Jean Bovin, Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Paul Henderson – Senior portfolio strategist and Devan Nathwani – Portfolio strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Rethinking portfolios: The joint stock-bond rally this year has put renewed focus on portfolio construction approaches. We think a new macro regime needs a new approach.

Market backdrop: U.S. stocks rose last week but lost steam on Friday on the market partly pricing out potential rate cuts. We don’t see cuts this year as core inflation stays sticky.

Week ahead: U.S. earnings results pick up this week and are overall expected to slump the most in three years. We don’t think that reflects the coming damage yet.

Stocks and bonds have both rallied this year. Some see this as reason to return to traditional portfolio approaches like 60% stocks and 40% bonds. Those used to work when both assets trended up and bonds offset equity slides. We think a focus on any one asset allocation mix misses the point: A regime of higher volatility with sticky inflation needs a new approach to building tactical and strategic portfolios. We see the appeal of income, get more granular with views and are more nimble.

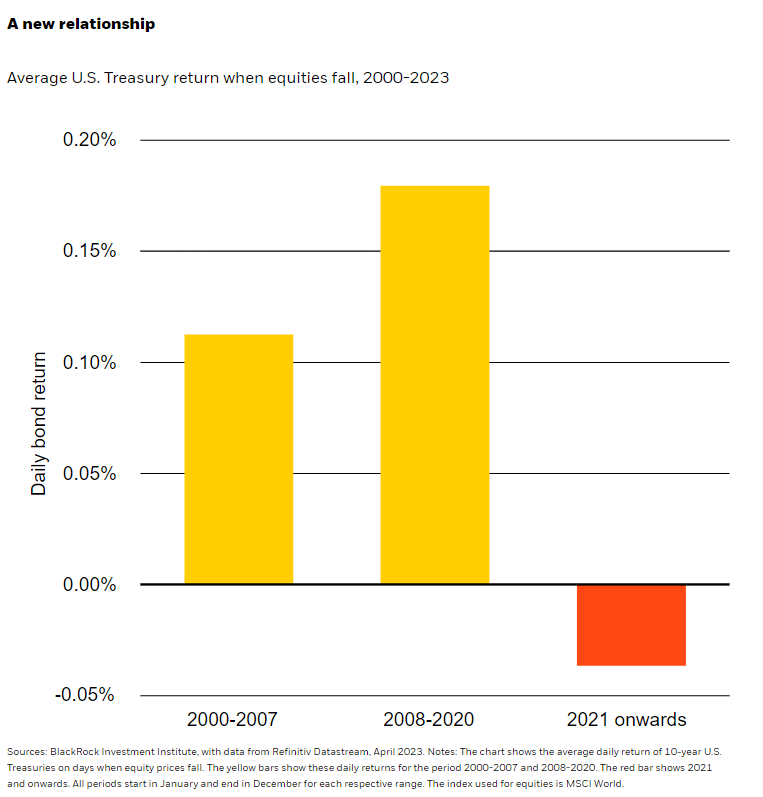

An allocation based on the traditional investing approach of using broad, public indexes of 60% equity and 40% bonds is having a strong start to 2023 after the worst year in decades. We don’t see the return of a joint stock-bond bull market like we saw in the Great Moderation. That was a decades-long period of largely stable activity and inflation when most assets rallied and bonds provided diversification when stocks slumped. We think strategic allocations of five years and beyond built on these old assumptions do not reflect the new regime we’re in – one where major central banks are hiking interest rates into recession to try to bring inflation down. We find that bond returns provided reliable diversification for most of the Great Moderation, helping offset equity selloffs (yellow bars in chart). Some of that ballast has gone away. Average bond returns have dipped alongside equities since 2021 (orange bar) – but higher yields mean income is finally back in fixed income.

Our new approach

The merit of long-term bonds as portfolio diversifiers has fueled a debate over the future of the 60% stocks, 40% bonds portfolio. We think talking about numbers misses the point. The debate should be more about the approach to portfolio construction rather than the broad allocation levels. We believe in a new approach to building portfolios.

Our approach starts with income: The longer rates stay higher, the greater the appeal of income in short-term bonds. We see interest rates staying higher as the Federal Reserve seeks to curb sticky inflation – and we don’t see the Fed coming to the rescue by cutting rates or a return to a historically low interest rate environment. This reinforces the appeal of income in short-term paper. Yet we also see long-term yields rising on both strategic and tactical horizons as investors demand more term premium, or compensation for holding long-term bonds in an environment of higher inflation and debt.

We are also breaking up traditional asset allocation buckets, moving away from broad allocations to public equities and bonds. We think strategic views need to be more granular – across sectors and within private markets – to help build more resilient portfolios in the new regime. On a tactical, six- to 12-month view, we prefer to get more granular by digging into sectors like energy and healthcare, actively selecting companies with quality characteristics: stronger earnings and cash flow that can better weather a recession, resilient supply chains, strong market share and the ability to pass on higher prices. Within fixed income, our granular approach aligns across tactical and strategic views. We’re overweight inflation-linked bonds on both horizons given our expectations of persistent inflation.

Why we stay nimble

We think being more nimble is key because coasting with strategic allocations can prove costly. It’s even more important against a backdrop of structural forces like geopolitical tensions, the energy transition and shifts driven by banking sector turmoil. We’re adjusting our strategic portfolios more frequently in response to new information and market shocks. One example: We’re strategically overweight developed market (DM) equities but tactically underweight. That’s because strategic investors are investing on a timeline where much of the short-term pain would be in the rear-view mirror – they can look ahead and seize opportunities now. We think that getting the asset mix right in the new regime will be crucial for maximizing returns: Our work finds that getting it wrong could be up to three times greater the impact now than in the Great Moderation.

Bottom line: Our portfolio construction approach favors income while getting granular and more nimble in the new regime.

Market backdrop

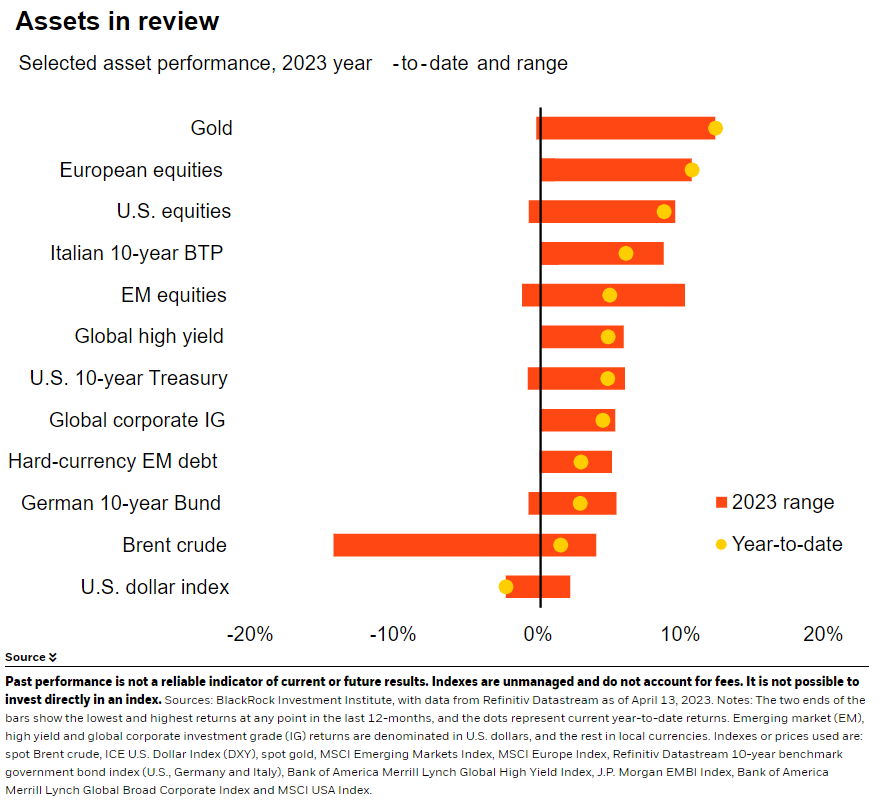

U.S. stocks rose last week near 2023 highs but lost steam on Friday on the market partly pricing out potential rate cuts. The two-year U.S. Treasury yield swung back above 4.0% but remains well off the 16-year high from early March, driven by market hopes for rate cuts. The core U.S. CPI for March showed a resurgence in goods prices and persistent pressure from services. That means inflation is still not on track to fall near policy targets, in our view – so we don’t see rate cuts this year.

U.S. first-quarter earnings results pick up this week. A few big banks led the way last Friday, beating market expectations for profit. First-quarter earnings are expected to slump the most in three years – and for the second quarter in a row, FactSet data show. We don’t think that reflects the coming damage yet.

Week Ahead

April 10-17: China total social financing

April 11: China CPI

April 12: U.S. CPI

April 14: U.S. retail sales; U.S. consumer sentiment survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 17th April, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.