Valerio Baselli discusses how investors are experiencing rough markets not seen in 11 years. Don’t obsess over short-term fluctuations; instead, focus on your financial goals.

Financial markets are going through one of the most complicated periods in recent history. Investors have been grappling with the fallout of Russia’s invasion of Ukraine, the energy crisis, the spike in inflation, and rising interest rates.

Red Across the Board

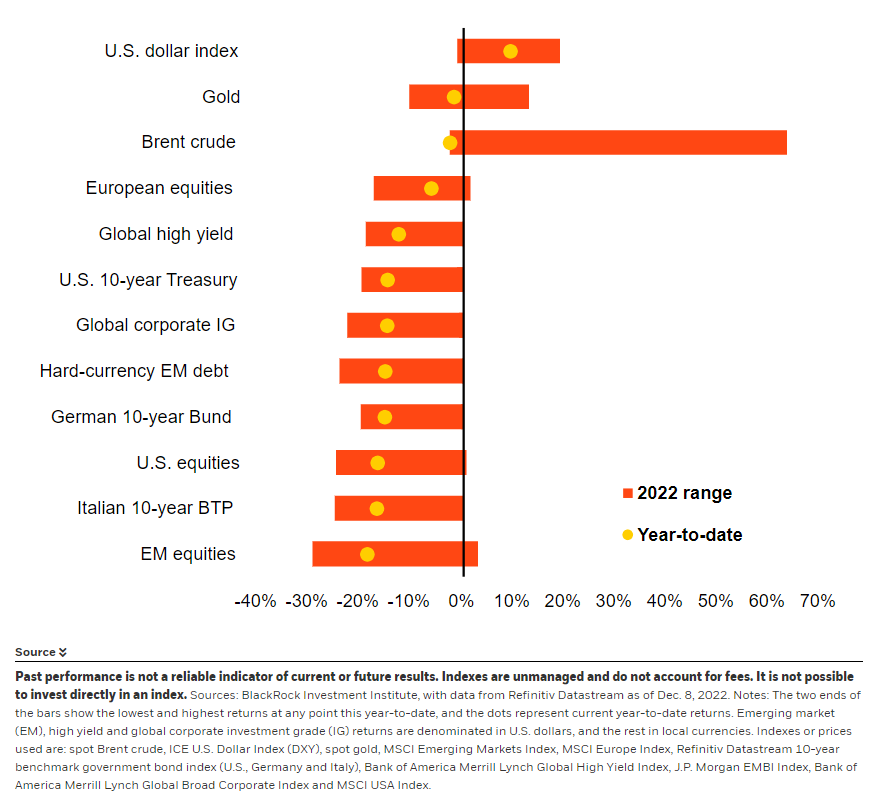

In 2022, the Morningstar Global Markets TR Index fell 10.4%, meanwhile the Morningstar Europe TR Index lost 17.7%, the Morningstar Canada Index is down 13.55% and the Morningstar Emerging Markets shed 13%. All international stock exchanges have suffered severe setbacks.

Bonds, traditionally considered a safe haven, have come out even more battered: the Morningstar Eurozone Core Bond Index, for instance, lost 15% of its value for the year-to-date. In the UK, the issue is pronounced, following Kwasi Kwarteng’s mini-budget.

For the first time since 1994, the waves of selloffs hit stocks and bonds at the same time, and the trusty 60/40 portfolio, a long time cornerstone of diversification, went through one of its worst periods ever.

This year, markets have also experienced increased two-way volatility in stocks, with sharp moves higher or lower (so far in 2022 the S&P 500 experienced 14 days with more than 2% moves, which is second only to 2020 in the last decade), which historically tend to signal that more volatility might be in store for stocks.

How to Keep Your Head

When faced with this stuff, the most important (and difficult) thing is to keep one’s nerve.

Knowing how to handle price fluctuations is at least as important as choosing the right investment. To be honest, most investors are unable to judge their risk tolerance objectively; they typically feel more resilient to risk in good times and suddenly become risk averse after periods of sustained losses such as those experienced recently.

Focusing on short-term movements inappropriately mixes the concepts of risk and volatility. Understanding the difference between the two, and focusing on the former and not the latter, is the key to making sure you achieve your financial goals.

What’s the Difference Between Risk and Volatility?

At first glance, it might seem the distinction between risk and volatility is purely academic and makes little difference to real-world investors. In fact, the two terms are often used almost interchangeably in the field of financial communication. It is also true that the term “risk” can refer to different concepts.

As investors, however, it is useful to create a mental distinction between volatility and risk. What are the key differences? Volatility indicates changes in the price of a security, portfolio or index, either upwards or downwards. Volatility, therefore, is not in itself bad news; it is theoretically possible (though unlikely) to own an investment that is very volatile but has so far only gone in one direction: up.

“If you are not going to sell, volatility is not a big problem and in fact can even be an ally, allowing you to buy additional shares in an investment that fits into your financial plan at a much lower price,” explains Christine Benz, Morningstar’s director of personal finance.

“The most intuitive definition of risk, on the other hand, is the possibility that you will not be able to meet your financial goals or honour your obligations, or that you will have to rethink your goals because circumstances have changed.”

From this point of view, risk should be the real concern for investors, not volatility. However, it is easy to see how the two terms merge. If you have a short time horizon and are in a volatile investment, what might simply be volatile for one investor can become downright risky for another. This is because there is a real risk you might have to sell and make a loss.

How to Cope with Risk and Volatility

So how can investors focus on risk while putting volatility aside?

The first step is to know that volatility is inevitable and if, you have a long enough time horizon, you will be able to use it to your advantage. The use of a dollar-cost averaging strategy can help to ensure that you can buy shares in a variety of market situations (however, it is important to be fully aware of the pros and cons of such a practice).

Traditionally, diversifying one’s investments across asset classes and investment styles can go a long way towards making your portfolio less volatile and your (financial!) life easier.

“Another good practice is to identify real risks: namely, to identify your financial goals and the possibility of not achieving them,” Benz says.

“For most of us, a comfortable retirement is a key goal. For those with children, saving for their education or their first home might be a goal. By identifying goals and risks one by one, you can prioritise and anticipate what you would do if you don’t achieve them.”

Finally, it is always a good idea to keep some of your savings in cash. In extremely uncertain times like the current one, the cash part of our portfolio could save you from having to liquidate investments that are performing badly to meet important expenses or to repay a possible debt. Liquidity can also give the possibility, for those who feel up to it, to enter the market by taking advantage of sharp falls in order to buy assets at a discount.

Morningstar Disclaimers:

The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Morningstar, Inc. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. Any decision to invest should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.