Jean Bovin, Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Michael Dilmanian – Investment Strategist, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Leaning in: We upped our overweight of inflation-linked bonds in March to quickly take advantage of the market pricing lower inflation – our new playbook in action.

Market backdrop: Bond yields rose after data showed a still-tight U.S. labor market. We think that keeps inflation sticky and makes Federal Reserve rate cuts this year unlikely.

Week ahead: U.S. inflation data this week will show core inflation remaining well above the Fed’s 2% target. We don’t see the Fed hiking enough to get it all the way to 2%.

Major central banks are hiking rates into recession to try to get inflation to policy targets. Inflation fell when past recessions hit. Pushing inflation to target now calls for a major recession. We expect a recession to help cool inflation but think the Fed will stop hiking before it gets severe. This week’s data is likely to show U.S. inflation staying sticky. We think market pricing is underappreciating persistent inflation and took advantage of the dip in expected inflation in March to up our overweight.

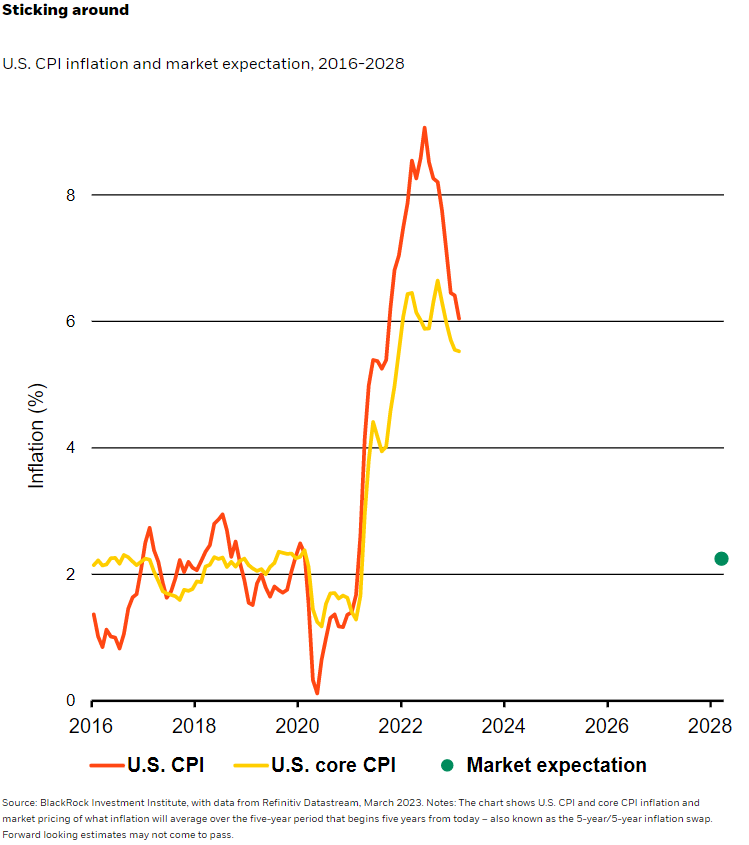

Inflation-linked government bonds behaved more like risk assets in the past, underperforming nominal government bonds in economic downturns. Concerns about bank stability and recession spurred a return of this old behavior last month. That’s the old playbook, in our view. U.S. core inflation is not on track to fall to the Fed’s 2% target, like markets expect (see the green dot above). February Personal Consumption Expenditures (PCE) data confirmed this. We expect the Consumer Price Index (CPI) data out this week to do the same. Lower energy prices and falling goods inflation as consumer spending shifted back to services initially led a decline in core CPI inflation (yellow line). But some goods inflation is already ticking back up. A tight labor market that’s boosting wage growth and services inflation is also making core inflation stubborn. Plus, supply shocks – like the surprise OPEC+ oil production cut – may cause brief spikes in headline inflation (dark orange line).

The Fed is sticking to hiking rates to get inflation down to target, even as financial cracks start to appear. We think the Fed will eventually stop hiking when the damage becomes more apparent. That means it won’t have done enough to create the deep recession needed to achieve its inflation goal, so it will be living with some above-target inflation. Updated Fed forecasts last month noted as much, with PCE inflation floating around 3% at year-end – even as the Fed expects growth to stall.

New playbook in action

The breakeven inflation rate – or the market’s pricing of future inflation – narrowed in March as markets saw inflation falling to 2% given the bank turmoil and nearing recession. We were already tactically overweight inflation-linked bonds. We used the repricing to go more overweight. Any old-playbook-style underperformance of inflation-linked versus nominal bonds presents opportunities, in our view. We think the market pricing in repeated rate cuts suggests investors are underestimating inflation’s persistence and expecting central banks to come to the rescue. We see sticky inflation preventing cuts in 2023. The magnitude of our tactical overweight is now closer to our longstanding overweight from a strategic view of five years and beyond as structural trends like aging populations, geopolitical tension and the energy transition keep inflation higher.

We are neutral on euro area inflation-linked government bonds and prefer U.S. counterparts. The reason: European inflation is more likely to reach the European Central Bank’s (ECB) 2% target. Not because inflation is less persistent – getting inflation to 2% will take a recession, just as in the U.S. But unlike the Fed, we see the ECB going full steam ahead with rate hikes to get inflation to target – regardless of the damage that entails. Consumers seem to agree, with their inflation expectations over three years ticking down closer to the ECB policy target, according to February ECB survey data. But at the moment, euro area inflation pricing is even higher than in the U.S. – and thus less attractive, in our view.

Our bottom line

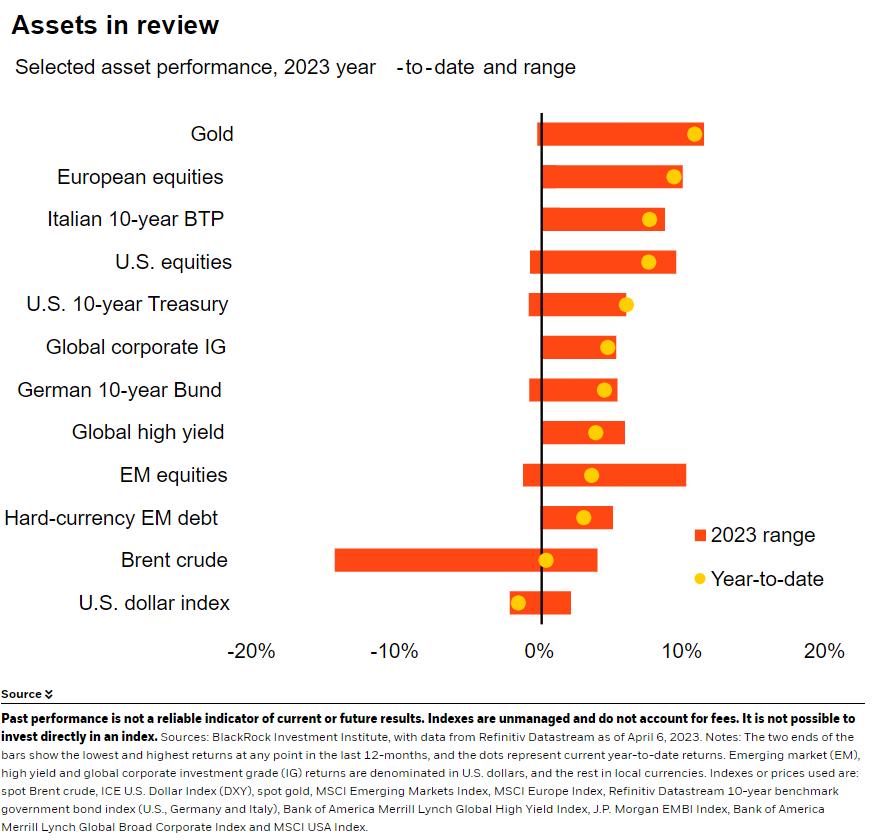

We think U.S. inflation will remain above the Fed’s target for some time. We wield our new playbook and seized the opportunity to add to our existing tactical overweight to inflation-linked bonds in March – one of our highest conviction views. We see structural trends supporting higher inflation, so we’ve been overweight strategically for a few years. We like other assets that help portfolios with higher inflation. Infrastructure assets have the potential to hedge some of the effects of inflation, too. We remain tactically underweight developed market shares and expect corporate earnings to come under pressure – and the upcoming earnings season starting this week may reveal such damage. We prefer emerging market peers that better price in the economic damage we expect.

Market backdrop

U.S. and European equity indexes ended largely unchanged on the week heading into the Easter holiday. U.S. Treasury yields ticked back up after the U.S. jobs report showed another solid gain in payrolls, with the unemployment rate dropping back near a five-decade low. The market priced back in a potential Fed hike in May but is still eyeing multiple rate cuts later in the year. We don’t see the Fed cutting policy rates later this year and prefer short-term government paper for income.

The focus is on the U.S. CPI this week. It is likely to show that inflation is proving sticky and not on track to quickly fall to the Fed’s 2% target. We think the market is underappreciating how persistent core inflation is proving. U.S. retail sales and consumer sentiment could offer signs of how much the Fed’s rate hikes are cooling economic activity.

Week Ahead

April 10-17: China total social financing

April 11: China CPI

April 12: U.S. CPI

April 14: U.S. retail sales; U.S. consumer sentiment survey

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 10th April, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.