Wei Li – Global Chief Investment Strategist of BlackRock Investment Institute, together with Vivek Paul – Head of Portfolio Research, Amanda Lynam – Head of Macro Credit Research, and Devan Nathwani – Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Public vs. private: We prefer private to public credit long term on better return potential. It’s the mirror image in equity: We prefer public stocks as risks fade in the medium term.

Market backdrop: U.S. stocks hit 2023 highs on hopes for a debt ceiling deal. Yields climbed on odds of another rate hike versus a pause or cuts. We don’t see rate cuts this year.

Week ahead: U.S. PCE this week will help gauge inflation’s persistence. We see wage pressure from worker shortages keeping inflation above policy targets for some time.

The banking tumult has reshaped opportunities for income: We now favor private over public credit on a strategic horizon of five years and longer. We think private credit could help fill a void left by banks pulling back on some lending and offer potentially attractive yields to investors. We see a mirror image in equity, strategically preferring public to private: Public stocks have repriced more than markets like private equity, and we see risks fading over a medium-term horizon.

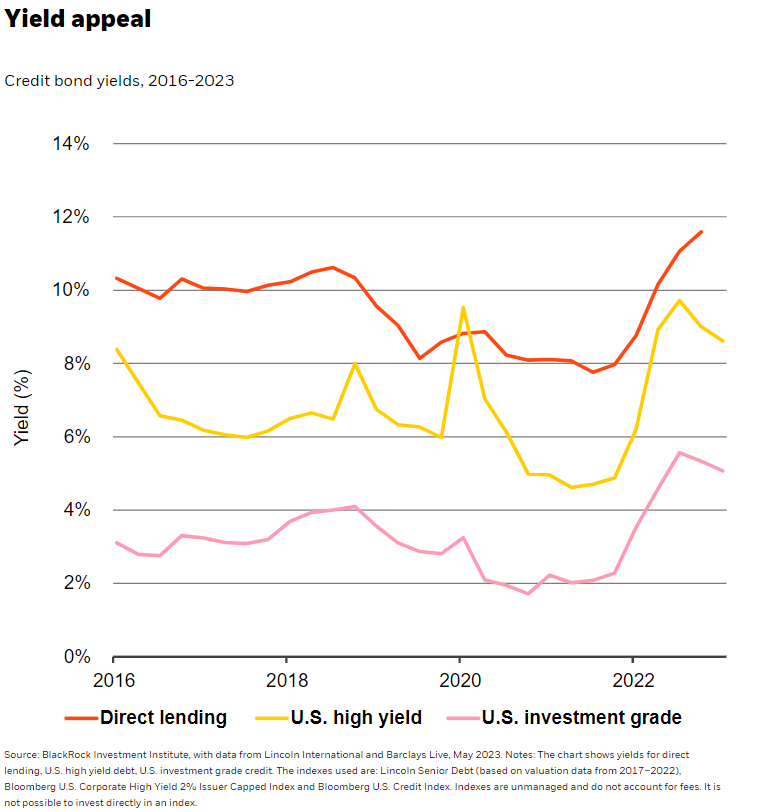

Investing in private markets takes time. So we see the repricing in private credit as an opportunity to be nimble with our strategic views and tap into our expectation that private credit can help fill a lending gap left by banks after the recent turmoil. Yields in direct lending, a subset of private credit, have risen (dark orange line in chart). These higher yields may better compensate investors for the risks we see ahead – even after factoring in lower credit quality. U.S. high yield and investment grade (IG) credit yields have faded from highs (yellow and pink lines), but we think they will rise eventually. We go overweight private credit as a result and move to neutral on global IG. Private markets overall are complex, with high risk and volatility, and aren’t suitable for all investors.

The fallout from the banking sector troubles and further tightening of credit conditions adds to the pressure on public credit but could be a potential boon for private credit, in our view. We think the rising interest rate environment and increased competition for deposits will put pressure on banks – and cause them to pull back some lending. We see this making room for non-bank lending and private credit to play a greater role.

Private credit appeal

Private credit refers to a wide range of investments, from direct lending to infrastructure and venture debt. We’re focused on direct lending – financing that is typically negotiated directly between a non-bank lender and a borrower, often a small to mid-sized company. This private credit is mostly made up of floating rate debt that adjusts with policy rates that we see staying high. We think there are potential benefits from a borrower’s perspective in seeking out non-bank lending. Dealing with one private lender could be easier than a broad group of banks as in public markets. The private nature could also help avoid spooking financial markets, such as with the risks that come with tapping funds from public markets at inopportune times. This demand from borrowers creates an investment opportunity for lenders, in our view: more attractive pricing and deal terms than would have been the case before.

But we think seeking out quality borrowers is key: That means a keen eye on deal terms and lending standards. We have had a conservative view on our assumptions about private credit default losses in our strategic views for some time because private credit is not immune to the credit risk from an economic downturn. Yet even after allowing for these more prudent assumptions that would be a drag on returns, the wider set of opportunities for private lenders in the wake of the banking fallout, coupled with the divergence between private and public credit yields is enough to spur an upgrade.

Our strategic view on equities is the mirror image of credit: We prefer public to private. We’re still strategically overweight developed market (DM) equities but underweight on a six- to 12-month tactical horizon because a strategic investor can look past some of the near-term pain. And the pressure from tighter credit conditions is also likely to have relented down the road. We remain strategically underweight growth private markets such as private equity. Private equity has started to reprice the tougher macro environment but not as much as publicly traded equities.

Our bottom line

We see the appeal of income in the new regime of greater macro and market volatility and favor private over public credit on a strategic horizon. We see a mirror image in equity, strategically preferring public to private.

Market backdrop

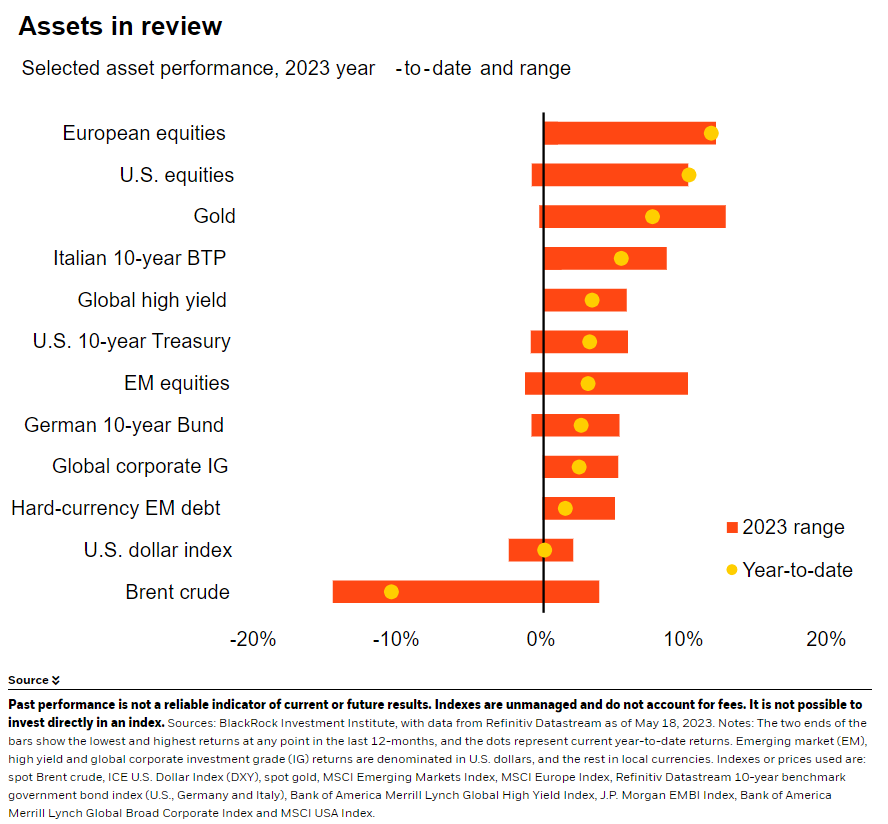

U.S. stocks hit 2023 highs last week on hopes for a debt ceiling solution. Yields climbed on expectations the Federal Reserve could hike rates again instead of pausing at its next meeting. First-quarter earnings contracted for the second-straight quarter – but less than expected. Inflation helped revenue and margins as firms passed on higher prices to a still-strong consumer. We think higher financing costs and dwindling savings could start to bite: Earnings expectations look too rosy.

We’re watching U.S. PCE closely this week, the preferred inflation gauge of the Federal Reserve. We expect inflation to remain above 2% policy targets for some time – that’s why we don’t see the Fed cutting rates this year. Global PMIs will help us gauge how much interest rate hikes are hitting economic activity in developed markets.

Week Ahead

May 22: Euro area consumer confidence

May 23: Global flash PMIs

May 24: UK CPI

May 26: U.S. PCE inflation

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 22nd May, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.