Wei Li, Global Chief Investment Strategist with the BlackRock Investment Institute, together with Alex Brazier, Deputy Head, Beata Harasim, Senior investment strategist and Tara Sharma, Investment Strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Earnings Pressure: We see company earnings deteriorating amid a rotation in consumer spending and a sputtering restart. This is partly why we remain cautious on stocks.

Market backdrop: Stocks jumped on hopes of the Fed pausing hikes soon as inflation edges lower. We think that’s premature and see inflation settling above pre-Covid levels.

Week ahead: U.S. activity data could show how much the economic restart is slowing. UK CPI is likely to continue its march up amid high energy costs.

Stocks are rallying as markets believe inflation is waning and the Fed will slow hikes soon. We don’t think the rally is sustainable. Why? We see the Fed hiking rates to levels that will stall the economic restart. Corporate earnings may weaken more as consumer spending shifts and profit margins contract. This is not a typical business cycle, so we expect differentiated regional and sectoral effects. The risk of disappointing earnings is one reason we’re tactically underweight stocks.

Good for Whom?

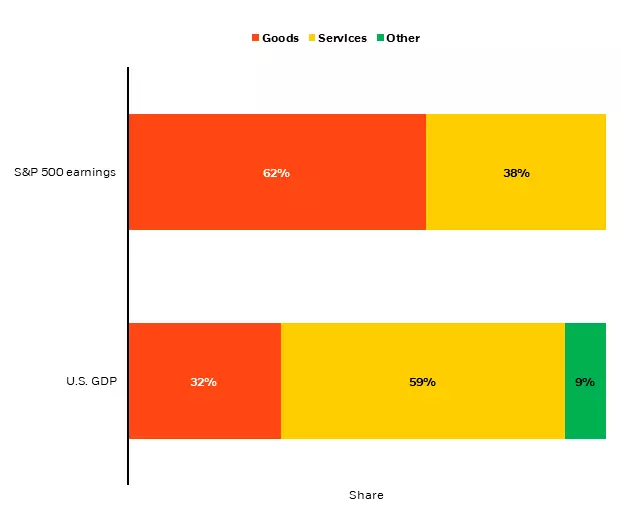

Goods and services split for U.S. economy and S&P 500 earnings

The pandemic and unique restart of economic activity brought about a massive re-allocation of resources. During the pandemic, consumer spending shifted to goods and away from services. That propped up goods producers’ earnings. That’s changing, in our view. Goods demand is weakening. Overstocked inventories, from retailers to semiconductor firms, are evidence of that. Meanwhile, spending is returning to services. This shift could hit stocks. Why? Earnings tied to goods are expected to make up 62% of S&P 500 profits this year, versus 38% tied to services. See the top bar of the chart. In addition, the stock market isn’t the economy. Goods accounted for less than a third of the U.S. economy in the first half of this year. See the bottom bar. This means a boom in services doesn’t power S&P 500 earnings as much as it does the economy.

Today’s labor market also shows we’re not in a typical business cycle. The labor shortage has been a key production constraint after many people left the workforce during the pandemic. We think higher wages would help normalize the labor market by encouraging workers to return and incentivizing employees to stop hopping jobs for more pay. On the flip side, higher wages also ratchet up companies’ costs and pressure margins. These spending and labor dynamics are unfolding as the restart itself sputters. In Europe, the energy shock amid Russia’s invasion of Ukraine will likely trigger a recession later this year, as we said in Taking stock of the energy shock. The restart is stalling in the U.S. as it bumps into production and labor supply constraints, and we believe U.S. activity is now set to contract.

Earnings View

What does all this mean for earnings? S&P 500 earnings growth has essentially ground to a halt, we calculate, if you exclude the energy and financial sectors. That’s down from 4% annualized growth last quarter, Bloomberg data show. What’s more, we believe analyst earnings expectations are still too optimistic. There are huge differences between sectors. High oil and gas prices have led to record profits for energy companies. We see these trends persisting for now. The reason: The West is aiming to wean itself off Russian energy and needs other suppliers. In the long run, high prices and profits could be eroded by the march toward decarbonization. The U.S. Senate passed a bill, called the Inflation Reduction Act, that is likely to shake up the sector. It calls for green energy infrastructure investments and tax benefits to incentivize the transition to net zero emissions.

Investment implications

What are the investment implications of a weaker earnings outlook? Stocks have rallied as markets price in hopes the Fed will pivot soon. But we’re not chasing the rally. Why? First, market expectations for a dovish pivot are premature, in our view. We think a pivot will come later as the Fed is for now responding to pressure to tame inflation. Second, we see the market’s views on earnings as overly optimistic. Spending returning to services, slowing growth and looming margin pressures pose risks.

Our bottom line: We are cautious in the short run but are staying invested. We tactically prefer investment grade credit over equities because we think it can weather a slowdown that equities haven’t priced in yet. We remain underweight most DM equities on a tactical basis until we see clear signs of a dovish central bank pivot. We like selected healthcare and energy stocks. We are cautious on tech stocks for now due to their sensitivity to higher rates. We do see strategic opportunities in tech and in healthcare as they’re set to outpace carbon-intensive sectors in the energy transition. Within sectors, we prefer quality firms with the ability to pass on higher costs, stable cash flows and strong balance sheets.

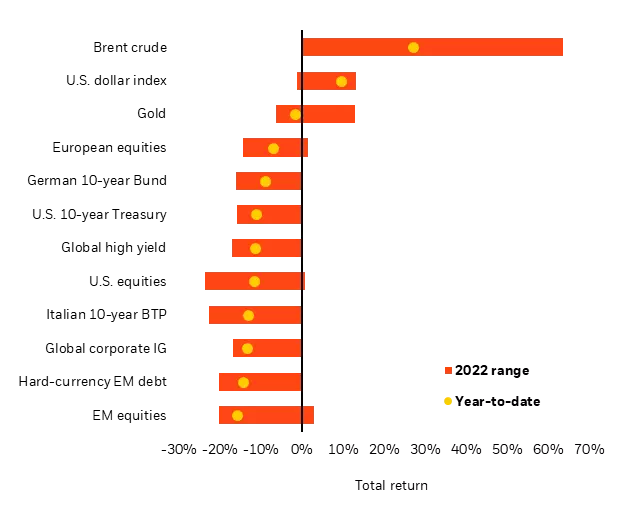

Market backdrop

Stocks marched higher after markets priced in a slowing Fed hiking cycle on softer-than-expected U.S. CPI inflation. We don’t think the equity bounce is worth chasing. We see inflation persisting and settling above pre-Covid levels. We believe the Fed will remain susceptible to “the politics of inflation,” a chorus of voices demanding it tame inflation. Our bottom line: The latest inflation reading isn’t enough to spur the Fed pivot we’ve been waiting for to lean back into stocks.

We’re watching U.S. industrial production and retail sales to see how quickly activity might be slowing. Consensus forecasts see U.S. industrial production improving in July but retail sales cooling for the same month. UK CPI inflation is likely to show a continued increase after the Bank of England revised up its expected peak to above a 13% annual rate earlier this month. Persistently high natural gas prices are likely to keep fuel and power costs elevated.

Week ahead

Aug. 15: Japan Q2 GDP

Aug. 16: U.S. industrial production

Aug. 17: U.S. retail sales, UK CPI

Aug. 18: U.S. Philadelphia Fed business survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 8th August, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.