Wei Li – Global Chief Investment Strategist of BlackRock Investment Institute together with Alex Brazier – Deputy Head, Carolina Martinez Arevalo – Portfolio Strategist and Michel Dilmanian – Investment Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Stagnation reflected: U.S. corporate earnings have stagnated with the economy. We stay selective in stocks and harness mega forces like artificial intelligence as key profit centers.

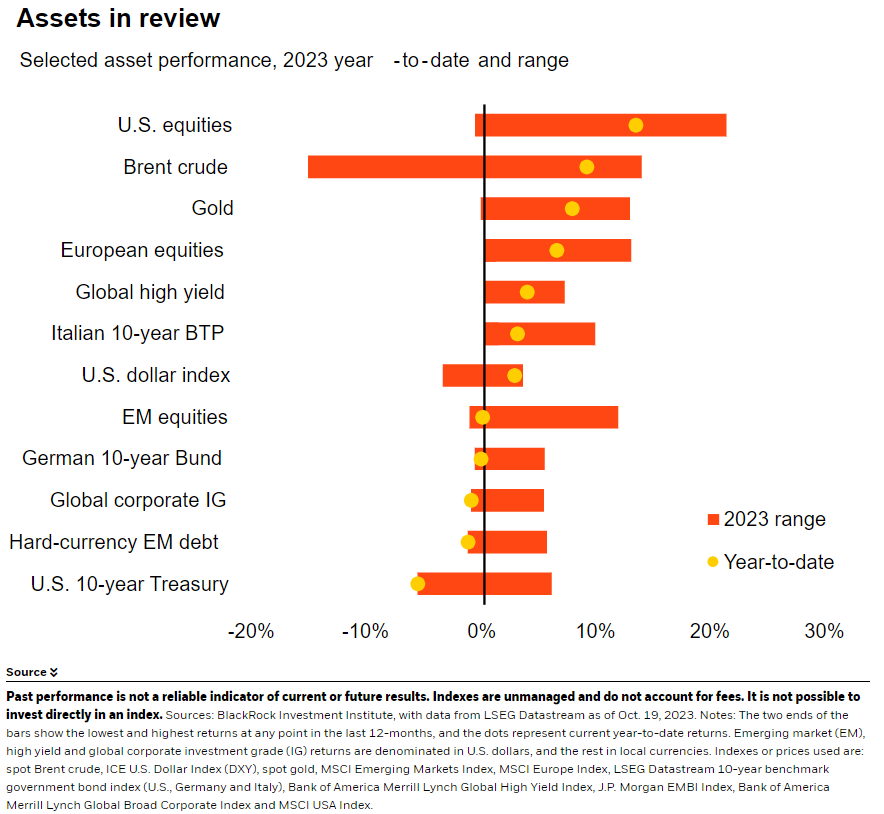

Market backdrop: The 10-year U.S. Treasury yield hit 16-year highs near 5.0% last week, while U.S. stocks fell more than 2% as markets eyed high-for-longer policy rates.

Week ahead: The Federal Reserve’s preferred inflation metric, PCE, is due for release this week. We expect consumer spending to keep shifting back to services

Markets expect a pickup in corporate earnings to start in the Q3 reporting season that gets underway in earnest this week. We are cautious. U.S. corporate profits have plateaued along with the economy. We think this has gone under the radar. The macro backdrop is bad news for broad equities, we think, but opportunities in stocks abound. We tap mega forces like artificial intelligence (we are closely watching the results of top players) and find value in sectors such as healthcare.

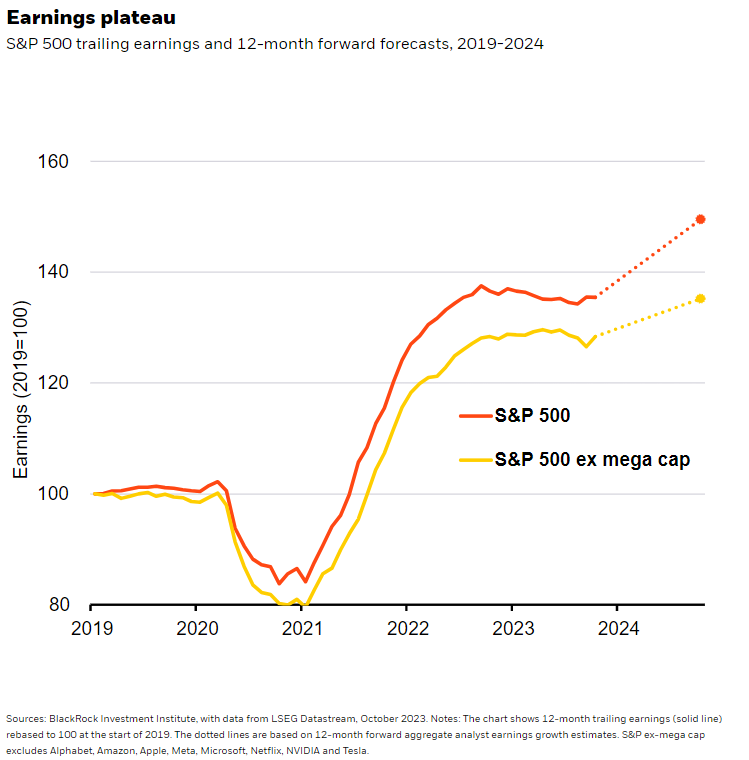

U.S. earnings growth has sputtered in the past year. See the solid lines in the chart. Markets expect year-over-year earnings growth to turn slightly positive in Q3. We think hopes of a long-awaited pickup are masking a still relatively stagnant growth trend. Modest earnings growth doesn’t reflect the market narrative of a resilient economy either, in our view. Focusing on earnings beating expectations may miss the point, too: that would be confirmation that low expectations are being met. The consensus eyes renewed S&P 500 earnings growth of about 10% over the next year. We’re more cautious – and selective. About half of expected earnings growth is tied to mega caps (orange dotted line), according to LSEG data, where the artificial intelligence (AI) mega force is well represented. Backing those out (yellow dotted line), expectations for broad equities are muted and overly optimistic, in our view.

We think the current macro backdrop isn’t friendly for broad equity exposures. Higher rates and stagnant growth have weighed on markets, but the move lower in stocks shows they are adjusting to the new macro regime. Stealth stagnation over the past 18 months – taking the average of GDP and gross domestic income, which adds up incomes and profits of households and firms – has been the weakest stretch ever seen outside a recession. We think this has gone under the radar because consumer spending, job growth and GDP have held up. We see stagnation persisting as the Federal Reserve keeps policy rates high in its battle with inflation.

Profit margin pressure

We think the inflation rollercoaster we see ahead creates risks to corporate profit margins. Inflation is cooling now as the pandemic-driven mismatches in spending between goods and services normalize. That could also drag on corporate revenues as pricing power for some firms fades. A shrinking workforce means the rate of growth the economy will be able to sustain without stoking inflation is likely to be lower than we were used to in the past. We see the labor market remaining tight. If job growth keeps up at its current pace, we think wage pressure could come back to bite margins, too. The risk of resurgent inflationary pressures is why we see the Fed holding policy tight. We expect higher rates to increase the interest expense for companies. We think markets are underappreciating profit margin pressure – even if that takes some time. Tech has supported broader margins this year – and cash held by firms has dulled the blow from higher interest expenses.

U.S. stock valuations – the driver of performance this year as earnings stagnated – remain elevated, in our view. Taking into account higher yields, the income in bonds is also more attractive than stocks on a relative risk basis. We stay underweight on broad equities on a six- to 12-month tactical horizon. We favor sectors like tech and harness the AI mega force where we see more potential for earnings growth and expanding profit margins. Tech earnings have come through and are driving the upward revisions in overall profit expectations. We’re closely monitoring the slew of big tech firm earnings reports in coming days. We also focus on granular sector or geographical opportunities, such as healthcare and Japanese equities.

Bottom line

U.S. corporate earnings have stagnated along with the economy. Markets expect a pickup starting with Q3 reporting underway. We are cautious. Broad equities have started to adjust to the new regime of greater volatility, but don’t fully reflect the macro damage we expect. We stay selective and harness mega forces. Read more in our new mega forces hub.

Market backdrop

The 10-year U.S. Treasury yield hit 16-year highs near 5.0%, while U.S. stocks fell more than 2%. Markets are coming around to our view of interest rates staying higher for longer in the new regime. Fed Chair Jerome Powell reinforced this in a speech last week – and suggested further hikes could be needed if sustained economic growth drives more persistent inflation. We think the tight labor market constrained by an aging population will eventually feed into inflation pressures.

U.S. inflation takes center stage this week with the Fed’s preferred inflation measure, the PCE. We keep track of how consumer spending is shifting back to services from goods, driving down goods prices and inflation in the near term. Yet we expect an aging population to keep the labor market tight, putting inflation pressures on a rollercoaster ride.

Week Ahead

Oct. 23: Euro area consumer confidence

Oct. 24: Global flash PMIs

Oct. 26: U.S. durable goods, Q3 GDP; Japan services PPI

Oct. 27: U.S. PCE

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 23rd October, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.