Jean Boivin, Head of the BlackRock Investment Institute together with Wei Li, Global Chief Investment Strategist, Alex Brazier, Deputy Head of the BlackRock Investment Institute and Vivek Paul, Senior Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points:

A new regime: Growth concerns, inflation and volatility fueled the debate at our Outlook Forum over why we’re entering a new macro and market regime and what that means.

Market backdrop: Poor activity data reinforced slowdown fears, resulting in falling yields and rising stocks last week. Persistent UK inflation caused worries of overtightening.

Week ahead: This week’s U.S. PCE inflation update may show if inflation pressures are easing. Euro area inflation data will likely reinforce the ECB’s rate hike plans.

Global growth and inflation concerns are keeping investors up at night. This backdrop made for a spirited gathering at our June 14-15, 2022 Outlook Forum, a semiannual meeting we host for BlackRock’s portfolio managers and executives. We made the case we’re entering a new macro and market regime, and debated the implications at our first in-person Forum since the pandemic broke out in early 2020. Watch for updated investment views in our 2022 midyear outlook on July 11.

A historic shift

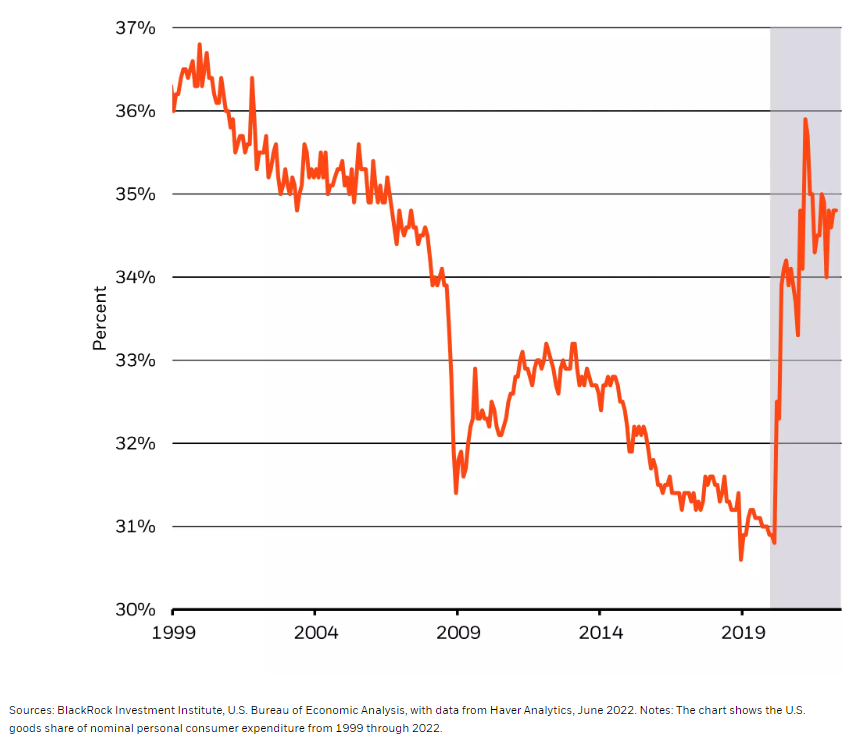

U.S. nominal goods share of consumer spending

Many forum discussions centered on the production constraints driving today’s inflation. The pandemic sparked a massive shift in consumer spending to goods and away from services. See the gray shaded area in the chart. This reallocation occurred as lockdowns limited production and movement – and led to a sectoral re-allocation of resources. The restart of economic activity unleashed pent-up demand for services, creating an ostensibly tight labor market. The war in Ukraine added an additional commodities price shock. These factors pushed up inflation to 40-year highs. Almost all Forum participants said average U.S. inflation would settle above the Federal Reserve’s target of 2% over the next five years. That was a marked change from our November Outlook Forum, when only half forecast this. Participants were divided on how companies will adapt to this new environment – and whether they can maintain historically high margins amid rising input costs and the need to diversify supply chains in a more fragmented world.

Concerns over a global growth slowdown weighed on participants as a stampede of central banks raised rates in an effort to rein in inflation – all in the week the Forum took place. Half of participants saw the restart stalling in the next two years, leading to a short and shallow global recession, up significantly from November 2021. Waning U.S. growth was in sharp focus as the risk of the Fed overtightening increases. The flurry of central bank rate hikes has shown many are ignoring the crushing effect this will have on growth, in our view, and we now see the U.S. restart of economic activity stalling.

Signs of a new regime

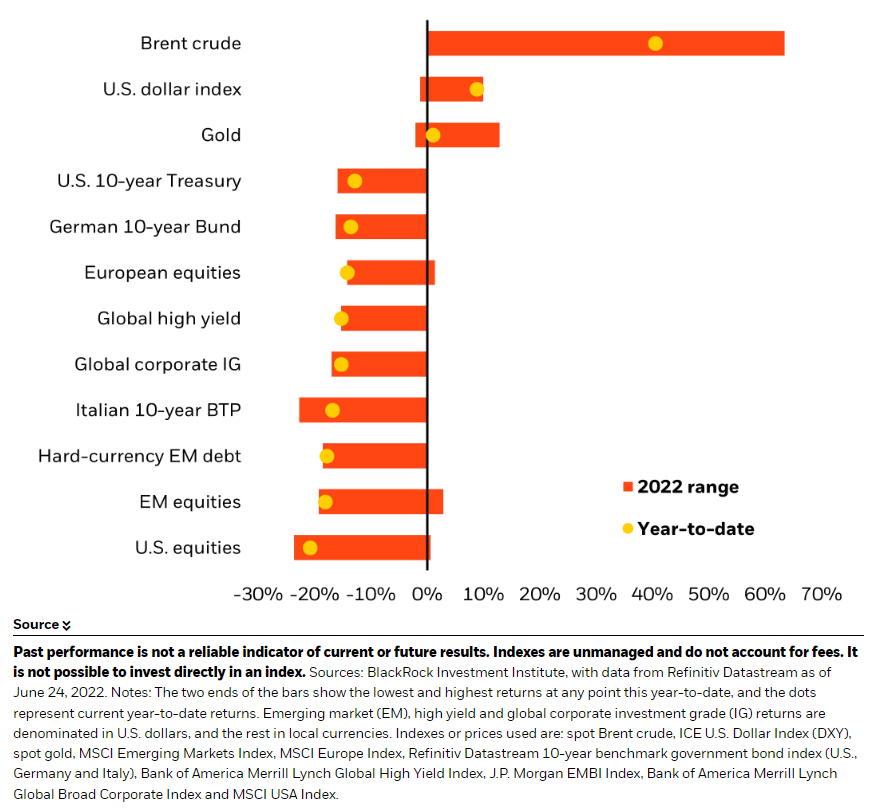

A quickly changing world complicates matters. The war in Ukraine has exacerbated high inflation caused by the restart’s supply disruptions – and sparked sharply higher commodity prices. Commodity prices are likely to stay elevated, Forum speakers said. Why? Lower production capacity after years of underinvestment as well as ballooning demand for industrial metals needed for the transition to net-zero carbon emission by 2050. The outperformance of traditional energy assets this year does not mean the transition is reversing, speakers said. It reflects higher expected earnings for companies replacing Russian energy supply. Energy use in coming decades will look very different, we believe, and lower carbon fossil fuels have a large role to play in enabling the transformation.

Geopolitical fragmentation is another tenet of the new regime, and the Ukraine war has accelerated this. The Forum focused on how many emerging market (EM) countries now try to find a middle ground between the U.S. and China or try to play one against the other. EM isn’t what it used to be, anyway. The name itself is a misnomer as it hides an incredibly diverse set of countries. The old approach of chasing growth and cheap assets in EMs is outdated, Forum participants argued. It’s now about quality investments, income potential and seeking out beneficiaries of “friend-shoring.” Another change: EM dependence on China is declining, buffering some of the effects of China’s lockdowns to prevent the spread of Covid-19.

The road ahead

So how should investors adjust to all this? Ignore macro peril at your own risk. Most attendees said they expect to see short cycles, more macro volatility and volatile markets. They stressed the need to be make quicker portfolio shifts amid shrinking investment horizons and prioritize liquidity, too. Participants also questioned the classic portfolio construction setup of 60% stocks and 40% bonds. A 40-30-30 split – comprising traditional fixed income, public equities and private assets – is perhaps more apt in the new regime. Simply betting on mean reversion, or buying the dip won’t work anymore, many agreed.

Market backdrop

Poor global PMI data reinforced slowdown fears, capping the rise in yields and triggering a rebound in stocks from 2022 lows. UK inflation hit a four-decade high of 9.1%, bolstering pressure on the Bank of England (BOE) to respond aggressively with further tightening. Many developed market (DM) central banks have moved ahead with rapid rate hikes without acknowledging how they could hurt economic activity. Failing to recognize policy trade-offs boosts risks to growth, we think.

Inflation and survey data will be top of mind this week. In the U.S., an update on the Fed’s preferred PCE inflation measure will shape its view of whether inflationary pressures are starting to subside amid a possible softening in activity surveys. Euro area inflation data will likely bolster the ECB’s resolve to tighten policy in July. While we see the ECB raising rates materially in coming meetings, the burden of the energy shock hitting Europe will ultimately force it to rethink its hiking cycle.

Week Ahead

June 28: U.S. consumer confidence

June 30: China PMI; U.S. consumer spending and PCE inflation

July 1: Euro area inflation; U.S. ISM manufacturing PMI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 27th, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.