Jean Boivin – Head of BlackRock investment institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, Vivek Paul – Head of Portfolio Research, and Scott Thiel – Chief Fixed Income Strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

In with the new: The new macro regime is playing out. We think that requires a new, dynamic playbook based on views of market risk appetite and pricing of macro damage.

Market backdrop: U.S. jobs data showed lower workforce participation is propping up wages and confirming labor shortages should help keep inflation persistently higher.

Week ahead: We’re watching services PMIs and key trade data for more signs of the damage from tighter financial conditions before key central bank meetings next week.

We see the new regime playing out and not going away. Persistent production constraints keep this regime of higher macro and market volatility in place, in our view. We think this means a new, dynamic playbook is needed – where tactical and strategic portfolios change more frequently to balance our views on risk appetite with the pricing of economic damage. It’s also about granular views within sectors and asset classes of portfolios.

Recession foretold

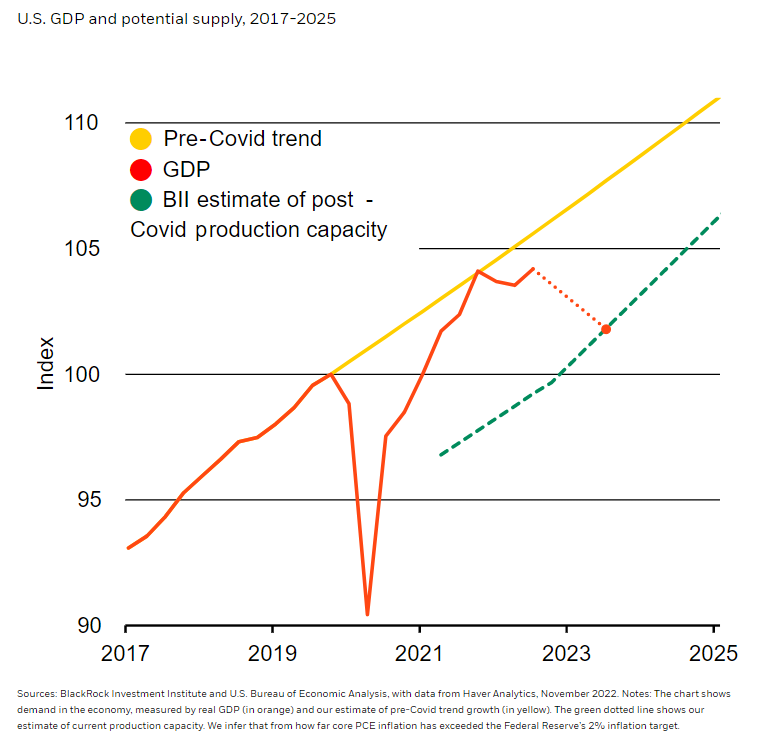

We see a world shaped by supply that involves sharp trade-offs for central banks. Higher policy rates can’t resolve limited production capacity (green line in chart) that we don’t see changing soon. That means the only way for central banks to bring inflation down to target is to hike rates enough to crush demand (orange line) down to the level the economy can comfortably sustain. That’s well below the pre-Covid growth trend (yellow line). Central banks appear set on doing “whatever it takes” to fight inflation, making recession foretold, in our view. We think a new playbook is needed – one that balances an assessment of overall risk appetite with estimates of the economic damage priced. Equities still don’t reflect the damage we see ahead, so we’re underweight. The trigger to turn positive is when the damage is priced, and visibility on the damage improves risk appetite.

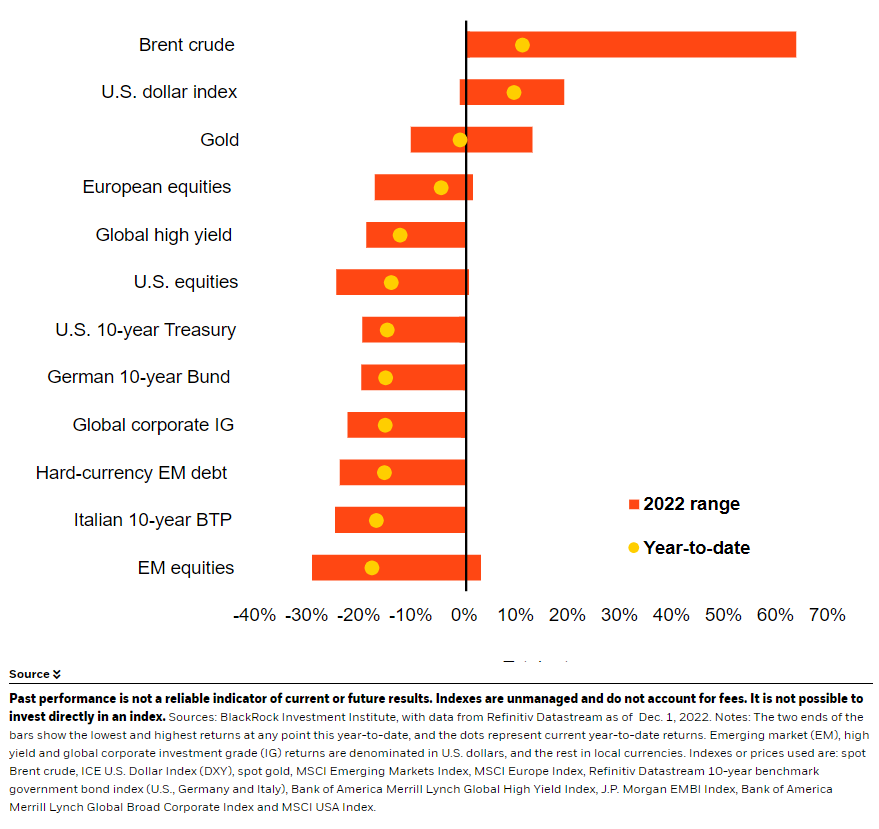

Our three investment themes help flesh out the new playbook. First, pricing the damage. The new playbook calls for a continuous reassessment of how much of the economic damage being generated by central banks is in the price. They are deliberately causing recessions and are unlikely to cut rates to cushion the impact. We stand ready to turn more positive as valuations get closer to reflecting economic damage – or if we think markets have enough clarity to sustainably dial up risk. But we won’t see this as the beginning of another decade-long bull market in stocks and bonds. We’re also rethinking bonds, our second theme. Fixed income finally offers attractive yield, especially in short-term government bonds and high-quality credit. But we don’t think long-term government bonds will play the role of portfolio ballast: Inflation, central banks reducing their holdings and record debt levels will lead investors to demand more compensation for holding long-term bonds, or term premium. That leads us to our third theme: living with inflation. We see inflation cooling as spending patterns normalize and energy prices ebb – but we see it persisting above targets in the coming years.

Regime reinforcement

A new playbook is important because three long-term drivers of production constraints mean the new regime isn’t about to change, in our view. The first driver is aging. We see aging populations shrinking workforces and hitting growth. Second, a new world order. We think geopolitical fragmentation will lead to a rewiring of globalization and drive up production costs while also creating mismatches in supply and demand. Third, a faster transition to net-zero carbon emissions. We believe the global transition could accelerate, boosted by significant climate policy action, by technological progress reducing the cost of renewable energy and by shifting societal preferences as physical damage from climate change becomes more evident.

What this means for portfolios

Our new investment playbook calls for more frequent portfolio changes and a granular approach. Take equities, we’re tactically underweight developed market (DM) equities. They’re not pricing the recession we see, but certain sectors are attractive, like healthcare. But we’re neutral in Japan given still-easy monetary policy. Strategically, we’re overweight DM stocks because we see better returns than fixed income over the coming decade. Within fixed income, we tactically like attractive income in investment-grade credit, U.S. agency mortgage-backed securities and short-term Treasuries. We stay underweight long-term government bonds though because we see investors demanding more term premium due to inflation and other risks. Our view that markets underappreciate the persistence of higher inflation underpins our high-conviction overweight to inflation-linked bonds, tactically and strategically.

Market backdrop

U.S jobs data showed wages rising twice as high as consensus forecasts and the labor force participation rate, or the share of the adult population in the workforce, ticking down. We think this shows how labor shortages are putting upward pressure on wages, likely keeping inflation persistently higher. That keeps the Federal Reserve on track to overtighten policy and trigger a recession, in our view. It also underscores why the Fed may keep rates higher for longer than markets expect.

This week’s services PMIs and trade data will be watched for signs of further damage from central banks’ policy overtightening before next week’s key meetings, including the Fed. The University of Michigan survey will again be scrutinized to see if consumer inflation expectations remain contained.

Week Ahead

Dec. 5: U.S. and China services PMIs

Dec. 6: U.S. trade; UK PMI

Dec. 7: UK house prices; China trade

Dec. 8: University of Michigan consumer sentiment; U.S. and China PPIs

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 5th December, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.