Liontrust GF High Yield Bond Fund is manufactured by Liontrust Fund Partners LLP and represented in Malta by MeDirect Bank (Malta) plc.

Market review

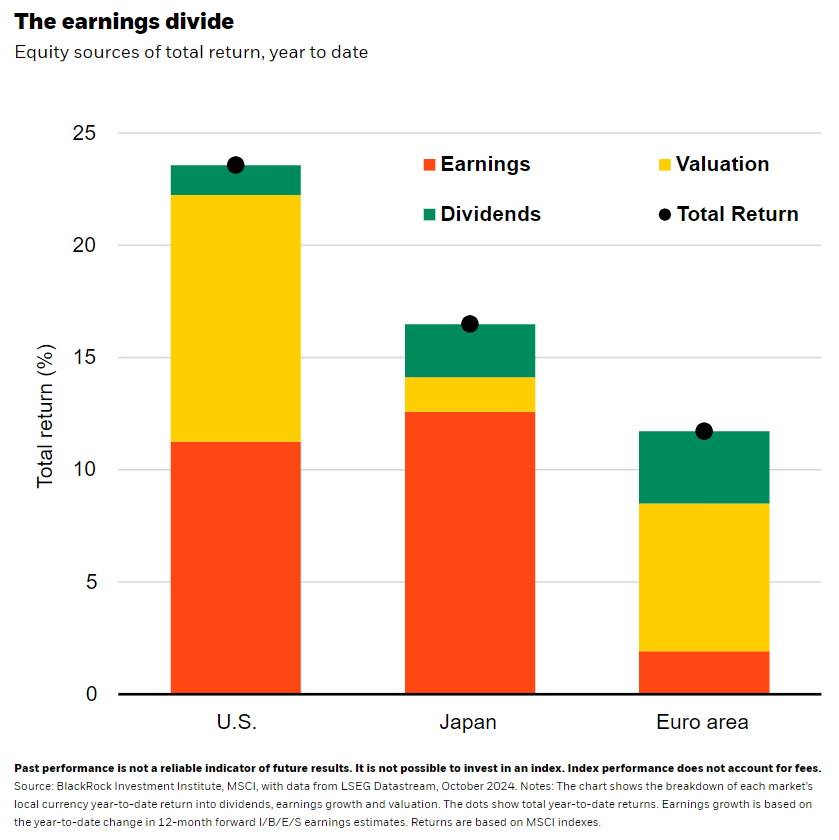

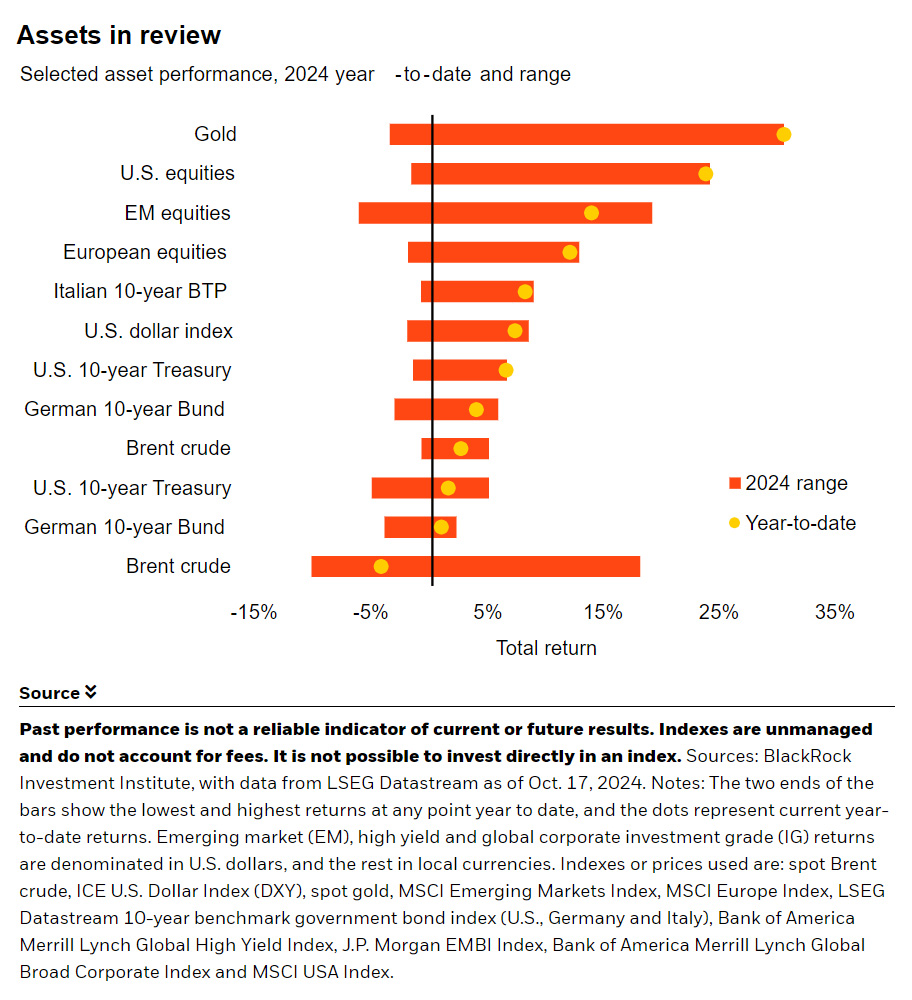

The global high yield market returned an impressive 4.98% (US dollar terms) in the third quarter of 2024, with lower quality bonds in particular driving the pace of the market as the prospect of a soft landing in the US was increasingly baked into credit valuations. The US high yield market produced a return of 5.27%; in Europe the market returned 3.97%.

The return of US CCC-rated bonds was stellar at 11.55%, the best quarterly return for this lowest quality cohort since Q4 2020, and outperforming BBs by more than seven percentage points in the period. With regards to the yield spread between CCCs and BBs in the US over the last three years, as CCC-rated bonds are of lower credit quality and represent a higher risk, they have a higher yield on average. However, the strong recent performance of CCCs has driven this yield premium, or spread, down to just over six percentage points, compared with a little under eight points at the start of the quarter.

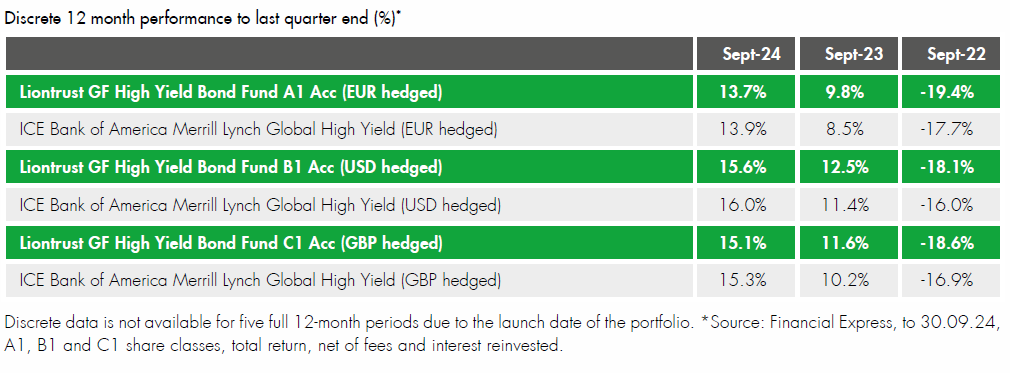

Fund performance

As you might expect given the quality skew of our process and philosophy, the marked outperformance of lower quality bonds explains the relative underperformance versus index. In other words, it’s what we didn’t own in the quarter explaining the deviation.

There were a limited number of individual bonds driving the strong absolute return of the Fund in the quarter. Real estate has continued to be a strong theme. We did reduce fund exposure to real estate in the early part of the summer, which with the benefit of hindsight was too soon. That being said, we saw strong performance from Aroundtown and, to a lesser extent, Castellum. Overall, real estate continued to be a positive contributor to Fund performance.

Less positively, two relatively recent additions, Brightline and Mahle, were the main negative contributors. With Brightline, we believe the market is showing impatience with its slow ramp up, but the company is scheduled to take delivery of rolling stock in Q4 and it should be an impressive 2025 growth story. Mahle, as a Europe-based auto supplier, is likely to have some tough quarters ahead as more and more auto equipment manufacturers issue profit warnings. Neither bond cost the Fund more than 5bps and both offer good compensation for the uncertainty.

Trade activity

We took new positions in Wilsonart (CCC), a US based producer of worktops; Arcosa (BB), a company making various infrastructure related products; French optical retailer, Alain Afflelou; and Bubbles (B), an Italian value retailer with an impressive growth trajectory.

Outlook

The high yield market has, in our view, moved a long way towards pricing in a soft landing. That being said, having outperformed BBs by over 7% in the quarter, it is feasible – if we do see a soft landing – that it could do the same again in the coming months. That is based on spreads between BB and CCC getting back to the QEfuelled tights of 2021. We are prepared to accept this opportunity cost as, by definition, any obstacles to the soft landing narrative will likely be most keenly felt in the CCC space.

The global high yield market has a yield to maturity a little over 7% (US dollar terms) and spread of around 320 basis points. If you view the market as a cousin of the equity market and use if for its long-term return potential, this 7% remains an interesting opportunity, in our view. If you view high yield within the fixed income complex and use it to make occasional total return gains versus government bonds, spreads are arguably on the tight side.

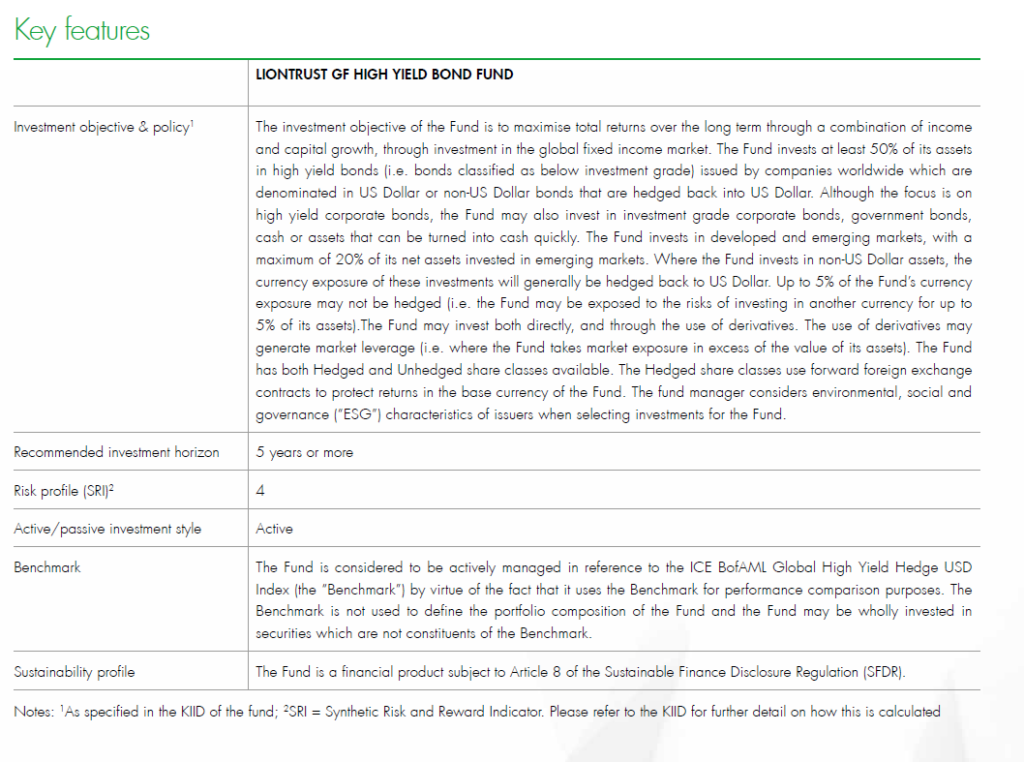

The Fund continues to invest in bonds based on strong corporate fundamentals and has a bias towards high quality defensive credits, with minimal exposure to cyclical credits. We believe our defensive approach stands us in good shape to perform if and when default risk is the major driver of the market, rather than interest rates. The Fund is currently offering yield of around 9.1% for sterling investors (and around 7.5% for euro investors), which we view as an attractive entry point.

Liontrust Key risks & Disclaimers:

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the GF High Yield Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in emerging markets/soft currencies and in financial derivative instruments, both of which may have the effect of increasing volatility. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative’s underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

Issued by Liontrust Fund Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518165) to undertake regulated investment business.

This document should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from Liontrust Fund Partners LLP. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instrument discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.