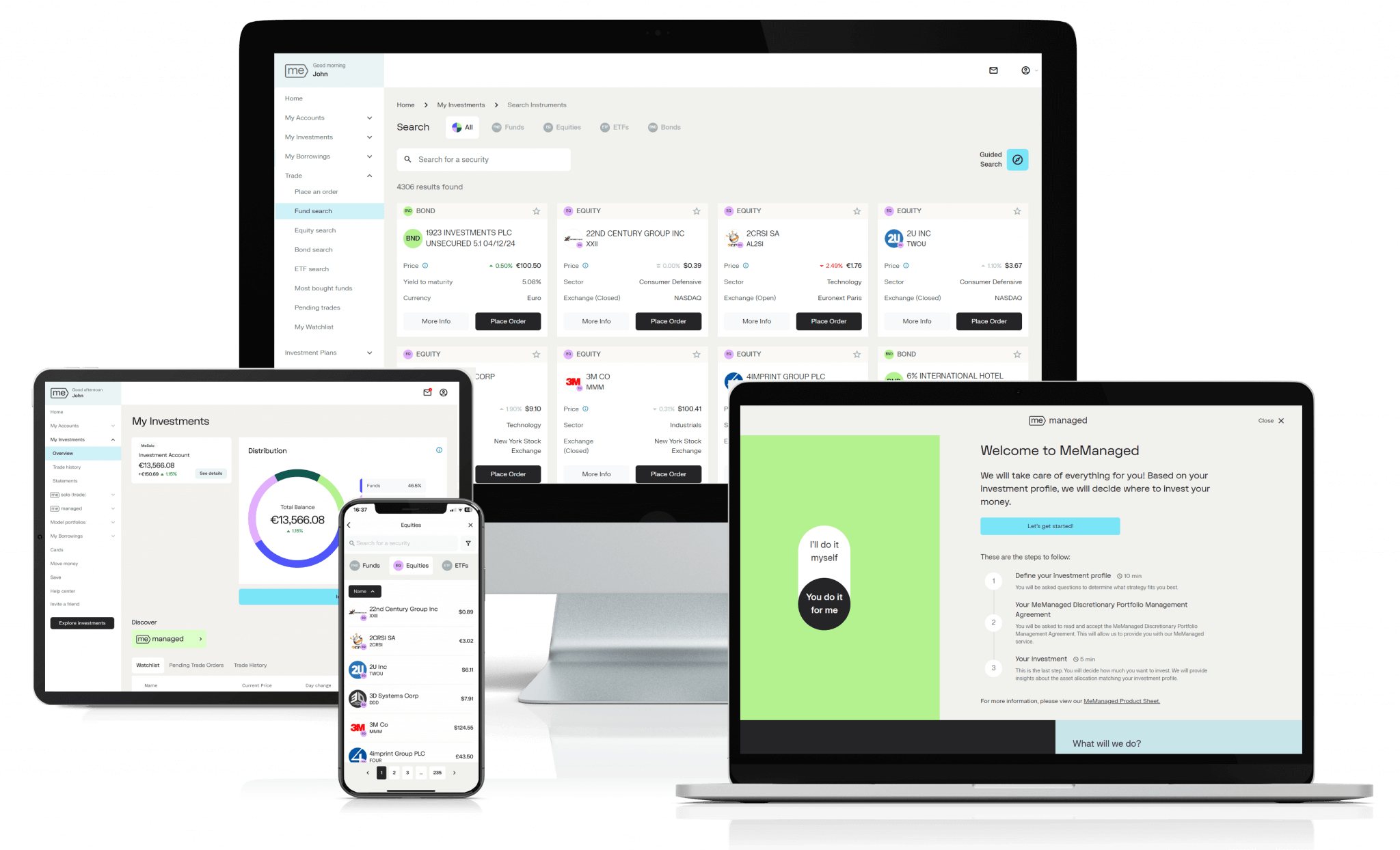

Experience better Investing

The sooner you start managing your money, your way, using the best-in-class tools, the sooner you’ll see results.

Sign up and open your account for free, within minutes.