Jean Bovin – Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Carolina Martinez Arevalo – Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Earnings outlook: Higher expected corporate earnings mask broad pressure under the surface. We see more earnings pain ahead and look for opportunities at the sector level.

Market backdrop: U.S. Treasury yields surged and stocks dipped last week. Data confirmed the U.S. labor market is still tight. We see signs markets are adjusting to the new regime.

Week ahead: All eyes are on U.S. CPI inflation data out this week. Continued evidence of stubbornly high inflation could add momentum to the recent rise in bond yields.

Bond yields have jumped, and we think markets are at a key juncture as central banks are poised to hold tight on policy. As Q2 results begin, corporate earnings need to deliver on market expectations to support stocks, in our view. We see a key divergence in earnings forecasts: They have risen for a few tech firms, while the rest stagnate. Profit margins are shrinking, and we see more pressure ahead. So we get granular and favor sectors like healthcare within developed market stocks.

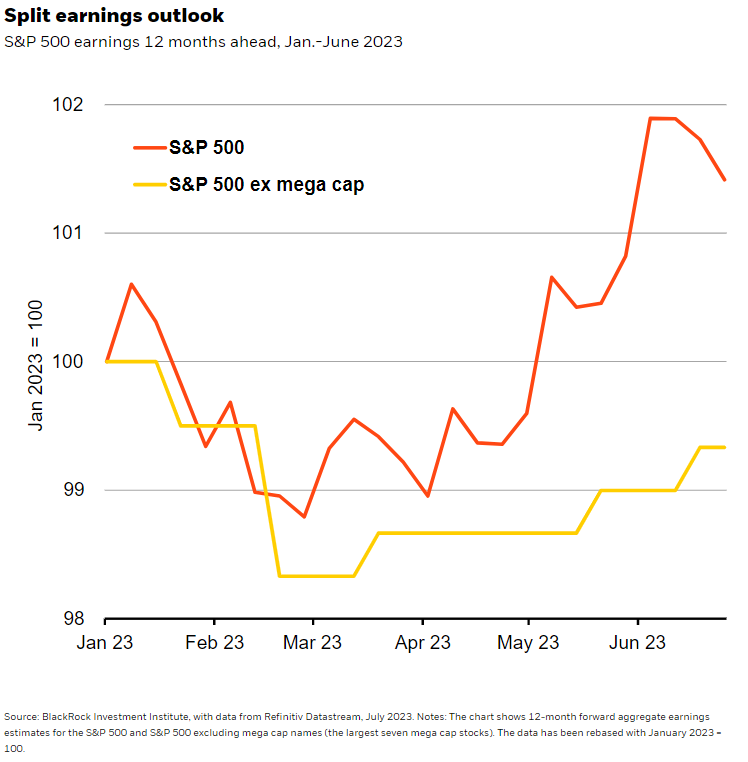

Q1 earnings growth was flat to slightly negative, Refinitiv and Factset data show. That masks significant divergence: We see a common denominator between what’s driving market performance this year and earnings – the artificial intelligence (AI) buzz. S&P 500 earnings forecasts for the next 12 months have risen in recent months (dark orange line in the chart) along with the market rally driven by tech firms with the largest market capitalization. Stripping out those mega-cap tech stocks, forecasts are flat this year (yellow line). 2023 consensus estimates have been cut but remain well above our expectation. We expect Q2 data will be similar to Q1 as the reporting season kicks off this week, with a contraction hitting in the second half of 2023. We assess profit margins, shaped by earnings and revenues, for cracks, too. Margins jumped during the pandemic when consumer demand for goods was strong and companies could push up prices as input costs soared.

Margins have slid since last year as spending shifted back to services, but they remain above their pre-Covid highs. At the same time, data like Friday’s U.S. jobs report reinforce how tight labor markets are in the U.S. and Europe. The key question right now, in our view: If rate hikes are not squeezing the labor market, where will the squeeze come from? Corporate profit margins, we believe, as wage gains and still-solid employment take a bigger toll on margins than in the past. Tight labor markets have caused employers to up wages to attract new hires. Broad worker shortages could incentivize companies to hold onto workers – even if sales decline – out of fear they won’t be able to hire them back. This outlook poses the unusual possibility of “full employment recessions” in the U.S. and Europe.

High stakes for earnings

Last week’s surge in government bond yields put some pressure on equities – and highlights that companies will need to deliver on the market’s earnings expectations as the Q2 reporting season gets under way to avoid more pressure. Resilient consumers have helped support earnings, but we see them exhausting the savings built up during the pandemic this year.

Yet not all corporate sectors will suffer margin pressures in the same way, as is reflected in market pricing. We tilt toward certain sectors within a modest underweight to developed market equities on a six- to 12-month tactical horizon: divergences create opportunities depending on what’s priced in. For example, technology and healthcare margins saw a boost during the pandemic. They could avoid the broad decline we expect as quality sectors that stand to benefit from mega forces, like AI and aging populations. These forces are driving profits now and in the future – and markets are reacting, as with this year’s tech rally. Plus, we like healthcare’s more attractive valuations and generally steady cash flow during economic downturns.

We also like the industrial sector, particularly automakers as they better price in future earnings risk while adding diversification and quality to our defensive portfolios. Automakers would also benefit if the downturns we expect do not occur and consumers stay strong. With a regional lens, we see the earnings improvement at European financials carrying on: Higher interest rates should boost their profit margins, and some are returning capital to investors via buybacks.

Bottom line

We see tight labor markets squeezing profit margins, and we think earnings will come under more pressure in the second half of the year. We think this macro environment is not a friendly one for broad asset class exposures. That’s why we get granular within developed market stocks and identify our selective preferences across regions and sectors.

Market backdrop

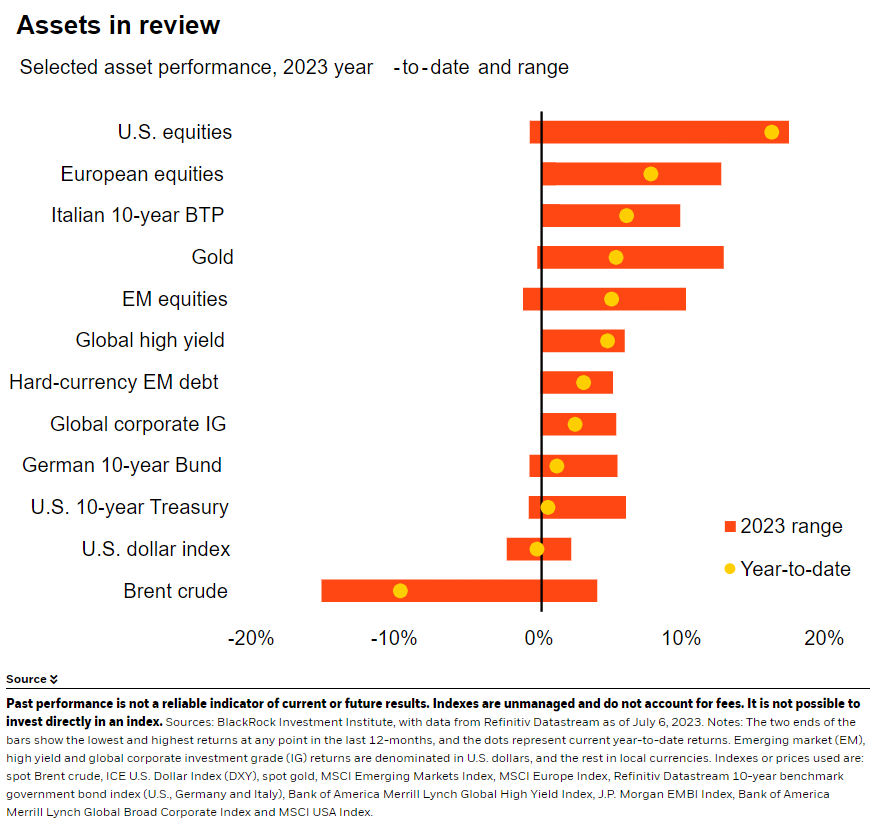

U.S. 10-year Treasury yields approached 15-year highs above 4% and stocks dipped last week after U.S. jobs data showed a still tight labor market. The unemployment rate fell lower, labor participation hasn’t risen further and wages are still growing even after the Fed’s rapid rate hikes. We think the yield move and equity retreat signal we are at an important juncture: Markets are coming around to our view that central banks will be forced to keep policy tight to curb inflationary pressures.

Stubbornly high U.S. CPI inflation data this week could bolster the recent bond yield surge as markets expect the Fed to hike rates this month after a June pause. The Bank of Canada hiked after a pause – and markets are leaning toward odds of another hike this week. We think central banks will be forced to keep policy tight to lean against inflationary pressures.

Week Ahead

July 10-17: China total social financing

July 12: U.S. CPI inflation; Bank of Canada policy rate decision

July 13: China trade data; U.S. initial jobless claims

July 14: University of Michigan consumer sentiment survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 10th July, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.